Car insurance rate comparison by state sets the stage for a comprehensive exploration of the factors that influence your car insurance premiums. Understanding how rates vary across different states is crucial for securing the best possible coverage at an affordable price. This guide delves into the intricacies of car insurance pricing, examining key determinants like demographics, driving history, vehicle type, and state-specific regulations.

From the impact of your age and driving record to the value of your vehicle and the specific laws in your state, this article unravels the complexities of car insurance rates, empowering you to make informed decisions about your coverage. Armed with this knowledge, you can navigate the insurance landscape with confidence, finding the most suitable and cost-effective plan to meet your individual needs.

Car Insurance Rate Comparison by State

Navigating the world of car insurance can be overwhelming, especially when you consider the vast differences in rates across states. Understanding how car insurance rates vary from state to state is crucial for finding the best coverage at the most affordable price.

Comparing car insurance rates across different states is essential because factors like state laws, traffic density, and accident rates significantly impact pricing. This comparison helps you identify potential savings and ensures you’re not overpaying for your insurance.

Factors Influencing Car Insurance Rates

Several factors contribute to the variations in car insurance rates across states. These factors influence how insurance companies assess risk and determine premiums.

- State Laws and Regulations: Each state has its own set of laws and regulations governing car insurance, including minimum coverage requirements and the availability of certain types of coverage. For example, some states require drivers to carry higher liability limits than others. These regulations directly influence insurance rates.

- Traffic Density and Accident Rates: States with higher traffic density and accident rates generally have higher car insurance premiums. This is because insurance companies anticipate a greater likelihood of accidents and claims in these areas.

- Cost of Living and Repair Costs: The cost of living, including healthcare costs and vehicle repair expenses, plays a role in determining insurance rates. States with higher costs of living tend to have higher insurance premiums.

- Demographics and Driving Habits: Factors like age, driving experience, and driving history can influence insurance rates. For instance, younger drivers and those with poor driving records often face higher premiums.

Factors Affecting Car Insurance Rates

Your car insurance premium is influenced by a range of factors, and understanding these factors can help you make informed decisions to potentially lower your costs. Let’s explore some key factors that insurers consider when setting your rates.

Demographics

Your age, gender, and marital status can influence your car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in their insurance rates. Similarly, gender can play a role, with some studies suggesting that men tend to have higher accident rates than women. Marital status can also be a factor, with married individuals often considered to be more responsible drivers.

Driving History

Your driving history is a crucial factor in determining your insurance rates. Insurers carefully examine your driving record, looking for any accidents, violations, or other incidents that might indicate a higher risk. For instance, a recent DUI conviction or multiple speeding tickets can significantly increase your premium. Conversely, a clean driving record with no accidents or violations can lead to lower rates.

Vehicle Type and Value

The type and value of your car can significantly impact your insurance costs. High-performance vehicles, luxury cars, and newer models are generally more expensive to repair or replace, leading to higher premiums. Conversely, older, less expensive vehicles with lower repair costs often have lower insurance rates.

State-Specific Laws and Regulations

Car insurance laws and regulations vary significantly from state to state. These laws can impact factors like minimum coverage requirements, the types of insurance available, and the rates insurers can charge. Some states have strict regulations that limit insurer pricing practices, while others offer more flexibility. For example, states with no-fault insurance systems may have lower average premiums compared to states with traditional fault-based systems.

