Largest insurance companies in united states – The largest insurance companies in the United States play a crucial role in safeguarding individuals and businesses against unforeseen risks. These companies, with their vast financial resources and extensive networks, offer a wide range of insurance products and services, ensuring financial security and peace of mind for millions of Americans. This article delves into the world of these giants, exploring their operations, market share, financial performance, and the impact they have on the economy.

From life insurance to health insurance, property and casualty coverage, and workers’ compensation, these companies provide a safety net against life’s uncertainties. They navigate a complex regulatory landscape, adapt to evolving consumer needs, and constantly strive to innovate and improve their offerings. This article examines the key trends shaping the industry, including technological advancements, increasing healthcare costs, and the changing demographics of the American population.

Top Insurance Companies in the United States

The insurance industry plays a vital role in the U.S. economy, providing financial protection against various risks. The largest insurance companies in the United States dominate the market, offering a wide range of products and services to individuals and businesses.

Top 10 Largest Insurance Companies in the United States

The following table lists the top 10 largest insurance companies in the United States based on revenue, as of 2022. This information provides a snapshot of the industry’s key players and their respective market share.

| Rank | Company Name | Year Founded | Headquarters | Major Lines of Insurance Coverage | Notable Subsidiaries or Divisions |

|---|---|---|---|---|---|

| 1 | UnitedHealth Group | 1977 | Minnetonka, Minnesota | Health insurance, dental insurance, vision insurance, life insurance, disability insurance | Optum, UnitedHealthcare |

| 2 | Berkshire Hathaway | 1955 | Omaha, Nebraska | Property and casualty insurance, life insurance, reinsurance | GEICO, General Reinsurance |

| 3 | Anthem, Inc. | 1935 | Indianapolis, Indiana | Health insurance, dental insurance, vision insurance, life insurance, disability insurance | Empire BlueCross BlueShield, Blue Cross and Blue Shield of Illinois |

| 4 | Cigna | 1845 | Bloomfield, Connecticut | Health insurance, dental insurance, vision insurance, life insurance, disability insurance | Express Scripts, Cigna Global |

| 5 | Humana Inc. | 1961 | Louisville, Kentucky | Health insurance, dental insurance, vision insurance, life insurance | Humana Military, Humana Pharmacy |

| 6 | Aetna Inc. | 1853 | Hartford, Connecticut | Health insurance, dental insurance, vision insurance, life insurance, disability insurance | Aetna International, Aetna Life Insurance Company |

| 7 | Progressive Corporation | 1937 | Mayfield Village, Ohio | Auto insurance, home insurance, motorcycle insurance | Progressive Insurance Agency, Inc., Arity |

| 8 | Allstate Corporation | 1931 | Northbrook, Illinois | Auto insurance, home insurance, life insurance | Esurance, Allstate Financial |

| 9 | Liberty Mutual Insurance | 1912 | Boston, Massachusetts | Auto insurance, home insurance, commercial insurance | Liberty Mutual Group, Safeco Insurance |

| 10 | Travelers Companies, Inc. | 1864 | Hartford, Connecticut | Property and casualty insurance, life insurance, business insurance | Travelers Indemnity Company, St. Paul Travelers |

Key Insurance Segments

The insurance industry in the United States is vast and complex, encompassing a wide range of products and services that cater to diverse needs. Understanding the key insurance segments is crucial for comprehending the industry’s dynamics and its impact on the economy.

Life Insurance

Life insurance provides financial protection to beneficiaries upon the death of the insured individual. It plays a vital role in mitigating financial hardship and ensuring the well-being of dependents. The life insurance market is dominated by a few major players, including:

- Prudential Financial: A leading provider of life insurance, retirement, and investment products, Prudential Financial holds a significant market share.

- MetLife: Another major player in the life insurance market, MetLife offers a comprehensive range of life insurance products, including term life, whole life, and universal life insurance.

