State of Maine insurance, a crucial aspect of life in the Pine Tree State, presents a unique landscape shaped by its distinct environment and regulations. This guide delves into the intricacies of Maine’s insurance market, offering insights into various types of insurance, key considerations, and essential resources for individuals and businesses alike.

From understanding the factors influencing auto insurance rates to navigating the complexities of health insurance plans, this comprehensive overview provides valuable information to help you make informed decisions about your insurance needs in Maine.

Understanding Maine’s Insurance Landscape

Maine’s insurance market presents a unique set of characteristics that influence the availability and cost of insurance products for its residents and businesses. Understanding these nuances is crucial for both consumers seeking coverage and insurance providers seeking to navigate the state’s regulatory landscape.

The Regulatory Environment for Insurance in Maine

The Maine Bureau of Insurance (MBI) plays a significant role in regulating the insurance industry within the state. It oversees insurance companies, agents, and brokers, ensuring fair and transparent practices. The MBI’s responsibilities include:

- Licensing and monitoring insurance companies and agents.

- Enforcing state insurance laws and regulations.

- Protecting consumers from unfair or deceptive practices.

- Providing education and resources to consumers about insurance.

The MBI also plays a key role in addressing issues related to affordability and access to insurance, particularly for vulnerable populations. This includes initiatives to promote affordable health insurance options and address the challenges of providing insurance for individuals with pre-existing conditions.

Major Insurance Providers Operating in Maine

Maine’s insurance market is served by a diverse range of insurance providers, including national, regional, and local companies. Some of the major insurance providers operating in the state include:

- Nationwide: Offers a wide range of insurance products, including auto, home, life, and health insurance.

- Progressive: Known for its innovative approach to auto insurance, with telematics-based programs and personalized coverage options.

- GEICO: Offers competitive auto insurance rates and a user-friendly online experience.

- Liberty Mutual: Provides a comprehensive suite of insurance products, including auto, home, renters, and business insurance.

- Maine Mutual Group: A leading provider of life insurance, annuities, and other financial products in Maine.

In addition to these national providers, several regional and local insurance companies operate in Maine, often specializing in niche markets or serving specific geographic areas. These smaller companies may offer more personalized service and competitive rates for certain types of insurance.

Factors Influencing Insurance Costs in Maine

Several factors contribute to the cost of insurance in Maine, making it essential for consumers to understand these influences when comparing rates and selecting coverage:

- Geographic Location: Coastal areas in Maine, particularly those susceptible to severe weather events like hurricanes and coastal storms, generally experience higher insurance premiums due to increased risk.

- Property Value: The value of the insured property is a significant factor in determining insurance premiums, as higher-value properties generally carry higher risks and require greater coverage.

- Driving History: In auto insurance, a driver’s history of accidents, traffic violations, and driving record significantly impacts premiums, with higher risk drivers typically facing higher rates.

- Insurance Coverage: The type and amount of coverage chosen can influence premiums. For example, comprehensive and collision coverage in auto insurance typically increase premiums but offer greater protection against damage and theft.

- State Regulations: The regulatory environment in Maine, including insurance laws and requirements, can impact insurance costs. For instance, regulations related to minimum coverage levels or mandatory benefits can influence premiums.

Types of Insurance in Maine: State Of Maine Insurance

Maine residents and businesses have access to a wide range of insurance options to protect themselves against various risks. Understanding the different types of insurance available and their key features is crucial for making informed decisions about your coverage.

Auto Insurance, State of maine insurance

Auto insurance is mandatory in Maine, covering financial losses arising from car accidents. It protects you from legal liability, medical expenses, and property damage. Maine law requires specific coverage types, including liability, uninsured/underinsured motorist, and personal injury protection (PIP).

Homeowners Insurance

Homeowners insurance protects your home and belongings against various perils, such as fire, theft, and natural disasters. It also covers liability for accidents on your property. Maine homeowners insurance policies often include coverage for personal property, additional living expenses, and medical payments to others.

Health Insurance

Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. Maine residents can choose from different health insurance plans, including individual, family, and employer-sponsored plans. The Affordable Care Act (ACA) has expanded access to health insurance in Maine, offering subsidies and tax credits to eligible individuals and families.

