Can you have insurance in a different state? The answer isn’t always a simple yes or no. The world of insurance is heavily influenced by state-specific regulations, and your residency plays a crucial role in determining your eligibility for coverage. This means that moving to a new state could require you to adjust your insurance policies, even if you’re simply relocating for a temporary period.

From the complexities of state-specific insurance regulations to the importance of residency verification, navigating the world of insurance across state lines can feel like a maze. But don’t worry, this guide is here to help you understand the intricacies of insurance coverage when you’re moving to a new state or simply traveling outside of your home state.

Understanding State-Specific Insurance Regulations

Insurance regulations in the United States are complex and differ significantly across states. This variation stems from the fact that insurance is primarily regulated at the state level, leading to a patchwork of rules and requirements.

State-Specific Insurance Regulations

State insurance regulations are designed to protect consumers and ensure the financial stability of insurance companies. These regulations cover a wide range of aspects, including:

- Types of insurance offered: States may mandate certain types of insurance coverage, such as auto insurance or health insurance, while others may allow insurers to offer a broader range of products.

- Pricing and underwriting: States regulate how insurance companies can set premiums and assess risk, often through restrictions on factors like age, gender, or driving history.

- Claims handling and dispute resolution: States have rules governing how insurance companies must handle claims and resolve disputes with policyholders.

- Financial solvency: States require insurance companies to maintain certain financial reserves to ensure they can pay claims and remain in business.

Examples of Heavily Regulated Insurance Types

Certain types of insurance are particularly subject to state-specific regulations, due to their significant impact on individuals and society. These include:

- Auto insurance: States mandate minimum liability coverage requirements, regulate insurance rates, and oversee claims processes.

