Car insurance cheaper than State Farm is a reality for many drivers. While State Farm is a well-known and trusted insurer, other companies offer competitive rates and coverage options. This exploration delves into the factors that influence car insurance costs, revealing why you might find better deals elsewhere. We’ll examine how driving history, vehicle type, location, and coverage choices affect your premiums, and explore ways to save money on your insurance.

Understanding the market is key to finding the best car insurance. We’ll compare average rates across major insurers, analyze potential reasons for price discrepancies, and identify alternative providers that often offer more affordable options. Ultimately, the goal is to equip you with the knowledge and tools to make informed decisions about your car insurance.

Understanding the Market

Car insurance prices are influenced by a variety of factors, and it’s crucial to understand these factors to find the best deals. This section explores the key drivers of car insurance costs and compares State Farm’s rates with other major insurers.

Factors Influencing Car Insurance Prices

Understanding the factors that influence car insurance prices is essential for making informed decisions. Here are some of the key factors:

- Driving History: Your driving record, including accidents, tickets, and claims, significantly impacts your insurance premium. A clean record generally translates to lower premiums.

- Vehicle Type: The make, model, year, and safety features of your car play a role in determining your insurance cost. Higher-performance vehicles or those with less robust safety features tend to have higher premiums.

- Location: Your geographical location, including the city, state, and even zip code, influences your insurance rate. Areas with higher traffic density, crime rates, and accident frequencies generally have higher premiums.

- Age and Gender: Younger drivers, particularly those under 25, typically have higher premiums due to their higher risk profiles. Gender can also play a role, although this varies by state.

- Credit Score: In many states, your credit score can influence your insurance rate. This is based on the assumption that individuals with good credit are more financially responsible and likely to be safe drivers.

- Coverage Options: The type and amount of coverage you choose, such as liability, collision, and comprehensive, directly impact your premium. Higher coverage limits and additional options typically result in higher premiums.

- Deductible: Your deductible, the amount you pay out-of-pocket before your insurance kicks in, influences your premium. Higher deductibles generally result in lower premiums.

- Driving Habits: Your driving habits, such as the number of miles you drive, the purpose of your driving, and your commuting patterns, can affect your insurance rate. High-mileage drivers and those who commute long distances may face higher premiums.

State Farm vs. Other Major Insurers

State Farm is a well-known and reputable insurance provider, but it’s not always the cheapest option. Comparing State Farm’s average car insurance rates with other major insurers can help you determine if there are more affordable alternatives.

- Geico: Geico often ranks among the most affordable car insurance providers, with rates that are typically lower than State Farm’s. Geico’s focus on online and telematics-based services allows it to offer competitive prices.

- Progressive: Progressive is another major insurer known for its competitive rates. It offers a variety of discounts and customization options, making it a good choice for drivers seeking affordable coverage.

- USAA: USAA is a highly-rated insurer that primarily serves active and retired military members and their families. USAA consistently offers competitive rates and excellent customer service, making it a top choice for eligible individuals.

- Allstate: Allstate is a well-established insurer with a wide range of coverage options. While its rates can be higher than some competitors, Allstate offers various discounts and benefits that can make it a good value for certain drivers.

Reasons for Cheaper Rates Than State Farm

Several factors can contribute to why some insurers offer cheaper rates than State Farm.

- Risk Assessment: Insurance companies use sophisticated algorithms and data analytics to assess risk and determine premiums. Different insurers may have different risk models, leading to variations in pricing.

- Operating Costs: Insurers with lower operating costs, such as those with a strong online presence and efficient claim processing systems, can often offer more competitive rates.

- Market Share and Competition: Insurers competing for market share may offer lower rates to attract new customers and retain existing ones. This can create opportunities for drivers to find cheaper options.

- Discounts and Promotions: Some insurers offer a wider range of discounts and promotions than others, which can significantly reduce premiums for eligible drivers.

Factors Affecting Insurance Costs

Your car insurance premium is determined by a variety of factors, each playing a significant role in calculating your overall cost. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a crucial factor in determining your car insurance cost. A clean driving record with no accidents or violations will generally lead to lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will significantly increase your insurance costs. This is because insurance companies perceive drivers with a poor driving history as higher risks.

Insurance companies use a system called a “risk score” to assess the likelihood of you filing a claim. A clean driving record will result in a lower risk score, leading to lower premiums.

For example, a driver with a recent DUI conviction will likely face a substantial increase in their insurance premiums due to the heightened risk of future accidents. Conversely, a driver with a spotless record for several years may qualify for discounts and lower premiums.

