State insurance auto is a critical aspect of responsible driving, providing financial protection in the event of accidents or other unforeseen circumstances. This guide delves into the world of state insurance auto, exploring its history, regulations, coverage options, and the factors that influence rates. We’ll also discuss the claims process and offer valuable advice for consumers seeking coverage.

Understanding the complexities of state insurance auto is essential for navigating the roads safely and confidently. By exploring the different types of coverage, analyzing rate determinants, and grasping the claims process, drivers can make informed decisions to ensure adequate protection and peace of mind.

State Insurance Auto Overview

State insurance auto refers to the system of motor vehicle insurance regulation and operation within individual states of the United States. It encompasses the legal framework, regulatory bodies, and insurance companies that govern the provision of auto insurance coverage to drivers and vehicle owners.

Historical Context and Evolution

The evolution of state insurance auto can be traced back to the early 20th century, with the rise of the automobile and the growing need for financial protection against accidents. Early state laws focused on establishing minimum liability coverage requirements and creating regulatory frameworks for insurance companies. Over time, the system has evolved to address new challenges, such as the increasing complexity of motor vehicle accidents, the emergence of new technologies, and the need for greater consumer protection.

Regulatory Landscape and Key Legislation

Each state has its own unique set of laws and regulations governing auto insurance. Key legislation includes:

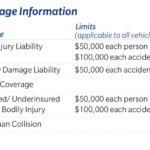

- Minimum Liability Coverage Requirements: These laws specify the minimum amounts of coverage that drivers must carry for bodily injury, property damage, and uninsured/underinsured motorist protection. These requirements vary from state to state.

- Financial Responsibility Laws: These laws ensure that drivers have the financial means to cover the costs of accidents they cause. They may require drivers to provide proof of insurance or post a bond.

- Rate Regulation: Some states regulate the rates that insurance companies can charge for auto insurance, while others allow insurers to set rates based on market competition.

- Consumer Protection Laws: These laws protect consumers from unfair or deceptive insurance practices. They may address issues such as rate discrimination, cancellation of policies, and the right to appeal insurance decisions.

Types of State Insurance Auto Coverage

State insurance auto providers offer a variety of coverage options to meet the diverse needs of their customers. These coverage types provide financial protection in the event of an accident or other unforeseen circumstances involving your vehicle. Understanding the different types of coverage and their benefits is crucial in making informed decisions about your auto insurance policy.

Liability Coverage

Liability coverage is a crucial component of any auto insurance policy. It protects you financially if you are found at fault for an accident that causes damage to another person’s property or injuries to another person. Liability coverage is typically divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries sustained in an accident caused by you.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property damaged in an accident caused by you.

For example, if you are driving and cause an accident that results in injuries to the other driver, bodily injury liability coverage will help cover their medical bills. Similarly, if you damage the other driver’s vehicle, property damage liability coverage will help pay for repairs or replacement.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle after a collision with another vehicle, an object, or even a single-car accident.

- Deductible: Collision coverage typically has a deductible, which is the amount you pay out of pocket before the insurance company covers the remaining costs.

For instance, if your vehicle is damaged in an accident with another car and you have a $500 deductible, you would pay the first $500 of repair costs, and your insurance company would cover the rest.

Comprehensive Coverage

Comprehensive coverage protects you financially if your vehicle is damaged by events other than a collision, such as theft, vandalism, fire, hail, or natural disasters.

- Deductible: Comprehensive coverage also typically has a deductible, which is the amount you pay out of pocket before the insurance company covers the remaining costs.

For example, if your car is stolen and never recovered, comprehensive coverage would help pay for the replacement cost, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you financially if you are injured in an accident caused by an uninsured or underinsured driver. This coverage can help pay for your medical expenses, lost wages, and other damages, even if the at-fault driver does not have sufficient insurance coverage.

- Uninsured Motorist Coverage: This coverage protects you if you are hit by a driver who has no insurance.

- Underinsured Motorist Coverage: This coverage protects you if you are hit by a driver who has insurance, but their coverage limits are not enough to cover your damages.

For example, if you are hit by a driver who has no insurance, uninsured motorist coverage will help pay for your medical expenses, lost wages, and other damages.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault coverage, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. PIP coverage is mandatory in some states.

