State Farm liability auto insurance is a crucial component of protecting yourself financially in the event of an accident. It provides coverage for injuries and damages you cause to others, offering peace of mind and financial security on the road. Understanding the intricacies of liability coverage, its different options, and how it works is essential for every driver.

State Farm offers a comprehensive range of liability coverage options, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These options provide protection for various scenarios, ensuring you’re adequately covered in case of an accident. Factors like your driving history, age, location, and vehicle type influence the cost of your premium, highlighting the importance of choosing the right coverage for your individual needs.

State Farm Liability Auto Insurance Overview

State Farm liability auto insurance is a type of coverage that protects you financially if you cause an accident that results in injuries or property damage to another person. It is a crucial component of any comprehensive auto insurance policy.

This type of insurance is essential because it covers the costs associated with the other driver’s injuries, medical expenses, lost wages, property damage, and legal fees, if you are found at fault for an accident. Without liability coverage, you could be held personally responsible for all these costs, which could lead to significant financial hardship.

Key Features and Benefits

State Farm liability auto insurance offers a range of features and benefits that can provide you with peace of mind and financial protection in the event of an accident.

- Financial Protection: State Farm liability coverage protects you from the financial burden of accidents you cause. This coverage helps pay for the other driver’s medical expenses, lost wages, property damage, and legal fees.

- Legal Representation: In the event of an accident, State Farm provides legal representation to defend you against claims made by the other party. This ensures that you have experienced legal counsel on your side to protect your interests.

- Peace of Mind: Knowing that you have adequate liability coverage can provide you with peace of mind, knowing that you are financially protected in the event of an accident. This allows you to focus on your recovery and the well-being of your loved ones.

Importance of Liability Coverage, State farm liability auto insurance

Liability coverage is an essential component of any auto insurance policy. It provides financial protection in the event that you are at fault for an accident, ensuring that you are not personally responsible for the costs associated with the other driver’s injuries or property damage.

“Liability coverage is not optional. It is a legal requirement in most states to operate a vehicle.”

Driving without liability coverage can result in significant financial penalties, including fines, license suspension, and even jail time. In addition to the legal ramifications, being uninsured can also leave you vulnerable to financial ruin if you are involved in an accident.

Coverage Options and Limits

State Farm offers a variety of liability coverage options to protect you financially in the event of an accident where you are at fault. Understanding these options and their limits is crucial to ensure you have adequate protection.

Liability Limits

Liability limits are the maximum amounts your insurance company will pay for damages caused by an accident. They are typically expressed as per-person and per-accident limits. For example, a policy with a 100/300 limit would cover up to $100,000 per person injured and up to $300,000 per accident.

Liability limits are crucial because they determine the maximum amount your insurance company will pay for damages, including medical bills, lost wages, and property damage.

Types of Liability Coverage

- Bodily Injury Liability: This coverage pays for injuries to other people caused by an accident for which you are at fault. This includes medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: This coverage pays for damages to another person’s property caused by an accident for which you are at fault. This includes damage to vehicles, buildings, and other structures.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are injured by an uninsured or underinsured driver. It pays for your medical expenses, lost wages, and other damages, even if the other driver does not have insurance or has insufficient coverage.

Factors Influencing Liability Coverage Limits

- State Requirements: Each state has minimum liability coverage requirements that all drivers must meet. These requirements can vary significantly from state to state.

- Individual Needs: The amount of liability coverage you need depends on your individual circumstances, such as the value of your assets, your driving history, and your financial situation. For example, individuals with significant assets may want to consider higher liability limits to protect themselves from potential lawsuits.

Factors Affecting Premiums

Your State Farm liability auto insurance premium is determined by a variety of factors, each contributing to the overall cost of your coverage. Understanding these factors can help you make informed decisions about your policy and potentially reduce your premium.

Driving History

Your driving history is a key factor influencing your premium. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents, traffic violations, or even DUI convictions, your premium will likely be higher. State Farm uses a points system to assess your driving history, with each violation adding points that increase your premium.

Age

Age plays a significant role in determining your premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher premiums. Conversely, older drivers with extensive driving experience and a clean record may qualify for lower premiums. This is because older drivers tend to have a lower risk profile.

Location

The location where you live can also impact your premium. Areas with higher traffic density, crime rates, and accident frequencies generally have higher insurance premiums. This is because insurance companies face a greater risk of claims in these locations. Conversely, areas with lower risk profiles may have lower premiums.

Vehicle Type

The type of vehicle you drive also plays a role in your premium. Vehicles with higher performance capabilities, expensive parts, or a history of theft or accidents tend to have higher premiums. This is because these vehicles are associated with a higher risk of claims. Conversely, vehicles with lower performance capabilities and lower repair costs may have lower premiums.

Other Factors

In addition to the factors mentioned above, other factors can influence your premium, such as:

- Credit Score: A good credit score can often lead to lower premiums, as it indicates financial responsibility.

- Coverage Options: Choosing additional coverage options, such as comprehensive or collision coverage, can increase your premium.

- Deductible Amount: A higher deductible amount can lower your premium, as you agree to pay more out-of-pocket in case of an accident.

