States with no car insurance present a unique situation in the American transportation landscape. While some might see it as a way to avoid mandatory coverage, driving without insurance in these states comes with significant risks. This exploration delves into the legal complexities, financial consequences, and safety implications of this decision, shedding light on the potential pitfalls of navigating the roads without the financial protection that insurance provides.

The absence of mandatory car insurance in certain states is a result of various historical and legislative factors. These states often rely on financial responsibility laws, requiring drivers to demonstrate proof of financial responsibility through alternative means, such as surety bonds or cash deposits. However, the effectiveness of these alternatives in ensuring responsible driving and protecting victims of accidents remains a subject of debate.

States Without Mandatory Car Insurance

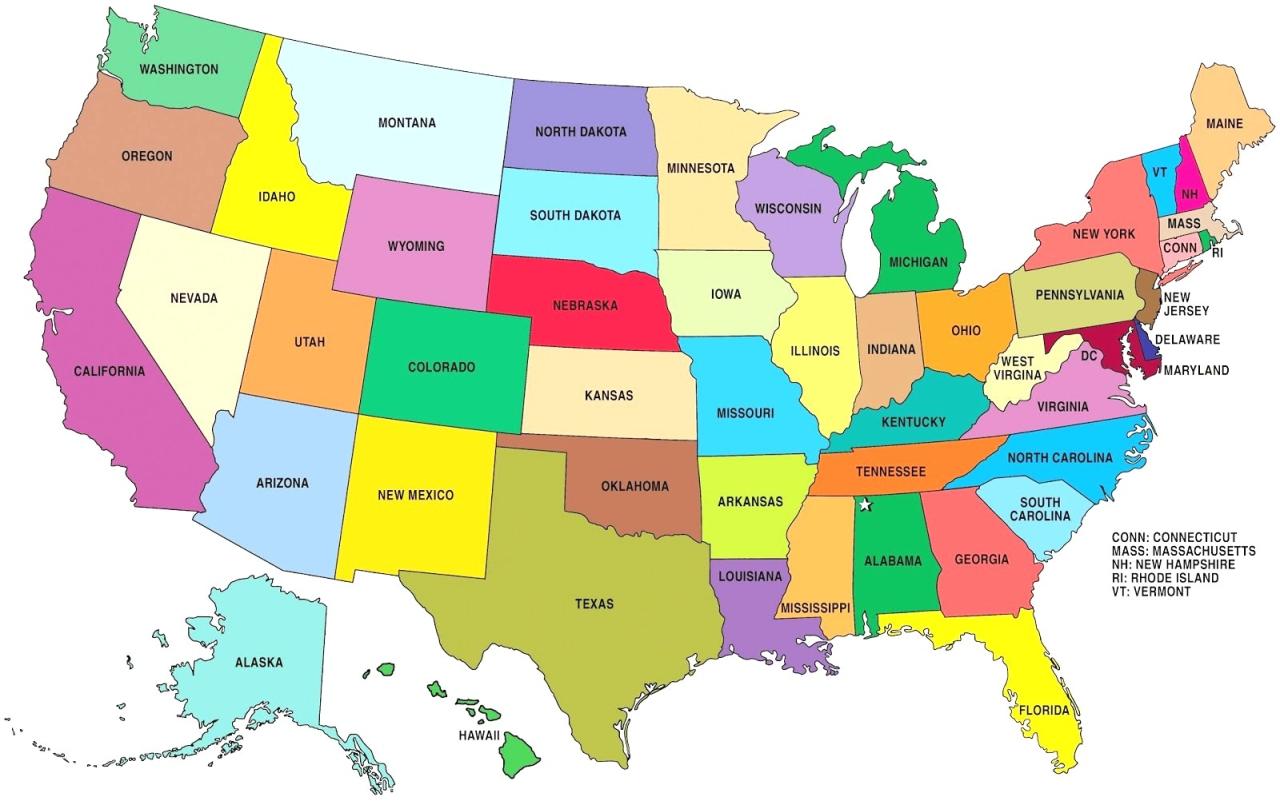

In the United States, most states require drivers to carry car insurance to protect themselves and others from financial hardship in the event of an accident. However, a handful of states have opted out of this requirement, leaving drivers with the choice of whether or not to purchase insurance. This decision has sparked debate, with proponents arguing for individual freedom and opponents citing the potential risks to public safety and financial stability.

States Without Mandatory Car Insurance

These states do not mandate car insurance, allowing drivers to operate vehicles without proof of coverage. Instead, they rely on financial responsibility laws to ensure that drivers can cover the costs of accidents they cause.

- New Hampshire: New Hampshire is the only state in the US that does not require any form of car insurance. However, drivers are required to provide proof of financial responsibility, such as a surety bond or cash deposit, to cover potential damages.

- Virginia: Virginia allows drivers to choose between purchasing car insurance or posting a surety bond of $50,000 to demonstrate financial responsibility.

