State Farm homeowner insurance coverage is a crucial aspect of protecting your most valuable asset – your home. This comprehensive guide delves into the intricacies of State Farm’s homeowner insurance offerings, providing valuable insights into coverage components, premium factors, the claims process, and customer service. We’ll also explore how State Farm stacks up against its competitors and offer tips for choosing the right homeowner insurance policy.

Understanding the nuances of homeowner insurance can be daunting, but with this guide, you’ll gain the knowledge necessary to make informed decisions about protecting your home and your peace of mind.

State Farm Homeowner Insurance Overview

State Farm homeowner insurance is a comprehensive policy designed to protect your home and belongings from various risks. It offers financial coverage for damages caused by events like fire, theft, and natural disasters, providing peace of mind and financial security in case of unexpected incidents.

Coverage Offered

State Farm offers a range of coverage options tailored to meet different homeowner needs. These include:

- Dwelling Coverage: This protects the physical structure of your home, including the foundation, walls, roof, and attached structures. It covers damages caused by perils like fire, windstorms, hail, and vandalism.

- Other Structures Coverage: This covers detached structures on your property, such as garages, sheds, fences, and swimming pools.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, electronics, clothing, and jewelry. It covers losses due to theft, fire, or other covered perils.

- Liability Coverage: This provides financial protection if someone is injured on your property or if you are found liable for property damage caused by you or members of your household.

- Additional Living Expenses Coverage: This covers temporary housing and other expenses if you are unable to live in your home due to a covered event.

Policy Structure

State Farm homeowner insurance policies typically follow a standard structure, outlining the coverage limits and deductibles.

- Coverage Limits: These represent the maximum amount State Farm will pay for a covered loss. The limits are set for each coverage type, such as dwelling, personal property, and liability.

- Deductibles: This is the amount you pay out of pocket before State Farm begins covering the remaining costs of a covered loss. Deductibles can vary depending on the type of coverage and the policy you choose.

Factors Affecting Premium

Several factors influence the cost of your State Farm homeowner insurance premium, including:

- Location: The risk of natural disasters, crime rates, and other factors in your area can affect your premium.

- Home Value: The value of your home directly impacts the premium, as higher-value homes typically require more coverage.

- Coverage Limits: The amount of coverage you choose for each category, such as dwelling and personal property, influences the premium.

- Deductibles: A higher deductible usually leads to a lower premium, while a lower deductible results in a higher premium.

- Safety Features: Installing security systems, smoke detectors, and other safety features can qualify you for discounts and lower premiums.

- Claims History: Your past claims history can impact your premium. Frequent claims can lead to higher premiums.

Coverage Components

State Farm homeowner insurance policies offer comprehensive coverage designed to protect your home and belongings from various risks. The coverage components are tailored to provide financial security in case of unexpected events.

Dwelling Coverage

Dwelling coverage protects your home’s structure, including the attached structures like a garage or porch. This coverage pays for repairs or replacement costs due to covered perils such as fire, windstorm, hail, vandalism, and theft.

Personal Property Coverage

Personal property coverage safeguards your belongings inside your home, including furniture, appliances, clothing, electronics, and other personal items. This coverage typically covers the actual cash value (ACV) or replacement cost value (RCV) of your possessions, depending on your policy.

Liability Coverage

Liability coverage provides financial protection if you are held responsible for injuries or property damage to others. This coverage helps pay for legal defense costs, medical expenses, and property damage settlements.

Additional Living Expenses

Additional living expenses (ALE) coverage helps cover the costs of temporary housing, meals, and other essential expenses if your home becomes uninhabitable due to a covered peril. This coverage ensures you can maintain a reasonable standard of living while your home is being repaired or rebuilt.

