The state that does not require car insurance, a unique situation in the US, sets the stage for a compelling exploration of risk, responsibility, and the delicate balance between individual freedom and societal safety. While most states mandate car insurance to protect drivers and victims of accidents, this lone state presents a fascinating case study in alternative approaches to financial responsibility on the road.

This state’s decision to forgo mandatory car insurance stems from a complex interplay of factors, including a belief in individual liberty, a desire to minimize government intervention, and a reliance on alternative mechanisms to ensure financial protection for accident victims. However, this unconventional approach comes with its own set of challenges and consequences, raising questions about the effectiveness of alternative solutions, the potential risks faced by uninsured drivers, and the broader implications for the insurance industry and public safety.

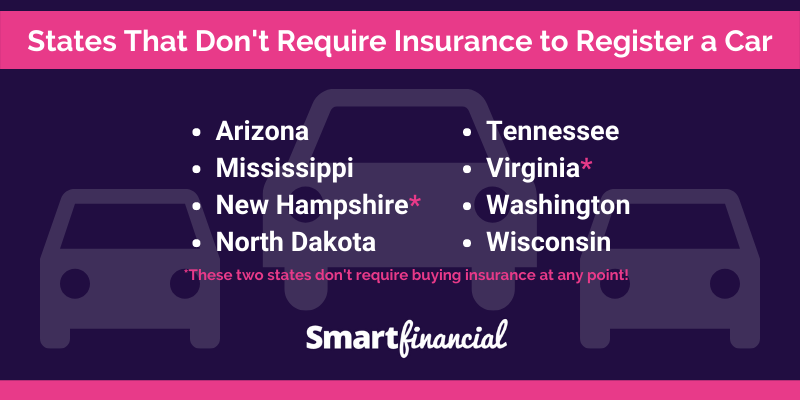

States Without Mandatory Car Insurance

In the United States, all states except New Hampshire and Virginia require drivers to carry some form of car insurance. These two states, however, do not mandate car insurance.

Rationale Behind Non-Mandatory Car Insurance

These states have chosen not to mandate car insurance for various reasons. One primary reason is the belief that individuals should be free to make their own decisions about whether or not to purchase insurance. Additionally, some argue that mandatory insurance can lead to higher premiums and increased costs for drivers. Opponents of mandatory insurance also point out that it can create a moral hazard, where individuals may be less careful if they know they are covered by insurance.

Benefits and Drawbacks of Not Requiring Car Insurance

The decision to not require car insurance presents both potential benefits and drawbacks.

Benefits

- Lower Insurance Costs: One potential benefit of not requiring car insurance is that it could lead to lower insurance costs for drivers who choose to purchase it. This is because the insurance pool would be smaller, and there would be fewer claims to cover.

- Increased Individual Freedom: Another benefit is that it allows individuals to make their own decisions about whether or not to purchase insurance. This can be seen as a matter of personal freedom and responsibility.

Drawbacks

- Higher Risk of Uninsured Drivers: A significant drawback of not requiring car insurance is that it can lead to a higher number of uninsured drivers on the road. This increases the risk of accidents involving uninsured drivers, potentially resulting in financial hardship for those involved in such accidents.

- Financial Burden on Victims: If an uninsured driver is responsible for an accident, the victims may be left to cover their own medical expenses and vehicle repairs. This can lead to significant financial hardship for the victims, particularly if they are unable to afford to pay for these expenses out of pocket.

- Potential for Higher Costs for Insured Drivers: While it may seem counterintuitive, the lack of mandatory insurance could potentially lead to higher costs for insured drivers. This is because insurance companies may need to raise premiums to cover the increased risk of uninsured drivers.

Financial Responsibility Laws

States without mandatory car insurance have financial responsibility laws that require drivers to prove they can pay for damages caused by accidents. These laws are designed to ensure that victims of accidents have a way to recover financial compensation for their injuries and property damage.

How Financial Responsibility Laws Ensure Financial Protection

Financial responsibility laws typically require drivers to demonstrate financial responsibility in one of the following ways:

- Carrying Liability Insurance: Drivers can meet the requirements by purchasing liability insurance that covers damages to others. This is the most common method of fulfilling financial responsibility obligations.

- Posting a Security Bond: Drivers can post a security bond with the state, which acts as a guarantee that they will be able to pay for damages if they cause an accident. This option is less common than carrying insurance.

- Providing Proof of Financial Responsibility: Drivers can demonstrate financial responsibility by providing proof of sufficient assets, such as savings, property, or investments, to cover potential damages. This option is rarely used.

Effectiveness of Financial Responsibility Laws

Financial responsibility laws can be effective in providing some financial protection for victims of accidents. However, they have limitations compared to mandatory insurance requirements:

- Lower Coverage Limits: Financial responsibility laws typically have lower coverage limits than mandatory insurance requirements. This means that victims may not be fully compensated for their losses if the driver’s financial responsibility falls short.

