State of Michigan car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a unique and complex system that stands apart from the rest of the nation. Michigan’s no-fault insurance system, a historical anomaly, presents a compelling story of its own, shaped by a unique blend of factors, including the state’s commitment to protecting its citizens, the evolving landscape of healthcare costs, and the inherent challenges of balancing individual rights with the need for a stable insurance market.

This comprehensive guide will delve into the intricacies of Michigan’s car insurance system, exploring its history, its unique features, and its impact on drivers. We will analyze the factors that contribute to the high cost of car insurance in Michigan, examine the options available to consumers, and discuss the ongoing efforts to reform this complex system.

Michigan’s Unique Car Insurance System: State Of Michigan Car Insurance

Michigan’s car insurance system is a distinctive one, often drawing comparisons and contrasting views due to its no-fault insurance model. Understanding the historical context and rationale behind this system is crucial for comprehending its complexities and implications.

The History and Rationale of Michigan’s No-Fault System

Michigan’s no-fault insurance system was established in 1973, becoming the first state in the nation to adopt such a model. The primary rationale behind this shift was to simplify the claims process and reduce court congestion by eliminating fault-based lawsuits. Instead of drivers having to prove fault in accidents, the system focused on compensating individuals for their own injuries and losses, regardless of who caused the accident. This was envisioned to streamline the process, reduce litigation costs, and provide quicker and more predictable compensation for accident victims.

Cost of Car Insurance in Michigan

Michigan’s car insurance system is unique and complex, with a high cost that often makes it a major financial burden for residents. Several factors contribute to this high cost, including the state’s no-fault system, high medical costs, and the prevalence of fraud and litigation.

Factors Contributing to High Car Insurance Costs

Michigan’s no-fault system, while intended to provide comprehensive coverage for injured drivers, has been criticized for driving up costs. The system requires drivers to pay for their own medical expenses, regardless of who is at fault in an accident. This can lead to higher premiums, as insurance companies need to cover these costs.

- High Medical Costs: Michigan has some of the highest medical costs in the country, which directly impacts car insurance premiums. This is partly due to the state’s no-fault system, which encourages extensive medical treatment and rehabilitation, leading to higher medical bills.

- Fraud and Litigation: Michigan has a significant problem with car insurance fraud, which drives up costs for everyone. This includes staged accidents, fraudulent claims, and inflated medical bills. Additionally, the state’s high number of lawsuits related to car accidents further contributes to increased premiums.

Average Car Insurance Premiums in Michigan

The average car insurance premium in Michigan is significantly higher than in other states. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for full coverage car insurance in Michigan was $2,616 in 2022, compared to the national average of $1,674.

Impact of Coverage Options on Premiums

The cost of car insurance in Michigan can vary significantly based on the type of coverage selected.

- Personal Injury Protection (PIP): PIP coverage is mandatory in Michigan and covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident. Choosing a higher PIP limit can significantly increase premiums.

- Collision and Comprehensive Coverage: These coverages are optional and protect against damage to your vehicle from accidents or other events, such as theft or vandalism. Choosing higher coverage limits or deductibles can impact your premiums.