Vehicle Type

The type of vehicle you drive is another key factor influencing your insurance costs. Some vehicles are inherently more expensive to repair or replace, while others are statistically more prone to accidents. This translates into higher insurance premiums for certain vehicles.

- High-performance vehicles, such as sports cars and luxury vehicles, often have higher insurance premiums due to their higher repair costs, increased risk of theft, and tendency for drivers to engage in more risky driving behaviors.

- Vehicles with safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts as they reduce the risk of accidents and injuries.

- Older vehicles may have lower insurance premiums, but this can vary depending on the vehicle’s condition and availability of replacement parts.

Location

The location where you live significantly impacts your car insurance costs. Urban areas with high traffic density and crime rates typically have higher insurance premiums due to the increased risk of accidents and theft. Conversely, rural areas with lower traffic volumes and crime rates may have lower premiums.

Insurance companies consider factors such as population density, accident rates, and theft rates in a particular location when determining insurance premiums.

For example, a driver living in a bustling city like New York City will likely pay higher premiums compared to a driver living in a rural town in Wyoming. This is because urban areas tend to have more congested roads, higher accident rates, and a greater risk of car theft.

Coverage Options

The type and amount of coverage you choose will also impact your insurance premiums. Higher coverage limits generally mean higher premiums.

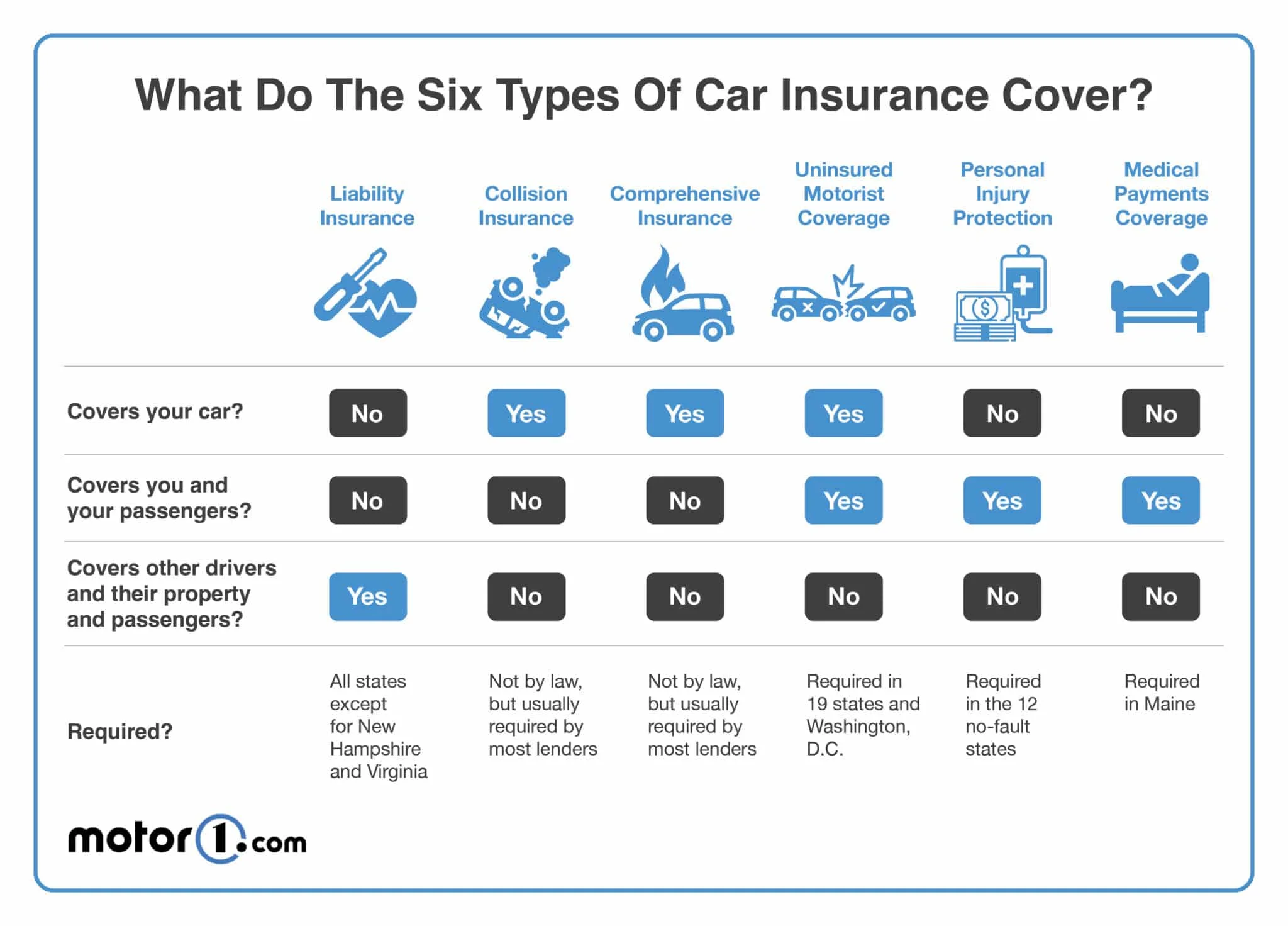

- Liability coverage, which protects you financially in case you cause an accident, is mandatory in most states. The higher your liability limits, the more you’ll pay for insurance.

- Collision coverage, which covers damage to your vehicle in an accident, is optional but often required if you have a car loan. Choosing a higher deductible, which is the amount you pay out of pocket before insurance kicks in, can lower your premium.

- Comprehensive coverage, which covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters, is also optional. Similar to collision coverage, a higher deductible can lower your premium.

Finding Cheaper Alternatives

You’ve determined that State Farm’s rates are not the most competitive for your needs. Now, it’s time to explore other insurance providers that might offer better deals.

Alternative Insurance Providers

There are numerous insurance companies that compete with State Farm. Some of these companies are known for offering lower rates, while others might have unique features or coverage options that appeal to you.

- Geico: Geico is renowned for its competitive rates and straightforward online purchasing process. They often offer discounts for good driving records, multiple vehicle policies, and bundling with other insurance products.

- Progressive: Progressive is known for its personalized pricing and flexible coverage options. They use a “name your price” tool that allows you to set a budget and see which coverage options fit within your desired range.

- USAA: USAA is a highly-rated insurance provider that exclusively serves active and retired military personnel and their families. They often have lower rates and exceptional customer service.

- Nationwide: Nationwide offers a wide range of insurance products, including car insurance, home insurance, and life insurance. They are known for their comprehensive coverage options and competitive rates.