- New York Life: A mutual life insurance company with a long history, New York Life is known for its financial stability and strong customer service.

Recent trends in the life insurance market include a growing demand for term life insurance due to its affordability and flexibility, and the increasing popularity of online platforms for purchasing and managing policies. The regulatory landscape for life insurance is overseen by state insurance departments, with a focus on consumer protection and ensuring the solvency of insurance companies. Potential challenges include the increasing cost of healthcare and the need for insurers to adapt to changing demographics and consumer preferences.

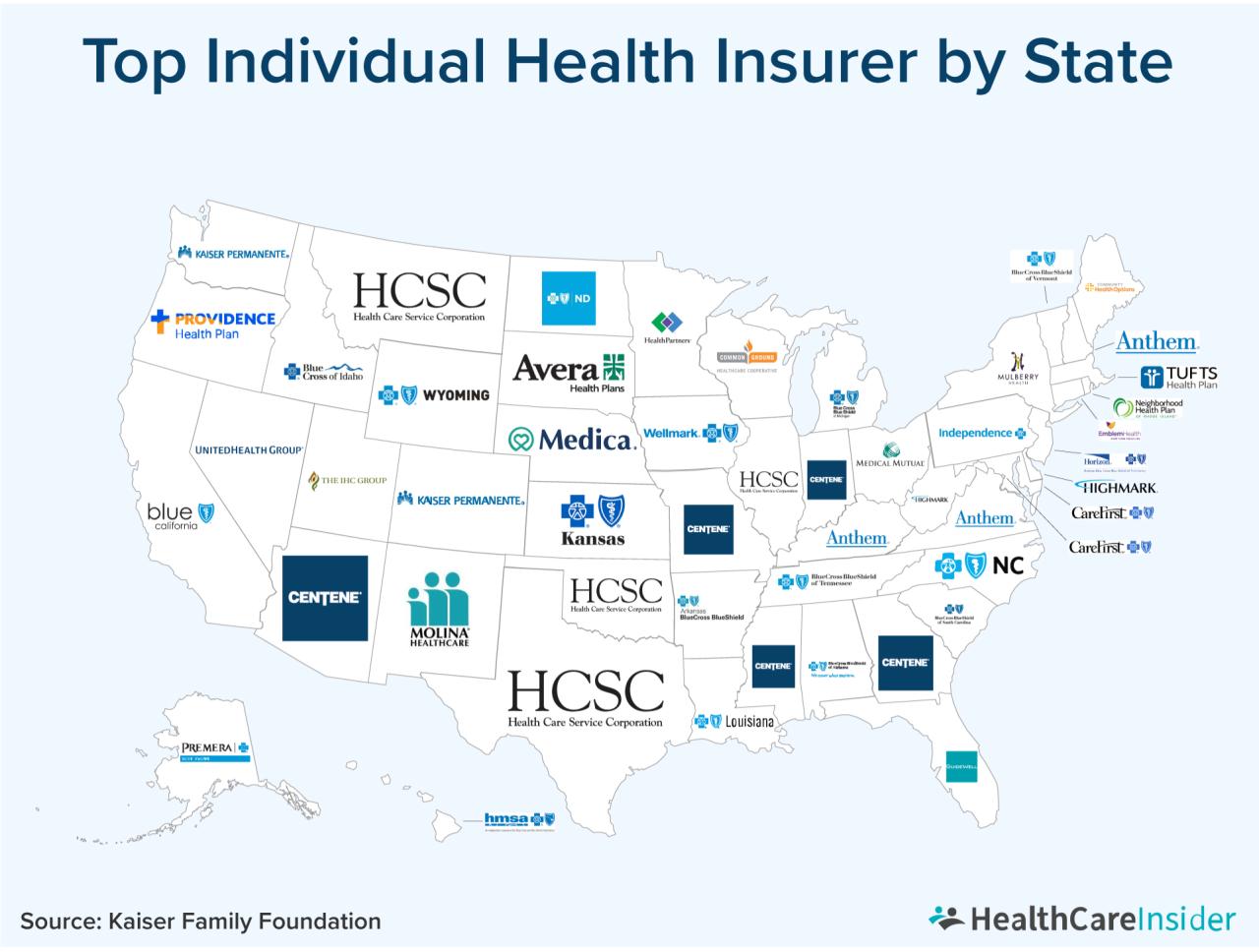

Health Insurance

Health insurance provides financial protection against the costs of healthcare services, including hospital stays, doctor visits, and prescription drugs. The health insurance market is highly regulated, with the Affordable Care Act (ACA) playing a significant role in shaping the industry. Key players in the health insurance market include:

- UnitedHealth Group: The largest health insurer in the United States, UnitedHealth Group offers a wide range of health insurance plans, including employer-sponsored and individual plans.

- Anthem: A major health insurer with a national footprint, Anthem provides health insurance plans to individuals, families, and employers.

- Cigna: A global health service company, Cigna offers a range of health insurance products, including medical, dental, and vision insurance.

Recent trends in the health insurance market include a shift towards value-based care, where insurers incentivize providers to deliver high-quality care at lower costs. The ACA has led to an increase in the number of Americans with health insurance, but challenges remain, including the rising cost of healthcare and the need for insurers to manage the growing burden of chronic diseases.

Property and Casualty Insurance

Property and casualty (P&C) insurance provides financial protection against losses resulting from damage to property or liability for injuries to others. The P&C insurance market is characterized by a wide range of products, including homeowners, auto, and commercial insurance. Key players in the P&C insurance market include:

- State Farm: A leading provider of homeowners and auto insurance, State Farm has a strong presence in the United States, with a large network of agents.

- Liberty Mutual: A major provider of property and casualty insurance, Liberty Mutual offers a wide range of products, including homeowners, auto, and commercial insurance.

- Allstate: A leading provider of homeowners and auto insurance, Allstate has a strong brand recognition and a wide distribution network.

Recent trends in the P&C insurance market include the increasing use of technology, such as telematics and artificial intelligence, to assess risk and personalize insurance products. The regulatory landscape for P&C insurance is complex, with both state and federal regulations governing the industry. Potential challenges include the increasing frequency and severity of natural disasters, the rise of cybercrime, and the need for insurers to adapt to changing consumer expectations.

Workers’ Compensation Insurance

Workers’ compensation insurance provides financial protection to employees who are injured or become ill as a result of their work. It is a mandatory insurance requirement in most states, and it helps to ensure that workers receive medical care and lost wages after a work-related injury or illness. Key players in the workers’ compensation insurance market include:

- Liberty Mutual: A leading provider of workers’ compensation insurance, Liberty Mutual offers a range of services to help employers manage risk and control costs.

- The Hartford: A major provider of workers’ compensation insurance, The Hartford offers a comprehensive range of products and services to help employers manage their risk.

- State Farm: A leading provider of workers’ compensation insurance, State Farm offers a wide range of products and services to help employers manage their risk.

Recent trends in the workers’ compensation insurance market include a focus on preventing workplace injuries and illnesses, as well as the use of technology to improve claims management and reduce costs. The regulatory landscape for workers’ compensation insurance is complex, with each state having its own set of laws and regulations. Potential challenges include the increasing cost of medical care and the need for insurers to adapt to changing demographics and workplace trends.

