State workman’s comp insurance is a crucial safety net for workers, providing financial protection and medical care in the event of work-related injuries or illnesses. This system, established in the early 20th century, has evolved to address the complexities of modern workplaces, balancing the needs of employers and employees.

Understanding the intricacies of state workman’s comp insurance is essential for both workers and employers. From eligibility requirements and coverage limitations to benefit levels and dispute resolution processes, navigating this system requires knowledge and awareness. This comprehensive guide aims to demystify the complexities of state workman’s comp insurance, empowering individuals to make informed decisions and protect their rights.

State Workman’s Comp Insurance Overview

State workman’s compensation insurance is a crucial aspect of the American labor landscape, designed to protect workers from financial hardship and medical expenses resulting from work-related injuries or illnesses. This system, mandated by individual states, ensures that injured employees receive compensation for lost wages and medical treatment, while employers are shielded from potential lawsuits.

History of Workman’s Comp Insurance in the United States

The concept of workman’s compensation emerged in the late 19th century, driven by the increasing industrialization and the associated rise in workplace accidents. Prior to the development of this system, injured workers had to rely on common law remedies, which often proved inadequate and cumbersome.

- The first state to enact a workman’s compensation law was Maryland in 1902. This law, however, was declared unconstitutional by the state’s highest court.

- In 1911, Wisconsin became the first state to successfully implement a workman’s compensation law, paving the way for other states to follow suit.

- By 1948, all states had adopted some form of workman’s compensation legislation, creating a national framework for worker protection.

Legal Framework and Regulations

Each state has its own unique set of laws and regulations governing workman’s compensation insurance. These laws typically establish the following:

- Eligibility criteria for receiving benefits, including the definition of a work-related injury or illness.

- Types of benefits available, such as lost wages, medical expenses, and disability payments.

- Procedures for filing claims and appealing decisions.

- Requirements for employers to provide coverage, including the establishment of a state-approved insurance fund or the purchase of private insurance.

Eligibility and Coverage

State workman’s comp insurance is designed to protect workers who experience work-related injuries or illnesses. The program provides benefits to cover medical expenses, lost wages, and other related costs. However, it is important to understand the specific eligibility requirements and coverage limitations.

Types of Workers Covered

State workman’s comp insurance typically covers employees who work for businesses within the state. However, the specific requirements can vary depending on the state. Here are some common categories of workers covered:

- Full-time employees: These are individuals who work a regular schedule for a specific employer.

- Part-time employees: Even those who work fewer hours are typically eligible for coverage.

- Temporary workers: Workers hired through staffing agencies or on a temporary basis are often covered under the employer’s workman’s comp policy.

- Independent contractors: In some cases, independent contractors may be eligible for coverage, depending on the state’s laws and the nature of their work.