Business Insurance

Business insurance protects your company from financial losses due to various risks, including property damage, liability claims, and employee injuries. Common types of business insurance in Maine include general liability, workers’ compensation, property insurance, and business interruption insurance.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It can help pay off debts, cover funeral expenses, and provide financial security for your family. Maine residents can choose from various life insurance policies, including term life, whole life, and universal life insurance.

Disability Insurance

Disability insurance provides income replacement if you become unable to work due to illness or injury. It can help cover your living expenses and protect your financial stability during a challenging time. Maine residents can obtain disability insurance through their employer, through private insurance companies, or through government programs like Social Security Disability Insurance (SSDI).

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory for most employers in Maine. It covers medical expenses and lost wages for employees who are injured or become ill on the job. Employers are required to purchase workers’ compensation insurance from a licensed insurer in Maine.

Flood Insurance

Flood insurance is not mandatory in Maine, but it is highly recommended for residents living in flood-prone areas. It covers damages caused by flooding, which is not typically covered by standard homeowners or renters insurance policies. The National Flood Insurance Program (NFIP) offers flood insurance policies in Maine.

Renters Insurance

Renters insurance provides coverage for your personal belongings and liability in case of damage or theft. It is important to note that renters insurance does not cover the building itself, which is the landlord’s responsibility. Maine renters can obtain renters insurance from various insurance companies.

Liability Insurance

Liability insurance protects you from financial losses arising from legal claims due to negligence or accidents. It can cover legal fees, medical expenses, and property damage. Different types of liability insurance are available, including personal liability, professional liability, and product liability.

Umbrella Insurance

Umbrella insurance provides additional liability coverage on top of your existing policies. It can protect you from significant financial losses in the event of a major accident or lawsuit. Umbrella insurance is often recommended for individuals and families with high net worth or significant assets.

Auto Insurance in Maine

Maine, like all other states, has its own set of rules and regulations regarding auto insurance. Understanding these rules and the factors that affect your insurance rates can help you find the best coverage at the most affordable price.

Factors Determining Auto Insurance Rates in Maine

Several factors contribute to the cost of your auto insurance in Maine. These include:

- Your Driving Record: A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents or violations will likely lead to higher rates.

- Your Age and Gender: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This often translates to higher premiums. Gender can also play a role, though this is less common in recent years.

- Your Vehicle: The type of vehicle you drive, its value, and its safety features all factor into your insurance rates. Luxury cars or high-performance vehicles tend to have higher premiums due to their higher repair costs and greater potential for accidents.

- Your Location: The area where you live can influence your auto insurance rates. Urban areas with higher traffic density and crime rates often have higher insurance premiums compared to rural areas.

- Your Credit Score: While this practice is controversial, some insurance companies in Maine may use your credit score as a factor in determining your premiums. The theory is that people with good credit are less likely to file claims.

- Your Coverage: The type and amount of coverage you choose will significantly impact your insurance premiums. More extensive coverage, such as collision and comprehensive, will generally result in higher premiums.

Mandatory Coverage Requirements for Auto Insurance in Maine

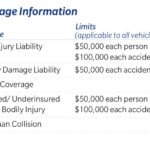

Maine requires all drivers to have the following minimum auto insurance coverage:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or property. It is divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries to others in an accident you caused.

- Property Damage Liability: Covers damage to another person’s property, such as their vehicle, in an accident you caused.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and property damage.

Types of Auto Insurance Policies in Maine

Beyond the mandatory coverage, there are several optional types of auto insurance policies available in Maine:

- Collision Coverage: Covers damage to your own vehicle if it is involved in an accident, regardless of who is at fault. This includes collisions with other vehicles, objects, or even hitting a pothole.

- Comprehensive Coverage: Covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is particularly useful for newer vehicles.

- Personal Injury Protection (PIP): Covers your own medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault. This coverage is often required in some states, but it is optional in Maine.

- Rental Car Coverage: Provides coverage for a rental car if your own vehicle is damaged or stolen and you need a replacement.

- Roadside Assistance: Provides coverage for services like towing, flat tire changes, and jump starts.

Tips for Finding Affordable Auto Insurance in Maine

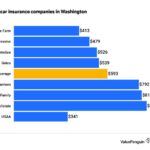

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can help streamline this process.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or violations is the most effective way to lower your insurance premiums.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket if you have an accident, but it can result in lower premiums.

