State farm general liability insurance small business – State Farm general liability insurance for small businesses provides essential protection against financial risks, ensuring peace of mind for business owners. This comprehensive policy covers a wide range of potential liabilities, from property damage to bodily injury, safeguarding your business from lawsuits and financial hardship. State Farm’s commitment to customer service and claims handling ensures a smooth and efficient experience, providing valuable support when you need it most.

The policy is designed to meet the unique needs of small businesses, offering customizable coverage options to address specific industry requirements and risk profiles. State Farm’s reputation for reliability and financial strength provides a solid foundation for your business, offering peace of mind and the confidence to focus on growth and success.

State Farm General Liability Insurance Overview

General liability insurance is a crucial aspect of safeguarding your small business from various financial risks. It provides protection against claims arising from bodily injury, property damage, or personal and advertising injury caused by your business operations or your employees. State Farm’s general liability insurance policy for small businesses offers comprehensive coverage and peace of mind, helping you focus on your business goals without worrying about unexpected liabilities.

State Farm’s General Liability Insurance Policy

State Farm’s general liability insurance policy for small businesses provides coverage for a wide range of potential risks, including:

- Bodily Injury: Coverage for medical expenses, lost wages, and pain and suffering if someone is injured on your business premises or as a result of your business operations.

- Property Damage: Coverage for repairs or replacement costs if your business operations cause damage to someone else’s property.

- Personal and Advertising Injury: Coverage for claims arising from libel, slander, copyright infringement, or other forms of personal and advertising injury.

- Defense Costs: Coverage for legal fees and other expenses incurred in defending against a lawsuit, even if the claim is ultimately found to be baseless.

Key Features and Benefits

State Farm’s general liability insurance policy for small businesses offers several key features and benefits that make it a valuable investment:

- Customizable Coverage: State Farm allows you to tailor your policy to meet the specific needs of your business, ensuring that you have the right level of protection.

- Competitive Pricing: State Farm offers competitive rates for general liability insurance, making it an affordable option for small businesses.

- Strong Financial Strength: State Farm is a financially strong company with a long history of providing reliable insurance coverage.

- Excellent Customer Service: State Farm is known for its excellent customer service, providing prompt and helpful assistance when you need it.

- Experienced Agents: State Farm’s network of experienced agents can help you understand your insurance needs and choose the right coverage for your business.

Coverage Provided by State Farm General Liability Insurance

State Farm’s General Liability Insurance for small businesses provides comprehensive protection against various financial risks that may arise from your business operations. It covers a wide range of incidents, including accidents, injuries, property damage, and lawsuits. This coverage is designed to safeguard your business from potential financial losses and legal liabilities, giving you peace of mind and allowing you to focus on running your business.

Types of Risks Covered

This section Artikels the specific types of risks covered by State Farm’s General Liability Insurance for small businesses.

- Bodily Injury: This coverage protects your business against financial losses arising from injuries sustained by third parties on your business premises or as a result of your business operations. For example, if a customer slips and falls on a wet floor in your store, this coverage would help pay for their medical expenses and legal costs if they sue your business.

- Property Damage: This coverage protects your business against financial losses arising from damage to the property of others caused by your business operations or your employees. For example, if your employee accidentally damages a customer’s car while delivering a product, this coverage would help pay for the repairs.

- Personal and Advertising Injury: This coverage protects your business against financial losses arising from libel, slander, copyright infringement, or other forms of personal injury or advertising injury. For example, if you accidentally publish false information about a competitor in an advertisement, this coverage would help pay for any legal costs and damages.

- Medical Payments: This coverage provides payment for medical expenses incurred by third parties who are injured on your business premises, regardless of fault. This coverage can help to resolve claims quickly and avoid potential lawsuits.

Examples of Coverage Situations

This section provides specific examples of situations where State Farm’s General Liability Insurance would provide coverage.

- A customer trips and falls on a loose floorboard in your store, injuring their leg. The policy would cover the customer’s medical expenses and any legal costs if they sue your business.

- Your delivery driver accidentally backs into a customer’s car while making a delivery. The policy would cover the cost of repairs to the customer’s car.

- You publish an advertisement that falsely claims your competitor’s product is defective. The policy would cover any legal costs and damages if the competitor sues your business for libel.

- A customer is injured while participating in a promotional event hosted by your business. The policy would cover the customer’s medical expenses and any legal costs if they sue your business.

Policy Limits and Exclusions

This section Artikels the policy’s limits and exclusions, explaining what is not covered by State Farm’s General Liability Insurance.

- Policy Limits: The policy has specific limits on the amount of coverage provided for each type of claim. These limits are usually expressed as a dollar amount per occurrence or per policy period. It’s crucial to understand these limits and ensure they are sufficient for your business’s needs.