Types of Work-Related Injuries and Illnesses Covered

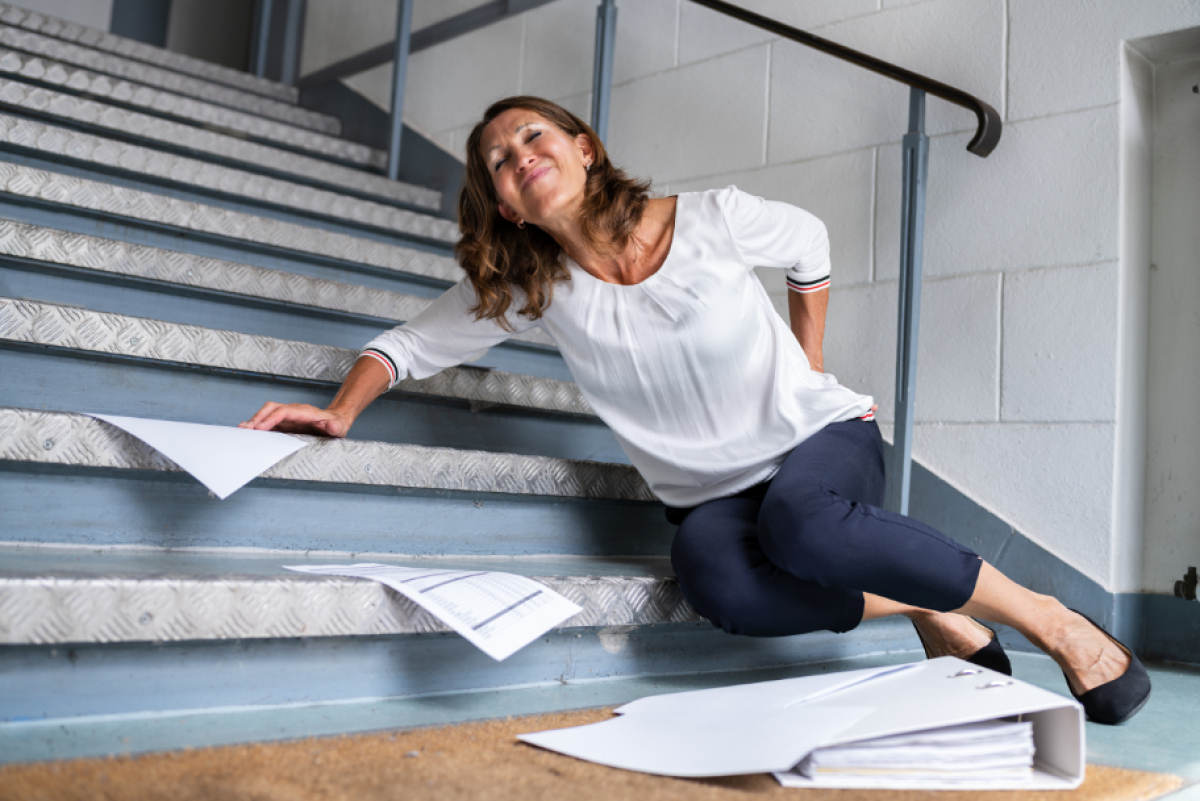

State workman’s comp insurance typically covers a wide range of work-related injuries and illnesses. These can include:

- Physical injuries: This includes cuts, burns, sprains, fractures, and other physical injuries sustained on the job.

- Occupational diseases: These are illnesses caused by exposure to hazardous substances or conditions in the workplace, such as asbestos, lead, or certain chemicals.

- Mental health conditions: Some states recognize work-related stress, anxiety, or depression as eligible for coverage, especially if it stems from workplace events or conditions.

Exclusions and Limitations of Coverage

While workman’s comp insurance offers valuable protection, it is important to understand the exclusions and limitations. Common exclusions include:

- Injuries or illnesses not related to work: For example, if an employee is injured in a car accident while commuting to work, this would typically not be covered.

- Injuries or illnesses caused by employee negligence or intoxication: If an employee is injured due to their own reckless behavior or while under the influence of drugs or alcohol, they may not be eligible for coverage.

- Pre-existing conditions: While some states may offer coverage for pre-existing conditions that are aggravated by work, they typically do not cover conditions that existed before employment.

Benefits and Payments

State workman’s comp insurance provides financial and medical benefits to employees who suffer work-related injuries or illnesses. These benefits aim to cover lost wages, medical expenses, and other related costs, enabling injured workers to focus on recovery and return to work.

Types of Benefits

The types of benefits available under state workman’s comp insurance vary depending on the state and the specific circumstances of the injury or illness. However, common benefits include:

- Medical Benefits: These cover the cost of medical treatment, including doctor visits, hospital stays, surgery, medication, and physical therapy. They are typically unlimited, meaning that the insurance will pay for all necessary medical treatment related to the work injury or illness.

- Lost Wage Benefits: These compensate employees for lost wages while they are unable to work due to their injury or illness. These benefits are typically calculated as a percentage of the employee’s average weekly wage and may have a maximum limit.

- Permanent Disability Benefits: These are paid to employees who have suffered a permanent disability as a result of their work injury or illness. The amount of these benefits depends on the severity of the disability and may be paid as a lump sum or as regular payments.

- Death Benefits: These are paid to the dependents of employees who die as a result of a work-related injury or illness. These benefits may include funeral expenses, lost wages, and other financial support for the deceased employee’s family.

- Rehabilitation Benefits: These help employees return to work after a work injury or illness. They may include vocational training, job placement assistance, and physical therapy.

Filing a Claim and Receiving Benefits, State workman’s comp insurance

The process for filing a claim and receiving benefits under state workman’s comp insurance varies depending on the state. However, the general steps involved include:

- Reporting the Injury or Illness: The employee must report the injury or illness to their employer as soon as possible. The employer is required to file a report with the state workman’s comp agency.