- Bundle Your Policies: Many insurance companies offer discounts for bundling your auto insurance with other policies, such as homeowners or renters insurance.

- Ask About Discounts: Insurance companies often offer discounts for various factors, such as good student discounts, safe driver discounts, and multi-car discounts. Be sure to ask about these options when you are getting quotes.

- Consider a Usage-Based Insurance Program: Some insurance companies offer programs that track your driving habits using a device plugged into your car. If you are a safe driver, you may qualify for lower premiums.

Homeowners Insurance in Maine

Owning a home in Maine is a dream for many, and protecting that investment with the right homeowners insurance is crucial. This section delves into the nuances of homeowners insurance in Maine, helping you understand the key factors influencing premiums, the coverage you need, and how to secure the best policy for your needs.

Factors Influencing Homeowners Insurance Premiums in Maine

Several factors influence the cost of homeowners insurance premiums in Maine. Understanding these factors can help you make informed decisions to potentially reduce your costs.

- Location: Maine’s coastline and its susceptibility to natural disasters, such as hurricanes and coastal storms, significantly impact insurance premiums. Coastal areas generally have higher premiums due to increased risk.

- Home Value: The value of your home directly impacts your insurance premium. Higher-valued homes typically require higher coverage amounts, leading to higher premiums.

- Home Features: Features like a swimming pool, hot tub, or detached garage can increase your risk and, consequently, your premiums.

- Credit Score: Believe it or not, your credit score can influence your insurance rates. Insurance companies often use credit scores as a proxy for risk assessment, and those with good credit often receive lower premiums.

- Deductible: A higher deductible, the amount you pay out of pocket before insurance coverage kicks in, generally leads to lower premiums.

- Claims History: Your past claims history, particularly if you have filed multiple claims, can increase your premiums. Insurance companies view frequent claims as a higher risk.

Types of Coverage Included in Homeowners Insurance Policies

Homeowners insurance policies typically include various types of coverage to protect your home and belongings from various risks.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the walls, roof, and foundation, against damage caused by perils like fire, windstorm, and hail.

- Other Structures Coverage: This coverage extends to detached structures on your property, such as garages, sheds, and fences, providing protection against similar perils as dwelling coverage.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, appliances, clothing, and electronics, against damage or theft.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if you accidentally damage someone else’s property.

- Additional Living Expenses Coverage: This coverage provides financial assistance if you need to live elsewhere temporarily due to a covered loss, such as a fire.

Obtaining Homeowners Insurance Quotes and Selecting a Policy

Shopping around for homeowners insurance quotes is crucial to ensure you’re getting the best possible coverage at the most competitive price.

- Gather Information: Before you start requesting quotes, gather essential information about your home, such as its square footage, age, construction materials, and any security features.

- Compare Quotes: Contact multiple insurance companies and provide them with the same information to receive accurate and comparable quotes.

- Review Policy Details: Carefully review the policy details of each quote, paying close attention to coverage limits, deductibles, exclusions, and any additional endorsements.

- Consider Your Needs: Choose a policy that provides adequate coverage for your specific needs and financial situation.

Protecting Your Home and Reducing Insurance Costs

Taking proactive steps to protect your home can help reduce your insurance costs and potentially earn you discounts.

- Install Security Systems: Installing a security system, including alarms and motion detectors, can deter theft and lower your premiums.

- Maintain Your Home: Regularly maintaining your home, including roof inspections, plumbing checks, and electrical system maintenance, can prevent costly repairs and potential claims.

- Install Smoke Detectors and Carbon Monoxide Detectors: These devices can alert you to dangerous situations and help prevent fires and other incidents, potentially lowering your premiums.

- Consider a Homeowners Discount: Ask your insurance company about potential discounts for bundling your homeowners and auto insurance policies or for being a long-term customer.

Health Insurance in Maine

Maine residents have a variety of health insurance options to choose from, with the Affordable Care Act (ACA) playing a significant role in shaping the state’s health insurance market. Understanding these options is crucial for making informed decisions about health coverage.

Types of Health Insurance Plans in Maine

Maine offers a diverse range of health insurance plans, each with its own structure and coverage features.

- Individual Health Insurance Plans: These plans are purchased by individuals or families directly from insurance companies. They offer flexibility in choosing coverage options but can be more expensive than employer-sponsored plans.