State-Specific Rate Comparisons

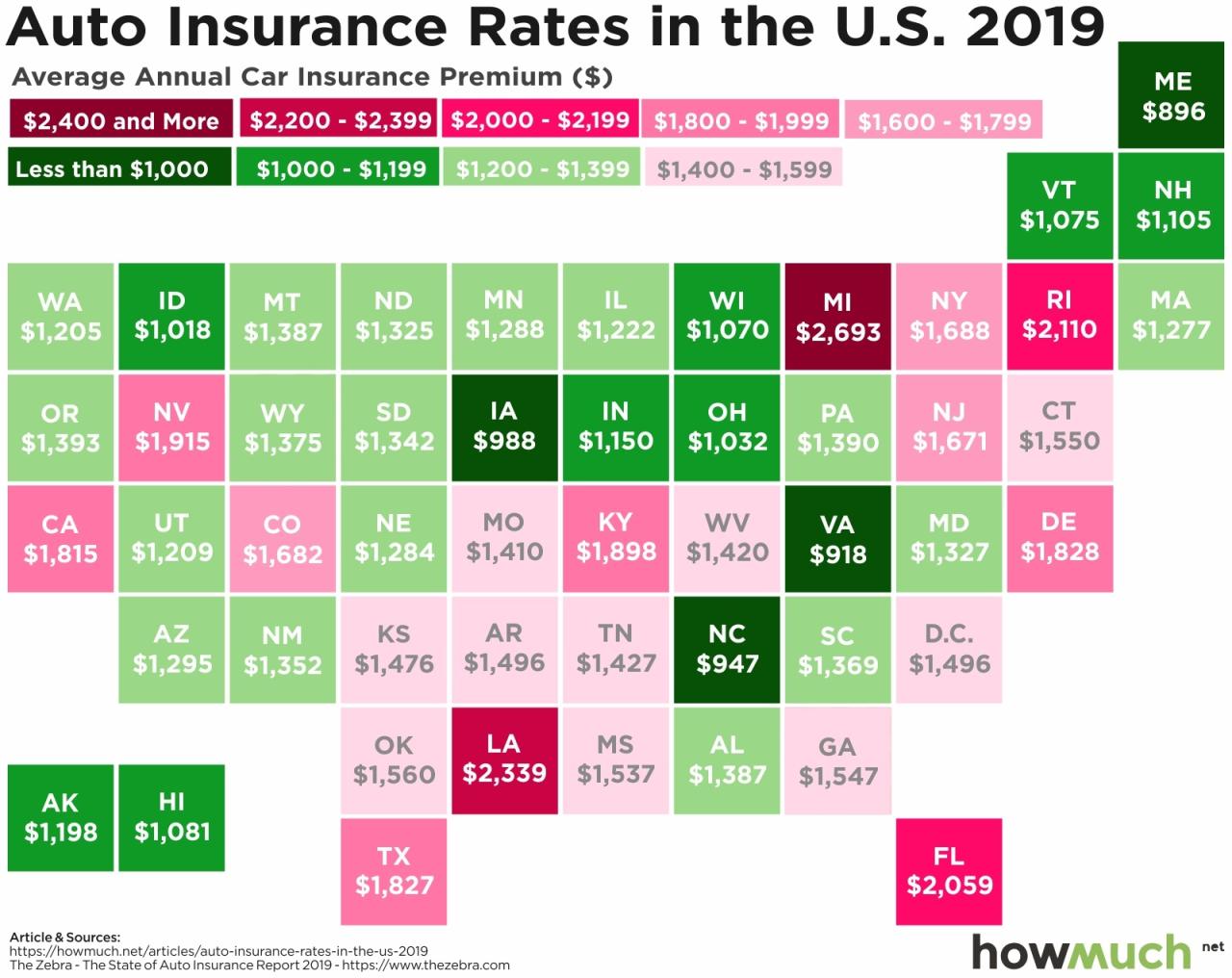

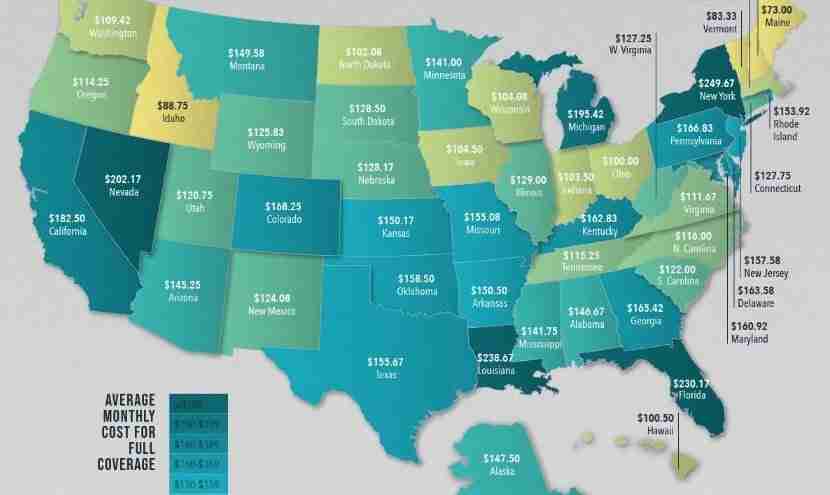

Car insurance rates vary significantly from state to state, influenced by a range of factors such as traffic density, accident rates, and the cost of living. Understanding these variations is crucial for consumers seeking the best value for their insurance needs.