- Medical Treatment: The employee should seek medical treatment from a doctor approved by the insurance company. The doctor will provide a report on the injury or illness and its impact on the employee’s ability to work.

- Filing a Claim: The employee or their employer may need to file a formal claim with the state workman’s comp agency. The claim should include information about the injury or illness, the date of the injury or illness, and the employee’s medical records.

- Review and Approval: The state workman’s comp agency will review the claim and determine whether it is eligible for benefits. If the claim is approved, the employee will receive benefits for lost wages, medical expenses, and other related costs.

Factors Determining Benefit Amount

The amount of benefits received under state workman’s comp insurance depends on several factors, including:

- Severity of the Injury or Illness: The more severe the injury or illness, the higher the amount of benefits received.

- Employee’s Average Weekly Wage: The amount of lost wage benefits is typically calculated as a percentage of the employee’s average weekly wage.

- State Law: Each state has its own laws regarding workman’s comp benefits, which may affect the amount of benefits received.

- Duration of Disability: The longer the employee is unable to work due to their injury or illness, the higher the amount of lost wage benefits received.

- Permanent Disability Rating: If the employee suffers a permanent disability, the amount of benefits received will be based on the severity of the disability.

Employer Responsibilities: State Workman’s Comp Insurance

Employers are obligated to provide a safe and healthy work environment for their employees. This includes ensuring that they have adequate workers’ compensation insurance coverage. Workers’ compensation insurance protects employers from financial liability for work-related injuries and illnesses. In return for this protection, employees are entitled to receive benefits for their injuries or illnesses.

Obtaining Workers’ Compensation Insurance

Employers typically obtain workers’ compensation insurance through private insurance companies or state-run programs. The process for obtaining insurance coverage varies from state to state, but it generally involves the following steps:

- Determine the appropriate coverage: Employers must first determine the type and amount of coverage they need based on their industry, the number of employees, and the risks associated with their work.

- Contact insurance companies or state agencies: Once the coverage needs are determined, employers can contact insurance companies or state agencies to obtain quotes and compare policies.

- Complete an application: Employers will need to complete an application, which will require information about their business, employees, and work activities.

- Pay premiums: Once the policy is issued, employers must pay premiums on a regular basis, typically monthly or quarterly.

Paying Premiums

The amount of workers’ compensation premiums employers pay is based on several factors, including:

- Industry: Some industries are considered riskier than others, and employers in these industries will generally pay higher premiums.

- Number of employees: Employers with more employees will generally pay higher premiums.

- Past claims history: Employers with a history of claims will generally pay higher premiums.

- Safety record: Employers with a strong safety record will generally pay lower premiums.

Penalties for Non-Compliance

Employers who fail to comply with state workers’ compensation laws can face significant penalties. These penalties may include:

- Fines: Employers may be fined for failing to obtain insurance, failing to pay premiums, or failing to comply with other requirements.

- Jail time: In some cases, employers may be subject to jail time for serious violations of workers’ compensation laws.

- Civil lawsuits: Employees who are injured on the job may be able to file civil lawsuits against their employers if they do not have workers’ compensation insurance.

“It is essential for employers to understand their responsibilities under state workers’ compensation laws. Failure to comply with these laws can result in significant penalties, including fines, jail time, and civil lawsuits.”

Workers’ Rights and Responsibilities

State workers’ compensation insurance offers essential protections for workers injured or ill on the job. Understanding your rights and responsibilities is crucial for navigating the system effectively.

Workers’ Rights

Workers’ rights under state workers’ compensation insurance are designed to ensure fair treatment and access to benefits. Here are some key rights:

- Right to Medical Treatment: Injured workers have the right to receive necessary medical treatment related to their work injury or illness. This includes doctor visits, physical therapy, medications, and other treatments. The employer or insurer usually chooses the healthcare provider, but workers can request a change if they have valid reasons.

- Right to Lost Wages: If a work injury or illness prevents you from working, you may be eligible for temporary disability benefits. These benefits typically cover a portion of your lost wages while you recover. The specific amount and duration of benefits vary depending on state law.

