State Farm insurance number claims are an integral part of the process when you need to file a claim for any type of insurance, whether it’s auto, home, life, or other policies. Understanding how to use your claim number and navigate the claims process can make a significant difference in the timeliness and efficiency of receiving your benefits.

This guide will delve into the significance of your State Farm insurance number, outlining its role in claim tracking and communication. We’ll explore how to locate your claim number, manage your claim, and address common questions that may arise during the claims process.

Understanding State Farm Insurance Claims

State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including auto, home, life, and health insurance. Understanding the process of filing a claim with State Farm is crucial for policyholders who need to make a claim.

Types of Claims State Farm Handles

State Farm offers a variety of insurance products, and each product has its own set of claims processes.

- Auto Insurance Claims: These claims are filed when an insured vehicle is involved in an accident, theft, or damage due to natural disasters. State Farm provides coverage for repairs, medical expenses, and lost wages.

- Home Insurance Claims: These claims are filed when an insured home experiences damage due to fire, theft, vandalism, or natural disasters. State Farm provides coverage for repairs, replacement costs, and temporary housing.

- Life Insurance Claims: These claims are filed when an insured person passes away. State Farm provides a death benefit to the beneficiary named in the policy.

- Health Insurance Claims: These claims are filed when an insured person incurs medical expenses. State Farm provides coverage for medical treatments, hospital stays, and prescription drugs.

The Process of Filing a Claim with State Farm

The process of filing a claim with State Farm is straightforward and can be done online, over the phone, or in person.

- Contact State Farm: The first step is to contact State Farm to report the claim. You can do this by calling their customer service line, visiting their website, or going to a local State Farm office.

- Provide Information: You will need to provide information about the claim, including the date and time of the incident, the location of the incident, and any witnesses involved.

- File a Claim: Once you have reported the claim, State Farm will provide you with a claim number and a claim representative who will handle your claim.

- Investigate the Claim: State Farm will investigate the claim to determine the validity of the claim and the extent of the damages. This may involve taking photos, interviewing witnesses, and reviewing documents.

- Negotiate a Settlement: Once the investigation is complete, State Farm will negotiate a settlement with you. This will involve determining the amount of compensation you are entitled to receive.

- Receive Payment: Once the settlement is agreed upon, State Farm will send you a payment.

Average Processing Time for State Farm Claims

The average processing time for State Farm claims varies depending on the type of claim and the complexity of the claim.

- Auto Insurance Claims: Simple auto insurance claims, such as those involving minor damage, can be processed within a few days. More complex claims, such as those involving significant damage or injuries, may take several weeks or even months to process.

- Home Insurance Claims: Simple home insurance claims, such as those involving minor damage, can be processed within a few weeks. More complex claims, such as those involving significant damage or structural issues, may take several months to process.

- Life Insurance Claims: Life insurance claims typically take several weeks to process.

- Health Insurance Claims: Health insurance claims can take a few days to several weeks to process, depending on the complexity of the claim and the specific provider.

State Farm Claim Number Significance

Your State Farm claim number is a unique identifier assigned to your claim. It serves as a crucial element throughout the entire claims process, ensuring smooth communication and efficient tracking of your claim.

Claim Number Usage in the Claims Process, State farm insurance number claims

Your claim number is the key to accessing information about your claim. It’s used to track the progress of your claim, from the initial reporting to the final settlement.

- Communication: When you contact State Farm about your claim, you’ll need to provide your claim number. This allows State Farm representatives to quickly access your claim details and provide you with the most up-to-date information.

- Claim Tracking: Your claim number is used to track the progress of your claim, from the initial report to the final settlement. You can use your claim number to check the status of your claim online or through the State Farm mobile app.

- Document Management: All documentation related to your claim, including estimates, repair orders, and settlement agreements, will be linked to your claim number. This ensures that all documents are easily accessible and organized.

Locating Your Claim Number

You can find your claim number on various State Farm documents.

- Claim Confirmation Email or Letter: When you report a claim, State Farm will send you a confirmation email or letter that includes your claim number.

- State Farm Mobile App: If you have the State Farm mobile app, you can find your claim number in the “My Claims” section.

- State Farm Website: You can access your claim information, including your claim number, by logging into your State Farm account online.

Managing Your State Farm Claim

Once you’ve filed a claim, you’ll want to keep track of its progress. State Farm provides various tools and resources to help you stay informed.

Checking Your Claim Status Online

State Farm’s online portal allows you to conveniently monitor your claim’s status. You can access your claim information and track its progress from the comfort of your home.

- Log in to your State Farm account using your username and password.

- Navigate to the “Claims” section of your account.

- Select the claim you wish to check.

- You’ll find detailed information about your claim, including its current status, any updates, and next steps.

Communicating with State Farm Representatives

Effective communication is crucial throughout the claims process. State Farm offers several channels for you to connect with their representatives.