Navigating Michigan’s Car Insurance Market

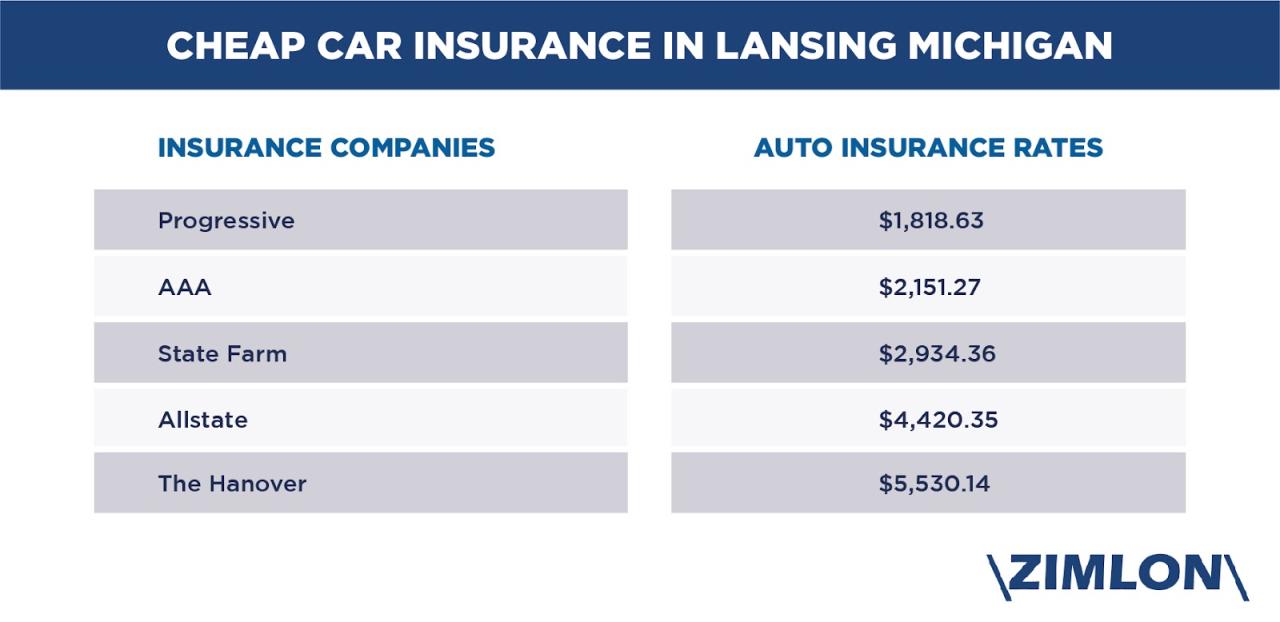

Navigating Michigan’s unique car insurance market can be a complex process, but with the right information and strategies, you can find the best policy for your needs and budget. This section will guide you through the key aspects of choosing car insurance in Michigan, providing insights into the major insurance companies, their offerings, and the process of obtaining quotes.

Major Car Insurance Companies in Michigan

Michigan has a diverse car insurance market with numerous companies competing for your business. Some of the most prominent players include:

- State Farm: A leading national insurer with a strong presence in Michigan, known for its competitive pricing and comprehensive coverage options.

- Auto-Owners Insurance: A Michigan-based company that has built a reputation for reliable service and personalized attention.

- Progressive: A national insurer that offers a wide range of coverage options and innovative features, such as its “Name Your Price” tool for customizing policies.

- Geico: A national insurer with a focus on affordability and convenience, known for its easy online quoting and claims process.

- Farmers Insurance: A national insurer with a network of local agents, offering personalized service and a range of insurance products.

- Allstate: A national insurer known for its strong brand recognition and diverse coverage options, including its “Drive Safe & Save” program.

Comparing Car Insurance Companies in Michigan

Choosing the right car insurance company involves comparing different factors, such as pricing, coverage options, and customer service.

- Pricing: Car insurance premiums in Michigan can vary significantly depending on the company, your driving record, vehicle type, and other factors. It’s crucial to compare quotes from multiple companies to find the most affordable option.

- Coverage Options: Michigan law requires certain types of coverage, including liability, personal injury protection (PIP), and property protection insurance (PPI). Companies may offer different levels of coverage and additional options, such as collision and comprehensive coverage, which can impact the overall premium. It’s essential to understand your specific needs and choose a policy that provides adequate protection.

- Customer Service: Customer service is a crucial factor in choosing a car insurance company. Consider factors like the ease of contacting customer support, response times, and the company’s reputation for handling claims efficiently and fairly.

Obtaining Car Insurance Quotes and Choosing the Right Policy

The process of obtaining car insurance quotes and choosing the right policy involves the following steps:

- Gather Information: Before you start requesting quotes, gather essential information about your vehicle, driving history, and desired coverage levels. This will streamline the quoting process.

- Compare Quotes: Use online quote comparison tools or contact insurance companies directly to obtain quotes. Make sure to compare quotes from multiple companies to find the best deal.

