Car insurance Florida State Farm sets the stage for a comprehensive exploration of the state’s unique insurance landscape, offering insights into coverage options, rates, and customer experiences. From the history of State Farm in Florida to the factors influencing car insurance costs, this guide provides a detailed overview of what you need to know to make informed decisions about your car insurance.

Navigating Florida’s car insurance market can be challenging due to its high rates and frequent claims. Understanding the factors that contribute to these trends, including the state’s no-fault insurance system and mandatory insurance requirements, is crucial for car owners. This guide explores these aspects, providing valuable information for those seeking to navigate the complexities of car insurance in Florida.

State Farm Car Insurance in Florida

State Farm is a prominent name in the insurance industry, boasting a strong presence in Florida. With a rich history in the state, State Farm has become a trusted provider for car insurance, offering a range of coverage options and services.

History of State Farm in Florida

State Farm entered the Florida market in 1937, expanding its operations across the state. Its commitment to providing reliable insurance solutions and customer service has contributed to its growth and reputation in the Florida insurance market.

State Farm Car Insurance Offerings in Florida

State Farm’s car insurance offerings in Florida cater to diverse needs and budgets. They provide a comprehensive suite of coverage options, including:

- Liability Coverage: This essential coverage protects you financially in case you’re responsible for an accident causing damage to another person’s property or injuries.

- Collision Coverage: This coverage covers repairs or replacement of your vehicle if it’s involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages from non-collision incidents, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This coverage covers medical expenses, lost wages, and other related costs for you and your passengers in case of an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage.

State Farm Car Insurance Discounts in Florida

State Farm offers various discounts to help policyholders save on their premiums. Some of these discounts include:

- Safe Driving Discount: This discount rewards drivers with a clean driving record and no accidents or violations.

- Good Student Discount: This discount is available to students who maintain good academic standing.

- Multi-Policy Discount: This discount is offered to customers who bundle multiple insurance policies with State Farm, such as home and auto insurance.

- Anti-theft Device Discount: This discount is available to policyholders who have anti-theft devices installed in their vehicles.

- Defensive Driving Course Discount: This discount is available to policyholders who complete a defensive driving course.

Comparison of State Farm Car Insurance Rates in Florida

State Farm’s car insurance rates in Florida are generally competitive with other major insurance providers. However, rates can vary significantly based on individual factors, such as driving history, vehicle type, and location.

Factors Influencing Car Insurance Rates in Florida

Several factors influence car insurance rates in Florida. These include:

- Driving History: Drivers with a history of accidents, traffic violations, or DUI convictions will typically pay higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can affect your insurance rates. Sports cars and luxury vehicles are often associated with higher risks and higher premiums.

- Location: Car insurance rates can vary significantly based on your location in Florida. Areas with higher crime rates or traffic congestion tend to have higher premiums.

- Credit Score: In some states, including Florida, insurers may use credit score as a factor in determining car insurance rates. Individuals with good credit scores may qualify for lower premiums.

- Age and Gender: Younger drivers and male drivers are generally considered to be at higher risk and may face higher premiums.

Florida’s Unique Insurance Landscape

Florida’s car insurance market is a complex and dynamic landscape, characterized by high rates and frequent claims. Several factors contribute to this unique environment, making it a challenging environment for both drivers and insurance companies.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system is a significant factor influencing car insurance rates. Under this system, drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages regardless of fault in an accident. This system aims to reduce lawsuits and streamline the claims process. However, it has also contributed to higher insurance premiums due to increased claim frequency and the potential for abuse.

The Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance market, including car insurance. The OIR is responsible for:

- Setting rates and ensuring they are fair and reasonable.

- Monitoring insurance companies’ financial stability and solvency.

- Investigating consumer complaints and resolving disputes.

- Regulating insurance agents and brokers.

Florida’s Mandatory Insurance Requirements

Florida law mandates specific insurance coverage for all car owners. These requirements include:

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the insured and passengers, regardless of fault. This coverage is mandatory for all Florida drivers, with a minimum coverage limit of $10,000 per person.

- Property Damage Liability (PDL): Covers damages to other vehicles or property in an accident. This coverage is also mandatory, with a minimum coverage limit of $10,000 per accident.

- Bodily Injury Liability (BIL): Covers injuries to others in an accident. This coverage is mandatory, with minimum coverage limits of $10,000 per person and $20,000 per accident.

- Uninsured Motorist Coverage (UM): Protects the insured in case of an accident with an uninsured or underinsured driver. This coverage is optional but highly recommended.

Understanding Car Insurance Coverage

Choosing the right car insurance coverage is crucial in Florida, where driving conditions can be unpredictable. State Farm offers various coverage options to meet your individual needs and protect you financially in case of an accident. Understanding the different types of coverage and their benefits is essential for making an informed decision.

