Which state has the most expensive car insurance? This question is on the minds of many drivers, particularly those seeking affordable coverage. The cost of car insurance can vary dramatically from state to state, influenced by a complex interplay of factors. From state regulations and geographic risks to the cost of living and insurance market dynamics, numerous elements contribute to the final price tag on your car insurance policy.

Understanding these factors is crucial for making informed decisions about your insurance needs. By exploring the reasons behind these variations, you can gain valuable insights into how to find the best coverage at a price that fits your budget.

Factors Influencing Car Insurance Costs

Car insurance premiums are determined by a complex interplay of factors that assess the risk associated with insuring a particular driver and vehicle. These factors can significantly influence the cost of car insurance, leading to variations in premiums across individuals and regions.

Vehicle Type

The type of vehicle you drive is a significant factor in determining your car insurance premium. Certain vehicle types are considered riskier than others, leading to higher premiums. This is because factors like the vehicle’s safety features, repair costs, and likelihood of theft influence the insurer’s risk assessment. For example, sports cars are often associated with higher insurance premiums due to their higher performance capabilities and potential for accidents. Conversely, vehicles with advanced safety features, such as anti-lock brakes and airbags, tend to have lower premiums.

Driver Demographics

Your personal characteristics, such as age, gender, and driving history, play a crucial role in determining your car insurance premium. Younger drivers, especially those under the age of 25, are generally considered higher risk due to their lack of experience and higher propensity for accidents. This can result in significantly higher premiums for young drivers. Gender can also influence premiums, with statistics suggesting that men tend to have higher accident rates than women, potentially leading to higher premiums for male drivers.

Location

The location where you live can significantly impact your car insurance premium. Insurers consider factors such as the density of traffic, crime rates, and weather conditions in a particular area when assessing risk. Areas with higher traffic congestion and crime rates tend to have higher accident rates, leading to higher insurance premiums. Similarly, regions prone to severe weather events, such as hurricanes or tornadoes, may have higher premiums due to the increased risk of damage to vehicles.

Driving History

Your driving history, including any accidents, violations, or claims, is a crucial factor in determining your car insurance premium. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents or traffic violations, your premium may be significantly higher. This is because insurers perceive you as a higher risk due to your past driving behavior.

State-Specific Regulations and Laws

State regulations and laws play a significant role in determining car insurance rates. Each state has its own set of rules and requirements that insurers must adhere to, influencing factors such as minimum coverage levels, insurance practices, and pricing structures. These regulations directly impact the cost of car insurance for drivers within a specific state.

Minimum Coverage Requirements

State minimum coverage requirements, also known as “liability limits,” mandate the minimum amount of financial protection drivers must have to cover damages or injuries caused to others in an accident. These requirements vary significantly from state to state. States with higher minimum coverage requirements generally have higher car insurance rates. This is because insurers need to provide more financial protection to policyholders, leading to increased costs.

For example, consider two states, State A and State B. State A has a minimum liability limit of $25,000 per person and $50,000 per accident, while State B has a limit of $50,000 per person and $100,000 per accident. Drivers in State B will generally have higher insurance rates because insurers are required to provide more financial protection in case of an accident.

Geographic Risk Factors

Beyond individual driver characteristics and vehicle factors, geographical location plays a significant role in determining car insurance premiums. Certain areas are inherently riskier than others due to various factors that influence the likelihood of accidents and the severity of claims.

Population Density and Traffic Congestion

Areas with high population density and heavy traffic congestion tend to have higher accident rates. The sheer volume of vehicles on the road increases the chances of collisions, and the close proximity of cars in congested areas can make accidents more severe.

- Increased Collision Frequency: More vehicles on the road lead to a higher frequency of accidents, as the probability of two vehicles colliding increases with the number of vehicles present. For example, major metropolitan areas like New York City and Los Angeles experience a higher density of vehicles and consequently have higher accident rates.

- Severity of Accidents: Traffic congestion can exacerbate the severity of accidents. When vehicles are closely packed, there is less room for drivers to react and avoid collisions, potentially leading to more significant damage and injuries.

Weather Conditions and Natural Disasters

Weather conditions and natural disasters can have a significant impact on the risk of accidents and the severity of claims. Areas prone to extreme weather events, such as hurricanes, tornadoes, earthquakes, or floods, often face higher insurance premiums.

