State Farm homeowners insurance claim numbers are essential for navigating the claims process, providing a unique identifier for your specific claim. These numbers are crucial for tracking your claim’s progress, accessing information, and communicating with State Farm representatives. They serve as a vital link between you and your policy, ensuring efficient and effective claim management.

Understanding the purpose, obtaining your claim number, and using it effectively are key to a smooth and successful claims experience. This guide will provide you with the information you need to navigate the process with confidence.

Understanding State Farm Homeowners Insurance Claim Numbers

A State Farm homeowners insurance claim number is a unique identifier assigned to each claim filed with State Farm. This number plays a crucial role in the claims process, serving as a reference point for all communication, documentation, and processing related to the claim.

Claim Number Types

State Farm may issue different types of claim numbers depending on the nature of the claim and the specific circumstances.

- Policyholder Claim Number: This is the primary claim number assigned to a claim filed by a policyholder. It is typically used for claims involving property damage or personal injury.

- Third-Party Claim Number: This type of claim number is assigned to claims filed by individuals or entities other than the policyholder. For example, a third-party claim number may be used for a claim filed by a neighbor whose property was damaged by a storm that also damaged the policyholder’s property.

- Sub-Claim Number: This number is assigned to a claim that is related to a primary claim. For example, if a policyholder files a claim for damage to their roof and later discovers additional damage to their gutters, a sub-claim number may be assigned to the gutter damage claim.

Claim Number Format

State Farm claim numbers typically follow a specific format. The exact format may vary slightly depending on the specific claim type and the date the claim was filed.

A common format is a combination of letters and numbers, such as “SF-1234567890”.

The first part of the claim number may indicate the state or region where the claim was filed, while the remaining digits represent a unique identifier for the claim.

Obtaining a Claim Number

Once you’ve experienced a covered loss, you’ll need to report it to State Farm to begin the claims process. Reporting your claim will initiate the process of assessing the damage and determining the extent of coverage. You’ll receive a claim number, which is essential for tracking your claim’s progress and communicating with State Farm.

Reporting Your Claim

You have several ways to report your claim to State Farm, each offering its own advantages:

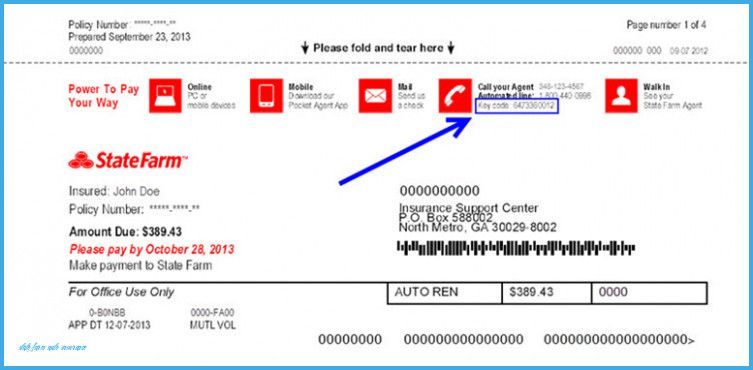

- Online: This method is convenient and available 24/7. You can access the State Farm website and navigate to the “Claims” section. Follow the prompts to provide details about your claim, including the date and time of the incident, the type of damage, and your contact information.

- Phone: If you prefer a more direct approach, you can call State Farm’s claims hotline. The number is typically available on your insurance policy or on the State Farm website. Be prepared to provide the same information you would online, including your policy number, contact information, and details about the incident.

- Mobile App: State Farm offers a mobile app that allows you to report claims, track their progress, and access other helpful features. If you have the State Farm app, you can typically report a claim directly through the app, following similar prompts to the online method.

Information Required for a Claim

Regardless of how you choose to report your claim, you’ll need to provide the following information to State Farm:

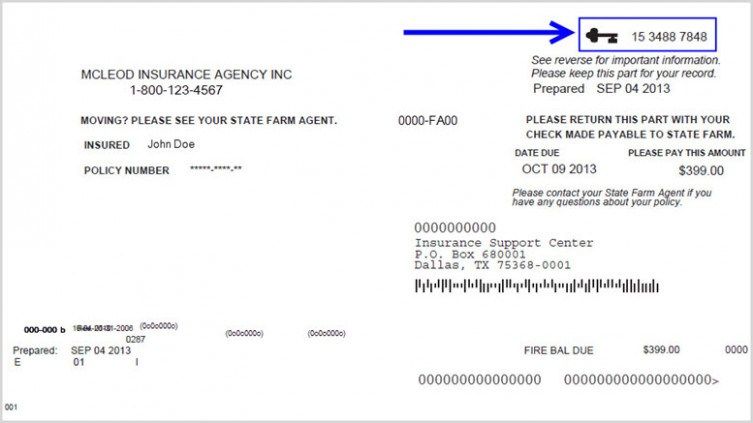

- Policy Number: Your policy number is essential for identifying your insurance policy and accessing your coverage details.