Liability Coverage

Liability coverage is a mandatory requirement in Florida and protects you financially if you cause an accident that injures another person or damages their property. It covers the costs of medical bills, lost wages, and property damage up to the limits you choose. This coverage does not cover your own injuries or vehicle damage.

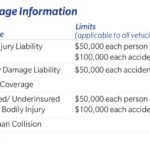

For example, if you cause an accident and the other driver incurs $50,000 in medical bills, your liability coverage will pay up to your policy limit, which could be $25,000, $50,000, or $100,000. You would be responsible for the remaining amount.

Collision Coverage

Collision coverage protects your own vehicle from damage caused by a collision with another vehicle or object, regardless of who is at fault. This coverage helps pay for repairs or replacement of your vehicle, minus your deductible.

For instance, if you hit a tree and your vehicle sustains $5,000 in damage, your collision coverage will pay for the repairs, minus your deductible of $500, leaving you responsible for $500.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It covers the cost of repairs or replacement, minus your deductible.

Imagine your vehicle is damaged by a hailstorm. Comprehensive coverage will pay for the repairs, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in case you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage pays for your medical bills, lost wages, and other expenses, up to your policy limits.

Suppose you are hit by an uninsured driver who is at fault, and you incur $20,000 in medical bills. Your UM/UIM coverage will pay for your medical expenses up to your policy limit, which could be $25,000, $50,000, or $100,000.

Coverage Limits and Claims Payouts

The amount of coverage you choose will directly impact the amount you receive in a claim. Higher coverage limits provide more financial protection in case of a significant accident.

For instance, if you choose a liability coverage limit of $25,000 and cause an accident resulting in $50,000 in damages, you will be responsible for the remaining $25,000. However, if you had chosen a limit of $100,000, your insurance would cover the full $50,000 in damages.

Comparison Table

| Coverage Type | Features | Cost | Benefits |

|---|---|---|---|

| Liability | Protects others from your negligence | Mandatory in Florida | Covers medical bills, lost wages, and property damage of others |

| Collision | Protects your vehicle from collision damage | Optional | Covers repairs or replacement of your vehicle, minus your deductible |

| Comprehensive | Protects your vehicle from non-collision damage | Optional | Covers repairs or replacement of your vehicle, minus your deductible |

| UM/UIM | Protects you from uninsured or underinsured drivers | Optional | Covers your medical bills, lost wages, and other expenses |

State Farm’s Customer Experience

State Farm, a prominent name in the insurance industry, has a significant presence in Florida. The company’s customer experience in the state is a crucial aspect for potential policyholders. Understanding State Farm’s customer service reputation, reviews, and initiatives helps individuals make informed decisions about their insurance needs.

Customer Service Reputation in Florida

State Farm’s customer service reputation in Florida is generally positive, though it varies based on individual experiences and specific situations. The company has a strong brand image and is known for its extensive network of local agents, which provides personalized service and convenient access. However, like any large insurance provider, State Farm faces challenges in consistently meeting the expectations of all customers.

Customer Reviews and Feedback

Online platforms like Trustpilot and Google Reviews offer valuable insights into customer experiences with State Farm in Florida. Reviews highlight both positive and negative aspects of the company’s services.

Claims Process

Customers often express satisfaction with the claims process, particularly with the availability and responsiveness of local agents. However, some reviews mention delays in processing claims or difficulties in obtaining desired outcomes.

Policy Changes

Policy changes, particularly those related to premium adjustments, can be a source of frustration for some customers. Reviews may reflect concerns about communication regarding policy updates and the impact of changes on premiums.

Overall Satisfaction

Overall, customer satisfaction with State Farm in Florida is generally positive. Customers appreciate the company’s reputation, local agent network, and access to various services. However, there are instances of dissatisfaction related to claims processing, policy changes, and communication.

Customer Service Initiatives and Programs

State Farm actively engages in customer service initiatives and programs in Florida to enhance customer experiences.

Agent Training and Development

The company invests in comprehensive training and development programs for its agents, equipping them with the knowledge and skills to effectively serve customers. This focus on agent development aims to ensure consistent quality of service across the state.

Digital Platforms and Tools

State Farm provides online platforms and mobile applications that allow customers to manage their policies, file claims, and access account information conveniently. These digital tools streamline processes and enhance customer accessibility.

Community Involvement

State Farm is known for its commitment to community involvement in Florida. The company sponsors various local events, supports charitable organizations, and participates in community initiatives. These efforts demonstrate the company’s commitment to its customers and the state.

Comparison to Other Insurance Providers

State Farm’s customer experience in Florida compares favorably to other insurance providers in the state. The company’s strong brand reputation, extensive agent network, and focus on customer service initiatives contribute to its competitive standing. However, it’s essential to compare individual quotes and policy details to determine the best fit for specific needs and preferences.