- Liberty Mutual: Liberty Mutual is another reputable insurance provider that offers a variety of coverage options and discounts. They are known for their strong customer service and financial stability.

Comparing Coverage Options and Features

Once you have identified a few potential alternatives, it’s essential to compare their coverage options and features. Consider the following factors:

- Liability Coverage: This coverage protects you financially if you are found liable for an accident that causes damage to another person’s property or injuries.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually results in lower premiums.

- Discounts: Most insurance companies offer discounts for safe driving, good student status, multiple vehicles, and bundling insurance products.

Benefits and Drawbacks of Switching

Switching insurance companies can have both advantages and disadvantages.

- Benefits:

- Lower premiums: The primary benefit of switching is the potential to save money on your car insurance premiums.

- Improved coverage: You might find a company that offers more comprehensive coverage options or better features that meet your specific needs.

- Better customer service: Some insurance companies are known for their exceptional customer service, which can be a significant advantage.

- Drawbacks:

- Administrative hassle: Switching insurance companies can involve some administrative work, such as notifying your current insurer and obtaining new insurance cards.

- Potential for higher deductibles: Some insurance companies may have higher deductibles than your current insurer, which could increase your out-of-pocket expenses.

- Disruption of claims history: Switching companies might reset your claims history, potentially affecting your future premiums.

Saving Money on Car Insurance

Now that you understand the factors influencing car insurance costs and have explored alternative insurers, let’s delve into practical ways to reduce your premiums.

Common Car Insurance Discounts

Discounts are a significant way to lower your insurance costs. Many insurers offer a variety of discounts, and comparing these offers can help you save. Here’s a table comparing common car insurance discounts:

| Discount Type | Description | Example |

|—|—|—|

| Good Driver Discount | Awarded to drivers with a clean driving record, typically no accidents or traffic violations within a specific timeframe. | A driver with no accidents or violations in the past 5 years might receive a 10% discount. |

| Safe Driver Discount | Offered to drivers who have completed defensive driving courses or have a proven history of safe driving. | A driver who has completed an accredited defensive driving course might receive a 5% discount. |

| Multi-Car Discount | Applied when insuring multiple vehicles with the same insurer. | Insuring two cars with the same insurer might result in a 10% discount on each vehicle. |

| Multi-Policy Discount | Offered when bundling multiple insurance policies, such as home, auto, and life insurance, with the same insurer. | Bundling car and home insurance with the same insurer might result in a 15% discount on both policies. |

| Loyalty Discount | Rewarded to long-term policyholders who have maintained continuous coverage with the same insurer. | A policyholder who has been with the same insurer for 10 years might receive a 5% discount. |

| Anti-theft Device Discount | Offered for vehicles equipped with anti-theft devices, such as alarms, immobilizers, or tracking systems. | Installing a GPS tracking system in your car might qualify you for a 5% discount. |

| Good Student Discount | Available to students who maintain a certain GPA or academic standing. | A student with a GPA of 3.5 or higher might receive a 10% discount. |