- Increased Accident Risk: Extreme weather conditions, such as heavy rain, snow, or ice, can make roads slippery and hazardous, increasing the likelihood of accidents. Natural disasters can also cause widespread damage to vehicles, leading to a surge in insurance claims.

- Higher Repair Costs: Natural disasters can cause significant damage to infrastructure and vehicles, leading to higher repair costs. For example, a hurricane can cause widespread flooding, damaging cars beyond repair, resulting in higher insurance payouts.

Cost of Living and Economic Factors

The cost of living in a particular region plays a significant role in determining car insurance premiums. Higher costs of living often translate into higher insurance rates due to a variety of factors.

Relationship Between Cost of Living and Car Insurance Premiums

The cost of living and car insurance premiums are closely intertwined. States with a high cost of living tend to have higher car insurance premiums, while states with a lower cost of living typically have lower premiums. This correlation is primarily due to the following factors:

- Higher Vehicle Values: In areas with a higher cost of living, vehicles tend to be more expensive. This means that insurance companies need to pay more to cover the cost of repairs or replacement in the event of an accident.

- Higher Repair Costs: Higher costs of living often go hand-in-hand with higher labor and material costs, which can lead to more expensive car repairs. This, in turn, translates to higher insurance premiums to cover these costs.

- Higher Risk of Accidents: Densely populated areas with a high cost of living often experience a higher volume of traffic, which can increase the likelihood of accidents. Insurance companies may adjust premiums based on the risk of accidents in a particular area.

- Higher Demand for Services: Areas with a high cost of living often have a higher demand for various services, including insurance. This can lead to higher competition among insurance companies, which may result in higher premiums to cover operational costs and maintain profitability.

Comparison of States with High Costs of Living and Average Car Insurance Rates, Which state has the most expensive car insurance

Here is a table comparing states with high costs of living and their average car insurance rates:

| State | Cost of Living Index (National Average = 100) | Average Annual Car Insurance Premium |

|---|---|---|

| New York | 137.4 | $2,090 |

| California | 133.6 | $2,110 |

| Hawaii | 184.5 | $2,350 |

| Massachusetts | 125.9 | $1,850 |

| Connecticut | 129.2 | $1,980 |

Note: These figures are based on average annual premiums for full coverage insurance for a 30-year-old driver with a clean driving record. Actual premiums may vary based on individual factors.

Impact of Economic Factors on Car Insurance Prices

Economic factors, such as unemployment and inflation, can also influence car insurance prices.

- Unemployment: High unemployment rates can lead to an increase in car insurance premiums. This is because people who are unemployed may be more likely to drive older vehicles that are less safe, or they may be more likely to drive recklessly due to financial stress. Insurance companies may adjust premiums to account for this increased risk.

- Inflation: Inflation can lead to an increase in the cost of car repairs, parts, and other expenses related to car ownership. Insurance companies may pass these increased costs onto consumers in the form of higher premiums to maintain profitability.

Insurance Company Market Dynamics: Which State Has The Most Expensive Car Insurance

The insurance market is a dynamic environment where competition and market share play a crucial role in shaping car insurance premiums. Understanding how insurance companies interact within a state’s market is essential for comprehending the factors that influence the cost of car insurance.

Impact of Competition on Premiums

The level of competition among insurance companies directly affects the affordability of car insurance. In states with a large number of insurance providers, competition is fierce, and companies often offer lower premiums to attract customers. Conversely, states with limited competition may see higher premiums as insurance companies have less incentive to lower prices.

The more insurance companies compete for customers, the lower the premiums tend to be.

Number of Insurance Providers and Coverage Availability

The number of insurance providers in a state also influences the availability and affordability of coverage options. A robust insurance market with numerous providers generally offers a wider range of coverage options, including specialized policies tailored to specific needs. This diversity in coverage choices allows consumers to find policies that best fit their individual requirements and budgets.

Mergers and Acquisitions in the Insurance Market

Mergers and acquisitions within the insurance industry can have a significant impact on the market dynamics and premiums. When insurance companies merge, they may consolidate their operations, potentially leading to reduced competition and higher premiums. However, mergers can also result in economies of scale, which could lead to lower costs and potentially lower premiums for consumers.

Mergers can lead to both positive and negative outcomes for consumers, depending on the specific circumstances and the actions taken by the merged entity.