Financial Responsibility Laws in States Without Mandatory Car Insurance

Financial responsibility laws in these states are designed to ensure that drivers can cover the costs of accidents they cause. These laws typically require drivers to:

- Provide proof of financial responsibility: This can be done through car insurance, a surety bond, or a cash deposit.

- Pay for damages caused by accidents: Drivers are responsible for covering the costs of injuries, property damage, and other expenses arising from accidents they cause.

- Comply with state-specific requirements: Each state has its own set of regulations regarding financial responsibility, which drivers must adhere to.

Consequences of Driving Without Car Insurance in States Without Mandatory Coverage

While some states don’t require drivers to carry car insurance, it’s crucial to understand the potential risks associated with driving without it. Not having car insurance can lead to significant financial and legal repercussions, even in states where it’s not mandatory.

Financial Consequences

Driving without insurance can result in substantial financial losses, potentially exceeding the cost of insurance itself. The potential financial repercussions include:

- Fines and Penalties: Most states, even those without mandatory insurance, impose fines and penalties on drivers caught operating a vehicle without insurance. These fines can range from hundreds to thousands of dollars, depending on the state and the number of offenses.

- Court Costs: If you’re involved in an accident without insurance, you’ll likely face court costs, including fees for filing lawsuits and legal representation. These costs can quickly add up and further strain your finances.

- Increased Insurance Premiums: Even if you obtain insurance after an accident, your premiums will likely be significantly higher than if you had insurance in place before the accident. This is because insurance companies consider drivers without insurance to be higher risk and charge accordingly.

- Medical Expenses: In an accident, you’ll be responsible for all medical bills, including your own and those of others involved. This can lead to significant debt, especially if you have serious injuries.

- Property Damage: If you cause damage to another person’s property, you’ll be liable for the repair or replacement costs. This can be a substantial expense, particularly if you damage a vehicle or other expensive assets.

Legal Consequences

Driving without insurance can also lead to serious legal consequences, potentially impacting your driving privileges and freedom.

- License Suspension or Revocation: Most states have laws that allow for the suspension or revocation of driving licenses for drivers caught operating vehicles without insurance. This can make it difficult or impossible to drive legally and may have a significant impact on your daily life.

- Jail Time: In some cases, driving without insurance can result in jail time, particularly if you’re involved in an accident that causes serious injuries or property damage. This is a serious consequence that can have lasting repercussions on your life.

- Legal Action: If you’re involved in an accident without insurance, the other party can sue you for damages, including medical expenses, lost wages, and property damage. This could lead to a lengthy and expensive legal battle, potentially resulting in a large judgment against you.

Financial Responsibility in States Without Mandatory Car Insurance

Even though states without mandatory car insurance don’t require drivers to have coverage, it’s still crucial to demonstrate financial responsibility. This ensures you can cover potential costs in case of an accident.

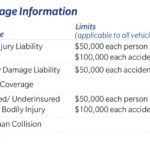

States without mandatory car insurance typically require drivers to prove they have sufficient financial resources to cover damages caused by an accident. This can be done through various methods, including purchasing insurance, posting a surety bond, or making a cash deposit.

Alternative Forms of Financial Responsibility

Here are some alternative forms of financial responsibility that drivers in states without mandatory car insurance can utilize:

- Surety Bond: A surety bond is a guarantee issued by a surety company to ensure financial responsibility. If a driver causes an accident, the surety company will pay for damages up to the bond amount. The cost of a surety bond varies depending on factors such as the driver’s driving history and the amount of coverage needed.

- Cash Deposit: Drivers can also choose to make a cash deposit with the state government as proof of financial responsibility. The deposit amount is typically determined by state law and can be quite substantial. This option provides immediate proof of financial responsibility but requires a significant upfront investment.

Benefits and Drawbacks of Alternative Options

Both surety bonds and cash deposits offer alternative ways to demonstrate financial responsibility in states without mandatory car insurance. However, each option has its own benefits and drawbacks:

| Option | Benefits | Drawbacks |

|---|---|---|

| Surety Bond |

|

|

| Cash Deposit |

|

|

The Impact of Uninsured Drivers on Society

Uninsured drivers pose a significant risk to society, impacting both insured drivers and accident victims. The lack of financial responsibility can lead to a cascade of negative consequences, ultimately burdening the entire community.

The Impact on Insured Drivers

The presence of uninsured drivers significantly impacts insured drivers, leading to higher insurance premiums. When uninsured drivers cause accidents, the costs associated with damages and injuries are often borne by insurance companies, which in turn, raise premiums for all policyholders to compensate for the losses.

- Increased Insurance Costs: Insurance companies factor in the risk of uninsured drivers when calculating premiums. As the number of uninsured drivers increases, so does the likelihood of claims arising from accidents involving them. This increased risk is reflected in higher premiums for all insured drivers.

- Higher Out-of-Pocket Expenses: Even with insurance, insured drivers who are involved in accidents with uninsured drivers may face higher out-of-pocket expenses. They might have to pay deductibles, cover the costs of repairs or medical bills exceeding their coverage limits, or deal with the hassle of pursuing claims against uninsured drivers.

