State minimum car insurance Michigan is a crucial aspect of driving in the state, but it can be confusing. Michigan’s unique no-fault system sets it apart from other states, with mandatory coverage types and minimum limits. This system aims to ensure that individuals injured in accidents are compensated for medical expenses and lost wages, regardless of fault. Understanding these requirements is vital for all Michigan drivers.

While the minimum coverage might seem tempting for its lower cost, it’s important to consider the potential risks associated with driving with only the bare minimum. This article delves into the complexities of Michigan’s no-fault system, exploring the costs, benefits, and limitations of state minimum car insurance.

Michigan’s Minimum Car Insurance Requirements

Michigan has a unique no-fault insurance system that differs from most other states. This system requires all drivers to carry a minimum amount of car insurance to cover their own medical expenses and property damage in the event of an accident, regardless of who is at fault.

Michigan’s No-Fault Insurance System

The no-fault system aims to simplify the claims process and ensure that accident victims receive prompt medical care. It eliminates the need for fault determination in most cases, reducing the number of lawsuits and speeding up the payment of benefits. Under this system, drivers are required to file claims with their own insurance company for coverage, regardless of who caused the accident.

Mandatory Coverage Types and Minimum Limits

Michigan law mandates that all drivers carry the following minimum coverages:

Personal Injury Protection (PIP)

- Coverage: This coverage pays for medical expenses, lost wages, and other related costs for the insured and their passengers, regardless of who caused the accident.

- Minimum Limit: $50,000 per person, $1 million per accident.

Property Protection (PIP)

- Coverage: This coverage pays for damage to the insured’s vehicle, up to a certain limit.

- Minimum Limit: $1,000.

Uninsured Motorist (UIM)

- Coverage: This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver.

- Minimum Limit: $25,000 per person, $50,000 per accident.

Implications of Driving Without Minimum Car Insurance

Driving without the required minimum car insurance in Michigan is a serious offense. Penalties include:

- Fines: Up to $500 for the first offense, and up to $1,000 for subsequent offenses.

- License Suspension: Your driver’s license can be suspended until you provide proof of insurance.

- Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In some cases, driving without insurance can lead to jail time.

- Financial Responsibility: If you are involved in an accident without insurance, you are personally responsible for all costs associated with the accident, including medical bills, property damage, and legal fees.

Understanding the Cost of Minimum Car Insurance in Michigan: State Minimum Car Insurance Michigan

Michigan’s minimum car insurance requirements are designed to protect drivers and their passengers in case of an accident. However, it’s important to understand that these minimum limits may not provide sufficient coverage in all situations. To make an informed decision about your car insurance needs, it’s essential to consider the factors that influence the cost of minimum car insurance in Michigan.

Factors Influencing Minimum Car Insurance Premiums

Several factors play a role in determining your minimum car insurance premiums in Michigan. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your insurance costs.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premiums. A clean driving record generally translates to lower premiums.

- Age and Gender: Younger drivers and males tend to have higher insurance premiums due to their statistically higher risk of accidents.

- Vehicle Type: The type of vehicle you drive, its value, and safety features can influence your insurance rates. Sports cars and luxury vehicles often have higher premiums compared to standard vehicles.

- Location: Where you live can affect your insurance premiums. Areas with higher rates of accidents and theft tend to have higher insurance costs.

- Credit Score: In some cases, your credit score may be considered when determining your insurance premiums. Individuals with good credit scores may qualify for lower rates.

- Insurance Company: Different insurance companies have varying rates and coverage options. It’s essential to compare quotes from multiple insurers to find the best deal.

Average Minimum Car Insurance Cost in Michigan

The average cost of minimum car insurance in Michigan can vary depending on the factors mentioned above. However, a recent study by the Insurance Information Institute (III) found that the average annual cost of minimum car insurance in Michigan was around $1,000. This figure can fluctuate based on individual circumstances.

Cost Comparison Across Regions

Minimum car insurance costs can vary significantly across different regions of Michigan. For example, drivers in urban areas like Detroit and Grand Rapids may face higher premiums due to increased traffic congestion and higher rates of accidents. Conversely, drivers in rural areas may benefit from lower premiums due to fewer traffic risks.

Potential Cost Savings with Increased Coverage

While minimum car insurance may seem affordable, it’s important to consider the potential financial consequences of inadequate coverage. Increasing your coverage beyond the minimum requirements can offer significant financial protection in the event of a serious accident.

For instance, if you’re involved in an accident that causes significant damage to your vehicle or results in injuries, minimum coverage may not be sufficient to cover all your expenses.

By increasing your coverage, you can protect yourself from financial hardship and ensure that you have the necessary resources to address any potential claims.

