The Idaho State Department of Insurance plays a vital role in safeguarding the financial well-being of Idaho residents by ensuring a stable and fair insurance market. The department’s mission extends beyond simply regulating insurance companies and agents; it also encompasses protecting consumers from unfair or deceptive practices and promoting a healthy insurance industry.

The department’s regulatory authority covers a wide range of insurance products, including life, health, property, and casualty insurance. It establishes and enforces standards for these products to ensure their quality and affordability. The Idaho State Department of Insurance also investigates consumer complaints and provides resources to help individuals navigate the insurance landscape.

Overview of the Idaho Department of Insurance

The Idaho Department of Insurance (DOI) is a state agency responsible for regulating the insurance industry in Idaho. It plays a crucial role in ensuring a fair and stable insurance market for Idaho residents and businesses.

Mission and Purpose

The DOI’s mission is to protect Idaho consumers by ensuring that insurance companies are financially sound, operate fairly, and provide adequate coverage. The department aims to create a competitive and stable insurance market that benefits both consumers and insurers.

Regulatory Authority

The DOI has broad regulatory authority over insurance companies and agents operating in Idaho. This authority encompasses various aspects, including:

- Licensing and regulating insurance companies

- Licensing and regulating insurance agents and brokers

- Supervising the financial solvency of insurance companies

- Enforcing state insurance laws and regulations

- Investigating consumer complaints and resolving disputes

Key Responsibilities

The DOI fulfills several key responsibilities to ensure a fair and stable insurance market. These responsibilities include:

- Consumer Protection: The DOI prioritizes consumer protection by educating the public about insurance, investigating consumer complaints, and resolving disputes. The department also works to prevent fraud and unfair business practices by insurers.

- Market Oversight: The DOI oversees the insurance market to ensure fair competition and prevent monopolies. This involves monitoring rates, reviewing insurance products, and ensuring that insurers comply with state regulations.

- Financial Stability: The DOI plays a vital role in maintaining the financial stability of insurance companies by monitoring their financial condition and requiring them to meet specific capital requirements. This ensures that insurers can meet their obligations to policyholders in the event of a claim.

Consumer Protection and Resources

The Idaho Department of Insurance is committed to protecting consumers and ensuring a fair and competitive insurance marketplace. This commitment is demonstrated through various consumer protection measures, complaint resolution processes, and resources readily available to Idaho residents.

Consumer Protection Measures

The Idaho Department of Insurance implements several measures to safeguard consumers’ interests. These include:

- Licensing and Regulation: The department licenses and regulates insurance companies, agents, and brokers operating in Idaho. This ensures that only qualified and reputable entities are allowed to conduct business within the state.

- Market Conduct Examinations: The department conducts regular examinations of insurance companies to ensure they are complying with state laws and regulations, treating policyholders fairly, and engaging in sound business practices.

- Consumer Education and Outreach: The department actively educates consumers about their rights and responsibilities, helping them make informed decisions about insurance products and services.

- Fraud Prevention: The department works to identify and prevent insurance fraud, protecting consumers from scams and deceptive practices.

Resolving Consumer Complaints

The Idaho Department of Insurance provides a mechanism for consumers to file complaints regarding insurance practices. These complaints are thoroughly investigated, and the department works to resolve them in a fair and timely manner. The department may:

- Mediate Disputes: The department can act as a neutral third party to help resolve disputes between consumers and insurance companies.

- Investigate Complaints: The department has the authority to investigate complaints and determine if violations of state laws or regulations have occurred.

- Take Enforcement Action: If a violation is found, the department can take enforcement action against the insurance company, such as fines or cease and desist orders.

Consumer Resources

The Idaho Department of Insurance offers a variety of resources to assist consumers. These include:

- Website: The department’s website provides information about insurance topics, consumer rights, and complaint procedures. It also includes online tools, such as a search function for licensed insurance companies and agents.

- Publications: The department publishes brochures and guides on various insurance topics, providing consumers with valuable information to make informed decisions.

- Contact Information: The department’s website and publications include contact information for consumers to reach the department by phone, email, or mail.

Licensing and Compliance

The Idaho Department of Insurance (DOI) ensures a fair and stable insurance market by regulating insurance companies and agents operating within the state. This includes licensing, compliance monitoring, and enforcement activities.