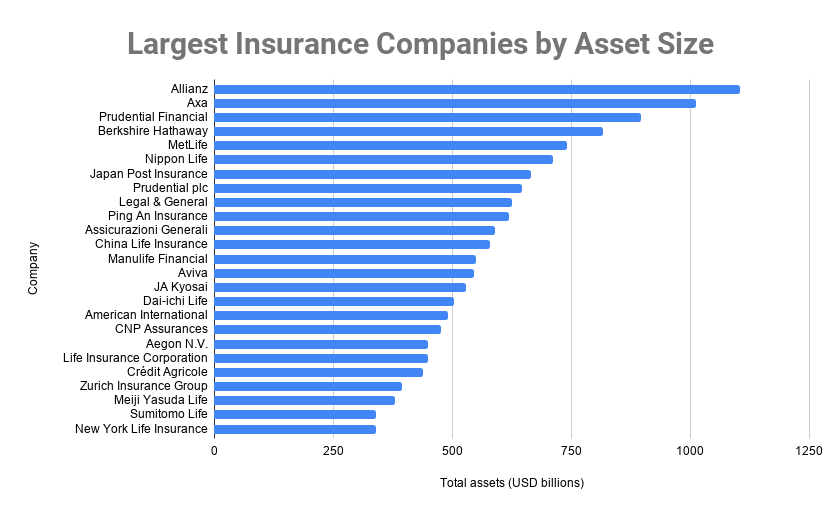

Financial Performance and Market Trends: Largest Insurance Companies In United States

The insurance industry is a dynamic and complex sector, with the largest players constantly adapting to changing market conditions. Understanding the financial performance of these companies and the trends shaping the industry is crucial for investors, consumers, and policymakers alike.

Revenue Growth and Profitability

Revenue growth and profitability are key indicators of an insurance company’s financial health. The largest insurance companies in the United States have generally experienced consistent revenue growth, driven by factors such as population growth, increasing healthcare costs, and expanding product offerings. Profitability, however, can fluctuate due to factors like investment returns, claims experience, and regulatory changes.

- Revenue Growth: The top insurance companies have consistently reported revenue growth in recent years, with some even exceeding the overall market growth rate. This growth is often attributed to factors such as population growth, increasing healthcare costs, and expanding product offerings. For example, the rise in demand for health insurance due to an aging population has boosted the revenue of health insurance companies.

- Profitability: Profitability is a crucial metric for assessing the financial health of an insurance company. It is influenced by various factors, including investment returns, claims experience, and regulatory changes. The profitability of insurance companies can fluctuate significantly, depending on these factors. For example, a significant natural disaster can lead to a surge in claims, negatively impacting profitability.

Investment Strategies and Portfolio Performance

Insurance companies invest a significant portion of their premiums in various asset classes, including stocks, bonds, and real estate. The performance of these investments directly impacts their profitability.

- Investment Strategies: Insurance companies employ a range of investment strategies, tailored to their risk appetite and long-term financial goals. They typically prioritize investments that offer a balance of risk and return, with a focus on generating stable and predictable income streams.

- Portfolio Performance: The performance of an insurance company’s investment portfolio is crucial for its financial health. A well-diversified portfolio with a mix of asset classes can help mitigate risk and generate consistent returns. However, market fluctuations can impact portfolio performance, requiring companies to adjust their investment strategies accordingly.

Key Financial Ratios and their Implications

Financial ratios provide insights into the financial health and performance of insurance companies. Key ratios include:

- Combined Ratio: This ratio measures the company’s underwriting profitability, indicating whether it is generating more revenue from premiums than it is paying out in claims and expenses. A combined ratio below 100% indicates underwriting profitability, while a ratio above 100% suggests underwriting losses.

- Return on Equity (ROE): This ratio measures the company’s profitability relative to its equity capital. A higher ROE indicates better utilization of shareholder capital and a stronger financial position.

- Debt-to-Equity Ratio: This ratio indicates the company’s financial leverage, highlighting the proportion of debt financing relative to equity financing. A higher debt-to-equity ratio implies a higher level of financial risk.

Technological Advancements and Digitalization

The insurance industry is undergoing a rapid transformation driven by technological advancements and digitalization.