- Discounts: State Farm offers various discounts that can help reduce your premium. These discounts can include safe driver discounts, good student discounts, multi-policy discounts, and more.

Claims Process and Customer Service: State Farm Liability Auto Insurance

When you’re involved in an accident, it’s important to know how to file a claim with State Farm and what to expect during the process. State Farm has a comprehensive claims process designed to make it as easy as possible for you to get the help you need.

Filing a Liability Claim

After an accident, you’ll need to contact State Farm to report the incident. You can do this by phone, online, or through the State Farm mobile app.

- Report the Accident: Immediately after the accident, contact State Farm to report the incident. Provide all the necessary details, including the date, time, location, and a description of what happened.

- Gather Information: Collect information from all parties involved, including names, addresses, phone numbers, insurance information, and driver’s license numbers. Take pictures of the damage to your vehicle and the other vehicles involved.

- File a Claim: Once you’ve reported the accident, you’ll need to file a claim. You can do this online, by phone, or through the State Farm mobile app. You’ll need to provide information about the accident, including the date, time, location, and a description of what happened. You’ll also need to provide information about your vehicle, including the year, make, model, and VIN.

- Investigate the Claim: State Farm will investigate the claim to determine liability. This may involve reviewing police reports, witness statements, and photographs.

- Receive a Settlement Offer: Once the investigation is complete, State Farm will make a settlement offer. You can accept or reject the offer. If you reject the offer, you can negotiate a higher settlement amount.

Customer Service Role in Claims

State Farm’s customer service representatives play a crucial role in the claims process. They are trained to guide you through the process, answer your questions, and provide support.

- Provide Information: Customer service representatives can provide information about the claims process, policy coverage, and available resources.

- Handle Inquiries: They can answer questions about your claim, the status of your claim, and any other concerns you may have.

- Facilitate Communication: Customer service representatives can help you communicate with other parties involved in the claim, such as the other driver’s insurance company or a repair shop.

- Resolve Issues: They can help resolve any issues or concerns you may have with your claim.

Understanding Policy Terms and Conditions

It’s important to understand the terms and conditions of your liability auto insurance policy. This will help you understand your coverage and what to expect in the event of an accident.

- Coverage Limits: Your policy will specify the limits of your coverage. This is the maximum amount that State Farm will pay for damages.

- Deductibles: Your policy will also specify your deductible. This is the amount you’ll have to pay out of pocket before State Farm starts paying for damages.

- Exclusions: Your policy will list certain situations that are not covered. For example, your policy may not cover damages caused by driving under the influence of alcohol or drugs.

Comparison with Other Providers

Choosing the right auto insurance provider can be a daunting task, as numerous companies offer diverse coverage options and pricing structures. To help you make an informed decision, this section will compare State Farm liability auto insurance with other leading providers in the market.

Key Differences in Coverage

It is important to understand that each provider offers different levels of coverage and benefits. While some insurers may prioritize comprehensive coverage, others may focus on specific aspects like accident forgiveness or roadside assistance. Comparing coverage options can help you determine which provider aligns best with your individual needs.

- State Farm provides a comprehensive range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. They also offer optional add-ons like rental reimbursement and accident forgiveness.

- Other leading providers, such as Geico, Progressive, and Allstate, also offer similar core coverage options. However, their specific coverage details and limitations may differ. For instance, Geico is known for its competitive pricing on liability coverage, while Progressive offers customizable coverage options through its “Name Your Price” tool.

- When comparing coverage, it’s crucial to consider the specific features and limitations offered by each provider. This includes deductibles, coverage limits, and exclusions.

Pricing Comparison

Pricing is a major factor for most consumers when choosing auto insurance. It is essential to compare quotes from multiple providers to find the most competitive rates.

- State Farm’s pricing is generally considered competitive, but it can vary significantly based on factors like location, driving history, vehicle type, and coverage options.

- Geico and Progressive are often known for their competitive pricing, particularly for drivers with good driving records. Allstate typically offers a broader range of discounts, which can benefit drivers with specific circumstances, such as being a good student or having multiple policies.

- To get an accurate price comparison, it’s recommended to obtain quotes from multiple providers using the same information for each. This allows you to directly compare rates and identify the best value for your needs.

Customer Service and Claims Process

Customer service and claims handling are crucial aspects of any insurance provider. A smooth and efficient claims process can significantly impact your experience during a challenging time.

- State Farm is renowned for its strong customer service and claims handling capabilities. They have a wide network of agents and a user-friendly online platform for managing policies and filing claims.

- Other providers, such as Geico and Progressive, have also invested in improving their customer service and claims processes. They often offer 24/7 support and online tools for managing policies and reporting claims.

- It’s essential to consider factors like response times, claim settlement speed, and customer satisfaction ratings when evaluating customer service and claims handling.

Pros and Cons of Choosing State Farm

Choosing State Farm offers certain advantages, but it’s also important to consider potential drawbacks.

- Pros:

- Comprehensive coverage options

- Strong customer service and claims handling

- Wide network of agents

- Extensive discounts and rewards programs

- Cons:

- Pricing may not be the most competitive for all drivers

- Limited customization options compared to some providers

Legal Considerations and Exclusions

Understanding the legal implications and limitations of your State Farm liability auto insurance policy is crucial for protecting yourself financially in case of an accident. This section will delve into the legal ramifications of liability coverage and highlight common exclusions that may affect your coverage.