Insurance Company Licensing

The DOI requires insurance companies to obtain a license before selling insurance products in Idaho. The process involves:

- Submitting an application with the necessary documentation, including financial statements and business plans.

- Meeting the DOI’s financial solvency requirements, ensuring the company can meet its obligations to policyholders.

- Demonstrating compliance with Idaho’s insurance laws and regulations.

- Paying the required licensing fees.

The DOI reviews applications thoroughly to ensure companies meet the licensing criteria. Once approved, the company is granted a license to operate in Idaho.

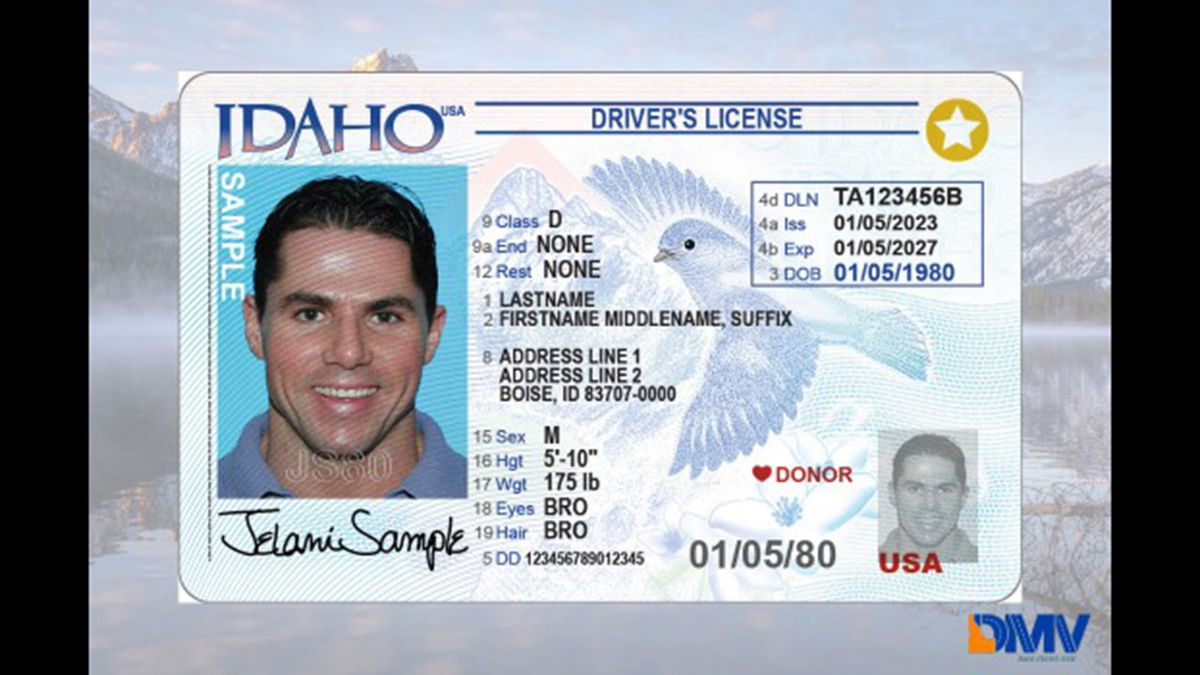

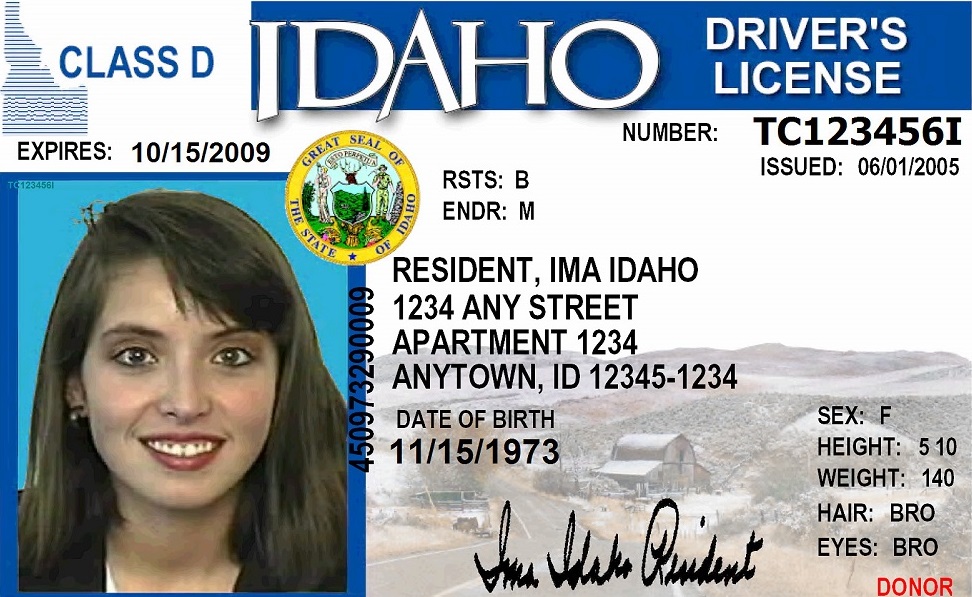

Insurance Agent Licensing, Idaho state department of insurance

Insurance agents also require a license to sell insurance in Idaho. This ensures that individuals representing insurance companies have the necessary knowledge and training to provide accurate and reliable information to consumers. The licensing process involves:

- Passing a written exam demonstrating proficiency in insurance principles and practices.

- Completing a pre-licensing education course.

- Submitting an application with required documentation, including background checks.

- Meeting the DOI’s character and fitness standards.

- Paying the required licensing fees.

Once an agent has met all the requirements, the DOI issues a license, allowing them to sell insurance in Idaho.

Compliance Monitoring and Enforcement

The DOI regularly monitors insurance companies and agents to ensure they comply with Idaho’s insurance laws and regulations. This includes:

- Conducting periodic financial audits of insurance companies to assess their financial stability.

- Reviewing insurance company marketing materials and sales practices to ensure they are fair and transparent.

- Investigating consumer complaints against insurance companies and agents.

- Taking enforcement actions against companies and agents who violate insurance laws and regulations.

Enforcement actions may include fines, license suspensions, or revocations. The DOI’s enforcement activities are essential to protect consumers from unfair or deceptive insurance practices.

Financial Stability and Oversight: Idaho State Department Of Insurance

The Idaho Department of Insurance (IDOI) plays a critical role in safeguarding the financial well-being of insurance companies operating within the state. This ensures the stability of the insurance market and protects policyholders’ interests. The IDOI employs a comprehensive regulatory framework to monitor the financial health of insurers, ensuring they can meet their obligations to policyholders.