Practical Tips for Reducing Insurance Premiums, Car insurance cheaper than state farm

Beyond discounts, there are several practical steps you can take to lower your insurance premiums:

- Bundle Your Policies: As mentioned earlier, bundling your home, auto, and other insurance policies with the same insurer often results in significant savings.

- Improve Your Driving Habits: Maintaining a safe driving record is crucial. Avoiding accidents, speeding tickets, and other traffic violations can significantly reduce your premiums.

- Increase Your Deductible: Opting for a higher deductible means you pay more out of pocket in case of an accident but can lower your premium.

- Choose a Car with Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered less risky by insurers and may qualify for lower premiums.

- Shop Around and Compare Quotes: Regularly comparing quotes from different insurers can help you find the best deals.

Utilizing Online Tools and Resources

The internet provides a wealth of resources for comparing insurance quotes and finding the best deals:

- Online Insurance Comparison Websites: Websites like NerdWallet, Policygenius, and The Zebra allow you to compare quotes from multiple insurers simultaneously.

- Insurer Websites: Most insurers offer online quote tools on their websites, allowing you to get an instant estimate.

- Insurance Agents: While online tools are convenient, consider consulting with an insurance agent who can provide personalized advice and help you navigate the process.

Considerations for Switching: Car Insurance Cheaper Than State Farm

While finding cheaper car insurance can be a rewarding experience, switching insurance providers isn’t always a smooth transition. It’s important to be aware of potential downsides and take steps to minimize any disruptions.

Potential Downsides of Switching

Before switching, it’s crucial to understand the potential downsides. You might encounter coverage gaps, higher deductibles, or even a decrease in the quality of service.

- Coverage Gaps: Switching insurance providers can leave you with gaps in coverage, especially if you have a claim pending with your current insurer. Make sure your new policy covers existing claims and that there are no lapses in coverage.

- Higher Deductibles: A new insurer might offer a lower premium but with a higher deductible. This means you’ll pay more out of pocket if you have an accident.

- Reduced Service Quality: Sometimes, switching to a cheaper provider might mean sacrificing customer service quality. It’s important to research the reputation of potential insurers and ensure they offer the level of service you need.

Effective Switching Strategies

To minimize disruptions and ensure a smooth transition, follow these strategies when switching insurance providers:

- Compare Quotes Carefully: Don’t just focus on the lowest premium. Compare coverage details, deductibles, and customer service ratings.

- Review Existing Policies: Before switching, review your current policy to understand your coverage limits, deductibles, and any additional features.

- Check for Coverage Gaps: Ensure the new policy covers existing claims and that there are no lapses in coverage.

- Time Your Switch: If possible, switch insurance providers at the end of your current policy period to avoid any overlap in coverage.

- Notify Your Current Insurer: Inform your current insurer of your decision to switch and request a cancellation confirmation.

Negotiating Better Rates with Existing Insurers

Sometimes, the best way to get a better rate is to negotiate with your current insurer. Here are some tips:

- Review Your Driving Record: If you’ve had a clean driving record for a period of time, you might be eligible for a discount.

- Shop Around: Get quotes from other insurers to show your current insurer that you’re willing to switch.

- Bundle Policies: Ask about discounts for bundling your car insurance with other policies like homeowners or renters insurance.

- Pay in Full: Some insurers offer discounts for paying your premium in full.

- Consider Safety Features: If you’ve added safety features to your car, such as anti-theft devices or a backup camera, your insurer might offer a discount.

Ending Remarks

Finding car insurance cheaper than State Farm is achievable with careful research and comparison. By understanding the factors that influence pricing, exploring alternative providers, and leveraging available discounts, you can secure a policy that meets your needs without breaking the bank. Remember, your insurance is a significant financial commitment, so taking the time to find the best value is crucial.

Questions and Answers

What are the most common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts, and good student discounts.

How often should I review my car insurance rates?

It’s recommended to review your rates at least annually, or whenever you experience a significant life change, such as a new car, a change in your driving record, or a move to a new location.

Is it worth switching insurance companies for a lower rate?

It can be worth switching if the savings outweigh any potential downsides, such as coverage gaps or higher deductibles. Carefully compare quotes and coverage options before making a decision.