- Medical Expenses: PIP coverage can help pay for medical bills, including doctor visits, hospital stays, and rehabilitation.

- Lost Wages: PIP coverage can help replace lost wages if you are unable to work due to injuries sustained in an accident.

For example, if you are injured in an accident, even if you are at fault, PIP coverage can help pay for your medical bills and lost wages.

Medical Payments Coverage

Medical payments coverage (MedPay) is a supplemental coverage that pays for your medical expenses, regardless of who is at fault in an accident. Unlike PIP coverage, MedPay is not mandatory in most states.

- Medical Expenses: MedPay can help pay for medical bills, including doctor visits, hospital stays, and rehabilitation.

For example, if you are injured in an accident, even if you are at fault, MedPay can help pay for your medical bills.

Rental Reimbursement Coverage

Rental reimbursement coverage helps pay for a rental car while your vehicle is being repaired after an accident. This coverage can be helpful if you need to use your car for work or other essential activities.

- Rental Car Expenses: Rental reimbursement coverage can help pay for the cost of renting a car while your vehicle is being repaired.

For example, if you are involved in an accident and your vehicle needs repairs, rental reimbursement coverage can help pay for a rental car until your vehicle is repaired.

Towing and Labor Coverage

Towing and labor coverage pays for the cost of towing your vehicle to a repair shop after an accident or breakdown. This coverage can also help pay for labor costs for minor repairs performed on the roadside.

- Towing Costs: Towing and labor coverage can help pay for the cost of towing your vehicle to a repair shop.

- Roadside Assistance: Towing and labor coverage can also provide roadside assistance, such as jump starts, tire changes, and lockout services.

For example, if your car breaks down on the side of the road, towing and labor coverage can help pay for the cost of towing your vehicle to a repair shop.

Factors Influencing State Insurance Auto Rates

Insurance premiums for state insurance auto policies are determined by a variety of factors. These factors are designed to assess the risk of an insured driver and their vehicle. The higher the risk, the higher the premium.

Demographics

Demographics play a significant role in determining insurance rates. Age, gender, and marital status are all considered factors. For example, younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. Similarly, male drivers generally have higher rates than female drivers, and married individuals often have lower rates than single individuals.

Driving History

A driver’s past driving record is a crucial factor in determining insurance rates. This includes information such as traffic violations, accidents, and driving convictions. A clean driving record will generally result in lower premiums, while a history of accidents or violations will likely lead to higher rates. Insurance companies may offer discounts for safe driving, such as accident-free periods.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Higher-performance vehicles, luxury cars, and vehicles with a history of theft or accidents tend to have higher insurance rates. This is due to the higher cost of repairs and the increased risk of accidents or theft.

Location

The location where you live and drive also affects your insurance rates. Areas with higher rates of car theft, accidents, or traffic congestion generally have higher insurance premiums. Urban areas, for example, tend to have higher rates than rural areas.

State Insurance Auto Claims Process

Filing a claim with a state insurance auto provider is a straightforward process designed to help you get back on the road after an accident. This section will Artikel the steps involved, the required documentation, and the procedures for investigating and resolving claims.

Filing a Claim

The first step in the claims process is to report the accident to your insurance company. This can typically be done by phone, online, or through a mobile app. You will need to provide the following information:

- Your policy number

- The date, time, and location of the accident

- A description of the accident

- The names and contact information of all parties involved

- The names and contact information of any witnesses

- Details of any injuries or damages

Documentation Required

To support your claim, you will need to provide the following documentation:

- A copy of your driver’s license

- A copy of your vehicle registration

- A copy of your insurance policy

- A police report (if applicable)

- Photos or videos of the damage to your vehicle

- Medical records (if applicable)

- Estimates for repairs or replacement of your vehicle

Claim Investigation and Resolution

Once you have filed a claim and provided the necessary documentation, your insurance company will begin investigating the accident. This investigation may involve:

- Reviewing the police report

- Contacting witnesses

- Inspecting the damage to your vehicle

- Evaluating your medical records (if applicable)

Role of Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for:

- Investigating the accident

- Determining the extent of the damages

- Negotiating settlements with policyholders

Handling Disputes

If you disagree with the insurance company’s decision on your claim, you have the right to appeal. This process may involve:

- Submitting additional documentation

- Meeting with an adjuster or supervisor

- Filing a formal complaint with the state insurance commissioner

Consumer Considerations for State Insurance Auto

Finding the right auto insurance policy can be a daunting task, but it’s crucial for protecting yourself financially in the event of an accident. With a bit of research and planning, you can find a policy that meets your needs and budget.