- Reduced Access to Coverage: In some cases, insurance companies may limit coverage options or even refuse to insure drivers in areas with a high concentration of uninsured drivers. This can leave insured drivers with fewer choices and potentially higher premiums.

The Financial Burden on Accident Victims

Accident victims who are uninsured often face a significant financial burden. They may be responsible for covering the costs of medical bills, property damage, and lost wages, even if they were not at fault.

- Unpaid Medical Bills: Uninsured victims may face substantial medical bills, especially if they sustain serious injuries. They may struggle to pay these bills, leading to debt and potentially even bankruptcy.

- Property Damage Costs: Uninsured victims are also responsible for repairing or replacing damaged property, such as their vehicles. This can be a major financial burden, especially if the damage is extensive.

- Lost Wages: Victims may be unable to work due to injuries, leading to lost wages and further financial strain.

Government Programs for Uninsured Drivers

Recognizing the challenges faced by uninsured drivers, many states have implemented programs to provide financial assistance and access to coverage.

- Low-Cost Insurance Programs: Some states offer low-cost insurance programs specifically designed for drivers with limited financial resources. These programs provide basic liability coverage at a subsidized rate, making insurance more affordable for low-income individuals.

- Uninsured Motorist Coverage: Most states require insurance companies to offer uninsured motorist coverage (UMC) as part of standard auto insurance policies. UMC provides coverage for insured drivers who are injured by uninsured or hit-and-run drivers.

- Financial Assistance Programs: Some states have financial assistance programs to help accident victims who are uninsured. These programs may cover medical expenses, lost wages, or other costs associated with an accident.

Safety Considerations in States Without Mandatory Car Insurance

The absence of mandatory car insurance in certain states raises serious concerns regarding road safety. Driving without insurance not only jeopardizes the financial security of individuals involved in accidents but also creates a riskier environment for all road users.

The Impact of Uninsured Drivers on Road Safety

The lack of mandatory car insurance can contribute to a higher incidence of uninsured drivers on the road. This can lead to a number of safety implications:

- Increased Risk of Financial Burden: Uninsured drivers are more likely to be involved in accidents and leave victims with substantial medical bills and property damage costs. This can result in financial hardship for accident victims, particularly those who are already struggling financially.

- Limited Access to Necessary Medical Care: Victims of accidents involving uninsured drivers may face challenges in obtaining adequate medical treatment due to the lack of financial resources available to cover medical expenses. This can lead to delayed or inadequate care, potentially impacting their recovery and long-term health.

- Higher Insurance Premiums for Insured Drivers: The presence of uninsured drivers on the road can increase insurance premiums for insured drivers. This is because insurance companies have to factor in the risk of covering claims arising from accidents involving uninsured drivers, which ultimately gets passed on to policyholders.

- Disincentivizes Safe Driving Practices: The lack of financial consequences for driving without insurance may encourage some drivers to engage in riskier behaviors, as they may feel less accountable for potential accidents. This can lead to a higher number of accidents and injuries on the road.

Accident Rates in States With and Without Mandatory Car Insurance, States with no car insurance

While a direct causal link between mandatory car insurance and accident rates is difficult to establish, studies have shown that states with mandatory car insurance generally have lower rates of uninsured drivers. This suggests that the presence of mandatory car insurance can contribute to a safer driving environment.

- Example: A study by the Insurance Institute for Highway Safety (IIHS) found that states with mandatory car insurance laws have a lower percentage of uninsured drivers compared to states without such laws. This finding supports the notion that mandatory insurance can play a role in reducing the number of uninsured drivers on the road.

Final Conclusion

Ultimately, driving without insurance, even in states that do not mandate it, is a risky choice. While the initial cost savings may seem appealing, the potential financial and legal repercussions can be severe. Understanding the implications of this decision is crucial for all drivers, regardless of their location, as it directly impacts their safety and financial well-being. As we move forward, promoting awareness of the risks associated with driving without insurance and encouraging responsible driving practices is paramount to ensuring safer roads for everyone.

FAQ Insights: States With No Car Insurance

What are the specific states that don’t require car insurance?

The states that do not require drivers to carry car insurance are New Hampshire and Virginia. However, both states have financial responsibility laws that require drivers to demonstrate proof of financial responsibility in other ways.

What are the potential legal consequences of driving without car insurance in states without mandatory coverage?

The legal consequences can vary depending on the state and the specific circumstances. In general, driving without insurance can lead to fines, license suspension or revocation, and even jail time in some cases.

What are the advantages and disadvantages of using surety bonds or cash deposits as proof of financial responsibility?

Surety bonds and cash deposits can be more expensive than traditional car insurance, but they can also offer flexibility and potentially lower premiums for drivers with good driving records. However, they may not provide the same level of coverage as insurance, and they may not be readily available to all drivers.