- Employer-Sponsored Health Insurance Plans: Many employers in Maine offer health insurance as a benefit to their employees. These plans typically provide comprehensive coverage at a lower cost than individual plans.

- Medicare: This federal health insurance program is available to individuals aged 65 and older, as well as certain younger individuals with disabilities. Medicare offers various coverage options, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D).

- Medicaid: This joint federal and state program provides health coverage to low-income individuals and families. Eligibility for Medicaid in Maine is determined based on income and other factors.

- MaineCare: Maine’s version of Medicaid, MaineCare, offers a range of health insurance benefits to eligible residents, including children, pregnant women, and low-income individuals and families.

The Affordable Care Act in Maine

The ACA has significantly impacted Maine’s health insurance market by expanding coverage options and affordability. Key features of the ACA in Maine include:

- Health Insurance Marketplace: The ACA established a marketplace where individuals and families can compare and purchase health insurance plans. The marketplace offers a variety of plans from different insurance companies, allowing consumers to choose the option that best suits their needs and budget.

- Premium Tax Credits: The ACA provides premium tax credits to individuals and families who meet certain income requirements. These credits reduce the cost of monthly health insurance premiums, making coverage more affordable.

- Essential Health Benefits: The ACA mandates that all health insurance plans sold in the marketplace must cover essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- Individual Mandate: The ACA previously required most individuals to have health insurance or face a tax penalty. However, the individual mandate penalty was eliminated in 2019.

Obtaining Health Insurance Coverage Through the Marketplace

The Maine Health Insurance Marketplace, also known as CoverME.gov, is a website where individuals and families can shop for and enroll in health insurance plans. To access the marketplace, individuals must create an account and provide information about their income, household size, and other relevant details.

- Eligibility Determination: The marketplace will determine eligibility for premium tax credits and other financial assistance based on the provided information.

- Plan Comparison: Once eligibility is established, individuals can browse and compare plans from different insurance companies based on coverage options, costs, and provider networks.

- Enrollment: Individuals can enroll in a plan through the marketplace during open enrollment periods or during special enrollment periods due to qualifying life events.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan is crucial for ensuring adequate coverage and affordability. Several factors should be considered when making this decision:

- Coverage Needs: Evaluate your healthcare needs, including preventive care, prescription drugs, and potential hospitalizations. Choose a plan that offers adequate coverage for your specific requirements.

- Budget: Consider your monthly budget and the cost of premiums, deductibles, and copayments. Explore plans that fit within your financial constraints.

- Provider Network: Ensure that your preferred doctors and hospitals are included in the plan’s provider network. Check the network directory before making a decision.

- Prescription Drug Coverage: If you require prescription medications, evaluate the plan’s formulary (list of covered drugs) and copayment amounts for your medications.

Business Insurance in Maine

Maine businesses face a unique set of challenges and risks, making comprehensive insurance coverage essential for their stability and success. From the unpredictable weather patterns to the seasonal nature of many industries, understanding the specific insurance needs of your business is crucial for navigating the Maine business landscape.

Types of Business Insurance in Maine

The specific types of insurance needed by a Maine business depend heavily on its industry, size, and operations. However, several essential coverages are common to most businesses:

- General Liability Insurance: This provides protection against claims of bodily injury or property damage to third parties. This is a fundamental coverage for most businesses, as it safeguards against lawsuits arising from customer injuries, property damage, or other accidents.

- Workers’ Compensation Insurance: This is mandatory in Maine and covers medical expenses, lost wages, and other benefits for employees injured on the job. It protects businesses from financial burdens related to workplace accidents and ensures employee well-being.

- Property Insurance: This covers physical damage to business property, including buildings, equipment, inventory, and other assets. It protects against losses caused by fire, theft, natural disasters, or vandalism, ensuring business continuity and financial recovery.

- Commercial Auto Insurance: This protects businesses from financial losses arising from accidents involving company vehicles. It covers damages to vehicles, injuries to drivers or passengers, and liability claims from third parties.

- Professional Liability Insurance: This is crucial for businesses offering professional services, such as consulting, accounting, or legal services. It protects against claims of negligence, errors, or omissions in professional work, safeguarding the business’s reputation and finances.

- Cyber Liability Insurance: In today’s digital age, this coverage is essential for businesses handling sensitive data. It provides protection against financial losses resulting from data breaches, cyberattacks, and other cyber-related incidents, safeguarding customer information and business operations.