Regulatory Framework for Solvency and Stability

The IDOI’s regulatory framework for ensuring the solvency and stability of insurance companies is multifaceted. It encompasses a range of tools and strategies aimed at identifying and mitigating potential risks, promoting responsible financial practices, and safeguarding policyholder interests.

- Capital Requirements: The IDOI mandates insurance companies to maintain adequate capital reserves to absorb potential losses and ensure their ability to meet policyholder claims. These requirements are based on factors such as the company’s size, risk profile, and line of business.

- Risk-Based Supervision: The IDOI employs a risk-based approach to supervision, focusing on insurers with higher risk profiles. This involves more frequent examinations, heightened scrutiny of financial statements, and proactive engagement with companies to address potential vulnerabilities.

- Financial Reporting and Examinations: The IDOI requires insurers to submit regular financial reports, including audited financial statements, to provide transparency into their financial health. The department conducts periodic examinations to verify the accuracy of these reports and assess the insurer’s financial condition.

- Reinsurance Oversight: The IDOI monitors the reinsurance arrangements of insurance companies to ensure the adequacy and reliability of reinsurance coverage. Reinsurance is a crucial mechanism for insurers to transfer risk to other companies, enhancing their financial stability.

- Early Intervention and Corrective Actions: The IDOI proactively identifies and addresses potential financial issues with insurers through early intervention strategies. This includes working with companies to develop corrective action plans to address identified weaknesses and improve their financial health.

Strategies for Mitigating Risks and Protecting Policyholder Interests

The IDOI’s strategies for mitigating risks and protecting policyholder interests are designed to ensure that insurers remain financially sound and able to fulfill their obligations to policyholders. These strategies include:

- Monitoring Market Trends and Emerging Risks: The IDOI closely monitors market trends, including economic conditions, interest rates, and emerging risks, to identify potential threats to the financial stability of insurers.