Coverage Limits and Exclusions

Here is a table that summarizes the specific coverage limits and exclusions for each component:

| Coverage Component | Coverage Limit | Exclusions |

|---|---|---|

| Dwelling | Varies based on policy and home value |

|

| Personal Property | Typically a percentage of dwelling coverage |

|

| Liability | Varies based on policy and individual needs |

|

| Additional Living Expenses | Varies based on policy and individual needs |

|

Factors Influencing Premiums

Your State Farm homeowner insurance premium is determined by a number of factors, all of which are designed to assess the risk of insuring your property. The more risk you present, the higher your premium will be. Here’s a breakdown of the most significant factors:

Location

Your home’s location plays a significant role in determining your insurance premium. Factors like the prevalence of natural disasters, crime rates, and even the proximity to fire hydrants can impact your rates. For instance, a home located in an area prone to hurricanes, earthquakes, or wildfires will likely have a higher premium compared to a home in a region with lower risk.

Home Value

The value of your home is directly proportional to your insurance premium. The higher the value of your home, the more it will cost to rebuild or repair it in case of damage. State Farm will assess the value of your home, considering its size, construction materials, age, and location, to determine the appropriate premium.

Coverage Levels

The amount of coverage you choose for your home and personal belongings also influences your premium. Higher coverage limits typically translate to higher premiums. It’s essential to carefully consider your needs and choose coverage levels that adequately protect your assets without unnecessarily increasing your premium.

Risk Profiles

State Farm uses various factors to assess your individual risk profile. This includes your credit score, claims history, and safety features in your home. For instance, a homeowner with a poor credit score or a history of filing claims may face higher premiums compared to a homeowner with a good credit score and no claims history.

Claims Process

Filing a claim with State Farm for homeowner insurance is a straightforward process designed to help you recover from covered losses. You’ll need to notify State Farm as soon as reasonably possible after the incident occurs.

Steps Involved in Filing a Claim, State farm homeowner insurance coverage

The claims process is designed to be as smooth and efficient as possible. Here are the key steps:

- Report the Claim: Contact State Farm by phone or online to report the claim. Provide details about the incident, including the date, time, and location. You should also provide your policy number and any other relevant information.

- Initial Investigation: State Farm will begin an initial investigation to gather information about the claim. This may involve reviewing your policy, speaking with you about the incident, and potentially contacting witnesses.

- Damage Assessment: A State Farm adjuster will be assigned to your claim to assess the damage to your property. The adjuster will inspect the property, document the damage, and determine the extent of the coverage under your policy.

- Claim Review and Approval: Once the damage assessment is complete, State Farm will review the claim and determine the amount of coverage you are eligible for. You will receive a written explanation of the claim decision, including any payments that will be made.

- Claim Payment: State Farm will make payments for covered losses directly to you or your chosen contractors. Payments may be made in installments depending on the type of loss and the repair process.

Documentation Required

You will need to provide certain documentation to support your claim. Here are some common documents:

- Proof of Loss: This is a document that describes the loss, its cause, and the amount of the loss. You can use a State Farm claim form or create your own written statement.

- Receipts and Estimates: Provide receipts for any repairs or replacements already made, and estimates for any future repairs.

- Photographs or Videos: Take photos or videos of the damaged property to document the extent of the loss.

- Police Report: If the loss was due to a crime, provide a copy of the police report.

Claim Processing Timeframes

The time it takes to process a claim can vary depending on the complexity of the claim and the amount of damage. However, State Farm strives to process claims promptly and fairly.

- Initial Claim Reporting: You should report your claim as soon as possible after the incident.

- Damage Assessment: The adjuster will typically schedule an inspection within a few days of the claim being reported.

- Claim Review and Approval: Once the damage assessment is complete, State Farm will review the claim and make a decision within a reasonable timeframe.

Role of State Farm Adjusters

State Farm adjusters play a crucial role in the claims process. They are responsible for:

- Damage Assessment: Inspecting the damaged property and determining the extent of the loss.

- Coverage Verification: Reviewing your policy to determine the extent of coverage for the loss.

- Negotiating Settlements: Working with you to reach a fair settlement for your claim.

Damage Assessment Process

The damage assessment process involves a thorough inspection of the damaged property. The adjuster will:

- Document the Damage: Take photographs and videos of the damaged property.

- Measure the Damage: Measure the extent of the damage to determine the cost of repairs or replacement.

