State with lowest car insurance – Finding the state with the lowest car insurance can be a significant factor when considering a move or simply wanting to save money. Several factors contribute to these varying rates, from traffic density and accident rates to the competitive landscape of insurance companies in each state. This exploration delves into the reasons behind these disparities, examining the influence of state regulations, demographics, and driving habits on car insurance premiums.

Understanding these nuances is crucial for drivers seeking affordable coverage. We’ll explore strategies for finding the best deals, including comparing quotes, increasing deductibles, and taking advantage of discounts. By navigating the complex world of car insurance, you can find the best protection at a price that fits your budget.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by a variety of factors, each contributing to the overall cost of coverage. These factors help insurance companies assess the risk associated with insuring a particular driver and vehicle, ultimately determining the premium you pay.

Driving History

Your driving history plays a crucial role in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates. Insurance companies view these events as indicators of riskier driving behavior.

Vehicle Type

The type of vehicle you drive is another significant factor influencing insurance rates. Some vehicles are considered inherently riskier than others due to their performance, safety features, or theft susceptibility. For instance, sports cars, luxury vehicles, and vehicles with powerful engines often have higher insurance rates due to their higher potential for accidents or theft.

Age

Age is a factor that insurance companies consider because younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Inexperience, risk-taking behavior, and a lack of mature driving habits contribute to this higher risk. However, as drivers age, their insurance rates typically decrease due to their greater experience and lower risk profile.

Location

The location where you live significantly impacts your insurance rates. Areas with higher population density, traffic congestion, and crime rates tend to have higher insurance premiums. This is because the likelihood of accidents, theft, and other claims is generally higher in these areas.

Coverage Levels

The level of coverage you choose directly affects your insurance rates. Comprehensive and collision coverage provide protection against a wide range of risks, including accidents, theft, and vandalism. However, these higher levels of coverage come with higher premiums. Conversely, choosing minimum coverage levels will result in lower premiums but provide less financial protection in the event of an accident or claim.

Demographics

Demographics, such as age and gender, can also influence insurance rates. As mentioned earlier, younger drivers typically face higher premiums due to their higher risk profile. Gender can also play a role, with some studies suggesting that male drivers may be slightly more likely to be involved in accidents. However, it’s important to note that these are general trends and individual driving habits play a significant role.

Driving Behaviors

Specific driving behaviors can significantly impact your insurance rates. For instance, speeding tickets, reckless driving violations, and accidents all increase your risk profile and result in higher premiums. Insurance companies use a points system to track driving violations, with each violation adding points to your record. A higher point accumulation leads to higher insurance rates.