- Phone: Contact State Farm’s customer service line to speak directly with a representative.

- Email: You can send an email to State Farm with any questions or concerns regarding your claim.

- Online Chat: Some State Farm websites offer a live chat feature, allowing you to connect with a representative in real time.

When communicating with State Farm representatives, be clear, concise, and polite. Provide all necessary information, including your claim number, and ask for clarification if needed.

Documents Needed for the Claims Process

State Farm may require you to provide certain documents to support your claim. These documents help them verify the details of your claim and ensure you receive the appropriate compensation.

- Police report: If your claim involves an accident, you’ll need to provide a copy of the police report.

- Proof of ownership: Provide documentation showing you own the property or vehicle involved in the claim, such as a title or registration.

- Photos or videos: Taking clear pictures or videos of the damage can help support your claim.

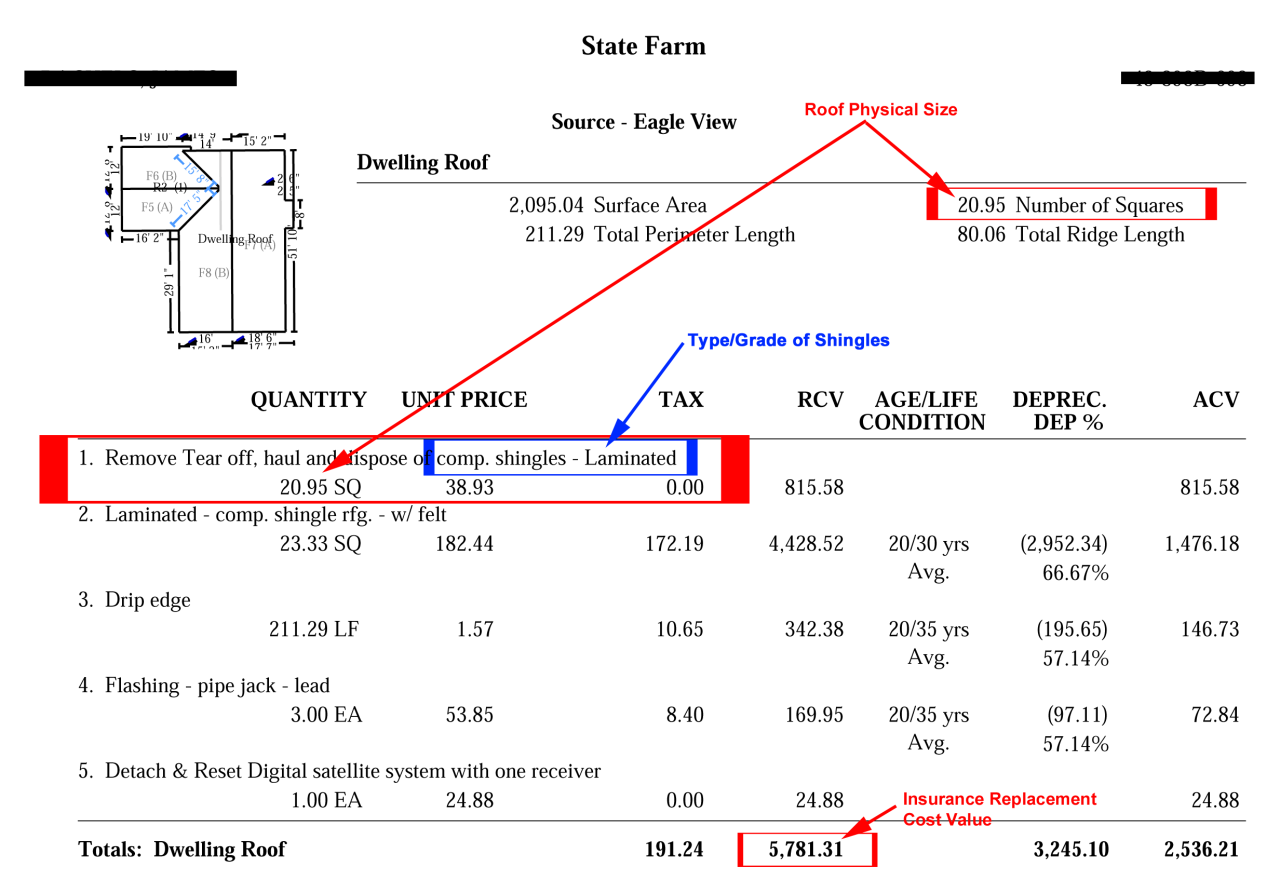

- Estimates: Get estimates from qualified repair professionals for any necessary repairs or replacements.

- Medical records: If you’ve sustained injuries, you’ll need to provide medical records to support your claim.

Common Claim-Related Questions

When dealing with insurance claims, it’s natural to have questions about the process and what to expect. This section addresses some of the most frequently asked questions related to State Farm insurance claims.