- Insurtech: The emergence of Insurtech companies is disrupting the traditional insurance model, offering innovative products and services through digital platforms. Insurtech companies leverage data analytics, artificial intelligence, and blockchain technology to streamline processes, personalize customer experiences, and offer competitive pricing.

- Digital Distribution Channels: Insurance companies are increasingly adopting digital distribution channels, such as online platforms and mobile apps, to reach a wider customer base and offer a more convenient buying experience. This shift has led to a decline in the reliance on traditional intermediaries, such as insurance agents and brokers.

- Data Analytics and Artificial Intelligence (AI): Insurance companies are leveraging data analytics and AI to gain insights into customer behavior, risk assessment, and fraud detection. These technologies enable companies to make more informed decisions, personalize products and services, and improve efficiency.

Increasing Healthcare Costs and Aging Population

The rising cost of healthcare and an aging population are major challenges facing the insurance industry, particularly for health insurance companies.

- Healthcare Cost Inflation: Healthcare costs have been rising steadily for several years, driven by factors such as technological advancements, new treatments, and an aging population. This rising cost puts pressure on insurance companies to increase premiums or find ways to manage healthcare expenses more effectively.

- Aging Population: As the population ages, the demand for healthcare services increases, leading to higher healthcare costs. This demographic shift presents a significant challenge for insurance companies, as they need to manage the increasing claims associated with an older population.

Regulatory Changes and Evolving Consumer Preferences

The insurance industry is subject to a complex regulatory environment, which is constantly evolving. Additionally, consumer preferences are changing, with customers increasingly demanding more personalized and digital-driven experiences.

- Regulatory Changes: The insurance industry is subject to a wide range of regulations at both the federal and state levels. These regulations cover areas such as product design, pricing, consumer protection, and solvency. Changes in regulations can significantly impact the operations and profitability of insurance companies.

- Evolving Consumer Preferences: Consumers are increasingly demanding personalized insurance products and services that cater to their specific needs and preferences. They also expect a seamless digital experience, with easy access to information, online policy management, and 24/7 customer support.

Competitive Landscape and Industry Dynamics

The U.S. insurance industry is characterized by intense competition, with a diverse range of players vying for market share. This dynamic landscape is shaped by several factors, including evolving customer needs, technological advancements, and regulatory changes. Understanding the competitive landscape and industry dynamics is crucial for insurers to develop effective strategies for growth and profitability.

Business Models and Strategies

Leading insurance companies employ a variety of business models and strategies to compete in the market. Some companies focus on niche markets, such as specialty insurance or life insurance, while others offer a broad range of products and services.

- Direct Writers: These companies sell insurance directly to consumers through their own agents or online platforms. Examples include Geico, Progressive, and USAA. Direct writers often emphasize lower prices and streamlined processes to attract customers.

- Independent Agents: These agents represent multiple insurance companies and can offer customers a wider range of options. Independent agents often have strong relationships with their local communities and provide personalized service. Examples include Allstate, State Farm, and Farmers.

- Captive Agents: These agents are employed by a specific insurance company and only sell that company’s products. Captive agents may have specialized training and expertise in a particular area of insurance. Examples include MetLife, Prudential, and New York Life.

Competitive Advantages

Insurance companies strive to differentiate themselves from competitors by offering unique value propositions. Key competitive advantages include:

- Price: Offering competitive premiums is a major factor in attracting customers. Companies may achieve this through efficient operations, sophisticated pricing models, and strategic risk management.

- Customer Service: Providing excellent customer service is essential for building loyalty and retaining customers. Companies may invest in technology, training, and processes to improve customer experiences.

- Product Innovation: Developing innovative products and services can attract new customers and meet evolving needs. Examples include telematics-based insurance, which uses data from connected vehicles to personalize premiums, and digital health solutions, which offer remote monitoring and health management tools.

- Brand Reputation: Strong brand recognition and a positive reputation can be valuable assets. Companies may build brand equity through advertising, community engagement, and social responsibility initiatives.