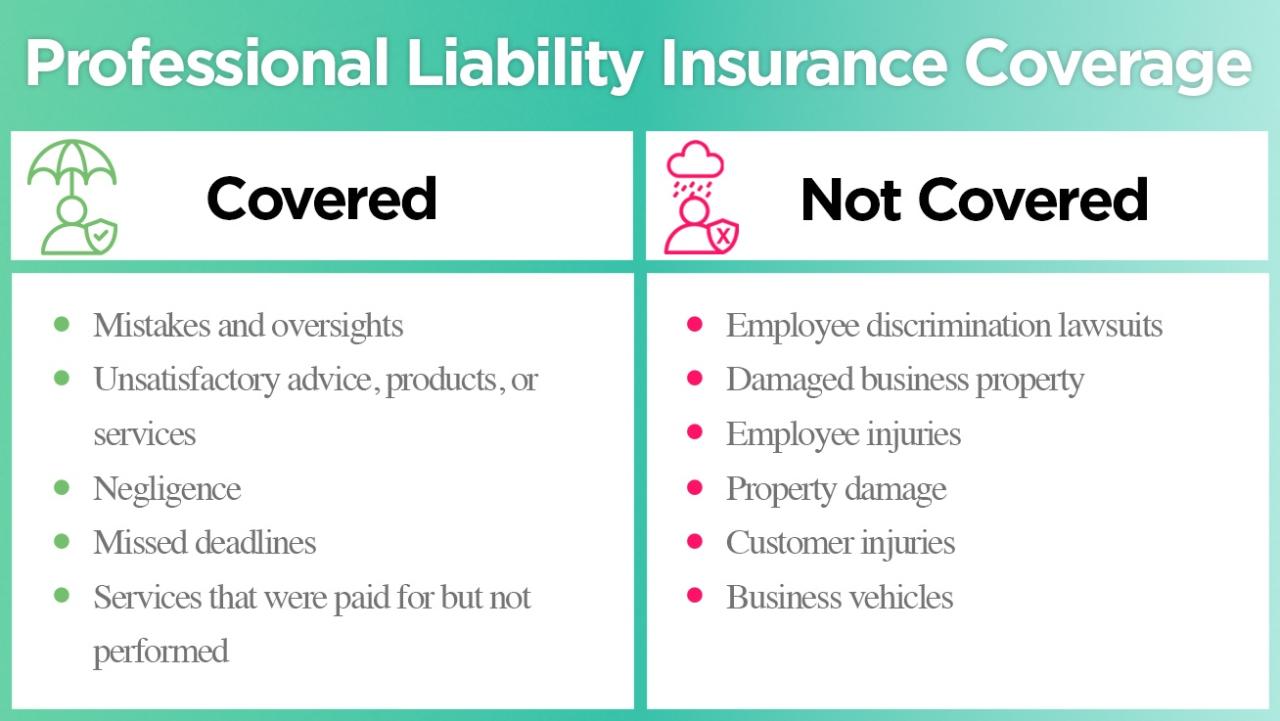

- Exclusions: There are certain situations and risks that are not covered by the policy. These exclusions are typically Artikeld in the policy document. Some common exclusions include intentional acts, criminal acts, employee injuries, and environmental damage. It’s essential to carefully review the policy document to understand the exclusions and ensure you have adequate coverage for your specific business needs.

Cost and Pricing Factors for State Farm General Liability Insurance: State Farm General Liability Insurance Small Business

The cost of State Farm general liability insurance for small businesses is determined by a variety of factors. Understanding these factors can help you make informed decisions about your insurance needs and potentially reduce your premiums.

Factors Influencing the Cost of General Liability Insurance

The cost of general liability insurance is influenced by several key factors, including the size and nature of your business, your industry, and your risk profile.

- Business Size: Generally, larger businesses with more employees and higher revenue tend to have higher insurance premiums. This is because they are considered to have a greater potential for liability claims.

- Industry: Different industries have varying levels of risk associated with them. For example, construction companies typically face higher insurance premiums than retail stores, as they are more likely to be involved in accidents or injuries.

- Risk Profile: Your business’s risk profile is a crucial factor in determining your insurance premiums. This includes your claims history, safety practices, and the nature of your business operations. Businesses with a history of claims or high-risk activities may face higher premiums.

Pricing Components of State Farm General Liability Insurance, State farm general liability insurance small business

State Farm’s general liability insurance premiums are typically calculated based on several key components:

- Premium Base: This is the starting point for your premium calculation and is often based on your business’s annual revenue or payroll.

- Risk Classification: This factor considers the specific industry you operate in and the associated risks. Different industries have different risk classifications, which can impact your premium.

- Loss History: Your past claims history plays a significant role in determining your premium. Businesses with a history of claims may face higher premiums, while those with a clean record may qualify for discounts.

- Safety Measures: Implementing strong safety practices and procedures can demonstrate your commitment to risk mitigation and potentially earn you discounts on your premium.

Tips for Reducing Your General Liability Insurance Costs

There are several strategies that small businesses can implement to potentially reduce their general liability insurance costs:

- Shop Around: Comparing quotes from multiple insurers can help you find the most competitive rates.

- Improve Safety Practices: Implementing comprehensive safety programs, providing employee training, and maintaining a safe work environment can demonstrate your commitment to risk management and potentially earn you discounts.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, but it also means you’ll be responsible for paying more out-of-pocket in the event of a claim.

- Bundle Your Policies: Bundling your general liability insurance with other policies, such as workers’ compensation or property insurance, can often result in discounts.