Factors Affecting Settlement Amount

The settlement amount for a claim is determined by several factors, including the nature of the claim, the policy coverage, the extent of the damage, and the applicable state laws.

- Policy Coverage: The type and amount of coverage you have will directly influence the maximum amount you can receive for your claim. For example, if you have a higher deductible, you will receive a lower payout.

- Extent of Damage: The severity of the damage will be a key factor in determining the settlement amount. A more significant damage will likely result in a higher payout.

- Applicable State Laws: State laws can impact how claims are handled and the maximum amounts payable. Some states may have specific regulations regarding the types of claims and the amount of compensation available.

- Negotiation: Both the insured and the insurer can negotiate the settlement amount. It is essential to understand your rights and options during the negotiation process.

Appealing a Claim Decision

If you disagree with State Farm’s decision on your claim, you have the right to appeal the decision.

- Understand the Appeal Process: The specific steps involved in appealing a claim decision will vary depending on the type of claim and the state you live in. It is essential to review your policy and contact State Farm to understand the appeal process in your situation.

- Gather Evidence: To support your appeal, you will need to gather evidence to demonstrate the validity of your claim and the reasons why you believe the initial decision was incorrect. This evidence could include medical records, repair estimates, photographs, or witness statements.

- Submit a Formal Appeal: Once you have gathered the necessary evidence, you will need to submit a formal appeal to State Farm. This typically involves completing a specific form and providing all relevant documentation.

Claim Handling Process for Different Policy Types

The claim handling process can vary depending on the type of insurance policy involved.

- Auto Insurance: If you have an auto insurance claim, you will need to report the accident to State Farm as soon as possible. The insurer will then investigate the claim, assess the damage, and determine the appropriate settlement amount.

- Homeowners Insurance: For homeowners insurance claims, you will need to report the damage to State Farm and provide documentation, such as photographs and repair estimates. The insurer will then assess the damage and determine the appropriate payout.

- Life Insurance: In the case of a life insurance claim, you will need to provide the insurer with a death certificate and other required documentation. The insurer will then verify the claim and process the payout to the designated beneficiary.

State Farm Claims Resources: State Farm Insurance Number Claims

State Farm provides a comprehensive suite of resources to assist policyholders in navigating the claims process smoothly and efficiently. These resources are designed to empower you with information, tools, and support to make informed decisions and manage your claim effectively.

Contact Information

This section provides a convenient table outlining State Farm’s customer service contact information.

| Service | Phone Number | Website |

|---|---|---|

| General Customer Service | 1-800-STATE-FARM (1-800-782-8332) | www.statefarm.com |

| Claims Reporting | 1-800-424-2424 | www.statefarm.com/claims |

| Roadside Assistance | 1-800-STATE-FARM (1-800-782-8332) | www.statefarm.com/roadside-assistance |

Online Claim Portal

State Farm’s online claim portal is a user-friendly platform that offers a range of features to streamline the claims process. This table highlights the key features of the portal.

| Feature | Description |

|---|---|

| Claim Reporting | File a claim online, 24/7, for most types of incidents. |

| Claim Status Tracking | Monitor the progress of your claim in real-time. |

| Document Upload | Upload supporting documents, such as photos or repair estimates. |

| Communication Center | Send and receive messages with your claims adjuster. |

| Payment Options | Manage payment information and track claim settlements. |

Additional Resources

State Farm offers a variety of resources to support policyholders beyond the claims process.

- State Farm Mobile App: The State Farm mobile app provides convenient access to policy information, claim reporting, and other features.

- State Farm Agent Network: Local State Farm agents are available to provide personalized assistance and guidance throughout the claims process.

- State Farm Website: The State Farm website offers a wealth of information on insurance policies, claims procedures, and other resources.

- State Farm Customer Care Center: The State Farm Customer Care Center provides 24/7 support for policyholders with questions or concerns.

Ending Remarks

By understanding the significance of your State Farm insurance number, you can navigate the claims process with confidence and ensure a smoother experience. Remember to keep your claim number readily available, follow the provided steps for managing your claim, and don’t hesitate to reach out to State Farm’s customer service for any questions or concerns. With a clear understanding of the process and your claim number, you can navigate the path to recovery with ease.

FAQ Section

How long does it take for State Farm to process a claim?

The processing time for a State Farm claim can vary depending on the type of claim, the complexity of the situation, and the availability of necessary documentation. However, State Farm strives to process claims promptly and efficiently.

What happens if my claim is denied?

If your claim is denied, you have the right to appeal the decision. State Farm provides detailed information on the appeals process, and you can contact their customer service for guidance.

What documents do I need to provide when filing a claim?

The specific documents required for a claim will depend on the type of claim. However, common documents include proof of insurance, police reports (if applicable), medical records, and receipts for expenses.