- Enforcement Challenges: Enforcing financial responsibility laws can be challenging. States may struggle to identify uninsured drivers and collect financial responsibility proof. This can lead to situations where victims are left without compensation.

- Limited Coverage: Financial responsibility laws generally only cover liability for damages to others. They may not cover the driver’s own injuries or property damage, leaving drivers financially vulnerable in the event of an accident.

Impact on Uninsured Drivers

Driving without insurance in states that don’t require it can lead to significant financial and legal consequences. Uninsured drivers face numerous risks, including potential financial ruin in the event of an accident.

Financial Risks

The lack of insurance can have a devastating impact on uninsured drivers in case of an accident. Here’s how:

- High Out-of-Pocket Expenses: Uninsured drivers are fully responsible for covering all costs associated with an accident, including medical bills, property damage, and legal fees. These expenses can quickly add up, potentially bankrupting an uninsured driver.

- Legal Battles: Without insurance, drivers may face lawsuits from injured parties seeking compensation for their damages. This can result in prolonged legal battles and significant financial burdens, even if the uninsured driver was not at fault.

- License Suspension or Revocation: Many states have financial responsibility laws that require drivers to prove they can pay for damages caused by an accident. Failing to do so can lead to license suspension or revocation, making it impossible to drive legally.

Impact on Accident Victims

The absence of insurance for the at-fault driver can also severely impact accident victims:

- Difficulty in Obtaining Compensation: Victims of an accident caused by an uninsured driver may face significant challenges in receiving compensation for their injuries and damages. This can be especially difficult if the at-fault driver is unable to afford to pay for the damages out of pocket.

- Increased Financial Burden: Victims may be forced to bear the financial burden of their injuries and property damage, potentially leading to financial hardship.

- Limited Access to Medical Care: Without insurance coverage, victims may struggle to afford necessary medical treatment, leading to potential long-term health complications.

Alternative Solutions

While mandatory car insurance is the most common approach to ensuring financial responsibility for drivers, states that don’t require it must explore alternative solutions. These alternatives aim to protect both drivers and accident victims in the absence of compulsory insurance.

Financial Responsibility Bonds

Financial responsibility bonds offer an alternative to traditional car insurance. These bonds guarantee the payment of damages up to a specific amount, typically determined by state law. Drivers who choose this option are required to post a bond with a surety company, ensuring they can cover potential liabilities arising from accidents.

The feasibility of financial responsibility bonds depends on several factors.

- The bond amount must be sufficiently high to cover potential damages in a serious accident. This can be a significant financial burden for some drivers, potentially excluding them from this option.

- The surety company must be financially stable and reliable to ensure that claims can be paid in full.

- Bonding companies may have strict eligibility criteria, potentially excluding certain drivers based on their driving history or financial status.

Despite these challenges, financial responsibility bonds offer several potential benefits.

- They can provide a less expensive alternative to traditional car insurance for drivers with clean driving records and strong financial standing.

- Bonds can offer a greater degree of flexibility in terms of coverage options compared to standard insurance policies.

Self-Insurance

Self-insurance is another alternative to mandatory car insurance. This approach allows drivers to set aside a designated fund to cover potential accident-related costs. This requires careful financial planning and a strong understanding of potential liabilities.

Self-insurance poses several challenges, including:

- The need to accumulate a substantial amount of funds to cover potential claims. This may be difficult for many drivers, particularly those with limited financial resources.

- The risk of facing financial ruin if a significant accident occurs and the self-insured fund is insufficient to cover the damages.

- The potential for legal challenges in the event of an accident, where the self-insured driver may be held personally liable for damages beyond their financial capacity.

Despite these challenges, self-insurance can be a viable option for some drivers.

- It can be more cost-effective than traditional insurance for drivers with a strong risk tolerance and a good understanding of their potential liabilities.

- Self-insurance offers a high degree of flexibility in terms of coverage options and allows drivers to tailor their coverage to their specific needs.

Impact on the Insurance Industry

The absence of mandatory car insurance in certain states has a profound impact on the insurance industry, leading to both challenges and opportunities. The lack of a universal requirement for coverage can affect premiums, coverage availability, and the overall financial stability of insurance companies operating in these states.

Impact on Premiums and Coverage Availability

The lack of mandatory car insurance can create a higher risk pool for insurance companies. This is because uninsured drivers are more likely to be involved in accidents and less likely to be able to pay for damages. To compensate for this increased risk, insurance companies may raise premiums for all drivers in states without mandatory car insurance. This can result in higher costs for insured drivers, even if they are responsible and have a clean driving record. Additionally, some insurance companies may choose to limit or even refuse coverage in states without mandatory car insurance, particularly for high-risk drivers. This can leave some individuals struggling to find affordable and comprehensive insurance coverage.