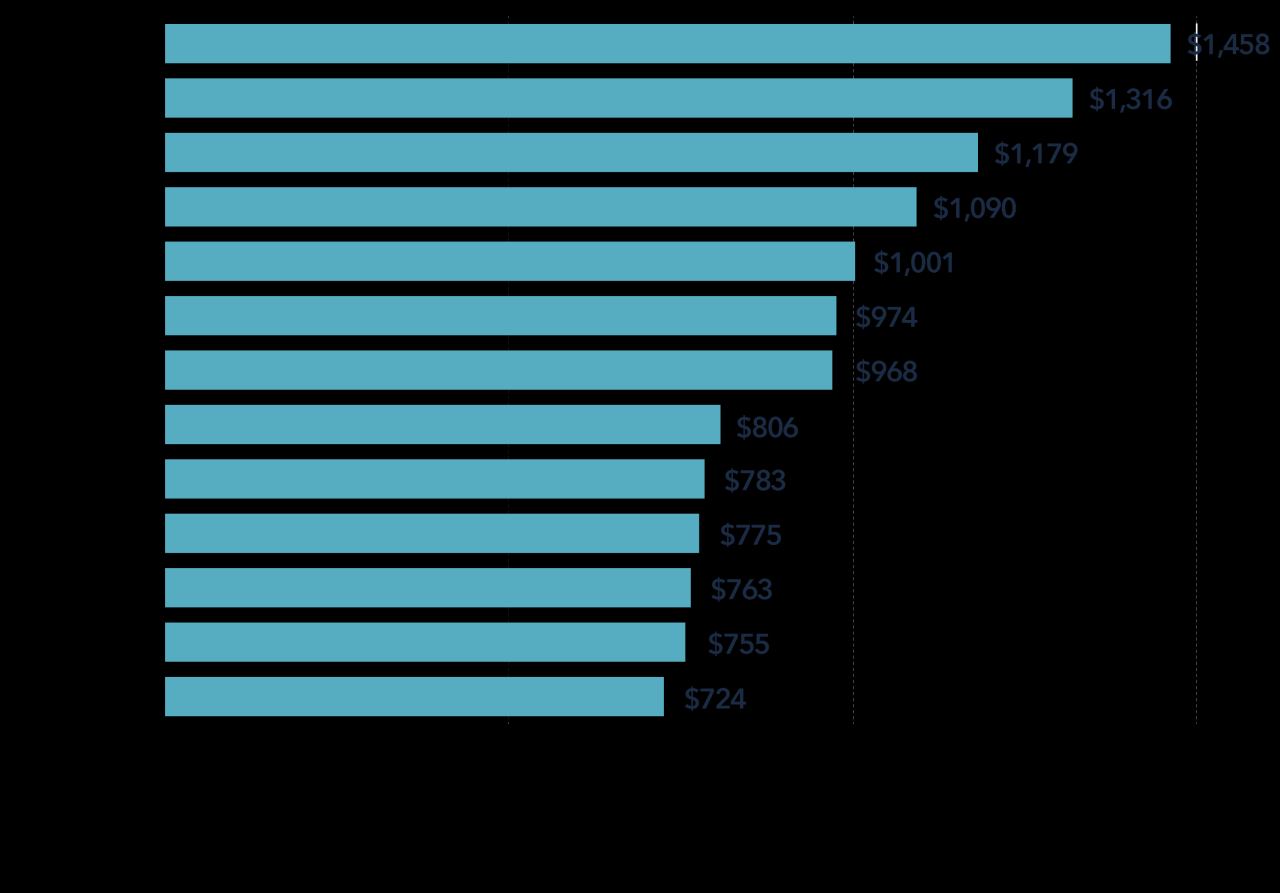

Average Car Insurance Rates by State

This table presents average car insurance rates across the United States, based on data collected from leading insurance companies. The rates reflect the average annual premium for a standard car insurance policy with minimum coverage requirements.

| State | Average Annual Premium |

|---|---|

| Alabama | $1,548 |

| Alaska | $2,034 |

| Arizona | $1,672 |

| Arkansas | $1,496 |

| California | $2,136 |

| Colorado | $1,784 |

| Connecticut | $2,088 |

| Delaware | $1,872 |

| Florida | $2,244 |

| Georgia | $1,632 |

| Hawaii | $2,412 |

| Idaho | $1,524 |

| Illinois | $1,824 |

| Indiana | $1,560 |

| Iowa | $1,488 |

| Kansas | $1,512 |

| Kentucky | $1,440 |

| Louisiana | $2,016 |

| Maine | $1,752 |

| Maryland | $1,968 |

| Massachusetts | $2,040 |

| Michigan | $2,280 |

| Minnesota | $1,728 |

| Mississippi | $1,404 |

| Missouri | $1,572 |

| Montana | $1,608 |

| Nebraska | $1,456 |

| Nevada | $1,896 |

| New Hampshire | $1,692 |

| New Jersey | $2,112 |

| New Mexico | $1,648 |

| New York | $2,208 |

| North Carolina | $1,680 |

| North Dakota | $1,424 |

| Ohio | $1,656 |

| Oklahoma | $1,536 |

| Oregon | $1,848 |

| Pennsylvania | $1,800 |

| Rhode Island | $2,064 |

| South Carolina | $1,704 |

| South Dakota | $1,472 |

| Tennessee | $1,592 |

| Texas | $1,860 |

| Utah | $1,620 |

| Vermont | $1,836 |

| Virginia | $1,768 |

| Washington | $1,920 |

| West Virginia | $1,432 |

| Wisconsin | $1,664 |

| Wyoming | $1,584 |

State-Specific Insurance Market Characteristics

Each state’s insurance market is unique, shaped by factors such as:

- Traffic Density and Accident Rates: States with higher traffic congestion and accident rates tend to have higher insurance premiums. For example, New York City, with its heavy traffic and frequent accidents, has significantly higher car insurance rates compared to rural areas.

- Cost of Living: States with a higher cost of living, particularly for healthcare and vehicle repairs, often have higher insurance premiums. For example, California, with its high cost of living, tends to have higher insurance rates compared to states with lower costs of living.

- State Regulations: State regulations regarding insurance coverage and pricing can impact rates. For example, some states require specific coverage, such as uninsured motorist coverage, which can increase premiums.

- Competition Among Insurers: The level of competition among insurance companies in a state can influence premiums. States with a more competitive market often have lower insurance rates. For example, Texas has a highly competitive insurance market, which contributes to lower average rates.

Key Factors Affecting Rate Variations, Car insurance rate comparison by state

Several factors contribute to the significant variations in car insurance rates across states:

- Driving Habits: States with higher rates of reckless driving, such as speeding and drunk driving, tend to have higher insurance premiums. Insurance companies factor in these risks when setting rates.

- Vehicle Theft Rates: States with higher rates of vehicle theft often have higher insurance premiums, as insurance companies need to cover the risk of theft. For example, states with large metropolitan areas, where vehicle theft is more common, tend to have higher rates.