- Assess the Cause: Determine the cause of the damage to ensure it is covered by your policy.

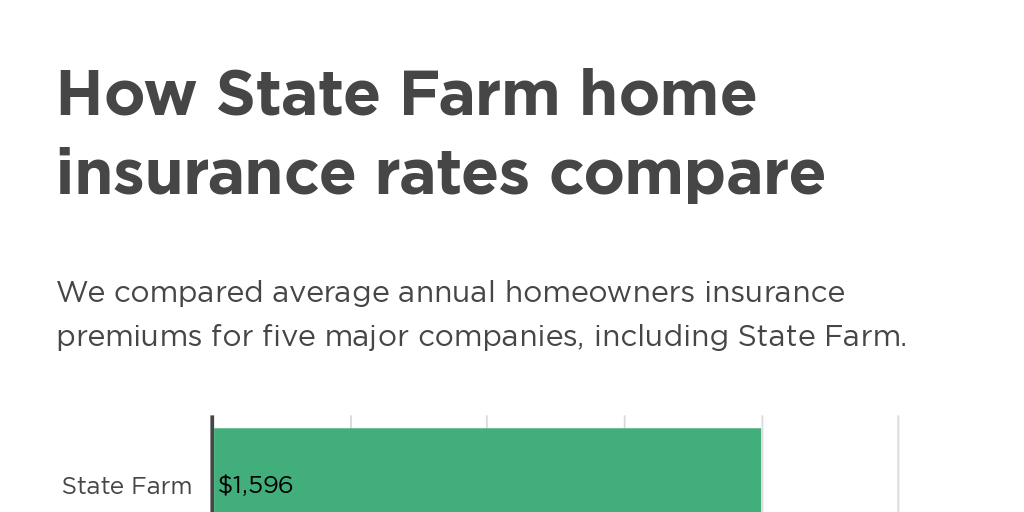

Comparing State Farm with Competitors: State Farm Homeowner Insurance Coverage

Choosing the right homeowner insurance policy can be a daunting task, especially with so many insurance providers vying for your business. State Farm is a well-known and trusted name in the industry, but it’s essential to compare its offerings with other leading insurers to ensure you’re getting the best value for your money. This section will provide an overview of State Farm’s competitors, highlighting their strengths and weaknesses in terms of coverage, pricing, and customer service.

Comparison of Key Features

It’s crucial to understand the key features offered by different insurers to make an informed decision. This section will compare State Farm’s homeowner insurance offerings with those of its competitors, focusing on coverage, pricing, and customer service.

Coverage

- State Farm: Offers comprehensive coverage options, including standard perils, optional endorsements for additional protection, and various discounts. It also provides excellent customer support and a user-friendly claims process.

- Allstate: Known for its customizable coverage options and discounts, Allstate offers a wide range of policies to suit diverse needs. It also provides online tools for managing policies and filing claims.

- Liberty Mutual: Offers competitive pricing and a variety of coverage options, including specialized policies for unique homes. Liberty Mutual also provides excellent customer service and a dedicated claims team.

- USAA: Exclusively available to military members and their families, USAA offers competitive rates, comprehensive coverage, and exceptional customer service. It’s known for its commitment to its members and its strong financial stability.

- Farmers Insurance: Provides customizable coverage options and discounts, catering to various needs. Farmers Insurance also offers a strong network of agents and a dedicated claims team.

Pricing

- State Farm: Prices vary depending on location, coverage level, and other factors. While State Farm is generally competitive, its rates can fluctuate, so it’s essential to compare quotes from multiple insurers.

- Allstate: Offers competitive pricing, often with discounts for bundling policies. Allstate’s pricing can vary depending on individual risk factors and location.

- Liberty Mutual: Known for its competitive pricing, Liberty Mutual often offers discounts for safe driving, good credit, and bundling policies. Its rates can fluctuate based on factors like location and coverage level.

- USAA: Typically offers highly competitive rates due to its focus on military members and families. USAA’s pricing is influenced by factors like location, coverage level, and risk factors.