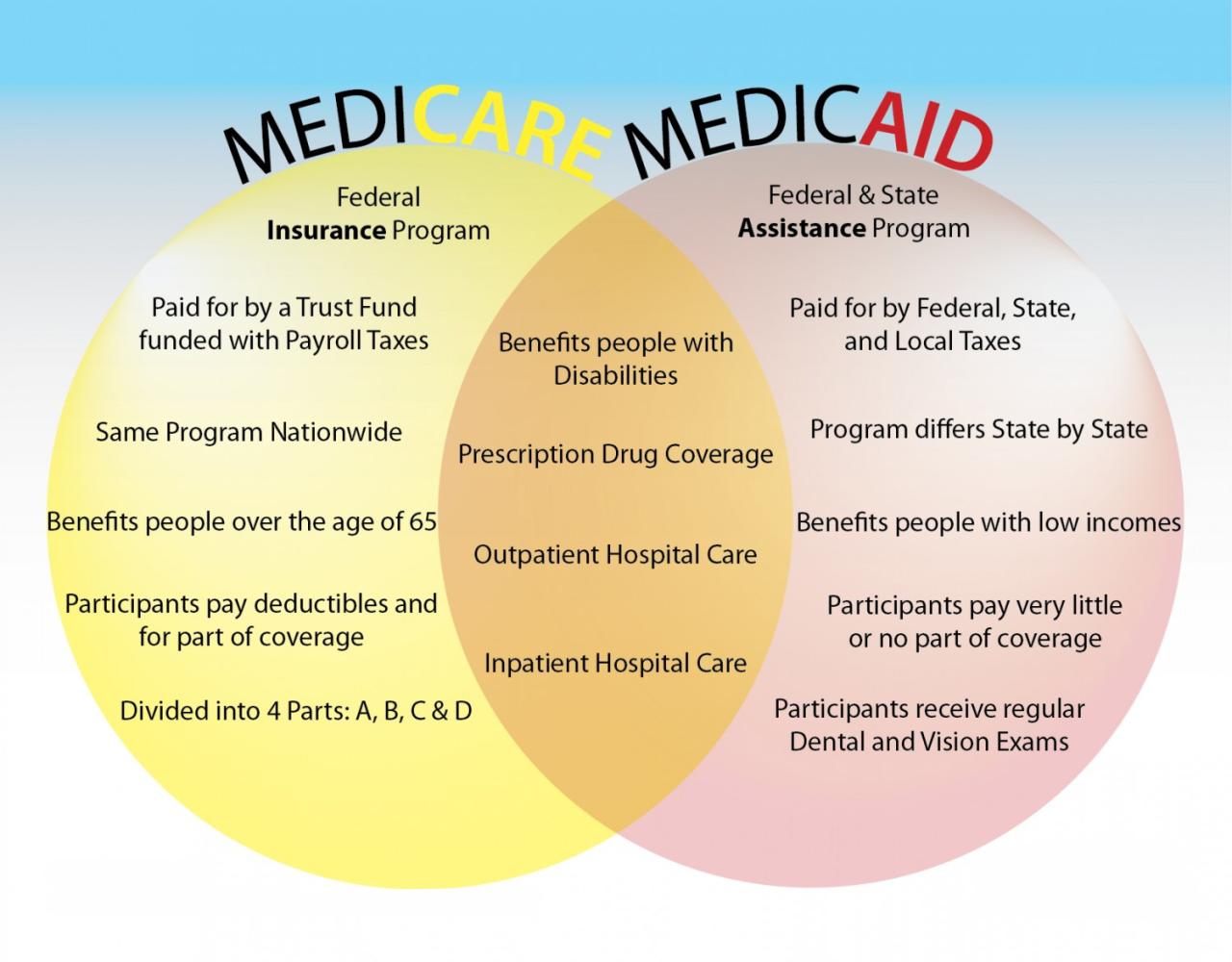

- Health insurance: States play a key role in regulating health insurance markets, particularly in the areas of coverage, pricing, and consumer protections.

Factors Influencing State Insurance Regulations

Several factors contribute to the variation in insurance regulations across states, including:

- Population density: States with higher population densities often have more stringent insurance regulations to manage higher risk levels and ensure adequate coverage for a larger population.

- Demographics: States with different demographic profiles, such as age, income, and health status, may have varying insurance needs and regulations to address those needs.

- Economic conditions: States with strong economies may have more resources to devote to insurance regulation and consumer protection, leading to more robust regulations.

- Political climate: The political climate in a state can influence the types of insurance regulations enacted, reflecting the priorities and values of the state’s elected officials.

The Importance of Residency and Insurance Coverage

Residency is a fundamental factor that insurance companies consider when determining your eligibility for coverage. It’s not just about where you live, but about your legal status within a specific state. Understanding this connection is crucial for ensuring you have the right insurance coverage.

Insurance companies rely on residency to establish a connection between you and the state where you seek coverage. This connection is important for several reasons. It helps insurers assess the risk associated with insuring you, determine the appropriate premiums, and comply with state regulations.

Verifying Residency

Insurance companies have established procedures to verify your residency. They typically require you to provide specific documents that demonstrate your legal presence and address within the state.

Here are some common documents used for residency verification:

- Driver’s license or state-issued ID

- Voter registration card

- Utility bills (gas, electric, water)

- Bank statements

- Lease agreement or mortgage statement

- Tax returns

- Pay stubs

The specific documents required may vary depending on the insurance company and the type of insurance you are seeking.

Examples of Residency as a Crucial Factor

Residency plays a crucial role in various insurance scenarios. Here are some examples:

- Auto Insurance: Your car insurance premiums are often influenced by the state where your vehicle is primarily registered and where you reside.

- Health Insurance: Health insurance plans are often tied to specific states, and you may need to meet residency requirements to be eligible for coverage under a particular plan.

- Homeowners Insurance: Your homeowners insurance policy is typically linked to the state where your home is located.

Navigating Insurance Coverage When Moving States

Moving to a new state often involves a lot of planning, including ensuring your insurance coverage is up-to-date and meets your needs in your new location. Navigating insurance coverage across state lines can be tricky, but with proper planning and understanding of state-specific regulations, the process can be smooth.

Transferring Insurance Coverage

When moving to a new state, it’s crucial to understand how your existing insurance policies will be affected. Transferring insurance coverage involves informing your current insurer about your move and ensuring your policies are compatible with the new state’s regulations. This process may involve updating your policy details, possibly adjusting your coverage based on the new state’s requirements, and potentially even switching insurers if your current one doesn’t operate in your new state.

- Notify Your Insurance Company: The first step is to inform your insurance company about your move. Most insurers require a formal notification of your change of address, usually through a phone call, email, or online portal. This notification is critical because it ensures your insurance company can update your records and maintain accurate contact information for any future correspondence or claims.