Insurance Claims and Disputes

Navigating the process of filing an insurance claim and resolving disputes can be challenging. Understanding the steps involved and your rights as a policyholder is crucial.

Filing an Insurance Claim in Maine

The process for filing an insurance claim in Maine typically involves the following steps:

- Report the incident: Contact your insurance company as soon as possible after the incident occurs. This is crucial for initiating the claims process and ensuring prompt action.

- Gather information: Collect all relevant documentation, including police reports, medical records, and repair estimates. This information will be needed to support your claim.

- Submit your claim: Fill out the necessary claim forms and provide all required documentation to your insurance company. This can be done online, by phone, or in person.

- Review and investigation: Your insurance company will review your claim and may conduct an investigation to determine the validity and extent of the claim.

- Negotiation and settlement: If your claim is approved, you will negotiate the settlement amount with your insurance company. This may involve back-and-forth discussions to reach a mutually agreeable outcome.

Common Types of Insurance Disputes

Disputes between policyholders and insurance companies can arise for various reasons. Some common types of insurance disputes include:

- Denial of coverage: Insurance companies may deny coverage for a claim based on policy exclusions, pre-existing conditions, or other reasons. If you believe your claim was unfairly denied, you have the right to appeal the decision.

- Low settlement offers: Insurance companies may offer a settlement amount that is significantly lower than the actual cost of damages or medical expenses. You can negotiate a higher settlement amount or seek legal advice if you believe the offer is unfair.

- Delayed or denied payments: You may experience delays in receiving insurance payments, or your claim may be denied without proper justification. It’s essential to follow up with your insurance company and document all communication to ensure timely and fair processing of your claim.

- Bad faith claims practices: Insurance companies may engage in unfair or deceptive practices to avoid paying claims. Examples include misrepresenting policy terms, delaying investigations, or refusing to negotiate in good faith. If you suspect bad faith practices, you should consult with an attorney.

Navigating the Claims Process and Resolving Disputes

To navigate the claims process effectively and resolve any disputes, consider the following tips:

- Read your policy carefully: Understand your policy terms, coverage limits, and exclusions. This will help you avoid potential disputes and ensure you are aware of your rights and obligations.

- Document everything: Keep detailed records of all communication with your insurance company, including dates, times, and content of conversations. This documentation can be helpful if a dispute arises.

- Be polite but firm: When communicating with your insurance company, be respectful but assertive in expressing your concerns and rights. Avoid making accusations or becoming overly emotional.

- Consider mediation: If you are unable to resolve a dispute through direct negotiation, consider seeking mediation. A neutral third party can help facilitate communication and reach a mutually agreeable solution.

- Consult with an attorney: If you are facing significant challenges or believe your rights have been violated, consulting with an insurance attorney is recommended. They can provide legal advice and representation to protect your interests.

Resources for Consumers Facing Insurance Issues

If you are facing insurance issues in Maine, several resources can provide assistance and guidance:

- Maine Bureau of Insurance: The Maine Bureau of Insurance regulates the insurance industry in the state and can provide information, assistance, and guidance on insurance matters. You can contact them at (207) 624-8477 or visit their website at https://www.maine.gov/insurance.

- Maine Office of the Public Advocate: The Maine Office of the Public Advocate provides legal representation and advocacy for consumers facing legal or regulatory issues, including insurance disputes. You can contact them at (207) 626-8800 or visit their website at https://www.maine.gov/pba/.

- Consumer Protection Division of the Maine Attorney General’s Office: The Consumer Protection Division investigates and resolves consumer complaints, including those related to insurance. You can contact them at (207) 626-8800 or visit their website at https://www.maine.gov/ag/consumer/.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that works to protect consumers and regulate the insurance industry. You can find information and resources on their website at https://www.naic.org/.

Tips for Finding Affordable Insurance in Maine

Finding affordable insurance in Maine can feel like navigating a maze, but with the right strategies, you can get the coverage you need without breaking the bank. This section provides tips on how to compare quotes, negotiate rates, and explore available discounts. We’ll also delve into state programs and resources that can help you manage insurance costs.

Comparing Quotes

It’s crucial to compare quotes from multiple insurance companies before making a decision. This ensures you’re getting the best possible rates. Here are some steps to follow:

- Use online comparison tools: Several websites allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort.