Finding Affordable Minimum Car Insurance in Michigan

Securing affordable car insurance in Michigan is crucial, especially when considering the state’s minimum coverage requirements. With careful planning and strategic approaches, you can find a policy that meets your needs without breaking the bank.

Tips for Obtaining Competitive Car Insurance Quotes in Michigan

Obtaining multiple quotes from different insurance companies is essential to finding the most competitive rates. By comparing quotes, you can identify the best deals and potentially save a significant amount on your premiums.

- Utilize online comparison websites: Many websites allow you to enter your information once and receive quotes from various insurance providers, streamlining the process and saving time.

- Contact insurance companies directly: Don’t hesitate to reach out to insurance companies directly to obtain quotes. This allows you to discuss your specific needs and potentially negotiate better rates.

- Ask for discounts: Insurance companies often offer discounts for various factors, such as safe driving records, good credit scores, bundling policies, or being a member of certain organizations. Be sure to inquire about these discounts when obtaining quotes.

The Benefits of Shopping Around for Car Insurance

Taking the time to compare quotes from multiple insurance companies offers significant advantages in securing affordable car insurance.

- Finding lower premiums: By comparing quotes, you can identify insurance companies that offer the most competitive rates, potentially saving hundreds of dollars annually.

- Discovering different coverage options: Each insurance company offers a range of coverage options, allowing you to customize your policy to meet your specific needs and budget. Shopping around helps you find the right coverage at the best price.

- Identifying reputable companies: Comparing quotes allows you to research different insurance companies and their reputations, ensuring you choose a reliable and trustworthy provider.

The Role of Credit Score in Determining Insurance Premiums

In Michigan, insurance companies can consider your credit score when calculating your car insurance premiums. This practice is legal in many states, and it’s based on the idea that individuals with good credit are more likely to be responsible drivers.

- Higher credit scores often lead to lower premiums: Insurance companies view individuals with good credit scores as less risky, which can translate into lower premiums.

- Lower credit scores may result in higher premiums: Individuals with lower credit scores may face higher premiums as insurance companies perceive them as a higher risk.

- Impact on minimum car insurance: Even if you’re only seeking minimum coverage, your credit score can still influence your premiums. Therefore, maintaining a good credit score is crucial to keeping your insurance costs manageable.

Improving Your Driving Record to Lower Insurance Costs

Your driving record plays a significant role in determining your car insurance premiums. A clean driving record often leads to lower premiums, while accidents or violations can significantly increase your costs.

- Avoid traffic violations: Traffic violations, such as speeding tickets or reckless driving, can significantly increase your insurance premiums. It’s essential to follow traffic laws and drive safely to avoid these violations.

- Take a defensive driving course: Completing a defensive driving course can demonstrate to insurance companies your commitment to safe driving practices, potentially leading to discounts on your premiums.

- Maintain a safe driving record: A clean driving record is crucial for keeping your insurance costs low. By driving safely and avoiding accidents, you can demonstrate your responsible driving habits to insurance companies.

Exploring Additional Car Insurance Options in Michigan

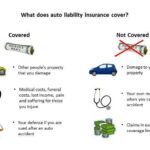

While Michigan’s minimum car insurance requirements are designed to cover basic liability, many drivers find that these limits may not be sufficient to protect them in the event of a serious accident. Opting for additional car insurance coverage can provide peace of mind and financial security in the face of unforeseen circumstances.

Benefits of Additional Car Insurance Coverage

Beyond the minimum requirements, additional coverage offers significant benefits, including:

- Financial Protection: Additional coverage can help cover costs exceeding your minimum liability limits, such as medical expenses, lost wages, property damage, and legal fees, protecting you from potential financial hardship.

- Peace of Mind: Knowing that you have adequate insurance protection can reduce stress and anxiety, allowing you to focus on recovering from an accident without worrying about overwhelming financial burdens.

- Enhanced Protection for Passengers: Additional coverage can extend protection to your passengers in case of an accident, ensuring they receive adequate medical care and compensation for injuries.

- Protection Against Uninsured or Underinsured Drivers: UM/UIM coverage provides financial protection when you are involved in an accident with a driver who lacks sufficient insurance or no insurance at all.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is particularly beneficial for newer or more expensive vehicles, as it can significantly reduce out-of-pocket expenses in the event of a collision.

Comprehensive Coverage

Comprehensive coverage provides financial protection against damages to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It helps cover repairs or replacement costs for your vehicle in situations where collision coverage doesn’t apply.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

UM/UIM coverage is crucial in Michigan, where a significant number of drivers operate without adequate insurance. It protects you and your passengers if you are injured by an uninsured or underinsured driver. This coverage can help pay for medical expenses, lost wages, and other related costs.

Potential Risks of Driving with Only Minimum Coverage

Driving with only minimum car insurance in Michigan carries significant risks, including:

- Financial Vulnerability: In a serious accident, minimum coverage may not be enough to cover your liability, leaving you financially responsible for substantial costs exceeding your coverage limits.