Challenges, Largest insurance companies in united states

Insurance companies face a number of challenges in today’s competitive environment:

- Economic Uncertainty: Economic downturns can lead to increased claims and lower investment returns, impacting insurer profitability.

- Regulatory Changes: The insurance industry is subject to complex and evolving regulations, which can create compliance challenges and impact business operations.

- Cybersecurity Threats: Insurance companies are increasingly vulnerable to cyberattacks, which can disrupt operations, compromise customer data, and damage their reputation.

- Technological Disruption: The rise of InsurTech companies and digital technologies is challenging traditional insurance models and creating new competitive pressures.

Industry Developments

The insurance industry is undergoing significant changes, driven by technological advancements, evolving customer expectations, and regulatory pressures. Key industry developments include:

- Mergers and Acquisitions: Consolidation is a common trend in the industry, as companies seek to achieve economies of scale, expand their product offerings, and gain market share.

- Strategic Partnerships: Insurers are increasingly forming partnerships with technology companies, healthcare providers, and other businesses to develop innovative products and services.

- Digital Transformation: Insurers are embracing digital technologies to improve customer experiences, streamline operations, and enhance risk management capabilities.

- Data Analytics: The use of data analytics is becoming increasingly important for insurers to understand customer behavior, assess risk, and develop personalized products and services.

Impact of the Insurance Industry on the Economy

The insurance industry plays a vital role in the United States economy, contributing significantly to employment, economic growth, and financial stability. Its impact extends beyond providing financial protection to individuals and businesses, influencing various aspects of the economy.

Employment Opportunities and Job Creation

The insurance industry is a significant source of employment in the United States, employing millions of people across various sectors.

- Insurance companies offer a wide range of jobs, from actuaries and underwriters to claims adjusters and customer service representatives.

- The industry also supports numerous related industries, such as software development, data analytics, and legal services.

- According to the Insurance Information Institute (III), the insurance industry directly employs over 2.8 million people in the United States.

Contributions to GDP and Financial Markets

The insurance industry contributes significantly to the United States Gross Domestic Product (GDP) and financial markets.

- Insurance premiums represent a substantial portion of the economy, contributing to the flow of funds and investment.

- Insurance companies invest a large portion of their assets in financial markets, supporting the growth of the economy.

- The industry’s contributions to GDP are substantial, with the III estimating that the insurance industry generated $1.3 trillion in economic activity in 2021.

Role in Risk Management and Financial Stability

The insurance industry plays a critical role in risk management and financial stability, mitigating the impact of unforeseen events and promoting economic resilience.

- Insurance policies provide financial protection against various risks, such as property damage, health issues, and liability claims.

- By pooling risks, insurance companies help individuals and businesses manage uncertainty and avoid catastrophic financial losses.

- The insurance industry’s role in risk management contributes to financial stability, as it helps to absorb shocks and prevent systemic risks.

Summary

The insurance industry in the United States is a dynamic and vital sector, constantly evolving to meet the changing needs of its customers. The largest insurance companies are at the forefront of this evolution, shaping the future of risk management and financial protection. As we look ahead, the industry is poised for continued growth, driven by technological innovation, expanding global reach, and a focus on providing personalized and tailored solutions. By understanding the key players, their strategies, and the broader market trends, we gain valuable insights into the crucial role insurance plays in securing the financial well-being of individuals and businesses alike.

Helpful Answers

What are the main types of insurance offered by these companies?

The largest insurance companies in the United States typically offer a wide range of insurance products, including life insurance, health insurance, property and casualty insurance, workers’ compensation insurance, and more.

How do these companies impact the economy?

Insurance companies contribute significantly to the economy through job creation, investment in financial markets, and their role in risk management, which promotes financial stability.

What are some of the challenges facing the insurance industry?

Challenges include increasing healthcare costs, regulatory changes, evolving consumer preferences, and the need to adapt to technological advancements.