- Natural Disasters: States prone to natural disasters, such as earthquakes, hurricanes, and floods, often have higher insurance premiums to cover the risk of damage to vehicles. For example, Florida, with its frequent hurricanes, has higher rates compared to states with lower risks of natural disasters.

Tips for Comparing Car Insurance Rates

Finding the best car insurance deal involves more than just getting the lowest quote. You need to consider your individual needs, compare rates from multiple insurers, and understand the coverage you’re getting.

Using Online Comparison Tools

Online comparison tools can save you time and effort when searching for car insurance. These tools allow you to enter your information once and receive quotes from multiple insurers.

- Choose a reputable comparison website. Look for websites that are accredited by organizations like the Better Business Bureau or the National Association of Insurance Commissioners. This will ensure that the website is trustworthy and that the quotes you receive are accurate.

- Be honest and accurate with your information. The more accurate your information is, the more accurate the quotes you receive will be. This will also help you avoid any surprises later on.

- Compare quotes carefully. Don’t just focus on the price. Make sure to compare the coverage offered by each insurer, as well as the deductibles and limits. Also, consider the insurer’s financial stability and customer service ratings.

Contacting Multiple Insurance Providers

While online comparison tools are helpful, it’s still important to contact multiple insurance providers directly. This allows you to:

- Get personalized quotes. Online comparison tools often provide general quotes. By contacting insurance providers directly, you can get a quote tailored to your specific needs.

- Ask questions about coverage and discounts. You can get clarification on the coverage offered by each insurer and inquire about any discounts you may be eligible for.

- Negotiate rates. Sometimes, insurance providers are willing to negotiate rates, especially if you’re a good customer with a clean driving record.

Understanding Policy Coverage and Terms

It’s essential to understand the coverage and terms of your car insurance policy. This will help you ensure you’re adequately protected and avoid any surprises down the line.

- Review your policy carefully. Read through your policy documents thoroughly and make sure you understand the coverage you’re getting. Ask questions if anything is unclear.

- Consider your individual needs. Your car insurance needs will vary depending on factors such as your driving habits, the value of your car, and your financial situation. Make sure the coverage you choose meets your individual needs.

- Understand the deductibles and limits. Deductibles are the amounts you’ll have to pay out of pocket before your insurance coverage kicks in. Limits are the maximum amounts your insurance company will pay for certain types of claims. Choose deductibles and limits that are appropriate for your budget and risk tolerance.

Conclusion

Finding the right car insurance policy can significantly impact your finances. By comparing rates across different providers and understanding the factors that influence premiums, you can secure a policy that offers adequate coverage at a competitive price.

Key Takeaways

- Car insurance rates vary significantly by state, with factors such as population density, accident rates, and cost of living playing a role.

- Understanding the factors that affect car insurance rates, such as your driving history, vehicle type, and coverage options, can help you make informed decisions.

- Comparing quotes from multiple insurance providers is essential to finding the best value for your needs.

Last Recap

In conclusion, understanding the nuances of car insurance rate comparison by state is essential for securing the best possible coverage at a price that aligns with your budget. By carefully considering the factors that influence rates, leveraging online comparison tools, and seeking quotes from multiple providers, you can make informed decisions that protect your financial well-being and ensure adequate coverage in the event of an accident. Remember, the right insurance plan is a key component of responsible driving and financial preparedness.

Key Questions Answered

What are the main factors that affect car insurance rates?

Factors influencing car insurance rates include demographics (age, gender, location), driving history (accidents, violations), vehicle type and value, and state-specific regulations.

How often should I compare car insurance rates?

It’s recommended to compare car insurance rates at least annually, or whenever you experience a significant life change, such as a change in address, driving record, or vehicle ownership.

Are there any discounts available on car insurance?

Yes, many insurance companies offer discounts for factors such as good driving records, safety features in your vehicle, bundling multiple insurance policies, and completing driver safety courses.