Data Analysis and Research

To understand why certain states have higher car insurance premiums than others, it’s crucial to analyze data and research findings from reputable sources. This section delves into car insurance rates across different states, highlighting key contributing factors and providing insights based on the collected data.

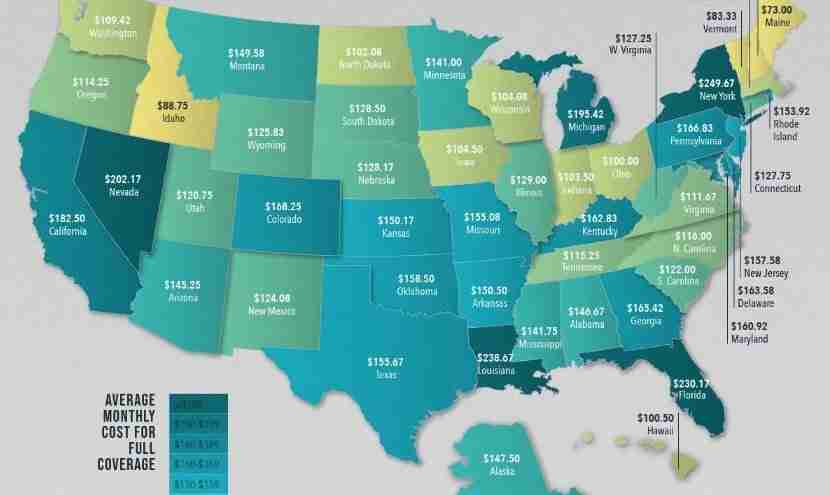

Car Insurance Rate Comparison Across States

The following table presents average car insurance premiums across different states, along with key contributing factors influencing these rates:

| State | Average Premium | Key Contributing Factors |

|---|---|---|

| Michigan | $2,636 | High accident rates, no-fault insurance system, high cost of healthcare |

| Louisiana | $2,237 | High accident rates, high cost of litigation, high cost of repairs |

| Florida | $2,155 | High population density, high number of uninsured drivers, high cost of repairs |

| New Jersey | $2,058 | High population density, high cost of living, high number of claims |

| New York | $1,956 | High population density, high cost of living, high number of uninsured drivers |

| Rhode Island | $1,864 | High population density, high cost of living, high number of claims |

The data clearly shows that states with high accident rates, high cost of living, and a high number of uninsured drivers tend to have higher average car insurance premiums. Additionally, states with no-fault insurance systems, where drivers are compensated by their own insurance regardless of fault, often have higher premiums due to the increased number of claims.

Tips for Finding Affordable Car Insurance

Finding affordable car insurance can be a challenge, especially in states with high average premiums. However, there are several strategies you can implement to potentially reduce your insurance costs. By understanding the factors that influence car insurance rates and taking proactive steps, you can significantly lower your premiums and save money.

Comparing Quotes from Different Insurance Companies

It’s essential to compare quotes from multiple insurance companies before making a decision. Each insurer uses different algorithms to calculate premiums, and their rates can vary significantly.

- Online Comparison Websites: Websites like Compare.com, NerdWallet, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort in gathering quotes manually.

- Directly Contact Insurance Companies: You can also contact insurance companies directly to request quotes. This gives you the opportunity to discuss your specific needs and ask questions about their policies.

- Consider Local and Regional Insurers: Local and regional insurers often offer competitive rates, especially if you’re in a smaller town or rural area. They may have a better understanding of your local risks and can offer more personalized service.

Conclusion

Ultimately, the cost of car insurance is a complex issue influenced by numerous factors. While some states consistently rank higher in terms of average premiums, individual circumstances and driving habits play a significant role. By understanding the key factors that drive insurance costs, you can make informed decisions to secure affordable coverage that meets your needs. Remember to compare quotes from multiple insurers, explore discounts, and consider your driving history to find the best value for your money.

Clarifying Questions

What are some common factors that influence car insurance rates?

Car insurance rates are influenced by factors such as your driving history, age, vehicle type, location, and credit score. These factors are used by insurance companies to assess your risk as a driver.

How do I find the cheapest car insurance?

To find the cheapest car insurance, compare quotes from multiple insurance companies, explore discounts, and consider bundling your policies. You can also look for ways to improve your driving record and maintain a good credit score.

What is the average car insurance rate in the United States?

The average car insurance rate in the United States varies depending on the state and individual factors. However, the national average for full coverage is around $1,700 per year.