- Promoting Sound Risk Management Practices: The IDOI encourages insurers to adopt sound risk management practices, including rigorous underwriting standards, prudent investment strategies, and effective claims management processes.

- Enhancing Consumer Education and Awareness: The IDOI prioritizes consumer education and awareness initiatives to empower policyholders to make informed decisions about their insurance coverage. This includes providing resources and information on insurance products, consumer rights, and complaint resolution processes.

- Prompt and Fair Claims Handling: The IDOI ensures that insurers handle claims promptly and fairly, in accordance with the terms of the insurance policy. This involves investigating complaints, resolving disputes, and ensuring that policyholders receive the benefits they are entitled to.

- Guaranty Funds: The IDOI administers the Idaho Insurance Guaranty Association, a safety net for policyholders in the event of an insurer’s insolvency. This fund provides coverage for unpaid claims, ensuring that policyholders are not left without protection.

Current Issues and Trends in Idaho Insurance

The Idaho insurance industry, like its counterparts across the nation, is constantly evolving, facing a range of challenges and opportunities. Understanding these current issues and trends is crucial for the Department of Insurance to effectively protect consumers, ensure the stability of the insurance market, and promote responsible growth within the industry.

Impact of Climate Change on Insurance

Climate change poses a significant threat to the insurance industry, particularly in Idaho, a state susceptible to natural disasters such as wildfires, floods, and droughts. Rising temperatures and changing weather patterns increase the frequency and severity of these events, leading to higher insurance claims and potentially impacting the affordability and availability of coverage.

The Department of Insurance is actively monitoring the impact of climate change on the insurance market and is collaborating with stakeholders to develop strategies to mitigate these risks.

Cybersecurity Threats and Data Privacy

The increasing reliance on technology in the insurance industry has also led to heightened cybersecurity risks. Data breaches and cyberattacks can compromise sensitive consumer information, disrupt business operations, and erode public trust. The Department of Insurance is committed to ensuring that insurers implement robust cybersecurity measures to protect consumer data and maintain the integrity of the insurance market.

Technological Advancements and Insurtech

Technological advancements are transforming the insurance industry, leading to the emergence of new business models, products, and services. Insurtech companies are leveraging data analytics, artificial intelligence, and other technologies to offer innovative solutions, improve efficiency, and enhance customer experiences. The Department of Insurance is monitoring these developments to ensure that consumers are protected and that the industry remains competitive and responsive to evolving consumer needs.

Regulatory Landscape and Compliance

The regulatory landscape for the insurance industry is constantly evolving, with new laws and regulations being implemented to address emerging issues and protect consumers. The Department of Insurance plays a vital role in ensuring that insurers comply with these regulations and operate within a fair and transparent marketplace.

Workforce Development and Talent Acquisition

The insurance industry faces challenges in attracting and retaining a skilled workforce, particularly in areas like data analytics, cybersecurity, and technology. The Department of Insurance is working with industry stakeholders to address these challenges and promote workforce development initiatives that ensure the industry has the talent it needs to thrive in the future.

Final Review

The Idaho State Department of Insurance is committed to maintaining a strong and stable insurance market that benefits both consumers and insurers. The department continuously monitors industry trends and adapts its regulations to address emerging challenges. Through its comprehensive oversight and consumer protection efforts, the Idaho State Department of Insurance strives to create a fair and transparent insurance environment for all Idahoans.

Clarifying Questions

How do I file a complaint against an insurance company?

You can file a complaint online, by phone, or by mail. The Idaho Department of Insurance provides detailed instructions on its website.

What types of insurance are regulated by the Idaho Department of Insurance?

The department regulates a wide range of insurance products, including life, health, property, casualty, and workers’ compensation insurance.

How can I find an insurance agent in Idaho?

The Idaho Department of Insurance maintains a directory of licensed insurance agents on its website. You can search for agents by name, location, or type of insurance.

What resources are available to help me understand my insurance policy?

The Idaho Department of Insurance provides a variety of resources, including publications, online tools, and FAQs, to help consumers understand their insurance policies and rights.