- Maintain a Good Claims History: Preventing claims by taking proactive measures to minimize risks can help you maintain a clean claims history and potentially qualify for discounts.

Benefits of Choosing State Farm for General Liability Insurance

Choosing the right general liability insurance for your small business is crucial. State Farm, a leading provider in the insurance industry, offers comprehensive coverage and reliable customer service, making it a strong contender for your business needs.

Comparison with Other Providers

State Farm’s general liability insurance stands out in the market due to its competitive pricing, comprehensive coverage, and exceptional customer service. When compared to other leading providers, State Farm offers a balance of affordability and robust protection, making it a valuable option for small businesses.

- Coverage: State Farm’s general liability insurance provides comprehensive coverage for various liabilities, including bodily injury, property damage, and advertising injury. This broad coverage ensures that your business is protected from a wide range of potential risks.

- Pricing: State Farm’s general liability insurance is competitively priced, offering value for the comprehensive coverage provided. They offer flexible payment options and discounts to further reduce premiums.

- Customer Service: State Farm is renowned for its exceptional customer service. Their agents are knowledgeable and responsive, providing personalized guidance and support throughout the insurance process.

- Claims Handling: State Farm’s claims handling process is efficient and transparent. They have a dedicated claims team that works diligently to resolve claims promptly and fairly.

Advantages of Working with State Farm

State Farm’s commitment to customer satisfaction, coupled with its strong financial stability and industry expertise, makes it a reliable partner for your business.

- Reputation: State Farm has a long-standing reputation for financial strength and customer satisfaction. This reputation is built on their commitment to providing reliable insurance solutions and exceptional service.

- Customer Service: State Farm prioritizes customer service, providing personalized guidance and support throughout the insurance process. Their agents are knowledgeable and readily available to answer questions and address concerns.

- Claims Handling: State Farm’s claims handling process is efficient and transparent. They have a dedicated claims team that works diligently to resolve claims promptly and fairly.

Positive Experiences with State Farm

Numerous testimonials and case studies highlight the positive experiences of businesses insured by State Farm.

- Testimonial: “State Farm has been an invaluable partner for my small business. Their general liability insurance provides me with peace of mind knowing that I am protected from potential risks. Their claims handling process was smooth and efficient, ensuring a quick resolution to my claim.” – [Business Owner Name], [Business Name]

- Case Study: A small bakery experienced a slip-and-fall incident, resulting in a claim against their general liability insurance. State Farm promptly investigated the claim and covered the resulting medical expenses and legal fees, ensuring that the bakery was protected from financial hardship.

Steps to Obtain State Farm General Liability Insurance

Securing State Farm’s general liability insurance for your small business is a straightforward process. Follow these steps to ensure you have the right coverage and are protected against potential risks.

Getting a Quote

To get a quote for State Farm general liability insurance, you can visit their website or contact an agent directly. The online quote process is quick and easy, requiring basic information about your business, such as its type, location, and annual revenue. State Farm also provides a variety of resources, including frequently asked questions (FAQs) and online calculators, to help you understand your insurance needs and potential costs.

Reviewing Policy Details

Once you receive a quote, take time to review the policy details carefully. Understand the coverage limits, exclusions, and any specific terms or conditions. If you have any questions or require clarification, don’t hesitate to contact your State Farm agent. They are there to guide you through the process and ensure you have the right coverage for your business.

Completing the Application Process

After reviewing the policy details, you can complete the application process. State Farm typically requires information about your business, including its legal structure, industry, and number of employees. They may also ask for details about your business operations, including any specific risks or hazards. Be sure to provide accurate and complete information to ensure your application is processed smoothly.

Paying Your Premium

Once your application is approved, you’ll need to pay your premium. State Farm offers various payment options, including online payments, debit card payments, and checks. Be sure to understand your payment schedule and ensure you make your payments on time to avoid any lapse in coverage.

Obtaining Your Policy

After your premium payment is processed, you’ll receive your policy documents. Carefully review the policy to ensure it meets your needs and addresses all your business risks.

Ultimate Conclusion

By investing in State Farm general liability insurance, small businesses can effectively mitigate potential risks, protect their assets, and maintain a strong financial foundation. The policy’s comprehensive coverage, coupled with State Farm’s exceptional customer service and claims handling expertise, provides a valuable safety net for businesses of all sizes. Whether you’re a new startup or an established enterprise, State Farm’s general liability insurance is a crucial component of a comprehensive risk management strategy, enabling you to focus on what matters most: growing your business.

FAQ Corner

What types of businesses does State Farm general liability insurance cover?

State Farm general liability insurance covers a wide range of small businesses, including but not limited to retail stores, restaurants, service providers, and professional offices.

What are the common exclusions in State Farm general liability insurance?

Common exclusions include intentional acts, employee injuries covered by workers’ compensation, and environmental pollution.

How can I get a quote for State Farm general liability insurance?

You can obtain a quote online, by phone, or by contacting a local State Farm agent.

What are the benefits of choosing State Farm for general liability insurance?

State Farm offers competitive pricing, excellent customer service, and a proven track record of claims handling efficiency.