- Review Policy Coverage: Once your insurance company is aware of your move, they will likely review your existing policies to ensure they comply with the new state’s regulations. This review might involve adjusting coverage limits, deductibles, or even adding specific endorsements required in your new state. For example, some states have mandatory insurance requirements for specific types of vehicles or coverage for certain natural disasters.

- Potential Challenges: Transferring insurance coverage might not always be straightforward. Some insurers might not operate in your new state, requiring you to find a new insurer. Additionally, certain insurance types, such as auto insurance, might be subject to different regulations in your new state, necessitating changes to your coverage. It’s essential to research the specific insurance requirements in your new state and discuss any potential changes with your insurer.

Reciprocity in Insurance

Reciprocity in insurance refers to an agreement between states where they recognize and accept each other’s insurance licenses and regulations. This means that if a state has reciprocity with another, individuals with insurance licenses or policies from the reciprocal state can operate or be covered in the other state without needing to obtain a new license or policy.

- Reciprocity in Auto Insurance: Auto insurance is a common example of reciprocity. Many states have agreements that allow drivers with valid insurance policies from other reciprocal states to drive in their state without needing to obtain a new policy. However, it’s crucial to note that reciprocity doesn’t always cover all aspects of insurance, and there might be specific coverage requirements or limitations based on the reciprocal agreement.

- Importance of Verifying Reciprocity: While reciprocity agreements can simplify the process of transferring insurance, it’s essential to verify if your specific insurance type is covered by the agreement between your current and new states. You can contact your insurance company or your state’s insurance department to confirm reciprocity for your situation.

Notifying Your Insurance Company, Can you have insurance in a different state

Informing your insurance company about your move is crucial for maintaining continuous coverage and avoiding potential issues. Failure to notify your insurer about a change of address can lead to various consequences, including:

- Coverage Lapse: If your insurance company doesn’t have your updated address, they might not be able to contact you in case of an emergency or claim. This could lead to a lapse in coverage, leaving you vulnerable to financial losses if an incident occurs.

- Claim Denial: If you file a claim after moving without notifying your insurer, your claim could be denied if they’re unaware of your new location. This could happen because your policy might be considered invalid in your new state due to the lack of proper notification.

- Increased Premiums: Some states have higher insurance premiums than others, and failing to notify your insurer about your move could result in paying higher premiums than necessary for your new location.

Insurance Coverage for Non-Residents

Non-resident insurance refers to coverage provided to individuals who are not permanent residents of the state where they are seeking insurance. It differs from standard coverage in that it typically offers more limited protection and may come with specific conditions and exclusions. This type of insurance is designed to cater to temporary stays or specific situations where individuals might need coverage for a limited period.

Scenarios Requiring Non-Resident Insurance

Non-resident insurance becomes relevant in various situations, particularly for those who are not permanent residents of the state in question. Here are some common scenarios where it might be necessary:

- Temporary Stays: Individuals visiting a state for a short period, such as for vacation, a business trip, or to attend a conference, may need non-resident insurance to ensure coverage during their stay.

- Business Travel: Employees frequently traveling to other states for work might need non-resident insurance to cover potential accidents or liabilities during their business trips.

- Student Housing: Students attending college or university in a different state may need non-resident insurance for their housing or personal belongings, especially if they are not permanent residents of that state.

- Second Homeowners: Individuals owning a second home in a different state might need non-resident insurance to protect their property while they are not residing there.

Types of Non-Resident Insurance

Several insurance types are commonly offered to non-residents, each tailored to specific needs and situations. Here are some examples:

- Non-Resident Auto Insurance: This type of insurance provides coverage for accidents or damages caused by a non-resident driver while operating a vehicle in a state where they are not permanently residing. It typically covers liability, collision, and comprehensive coverage, with varying limits and conditions based on the insurance provider and state regulations.

- Non-Resident Health Insurance: Non-resident health insurance offers temporary coverage for medical expenses incurred by individuals who are not permanent residents of the state where they are seeking medical treatment. It can be particularly beneficial for travelers, students, or individuals working in a different state on a temporary basis. Coverage can vary significantly based on the plan and the state, with some plans offering limited coverage for emergencies or specific medical conditions.

- Non-Resident Property Insurance: This type of insurance covers property damage or loss for non-residents who own property in a different state. It typically provides coverage for fire, theft, vandalism, and other perils, with varying coverage limits and exclusions based on the insurance provider and state regulations.