- Right to Permanent Disability Benefits: If a work injury or illness results in a permanent disability, you may be entitled to permanent disability benefits. These benefits are designed to compensate for the loss of earning capacity due to the disability. The amount of permanent disability benefits depends on the severity of the disability and state law.

- Right to Appeal Decisions: If you disagree with a decision made by the insurer or the state workers’ compensation agency, you have the right to appeal the decision. The appeal process allows for a review of the decision and the opportunity to present additional evidence.

Reporting Injuries and Illnesses

Workers have a responsibility to report injuries and illnesses promptly and accurately. This is crucial for ensuring timely medical treatment and the proper processing of claims.

- Report Injuries and Illnesses Immediately: It’s important to report any work-related injury or illness to your supervisor or employer as soon as possible. This ensures that appropriate medical attention is sought and that the claim is filed promptly.

- Provide Accurate Information: When reporting an injury or illness, be sure to provide accurate information about the incident, including the date, time, location, and details of what happened. This information helps to establish the connection between the injury or illness and the workplace.

- Follow Employer’s Reporting Procedures: Each employer has specific procedures for reporting injuries and illnesses. It’s important to follow these procedures carefully to ensure that the claim is properly filed and processed.

Navigating the Claims Process

The workers’ compensation claims process can be complex. Understanding the steps involved can help you navigate the process smoothly.

- File a Claim Promptly: Once you have reported the injury or illness to your employer, the next step is to file a formal claim with the insurer. The claim form should be completed accurately and submitted within the timeframes specified by state law.

- Provide Medical Documentation: The insurer will likely require medical documentation from your healthcare provider to support your claim. It’s important to keep your doctor informed about the claim and to obtain all necessary medical records.

- Communicate with the Insurer: It’s essential to keep in touch with the insurer throughout the claims process. This includes providing updates on your recovery, responding to requests for information, and attending any scheduled appointments.

- Seek Legal Assistance if Needed: If you have difficulty navigating the claims process or have questions about your rights, consider seeking legal assistance from a qualified workers’ compensation attorney. An attorney can help you understand your rights and advocate for your interests.

Appealing Decisions

If you disagree with a decision made by the insurer or the state workers’ compensation agency, you have the right to appeal the decision. The appeal process allows for a review of the decision and the opportunity to present additional evidence.

- Understand the Appeal Process: Each state has its own specific rules and procedures for appealing workers’ compensation decisions. It’s important to understand these rules and deadlines to ensure that your appeal is filed properly.

- Gather Evidence: To support your appeal, it’s essential to gather all relevant evidence, such as medical records, witness statements, and any other documentation that supports your claim.

- File the Appeal within the Deadline: Appeals must be filed within a specific timeframe, usually within a certain number of days from the date of the decision. It’s important to meet these deadlines to avoid having your appeal dismissed.

State-Specific Variations

Workman’s compensation laws vary significantly from state to state, impacting both employers and workers. Understanding these differences is crucial for navigating the system effectively.

State-Specific Variations in Workman’s Compensation Laws

This section will provide a table comparing key differences in workman’s comp laws across different states. The table will cover:

* State Name

* Coverage Requirements

* Benefit Levels

* Premium Rates

* Dispute Resolution Processes

| State Name | Coverage Requirements | Benefit Levels | Premium Rates | Dispute Resolution Processes |

|---|---|---|---|---|

| California | All employers with one or more employees are required to provide workers’ compensation insurance. | Benefits include medical expenses, lost wages, and permanent disability payments. | Premium rates are determined by industry classification and the employer’s claims history. | Disputes are resolved through the Workers’ Compensation Appeals Board. |

| Texas | Employers with three or more employees are required to provide workers’ compensation insurance. | Benefits include medical expenses, lost wages, and death benefits. | Premium rates are determined by industry classification and the employer’s claims history. | Disputes are resolved through the Texas Department of Insurance. |

| New York | All employers with one or more employees are required to provide workers’ compensation insurance. | Benefits include medical expenses, lost wages, and permanent disability payments. | Premium rates are determined by industry classification and the employer’s claims history. | Disputes are resolved through the Workers’ Compensation Board. |

| Florida | All employers with one or more employees are required to provide workers’ compensation insurance. | Benefits include medical expenses, lost wages, and permanent disability payments. | Premium rates are determined by industry classification and the employer’s claims history. | Disputes are resolved through the Florida Division of Administrative Hearings. |

Impact of Variations on Employers and Workers

The variations in workman’s compensation laws across states can have significant implications for both employers and workers.