Consequences for Insurance Companies, State that does not require car insurance

Insurance companies operating in states without mandatory car insurance face several challenges. They may experience higher claims costs due to the increased number of uninsured drivers. Additionally, the lack of mandatory insurance can lead to more complex claims processes, as insurers may need to pursue legal action to recover damages from uninsured drivers. In some cases, insurance companies may also face financial losses due to uninsured motorists who are unable to pay for damages. However, the lack of mandatory car insurance also presents opportunities for insurance companies to develop innovative products and services that cater to the specific needs of drivers in these states. For example, some insurance companies may offer discounts to drivers who maintain a clean driving record or who choose to purchase additional coverage.

Public Policy Considerations

The decision of whether or not to require car insurance is a complex one with significant public policy implications. This decision involves weighing the potential benefits of mandatory insurance against the potential drawbacks.

Arguments for Mandatory Car Insurance

Mandatory car insurance is a policy designed to address the financial and social consequences of car accidents. Proponents of mandatory car insurance argue that it is a crucial tool for ensuring public safety and financial stability.

- Financial Protection for Victims: Mandatory car insurance provides financial protection for victims of car accidents, regardless of fault. This includes covering medical expenses, lost wages, and property damage. Without insurance, victims may face significant financial hardship, potentially leading to bankruptcy or other financial instability.

- Road Safety: The presence of mandatory car insurance can incentivize drivers to be more responsible and cautious on the road. Knowing that they are financially liable for any accidents they cause, drivers may be more likely to avoid risky behaviors, such as speeding, driving under the influence, or distracted driving.

- Reduced Uninsured Motorist Costs: Mandatory car insurance helps reduce the costs associated with uninsured motorists. Uninsured drivers are more likely to be involved in accidents, and their lack of insurance can lead to higher costs for other drivers and insurers.

- Increased Access to Healthcare: Mandatory car insurance can increase access to healthcare for victims of car accidents. By ensuring that drivers have financial coverage, victims are more likely to receive the medical treatment they need, improving their chances of recovery.

Arguments Against Mandatory Car Insurance

Opponents of mandatory car insurance argue that it can be an infringement on individual liberty and that it can lead to higher insurance premiums.

- Individual Liberty: Some argue that mandatory car insurance is an infringement on individual liberty, as it forces people to purchase a product they may not want or need. This argument suggests that individuals should be free to make their own decisions about whether or not to purchase car insurance.

- Increased Insurance Premiums: Opponents also argue that mandatory car insurance can lead to higher insurance premiums. They suggest that by forcing everyone to purchase insurance, insurers may have less incentive to offer competitive rates, leading to higher costs for consumers.

Impact on Public Safety and Financial Stability

State policies regarding mandatory car insurance can have a significant impact on public safety and financial stability.

- Public Safety: Mandatory car insurance can improve public safety by reducing the number of uninsured drivers on the road. This can lead to fewer accidents and injuries, as drivers are more likely to be financially responsible for their actions.

- Financial Stability: Mandatory car insurance can contribute to financial stability by reducing the number of uninsured claims. This can help to stabilize the insurance market and ensure that insurers can continue to provide coverage to policyholders.

Ending Remarks

Ultimately, the debate surrounding the state that does not require car insurance highlights the ongoing conversation about balancing individual freedom with the need for societal safety. While the state’s approach may offer a unique perspective on financial responsibility, it raises critical questions about the effectiveness of alternative solutions and the potential consequences for both drivers and accident victims. As this state continues to navigate this unique landscape, it serves as a reminder of the complex interplay of factors that shape our approach to car insurance and the ongoing quest for a system that balances individual liberty with societal responsibility.

Q&A: State That Does Not Require Car Insurance

Is it really legal to drive without car insurance in this state?

Yes, this state does not require car insurance, but it’s important to note that they have alternative financial responsibility laws in place to protect accident victims.

What are the risks of driving without insurance in this state?

While it’s legal, driving without insurance in this state can lead to significant financial hardship if you’re involved in an accident. You could be held personally liable for the full cost of damages, including medical bills, property repairs, and lost wages. You could also face legal action and potential fines.

What are the alternatives to car insurance in this state?

This state typically requires drivers to demonstrate financial responsibility through options like a surety bond, a deposit of cash or securities, or self-insurance. These alternatives aim to ensure that drivers can cover the costs of accidents, even without traditional insurance.

How does this state’s approach impact the insurance industry?

The lack of mandatory car insurance in this state could affect insurance premiums and coverage availability for drivers in other states. It could also lead to changes in how insurance companies operate and assess risk in this particular state.