- Contact insurance agents directly: While online tools are convenient, it’s beneficial to connect with insurance agents directly. They can provide personalized guidance and help you understand different policy options.

- Be specific about your needs: When requesting quotes, be clear about your coverage requirements. This helps insurers provide accurate and relevant quotes.

Negotiating Rates

Once you have a few quotes, you can negotiate with insurance companies to potentially lower your rates. Here are some strategies:

- Bundle your policies: Combining your auto, home, and other insurance policies with the same company often results in discounts.

- Ask about discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your home, and paying your premium in full.

- Shop around regularly: It’s a good practice to review your insurance policies and compare quotes annually. This ensures you’re still getting the best rates.

Seeking Discounts

Insurance companies offer a range of discounts to make their policies more affordable. Here are some common discounts to explore:

- Good driver discount: This discount is awarded to drivers with clean driving records.

- Safe driver discount: Insurers may offer discounts for drivers who complete defensive driving courses.

- Multi-car discount: This discount is typically available for insuring multiple vehicles with the same company.

- Homeowner discount: This discount is often available for homeowners who insure their home and belongings with the same company.

- Loyalty discount: Some insurers offer discounts to long-term policyholders.

State Programs and Resources

Maine offers several programs and resources to help residents manage insurance costs. These programs may provide financial assistance, subsidies, or access to affordable insurance options.

- Maine Health Insurance Marketplace: This online marketplace allows individuals and families to compare and enroll in health insurance plans.

- Maine Department of Health and Human Services: This department provides information and resources on various health and social services, including insurance assistance programs.

- Maine Bureau of Insurance: This bureau regulates insurance companies and provides consumer information on insurance policies and claims.

Insurance Resources in Maine

Navigating the insurance landscape in Maine can be challenging, but various resources are available to help you find the right coverage and resolve any issues you might encounter. This section provides an overview of key insurance resources available in Maine, including state agencies, consumer protection organizations, and insurance industry associations.

State Agencies

Maine offers a range of state agencies that play a vital role in regulating the insurance industry and protecting consumers.

- Maine Bureau of Insurance (MBI): The MBI is the primary regulatory body for insurance in Maine. It licenses insurance companies, sets rates, and investigates consumer complaints. The MBI also provides educational resources and information about insurance products.

- Website: https://www.maine.gov/insurance/

- Phone: (207) 624-8475

- Maine Office of the Attorney General: The Attorney General’s Office investigates consumer complaints against insurance companies and can help resolve disputes.

- Website: https://www.maine.gov/ag/

- Phone: (207) 626-8841

Consumer Protection Organizations

Consumer protection organizations advocate for consumer rights and provide information and resources to help consumers understand their insurance options.

- Maine Center for Public Interest Law: This non-profit organization provides legal assistance to low-income Mainers, including those with insurance disputes.

- Website: https://www.mainepublicinterest.org/

- Phone: (207) 623-5555

- Consumer Reports: This independent consumer organization provides reviews and ratings of insurance companies and offers tips for finding affordable insurance.

- Website: https://www.consumerreports.org/

Insurance Industry Associations

Insurance industry associations represent insurance companies and work to promote best practices and advocate for the industry’s interests.

- Maine Insurance Agents & Brokers Association (MIABA): MIABA represents insurance agents and brokers in Maine and provides resources and training for its members.

- Website: https://www.miaba.org/

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to standardize insurance regulations and promote consumer protection.

- Website: https://www.naic.org/

Last Recap

Navigating the insurance landscape in Maine requires careful consideration of your individual circumstances and needs. By understanding the unique characteristics of the state’s insurance market, exploring available options, and utilizing the resources provided, you can confidently choose the right insurance coverage to protect yourself, your family, and your assets.

FAQ Insights

What are the main factors influencing auto insurance rates in Maine?

Auto insurance rates in Maine are influenced by factors such as driving history, age, vehicle type, location, and credit score.

How do I find affordable homeowners insurance in Maine?

To find affordable homeowners insurance, compare quotes from multiple insurers, consider discounts for safety features, and explore state programs that may offer assistance.

What are the key resources for consumers facing insurance issues in Maine?

Consumers facing insurance issues can contact the Maine Bureau of Insurance, the Maine Office of the Public Advocate, or the National Association of Insurance Commissioners for assistance.