Factors to Consider When Choosing Insurance in a New State

Moving to a new state can be an exciting time, but it also comes with the responsibility of updating your insurance policies. You’ll need to ensure your coverage meets the requirements of your new state and provides adequate protection for your needs. Choosing the right insurance in your new state is crucial, and careful consideration of several factors can help you make an informed decision.

Comparing Insurance Quotes

It is essential to compare quotes from multiple insurance providers before making a decision. Different insurance companies offer varying coverage options, pricing, and benefits. Obtaining quotes from several providers allows you to compare prices, coverage, and other factors to determine the best value for your needs.

“Don’t settle for the first quote you receive. Shop around and compare prices, coverage, and customer service before making a decision.”

Key Factors to Consider When Choosing Insurance in a New State

Here is a table outlining key factors to consider when choosing insurance in a new state:

| Factor | Description |

|——————-|—————————————————————————————————————————————————————————————————————————————————————————————–|

| Coverage Options | * Liability Coverage: Minimum liability limits vary by state. Ensure you have sufficient coverage to protect yourself financially in case of an accident.

* Collision and Comprehensive Coverage: These cover damage to your vehicle in an accident or from other events.

* Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance or is uninsured. |

| Pricing | * Deductible: The amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums.

* Premiums: The amount you pay for your insurance policy. Factors like your driving history, age, and vehicle type influence premiums. |

| Provider Reputation | * Financial Stability: Check the company’s financial ratings to ensure it’s financially sound and able to pay claims.

* Customer Satisfaction: Look at customer reviews and ratings to gauge the company’s customer service and claims handling process. |

Potential Legal and Financial Implications

Driving without valid insurance in a new state can have serious legal and financial consequences. If you are involved in an accident, lack of proper insurance coverage could result in significant financial burdens, legal issues, and even license suspension.

Legal Consequences of Driving Without Insurance

Driving without valid insurance is illegal in all states and can lead to various legal repercussions. These consequences can include:

- Fines and Penalties: You could face hefty fines and penalties for driving without insurance, which can vary significantly depending on the state and the number of offenses.

- License Suspension: Your driver’s license can be suspended or revoked if you are caught driving without insurance. This means you will be unable to legally operate a vehicle.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Criminal Charges: In some states, driving without insurance can result in criminal charges, especially if you are involved in an accident.

Financial Implications of Not Having Insurance

The financial implications of not having proper insurance coverage in case of an accident or claim can be substantial. These include:

- Medical Expenses: If you are injured in an accident, you will be responsible for all medical bills, including hospital stays, surgeries, and rehabilitation.

- Property Damage: You will be responsible for repairing or replacing any damage to your vehicle or the property of others.

- Legal Fees: You may have to pay legal fees if you are sued by the other party involved in the accident.

- Lost Wages: If you are unable to work due to injuries, you will lose income, which can be a significant financial burden.

Examples of Financial Burdens

- Scenario 1: Imagine you are involved in an accident and are found at fault. Without insurance, you are responsible for all medical expenses of the other driver, totaling $50,000, as well as the $20,000 damage to their vehicle. This could easily lead to significant debt and financial hardship.

- Scenario 2: You are driving in a new state without insurance and get into a minor accident. While your injuries are minor, the other driver suffers a severe injury and incurs $100,000 in medical expenses. You could be held personally liable for this entire amount, potentially leading to bankruptcy.

Ultimate Conclusion

Ultimately, understanding the nuances of state-specific insurance regulations is essential for anyone who plans to move or travel across state lines. By carefully navigating the process, understanding your residency status, and considering your insurance needs, you can ensure that you have the appropriate coverage to protect yourself and your loved ones. Remember, it’s always best to consult with an insurance professional to discuss your specific situation and obtain personalized advice.

Helpful Answers: Can You Have Insurance In A Different State

What happens if I don’t notify my insurance company about my move?

Failing to notify your insurance company about a change of address can have serious consequences. You could face coverage issues, potential penalties, and even legal repercussions if you’re involved in an accident in your new state.

Can I use my existing insurance policy in a new state for a short trip?

In most cases, you can use your existing insurance policy for short trips outside of your home state. However, it’s always a good idea to check with your insurance company to confirm coverage details and any potential limitations.

How can I find affordable insurance in a new state?

Comparing quotes from multiple insurance providers is crucial for finding the best rates. You can use online comparison tools or contact insurance agents directly to get personalized quotes and compare coverage options.