Comparing Quotes

It’s essential to compare quotes from multiple insurance companies before making a decision. You can use online comparison tools, contact insurance agents directly, or work with an insurance broker.

- Consider your individual needs. Your coverage requirements will depend on factors such as your driving history, the type of car you drive, and your location.

- Look for discounts. Many insurance companies offer discounts for safe driving, good credit scores, and other factors.

- Compare coverage limits. Make sure you have enough coverage to protect yourself in the event of a major accident.

Understanding Policy Terms

It’s important to understand the terms of your auto insurance policy before you sign on the dotted line.

- Deductible: This is the amount you pay out-of-pocket before your insurance kicks in.

- Premium: This is the amount you pay for your insurance coverage.

- Coverage limits: These are the maximum amounts your insurance company will pay for certain types of claims.

Choosing the Right Coverage, State insurance auto

The right coverage for you will depend on your individual circumstances.

- Liability coverage: This protects you financially if you cause an accident that injures someone else or damages their property.

- Collision coverage: This covers damage to your car if you are involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This covers damage to your car from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses.

Shopping Around and Seeking Professional Advice

It’s important to shop around and compare quotes from multiple insurance companies before making a decision. You can use online comparison tools, contact insurance agents directly, or work with an insurance broker.

- Consider your individual needs. Your coverage requirements will depend on factors such as your driving history, the type of car you drive, and your location.

- Look for discounts. Many insurance companies offer discounts for safe driving, good credit scores, and other factors.

- Compare coverage limits. Make sure you have enough coverage to protect yourself in the event of a major accident.

- Seek professional advice. An insurance agent or broker can help you understand your options and choose the right coverage for your needs.

Industry Trends in State Insurance Auto

The state insurance auto industry is experiencing a period of significant transformation driven by technological advancements, evolving consumer preferences, and a growing focus on data-driven insights. These trends are shaping the landscape of insurance provision, leading to both challenges and opportunities for state insurance auto providers.

Impact of Technology

The integration of technology is revolutionizing the state insurance auto industry.

- Telematics: Telematics devices and smartphone applications are becoming increasingly popular, allowing insurers to collect real-time driving data. This data provides valuable insights into driver behavior, enabling insurers to offer personalized premiums based on individual driving habits. For example, safe drivers with low-risk profiles can receive discounts, while high-risk drivers may face higher premiums.

- Artificial Intelligence (AI): AI is being used to automate various tasks, such as claims processing, fraud detection, and customer service. AI-powered chatbots are becoming increasingly prevalent in customer service, providing instant support and resolving queries efficiently.

- Blockchain Technology: Blockchain technology offers potential benefits in areas such as claims processing and fraud prevention. Its decentralized and transparent nature can enhance security and efficiency in these areas.

Closure

Navigating the world of state insurance auto requires careful consideration of your individual needs and driving habits. By comparing quotes, understanding policy terms, and seeking professional advice, you can find the right coverage to meet your specific requirements. Staying informed about industry trends and innovations will empower you to make the best choices for your financial well-being and driving safety.

User Queries: State Insurance Auto

What are the minimum insurance requirements in my state?

Minimum insurance requirements vary by state. It’s crucial to check with your state’s Department of Motor Vehicles to determine the specific coverage mandated for legal driving.

How often should I review my insurance policy?

It’s recommended to review your insurance policy annually, or more frequently if there are significant changes in your driving habits, vehicle, or financial situation.

What factors influence my insurance rates?

Rates are determined by various factors, including driving history, age, gender, vehicle type, location, credit score, and the type of coverage you choose.

How can I lower my insurance premiums?

Consider taking defensive driving courses, maintaining a clean driving record, bundling insurance policies, and comparing quotes from multiple providers to potentially lower your premiums.