Tips for Saving on Car Insurance in Florida

Florida’s unique driving environment and high insurance rates can make finding affordable car insurance a challenge. However, there are several strategies you can implement to reduce your premiums and save money.

Safe Driving Practices

Safe driving habits are crucial for lowering your car insurance costs. Driving safely not only protects you and others on the road but also reduces your risk of accidents, which can lead to higher premiums.

- Maintain a Clean Driving Record: A clean driving record is essential for keeping your premiums low. Avoid traffic violations, such as speeding, reckless driving, and DUI offenses, as these can significantly increase your insurance rates.

- Take Defensive Driving Courses: Enrolling in defensive driving courses can demonstrate your commitment to safe driving and may qualify you for discounts from your insurance provider.

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, increases the risk of accidents. Focus on the road and avoid distractions to maintain a safe driving environment.

Vehicle Safety Features

Modern vehicles are equipped with advanced safety features that can help prevent accidents and potentially reduce your insurance premiums.

- Anti-theft Devices: Installing anti-theft devices, such as alarms, immobilizers, and GPS tracking systems, can deter theft and lower your insurance costs.

- Advanced Safety Technology: Features like lane departure warning, automatic emergency braking, and blind spot monitoring can help prevent accidents and may qualify you for discounts.

- Airbags and Seatbelts: Vehicles with multiple airbags and seatbelts offer enhanced safety and can lead to lower insurance premiums.

Discounts, Car insurance florida state farm

Insurance companies offer various discounts to encourage safe driving practices and reward good customers.

- Good Student Discount: If you are a student with good grades, you may be eligible for a discount on your car insurance.

- Multi-Car Discount: Insuring multiple vehicles with the same company can often result in a discount on your premiums.

- Safe Driver Discount: Maintaining a clean driving record for a specific period can qualify you for a safe driver discount.

- Bundling Insurance Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings.

Bundling Insurance Policies with State Farm

State Farm offers a variety of insurance products, including car insurance, homeowners insurance, renters insurance, and life insurance. Bundling these policies with State Farm can lead to significant savings on your premiums.

- Convenience: Bundling your policies with State Farm simplifies your insurance needs, as you only have one provider to manage.

- Discounts: State Farm offers substantial discounts for bundling multiple policies, which can save you a considerable amount of money.

- Streamlined Claims Process: In the event of a claim, having all your policies with State Farm can simplify the claims process and potentially expedite the resolution.

Obtaining Quotes and Comparing Rates

Getting quotes from multiple insurance providers is crucial for finding the best rates.

- Online Quote Tools: Most insurance companies offer online quote tools that allow you to get instant estimates based on your specific needs.

- Contact Insurance Agents: Contacting insurance agents directly allows you to discuss your individual needs and get personalized quotes.

- Compare Quotes: Compare the quotes you receive from different providers to determine the best value for your money.

Effective Ways to Save on Car Insurance in Florida

| Tip | Description |

|---|---|

| Maintain a Clean Driving Record | Avoid traffic violations and maintain a safe driving history. |

| Take Defensive Driving Courses | Demonstrate your commitment to safe driving and potentially qualify for discounts. |

| Install Anti-theft Devices | Deter theft and potentially reduce your insurance premiums. |

| Choose Vehicles with Advanced Safety Features | Enhance safety and potentially qualify for discounts. |

| Bundle Insurance Policies with State Farm | Combine your car insurance with other policies for significant savings and convenience. |

| Shop Around for Quotes | Compare quotes from multiple insurance providers to find the best rates. |

Last Point

By understanding the nuances of car insurance in Florida and the offerings of State Farm, drivers can make informed choices to secure the best coverage at competitive rates. From comparing coverage options to utilizing discounts and saving tips, this guide equips you with the knowledge to navigate the Florida insurance market confidently.

General Inquiries: Car Insurance Florida State Farm

What are the main types of car insurance coverage offered by State Farm in Florida?

State Farm offers various coverage options in Florida, including liability, collision, comprehensive, and uninsured motorist coverage. Each type of coverage provides specific protection for different situations, and understanding their benefits and limitations is crucial for choosing the right coverage for your needs.

How do I get a car insurance quote from State Farm in Florida?

You can obtain a car insurance quote from State Farm in Florida by visiting their website, contacting a local agent, or calling their customer service line. You will need to provide information about your vehicle, driving history, and desired coverage levels to receive a personalized quote.

What discounts are available for car insurance with State Farm in Florida?

State Farm offers various discounts for car insurance in Florida, including safe driver discounts, good student discounts, multi-policy discounts, and discounts for vehicle safety features. You can inquire about available discounts when obtaining a quote.