State-Specific Considerations

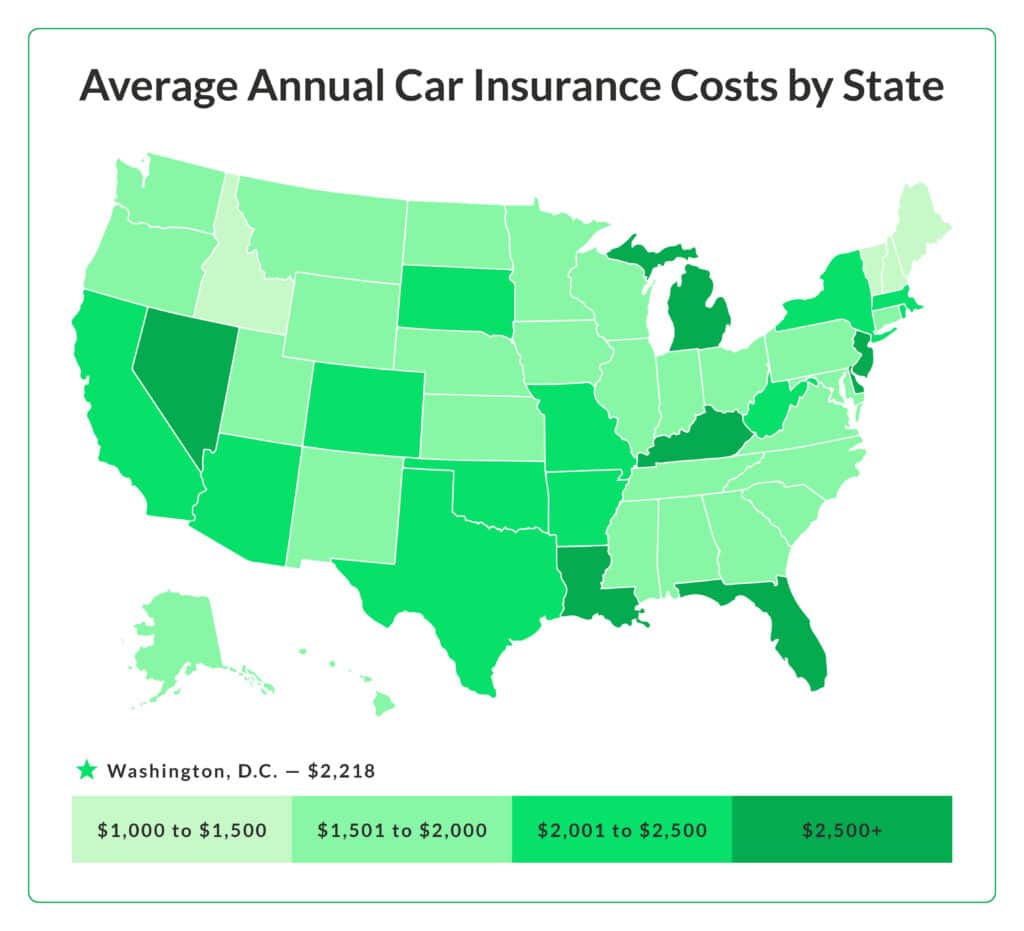

Understanding the factors that influence car insurance rates is crucial, but diving deeper into specific states reveals a more nuanced picture. Examining states with the lowest average car insurance rates sheds light on the interplay of factors unique to each region.

States with the Lowest Average Car Insurance Rates

States with the lowest average car insurance rates often share characteristics like lower population density, reduced traffic congestion, and fewer accidents. These factors contribute to a more favorable insurance environment.

- Idaho: With an average annual premium of $1,054, Idaho boasts the lowest average car insurance rate in the US. This can be attributed to its relatively low population density, reducing the likelihood of accidents and traffic congestion.

- Maine: Maine, with an average annual premium of $1,120, is another state with a low average car insurance rate. Its rural landscape and lower traffic volume contribute to fewer accidents, thus influencing lower premiums.

- North Dakota: North Dakota, with an average annual premium of $1,144, also ranks among states with lower car insurance rates. This is partly due to its relatively low population density and a robust economy, which contributes to a lower risk profile for insurers.

- Wyoming: Wyoming, with an average annual premium of $1,181, is another state with a low average car insurance rate. Similar to Idaho and Maine, its sparsely populated landscape and lower traffic volume contribute to lower premiums.

- Iowa: Iowa, with an average annual premium of $1,203, also benefits from a lower population density and fewer accidents. Its relatively low traffic volume further contributes to lower premiums.

Factors Contributing to Lower Car Insurance Rates

Several factors contribute to lower car insurance rates in specific states, influencing the overall cost of coverage.

- Traffic Density: States with lower population density and less traffic congestion tend to have fewer accidents, resulting in lower insurance premiums.

- Accident Rates: States with lower accident rates are generally perceived as lower risk by insurance companies, leading to lower premiums.

- Insurance Market Competition: A competitive insurance market with numerous companies vying for customers can drive down prices, leading to lower premiums.

- State Regulations: State regulations governing car insurance can influence premiums. States with less stringent regulations may have lower average rates.

Comparison of Average Premiums

Comparing the average car insurance premiums in states with the lowest rates to those with higher rates highlights the significant differences.

| State | Average Annual Premium | Rank |

|---|---|---|

| Idaho | $1,054 | 1 |

| Maine | $1,120 | 2 |

| North Dakota | $1,144 | 3 |

| Wyoming | $1,181 | 4 |

| Iowa | $1,203 | 5 |

| Pennsylvania | $1,900 | 45 |

| New Jersey | $2,000 | 48 |

| New York | $2,100 | 50 |

As seen in the table, states like Pennsylvania, New Jersey, and New York have significantly higher average car insurance premiums compared to states with the lowest rates. This difference is largely driven by factors like higher population density, increased traffic congestion, and higher accident rates in these states.

Impact of State Regulations

State regulations play a crucial role in shaping the car insurance landscape, influencing both the coverage requirements and the pricing practices of insurance companies. These regulations directly impact the cost of car insurance, making some states more expensive than others.

Mandatory Coverage Requirements

The types of coverage mandated by each state significantly impact insurance premiums. States with more stringent coverage requirements, such as those requiring higher liability limits or personal injury protection (PIP), generally have higher average insurance premiums. This is because insurers are required to provide these coverages, even if they are not desired by all policyholders.