- Review Coverage Options: Carefully review the coverage options and limitations of each policy. Ensure that the chosen policy provides adequate protection for your needs and budget.

- Choose a Policy: Once you’ve compared quotes and reviewed coverage options, select the policy that best suits your requirements. Remember to consider the company’s reputation, customer service, and financial stability.

- Make Payment: Once you’ve chosen a policy, make the initial payment to activate your coverage.

Consumer Rights and Protections

Michigan car insurance policyholders have a range of rights and protections in place to ensure fair treatment and access to necessary coverage. These rights are Artikeld in state laws and regulations, and they are enforced by the Michigan Department of Insurance and Financial Services (DIFS).

Understanding Your Rights

Michigan’s No-Fault law provides policyholders with several key rights, including:

- Right to Choose Your Own Doctor and Treatment: You are free to select your own healthcare provider, including doctors, hospitals, and therapists, for treatment related to your car accident injuries.

- Right to Receive Coverage for Medical Expenses: Your car insurance policy will cover reasonable and necessary medical expenses related to your car accident injuries, regardless of fault. This includes treatment, rehabilitation, and other related costs.

- Right to Receive Coverage for Lost Wages: If your injuries prevent you from working, your car insurance policy will cover a portion of your lost wages, subject to specific limitations.

- Right to Receive Coverage for Other Expenses: Your car insurance policy may cover other expenses related to your car accident, such as replacement services, attendant care, and funeral expenses, depending on the specific coverage you have chosen.

Filing a Claim and Resolving Disputes

When you need to file a claim with your insurance company, it’s important to understand the proper procedures:

- Notify Your Insurance Company Promptly: Contact your insurance company as soon as possible after an accident, even if it seems minor. You should report the accident within a reasonable timeframe, typically 24 to 48 hours. This ensures your claim is processed in a timely manner.

- Provide Necessary Information: Be prepared to provide your insurance company with all relevant details about the accident, including the date, time, location, and any injuries sustained. You may need to provide police reports, medical records, and other supporting documentation.

- Cooperate with Your Insurance Company: It’s essential to cooperate fully with your insurance company during the claims process. Respond promptly to requests for information, attend scheduled appointments, and provide any necessary documentation.

In cases where you have a dispute with your insurance company, you have options for resolving the issue:

- Contact Your Insurance Company Directly: Start by contacting your insurance company directly to try and resolve the dispute. Explain your concerns and provide any relevant documentation.

- File a Complaint with DIFS: If you are unable to resolve the dispute with your insurance company, you can file a complaint with the Michigan Department of Insurance and Financial Services (DIFS). DIFS investigates complaints and can help you negotiate a fair settlement.

- Seek Legal Counsel: In some cases, you may need to seek legal counsel to protect your rights and interests. An attorney can help you understand your options and navigate the legal process.

The Role of DIFS

The Michigan Department of Insurance and Financial Services (DIFS) plays a crucial role in regulating the car insurance industry in Michigan:

- Enforces State Laws and Regulations: DIFS ensures that insurance companies comply with Michigan’s car insurance laws and regulations, including those related to consumer rights and protections.

- Investigates Consumer Complaints: DIFS investigates complaints from consumers who have experienced problems with their insurance companies, such as unfair claim denials or delays in processing claims.

- Provides Consumer Education and Resources: DIFS provides educational resources and information to help consumers understand their car insurance rights and make informed decisions about their coverage.

The Future of Car Insurance in Michigan

The landscape of car insurance in Michigan is undergoing a significant transformation, driven by technological advancements, evolving consumer expectations, and ongoing reform efforts. This evolution presents both challenges and opportunities for the state’s insurance market, impacting how Michiganders purchase, utilize, and experience car insurance in the years to come.

Impact of Emerging Trends

The emergence of autonomous vehicles (AVs) and telematics technologies is poised to revolutionize the car insurance industry. These technologies offer the potential to significantly alter how risk is assessed, premiums are calculated, and coverage is provided.

Autonomous Vehicles

Autonomous vehicles are expected to dramatically reduce the number of accidents caused by human error, leading to a decrease in insurance claims. This could result in lower premiums for AV owners. However, the insurance industry is still grappling with the complexities of insuring AVs, including:

- Determining liability in the event of an accident involving an AV.