- Contact Information: This includes your name, phone number, and email address.

- Date and Time of Incident: State Farm will need to know when the incident occurred to determine if it falls within your policy’s coverage period.

- Description of Incident: Briefly describe what happened, including the cause of the damage and the extent of the loss.

- Location of Incident: State Farm will need to know where the incident occurred, particularly if it involves your home.

Claim Number Assignment

Once you’ve provided the necessary information, State Farm will assign a unique claim number to your claim. This number will be communicated to you via email, phone, or through the mobile app, depending on how you reported the claim.

Using Your Claim Number: State Farm Homeowners Insurance Claim Number

Your State Farm homeowners insurance claim number is a unique identifier that is essential for accessing information about your claim and communicating with State Farm. It’s important to keep your claim number safe and secure, as it can be used by unauthorized individuals to access your claim information.

Accessing Claim Information Online

You can use your claim number to access information about your claim online through the State Farm website. This includes:

- Claim status updates

- Payment information

- Documents related to your claim

To access your claim information online, you will typically need to create an account on the State Farm website and provide your claim number.

Importance of Claim Number Security

Your claim number is confidential and should be kept secure. Do not share your claim number with anyone you do not trust, as it can be used to access sensitive information about your claim. Be cautious about providing your claim number over the phone or email, and only provide it to individuals you are certain are legitimate State Farm representatives.

Using Your Claim Number in Communication

Your claim number is essential for communicating with State Farm representatives, adjusters, and contractors. It allows them to quickly and easily access your claim information and process your claim efficiently.

- When contacting State Farm by phone, you will be asked for your claim number to identify your claim.

- When communicating with adjusters, you will need to provide your claim number to ensure they are accessing the correct information.

- When working with contractors, your claim number will be used to track payments and ensure that the work is being done according to your claim.

Claim Number and Policy Information

Your State Farm homeowners insurance claim number is directly linked to your policy details. It acts as a unique identifier that allows State Farm to access your policy information and manage your claim efficiently.

The claim number connects you to specific coverage details and policy limits relevant to your claim. This means State Farm can quickly determine the extent of your coverage and the maximum amount they will pay for your claim.

Using Your Claim Number for Coverage Verification, State farm homeowners insurance claim number

Your claim number can be used to verify your coverage in several ways:

* Confirming Coverage: When you contact State Farm about a potential claim, they will ask for your claim number to verify your coverage.

* Determining Coverage Limits: Your claim number allows State Farm to access your policy limits, which specify the maximum amount they will pay for different types of losses.

* Understanding Coverage Exclusions: State Farm can use your claim number to identify any exclusions in your policy, such as coverage limitations for specific events or property types.

For example, if your home is damaged by a fire, your claim number will help State Farm determine if your policy covers fire damage and what the maximum payout would be.

Common Questions and Concerns

It’s understandable to have questions about your State Farm homeowners insurance claim number. This unique identifier is crucial for managing your claim efficiently. Let’s address some common concerns and provide clarity on how to navigate any potential issues.

Retrieving a Lost Claim Number

If you’ve misplaced your claim number, there are several ways to retrieve it.

- Contact State Farm directly: Call their customer service line or visit their website. They can assist you in retrieving your claim number using your policy information.

- Check your claim documents: Review any paperwork you received when you filed your claim. Your claim number should be prominently displayed on these documents.

- Access your online account: If you have an online account with State Farm, you can often find your claim number in your account history or claim details.

Final Thoughts

Navigating the claims process can be stressful, but understanding the role of your State Farm homeowners insurance claim number can help streamline the process and ensure a smoother experience. By using your claim number effectively, you can access important information, communicate with State Farm representatives, and track the progress of your claim. Remember to keep your claim number secure and confidential, and don’t hesitate to reach out to State Farm if you have any questions or concerns.

Common Queries

How do I find my State Farm claim number?

You can find your claim number on the confirmation email or letter you received after filing your claim. You can also access it online through your State Farm account or by contacting their customer service.

What if I lost my State Farm claim number?

Don’t worry! You can contact State Farm customer service and provide them with your policy information to retrieve your claim number.

What if my State Farm claim number is incorrect?

Contact State Farm customer service immediately and they will help you resolve the issue. They will likely ask you to provide details about your claim and policy.

Can I file a claim without a claim number?

You can still report a claim without a claim number. However, it’s essential to provide State Farm with all the necessary information, including your policy details and the nature of the claim. They will then assign you a claim number.