- Farmers Insurance: Prices can vary significantly depending on location, coverage level, and other factors. Farmers Insurance often offers discounts for bundling policies and maintaining a good driving record.

Customer Service

- State Farm: Renowned for its excellent customer service, State Farm provides 24/7 support, online resources, and a network of local agents. Its commitment to customer satisfaction is a key differentiator.

- Allstate: Offers a variety of customer service channels, including online resources, phone support, and a network of agents. Allstate strives to provide quick and efficient service to its customers.

- Liberty Mutual: Known for its responsive and helpful customer service, Liberty Mutual provides 24/7 support, online resources, and a dedicated claims team. It aims to provide a seamless and positive customer experience.

- USAA: Widely recognized for its exceptional customer service, USAA provides dedicated support to military members and their families. Its commitment to customer satisfaction is deeply ingrained in its culture.

- Farmers Insurance: Offers a strong network of agents and a dedicated claims team, providing personalized service and support to its customers. Farmers Insurance strives to build lasting relationships with its policyholders.

Summary of Key Differences

| Feature | State Farm | Allstate | Liberty Mutual | USAA | Farmers Insurance |

|---|---|---|---|---|---|

| Coverage | Comprehensive, customizable | Customizable, wide range of options | Competitive, specialized policies | Comprehensive, high-quality | Customizable, caters to diverse needs |

| Pricing | Competitive, varies by location | Competitive, discounts for bundling | Competitive, discounts for safe driving, good credit | Highly competitive, varies by location | Varies by location, discounts for bundling |

| Customer Service | Excellent, 24/7 support, local agents | Variety of channels, quick and efficient | Responsive, 24/7 support, dedicated claims team | Exceptional, dedicated support for military | Strong network of agents, dedicated claims team |

Tips for Choosing Homeowner Insurance

Choosing the right homeowner insurance policy is crucial to protect your most valuable asset: your home. This decision requires careful consideration of your specific needs and a thorough understanding of the available options. By taking the time to learn about different policies and compare prices, you can ensure you have the coverage you need at a price that fits your budget.

Assess Your Coverage Needs

Understanding your specific coverage needs is essential before choosing a homeowner insurance policy. This involves evaluating your home’s value, the potential risks you face, and the level of protection you desire. Consider the following:

- Home’s Value: Start by determining the replacement cost of your home, which is the amount needed to rebuild or replace it if it were destroyed. This includes the cost of materials, labor, and permits. You may need to adjust the value based on the current market conditions and any recent renovations or improvements.

- Personal Property: Evaluate the value of your personal belongings, such as furniture, electronics, clothing, and jewelry. You’ll need to decide how much coverage you want for these items, and whether you want additional coverage for specific items like valuable collections or jewelry.

- Liability Coverage: This coverage protects you against lawsuits if someone is injured on your property. You’ll need to determine how much liability coverage you need based on the potential risks you face. Consider factors such as the size of your property, the number of visitors you have, and whether you have a pool or other potential hazards.

Final Wrap-Up

Choosing the right homeowner insurance policy is a critical step in safeguarding your home and financial well-being. By carefully considering your needs, comparing coverage options, and understanding the intricacies of State Farm’s offerings, you can confidently navigate the insurance landscape and find a policy that provides the right level of protection at a competitive price.

Essential FAQs

What are the typical coverage limits for dwelling coverage with State Farm?

Coverage limits for dwelling coverage vary depending on factors such as your home’s value and location. It’s essential to review your policy details to determine your specific coverage limits.

Does State Farm offer discounts for homeowners who install security systems?

Yes, State Farm often provides discounts for homeowners who implement safety measures such as security systems, smoke detectors, and fire sprinklers. These discounts can help reduce your premiums.

What are the typical deductibles for State Farm homeowner insurance?

Deductibles for State Farm homeowner insurance can range from $500 to $2,500 or more, depending on your chosen coverage level and policy terms. It’s important to select a deductible that aligns with your financial capabilities.

How can I contact State Farm customer service?

You can contact State Farm customer service through their website, phone number, or local agent. Their contact information is readily available on their website.