- Developing new risk assessment models to account for the unique characteristics of AVs.

- Addressing the potential for cyberattacks on AVs and their impact on insurance coverage.

Telematics

Telematics devices, which track driving behavior, are increasingly being used by insurance companies to offer usage-based insurance (UBI) programs. These programs reward safe drivers with lower premiums based on factors such as speed, braking, and time of day.

- Telematics data can provide valuable insights into driving habits, allowing insurers to tailor premiums more accurately.

- UBI programs can incentivize safe driving and potentially reduce accidents.

- However, concerns about privacy and data security associated with telematics need to be addressed.

Ongoing Reform Efforts

Michigan’s car insurance system has been a subject of ongoing debate and reform efforts. The 2019 reform legislation aimed to address the high cost of insurance in the state, introducing changes such as:

- A tiered system for personal injury protection (PIP) coverage, allowing drivers to choose different levels of coverage and corresponding premiums.

- A cap on medical expenses for certain injuries.

- Increased transparency and competition among insurers.

These reforms have had a mixed impact on the market, with some drivers experiencing lower premiums while others have seen increases. The long-term effects of these reforms are still being evaluated, and further adjustments may be necessary to achieve the desired outcomes.

Challenges and Opportunities, State of michigan car insurance

The future of car insurance in Michigan is characterized by both challenges and opportunities:

Challenges

- Maintaining affordability: The high cost of car insurance remains a significant concern for many Michiganders, and ensuring affordability while addressing other critical issues is a key challenge.

- Adapting to technological advancements: The rapid pace of technological change, particularly in the area of autonomous vehicles and telematics, presents a challenge for insurers to adapt their products and services to meet evolving needs.

- Addressing fraud and abuse: Car insurance fraud is a persistent problem, and combating it effectively is essential to maintain a stable and fair insurance market.

Opportunities

- Improving customer experience: Technology can be used to enhance the customer experience by providing more personalized services, simplified claims processes, and greater transparency.

- Developing innovative insurance products: The emergence of new technologies and driving patterns opens up opportunities for insurers to develop innovative insurance products tailored to specific needs and risks.

- Promoting safety and reducing accidents: Car insurance plays a crucial role in promoting road safety. By leveraging data and technology, insurers can develop programs and incentives to encourage safe driving behaviors.

Final Conclusion

As we conclude our exploration of Michigan’s car insurance landscape, it becomes clear that this system is a fascinating study in the interplay of economics, politics, and individual rights. While the challenges are undeniable, the commitment to reform and the ongoing dialogue surrounding the future of car insurance in Michigan offer hope for a more equitable and sustainable system. Understanding the complexities of Michigan’s car insurance system empowers drivers to make informed choices and advocate for change. This guide serves as a starting point for navigating this complex world, equipping readers with the knowledge and insights necessary to understand their rights, compare options, and ultimately, secure the best possible coverage for their needs.

Popular Questions

What is the difference between no-fault insurance and traditional car insurance?

No-fault insurance means that your own insurance company pays for your medical expenses and lost wages after an accident, regardless of who was at fault. Traditional car insurance requires you to file a claim against the other driver’s insurance company.

How can I lower my car insurance premiums in Michigan?

There are several ways to lower your premiums, including choosing a higher deductible, taking a defensive driving course, and bundling your car insurance with other policies like homeowners or renters insurance.

What are the key factors that influence the cost of car insurance in Michigan?

The cost of car insurance in Michigan is influenced by several factors, including the type of car you drive, your driving history, your age and gender, and the location where you live.

What are some of the common coverage options available in Michigan car insurance policies?

Common coverage options include personal injury protection (PIP), property damage liability, collision coverage, comprehensive coverage, and uninsured motorist coverage.

What are the rights of Michigan car insurance policyholders?

Michigan car insurance policyholders have several rights, including the right to fair and prompt payment of claims, the right to access their insurance records, and the right to file complaints with the Michigan Department of Insurance and Financial Services (DIFS).