- Legal Issues: If you are found liable for an accident and your minimum coverage doesn’t fully cover the damages, you could face legal action and potentially lose assets to satisfy the judgment.

- Difficulty in Recovering from an Accident: Without sufficient coverage, you may struggle to cover medical bills, repair costs, and other expenses, making it challenging to recover from an accident.

Comparing Car Insurance Coverage Options

| Coverage Option | Cost | Benefits |

|—|—|—|

| Minimum Coverage | Lowest cost | Covers basic liability |

| Collision Coverage | Higher cost | Pays for repairs or replacement of your vehicle in an accident |

| Comprehensive Coverage | Higher cost | Covers damages caused by events other than accidents |

| UM/UIM Coverage | Higher cost | Protects you and your passengers in accidents with uninsured or underinsured drivers |

Understanding Michigan’s No-Fault System

Michigan is one of only a handful of states that operate under a no-fault auto insurance system. This system differs significantly from traditional fault-based systems, where liability for an accident is determined and the at-fault driver’s insurance is responsible for covering damages. In Michigan, each driver is responsible for their own injuries and damages, regardless of who caused the accident.

Explanation of No-Fault Insurance in Michigan

Under Michigan’s no-fault system, drivers are required to carry personal injury protection (PIP) coverage. PIP coverage pays for medical expenses, lost wages, and other related costs resulting from an accident, regardless of who was at fault. This means that even if you are involved in an accident caused by another driver, your own insurance will cover your injuries and losses.

Benefits of Michigan’s No-Fault System

- Faster Claim Processing: No-fault systems generally result in faster claim processing times as the focus is on reimbursing the injured party rather than determining fault.

- Reduced Litigation: By eliminating the need to determine fault, no-fault systems can significantly reduce the number of lawsuits related to auto accidents.

- Guaranteed Benefits: Regardless of fault, no-fault insurance guarantees that you will receive coverage for your injuries and losses.

Limitations of Michigan’s No-Fault System

- Higher Insurance Premiums: Michigan’s no-fault system is known for its high insurance premiums. This is primarily due to the unlimited medical coverage provided under the system and the high costs associated with catastrophic injuries.

- Limited Coverage for Non-Economic Damages: Michigan’s no-fault system generally limits coverage for non-economic damages, such as pain and suffering, unless the injury meets specific criteria.

- Potential for Abuse: Some argue that the no-fault system can be abused by individuals seeking to inflate their medical expenses or claim benefits for injuries that are not related to the accident.

Examples of How the No-Fault System Works

- Scenario 1: You are driving to work when another car runs a red light and hits your vehicle. You sustain injuries and require medical treatment. Under Michigan’s no-fault system, your own insurance will cover your medical expenses, lost wages, and other related costs, regardless of who caused the accident. The other driver’s insurance will be responsible for any property damage to your vehicle.

- Scenario 2: You are involved in a minor fender bender with another driver. Both drivers are at fault for the accident. Under Michigan’s no-fault system, both drivers’ insurance companies will cover their respective injuries and property damage.

The Michigan Catastrophic Claims Association (MCCA), State minimum car insurance michigan

The MCCA is a state-run agency that helps to ensure the availability of no-fault insurance coverage for catastrophic injuries in Michigan. The MCCA collects a fee from all Michigan drivers, which is used to fund claims for individuals who have sustained catastrophic injuries, such as permanent brain damage or paralysis. The MCCA plays a crucial role in mitigating the risk associated with catastrophic claims, which helps to keep insurance premiums affordable for all drivers.

Last Word

Navigating Michigan’s car insurance landscape can be challenging, but with the right knowledge and planning, drivers can find affordable and appropriate coverage. Understanding the intricacies of the no-fault system, comparing costs and benefits, and considering additional coverage options are all crucial steps in securing adequate protection on the road. By making informed decisions about car insurance, Michigan drivers can gain peace of mind and ensure they are properly protected in the event of an accident.

Questions and Answers

How much does minimum car insurance cost in Michigan?

The average cost of minimum car insurance in Michigan varies depending on factors like age, driving history, and location. However, it’s generally less expensive than purchasing higher coverage levels.

What are the penalties for driving without car insurance in Michigan?

Driving without minimum car insurance in Michigan is illegal and carries serious consequences, including fines, license suspension, and even jail time.

What is the Michigan Catastrophic Claims Association (MCCA)?

The MCCA is a state-run entity that helps cover extremely high medical costs for individuals involved in serious accidents. All Michigan drivers contribute to the MCCA through their car insurance premiums.

Can I get car insurance quotes online?

Yes, many car insurance companies offer online quoting tools that allow you to compare rates and find the best deals.