Legal Implications of Liability Coverage

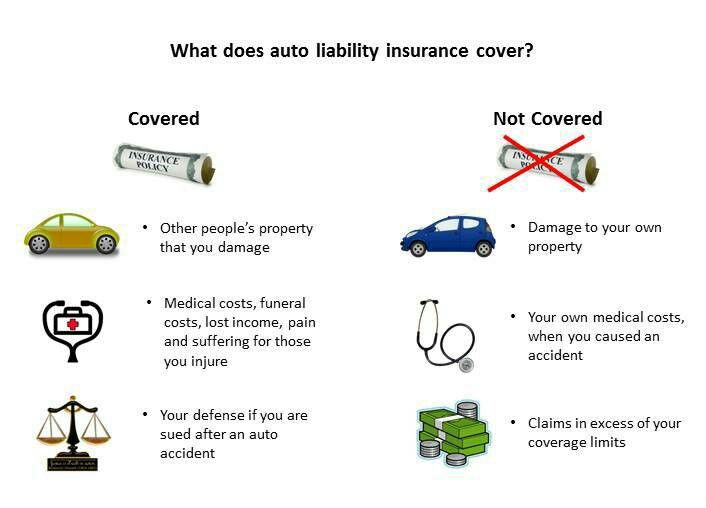

Liability coverage in auto insurance is designed to protect you financially if you are found legally responsible for an accident. If you are deemed at fault, your liability coverage will help pay for the other driver’s damages, including medical expenses, property damage, and lost wages. This coverage can also protect you from lawsuits filed by the other driver. It’s essential to note that liability coverage does not cover your own damages. For that, you’ll need collision and comprehensive coverage.

Common Exclusions in State Farm Liability Auto Insurance Policies

State Farm, like most insurance providers, has specific exclusions in its liability auto insurance policies. These exclusions are limitations on the coverage provided and may affect your claim payout. It’s important to review your policy carefully to understand these exclusions.

Here are some common exclusions:

- Intentional Acts: If you intentionally cause an accident, your liability coverage will not apply.

- Driving Under the Influence: If you are driving under the influence of alcohol or drugs, your liability coverage may be limited or denied.

- Unlicensed or Uninsured Drivers: If you are driving without a valid driver’s license or without insurance, your liability coverage may not apply.

- Using the Vehicle for Commercial Purposes: If you use your vehicle for commercial purposes, such as delivering goods or services, your liability coverage may be limited.

- Certain Types of Accidents: Some accidents, such as those involving racing or off-road driving, may be excluded from your liability coverage.

Importance of Consulting a Legal Professional

It is crucial to consult with a legal professional if you have any questions about your liability coverage or if you are involved in an accident. A lawyer can help you understand your rights and responsibilities, advise you on how to proceed with a claim, and negotiate with the insurance company on your behalf.

Additional Resources and Information

This section will provide you with valuable resources to help you gain a comprehensive understanding of State Farm liability auto insurance. You can find links to official State Farm websites, policy documents, and contact information. Additionally, you can find suggestions for seeking professional advice on insurance matters.

Official State Farm Website

The official State Farm website is a valuable resource for obtaining detailed information about their liability auto insurance policies. The website provides comprehensive information about coverage options, policy terms, and pricing. You can also use the website to get a personalized quote, manage your existing policy, and file claims.

Policy Documents

State Farm offers various policy documents that provide detailed information about their liability auto insurance policies. These documents Artikel the coverage options, exclusions, and limitations of your policy. You can access these documents through the official State Farm website or by contacting your insurance agent.

Contact Information

State Farm provides multiple channels for contacting their customer service representatives. You can reach them by phone, email, or through their online chat service. Their customer service team is available to answer your questions, address concerns, and provide assistance with your policy.

Seeking Professional Advice

While this guide provides a comprehensive overview of State Farm liability auto insurance, it is always recommended to seek professional advice from an insurance agent or financial advisor. They can provide personalized guidance based on your specific needs and circumstances.

Closing Notes

Navigating the world of auto insurance can be complex, but understanding State Farm liability auto insurance empowers you to make informed decisions. By carefully considering your coverage options, premium factors, and the claims process, you can secure the protection you need while driving. Remember to consult with a State Farm agent or insurance professional to discuss your specific requirements and ensure you have the right coverage for your peace of mind.

Question & Answer Hub

What is the difference between bodily injury liability and property damage liability?

Bodily injury liability covers injuries you cause to others in an accident, while property damage liability covers damage you cause to another person’s vehicle or property.

How do I know if I have enough liability coverage?

Your state likely has minimum liability coverage requirements, but it’s best to consult with a State Farm agent to determine the appropriate coverage for your individual needs and risk tolerance.

What happens if I’m involved in an accident with an uninsured driver?

Uninsured/underinsured motorist coverage protects you in case you’re involved in an accident with a driver who doesn’t have sufficient insurance. This coverage can help pay for your injuries and damages.