- For example, states with mandatory PIP coverage often have higher premiums compared to states that do not require it. PIP coverage provides benefits for medical expenses and lost wages, regardless of fault in an accident. While it can provide valuable protection, it also adds to the cost of insurance.

- Similarly, states with high minimum liability limits, which cover damages to other parties in an accident, tend to have higher premiums. This is because insurers must provide these limits, even if they are not necessary for all drivers.

Restrictions on Pricing Practices

State regulations can also influence car insurance rates by restricting pricing practices. Some states have regulations that limit the factors that insurers can use to determine premiums. These restrictions aim to prevent unfair discrimination and promote affordability.

- For instance, some states prohibit insurers from using credit scores or zip codes to set premiums. This can help ensure that drivers with similar risk profiles are charged similar rates, regardless of their credit history or location.

- Other states have regulations that limit the use of driving records or age to set premiums. These regulations can help to ensure that young drivers or those with minor driving infractions are not unfairly penalized.

Impact of No-Fault Insurance Laws, State with lowest car insurance

No-fault insurance laws, which are in place in some states, can also impact premiums. These laws require drivers to file claims with their own insurance company, regardless of fault in an accident. This can simplify the claims process and reduce litigation costs, potentially leading to lower premiums.

“No-fault insurance laws can be a double-edged sword. While they can potentially lower premiums by reducing litigation costs, they can also lead to higher premiums if the benefits provided under the law are extensive.”

- For example, states with no-fault laws that require extensive benefits, such as unlimited medical coverage, may have higher premiums than states with less comprehensive no-fault laws.

- Conversely, states with no-fault laws that limit benefits and encourage drivers to pursue claims against at-fault parties may have lower premiums.

Finding Affordable Coverage: State With Lowest Car Insurance

Finding affordable car insurance is essential for most drivers. There are a number of strategies you can use to lower your premiums, while still ensuring you have adequate coverage.

Comparing Quotes

Getting quotes from multiple insurance companies is the best way to find the most affordable rates. You can use online comparison websites or contact insurance companies directly. When comparing quotes, make sure you are comparing the same coverage levels so you can accurately compare prices.

Increasing Deductibles

Your deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, as you are taking on more financial risk. However, make sure you can afford to pay your deductible in the event of an accident.

Taking Advantage of Discounts

Many insurance companies offer discounts for safe driving, good grades, and other factors. Ask your insurance company about available discounts and see if you qualify.

Understanding Policy Terms and Conditions

It’s important to carefully review your insurance policy terms and conditions to ensure you understand what is covered and what is not. Make sure you have adequate coverage for your needs, but avoid paying for unnecessary coverage.

Sample Insurance Company Comparison

| Insurance Company | Average Premium | Key Features | Discounts Offered |

|---|---|---|---|

| Company A | $1,000 | Comprehensive and Collision Coverage, Roadside Assistance | Safe Driver Discount, Good Student Discount |

| Company B | $1,200 | Rental Car Reimbursement, Accident Forgiveness | Multi-Car Discount, Loyalty Discount |

| Company C | $900 | Gap Coverage, Emergency Roadside Assistance | Multi-Policy Discount, Anti-theft Device Discount |

Ultimate Conclusion

In conclusion, while factors like driving history and vehicle type play a role, the state you reside in can significantly impact your car insurance premiums. By understanding the key factors influencing rates and utilizing strategies to find affordable coverage, you can make informed decisions to protect yourself on the road without breaking the bank. Remember, comparing quotes and taking advantage of discounts are essential steps in securing the best possible car insurance rates.

FAQ Compilation

What are the most common factors that influence car insurance rates?

Several factors impact car insurance rates, including your driving history, vehicle type, age, location, and the level of coverage you choose. For instance, drivers with a history of accidents or traffic violations generally pay higher premiums. Similarly, expensive or high-performance vehicles tend to cost more to insure.

How do state regulations affect car insurance rates?

State regulations play a significant role in setting car insurance rates. For example, states with mandatory coverage requirements, such as no-fault insurance laws, can impact premiums. These regulations can influence the types of coverage offered, pricing practices, and the overall cost of insurance in a state.

What are some tips for finding affordable car insurance?

To find affordable car insurance, compare quotes from multiple insurance companies, consider increasing your deductible (the amount you pay out of pocket before your insurance kicks in), and explore discounts for safe driving, good student status, or bundling multiple insurance policies.