For employers, the differences in coverage requirements, benefit levels, and premium rates can impact their overall costs. For example, states with higher benefit levels or more stringent coverage requirements may have higher premium rates. Employers must ensure they are compliant with the laws in their state to avoid penalties.

For workers, the differences in benefit levels and dispute resolution processes can impact their access to compensation and the speed of their claims processing. For example, states with more generous benefit levels may provide workers with greater financial support during their recovery. Workers should be aware of their rights and the processes for filing claims in their state.

Emerging Trends and Challenges

State workman’s comp insurance systems are continually evolving to address the changing landscape of work and the needs of both employers and employees. The rise of new industries, technological advancements, and shifting demographics are creating unique challenges and opportunities for these systems.

Impact of Changing Demographics

The demographics of the workforce are changing, with an aging population and increasing diversity. This presents challenges for state workman’s comp insurance systems. As the workforce ages, the risk of workplace injuries and illnesses may increase. Additionally, a more diverse workforce requires systems to be sensitive to cultural differences and language barriers.

- For example, the increasing number of older workers may require adjustments to existing programs to address their unique needs, such as providing specialized training or adapting workplace safety protocols to accommodate age-related physical limitations.

- Similarly, a diverse workforce necessitates communication materials and resources in multiple languages to ensure all workers understand their rights and responsibilities.

Impact of Workplace Safety

Workplace safety is a critical aspect of workman’s comp insurance. Advancements in technology, automation, and artificial intelligence are creating new hazards and risks in the workplace. These changes require state workman’s comp systems to adapt and ensure that they are adequately addressing the evolving safety needs of employers and employees.

- For instance, the increasing use of robotics and automation in manufacturing and other industries may require specialized training for workers to operate these machines safely.

- Additionally, the rise of remote work and gig economy jobs presents challenges in ensuring workplace safety, as these workers may not be covered under traditional workplace safety regulations.

Impact of Technological Advancements

Technological advancements are transforming the way we work, with implications for state workman’s comp systems. The rise of telemedicine and remote healthcare services provides new avenues for treating work-related injuries and illnesses. However, it also raises concerns about data privacy and security.

- For example, telemedicine can provide timely access to medical care for workers in remote locations, but it requires robust systems to ensure the confidentiality and integrity of patient data.

- Additionally, the use of wearable technology and data analytics in the workplace can be used to improve workplace safety, but it also raises ethical considerations about worker surveillance and data ownership.

Potential for Future Reforms and Improvements

State workman’s comp systems are continually evolving to address the challenges and opportunities presented by these emerging trends. Future reforms may focus on areas such as:

- Streamlining the claims process to make it more efficient and user-friendly for both employers and employees.

- Expanding access to preventive care and early intervention programs to reduce the incidence of workplace injuries and illnesses.

- Developing innovative solutions to address the challenges of workplace safety in the gig economy and remote work environments.

- Enhancing data collection and analysis to better understand the impact of emerging trends on the workman’s comp system.

Last Recap

State workman’s comp insurance plays a vital role in ensuring a safe and secure work environment for millions of Americans. By understanding the system’s purpose, benefits, and obligations, both workers and employers can navigate this complex landscape effectively. As workplaces continue to evolve, so too must the system, adapting to emerging trends and challenges to provide fair and equitable protection for all.

Question & Answer Hub

What happens if my employer doesn’t have workman’s comp insurance?

If your employer does not carry workman’s comp insurance, they could face serious penalties, including fines and even criminal charges. You may also be able to file a claim directly against your employer for your injuries or illnesses.

Can I choose my own doctor for treatment under workman’s comp?

In some states, you have the right to choose your own doctor for treatment. However, in other states, your employer may designate a specific physician or medical provider. It’s important to check your state’s specific laws and regulations.

How long do I have to file a workman’s comp claim?

The time limit for filing a workman’s comp claim varies by state. It’s crucial to report your injury or illness to your employer as soon as possible and file a claim within the designated timeframe.

What if my workman’s comp claim is denied?

If your claim is denied, you have the right to appeal the decision. The appeals process can be complex, so it’s advisable to seek legal counsel to understand your options and protect your rights.