State farm car insurance wuote – State Farm car insurance quotes offer a comprehensive approach to protecting your vehicle and financial well-being. By understanding the factors that influence your quote, you can make informed decisions about your coverage and ensure you have the right protection for your needs.

State Farm offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. You can customize your policy to fit your specific requirements and budget. Obtaining a quote is simple and straightforward, with online tools, mobile apps, and dedicated agents available to guide you through the process.

Understanding State Farm Car Insurance Quotes: State Farm Car Insurance Wuote

Getting a car insurance quote from State Farm is a crucial step in finding the right coverage for your needs. It’s essential to understand the factors that influence the quote and the different types of coverage available. This will help you make an informed decision about your car insurance policy.

Factors Influencing State Farm Car Insurance Quotes, State farm car insurance wuote

Several factors determine the cost of your State Farm car insurance quote. These include:

- Your driving history: This includes your driving record, any accidents or violations, and the number of years you’ve been driving. A clean driving record will generally result in a lower quote.

- Your vehicle: The make, model, year, and safety features of your vehicle play a significant role in determining your quote. Newer, safer vehicles often have lower premiums.

- Your location: The area you live in, including factors like population density and crime rates, can influence your insurance rates.

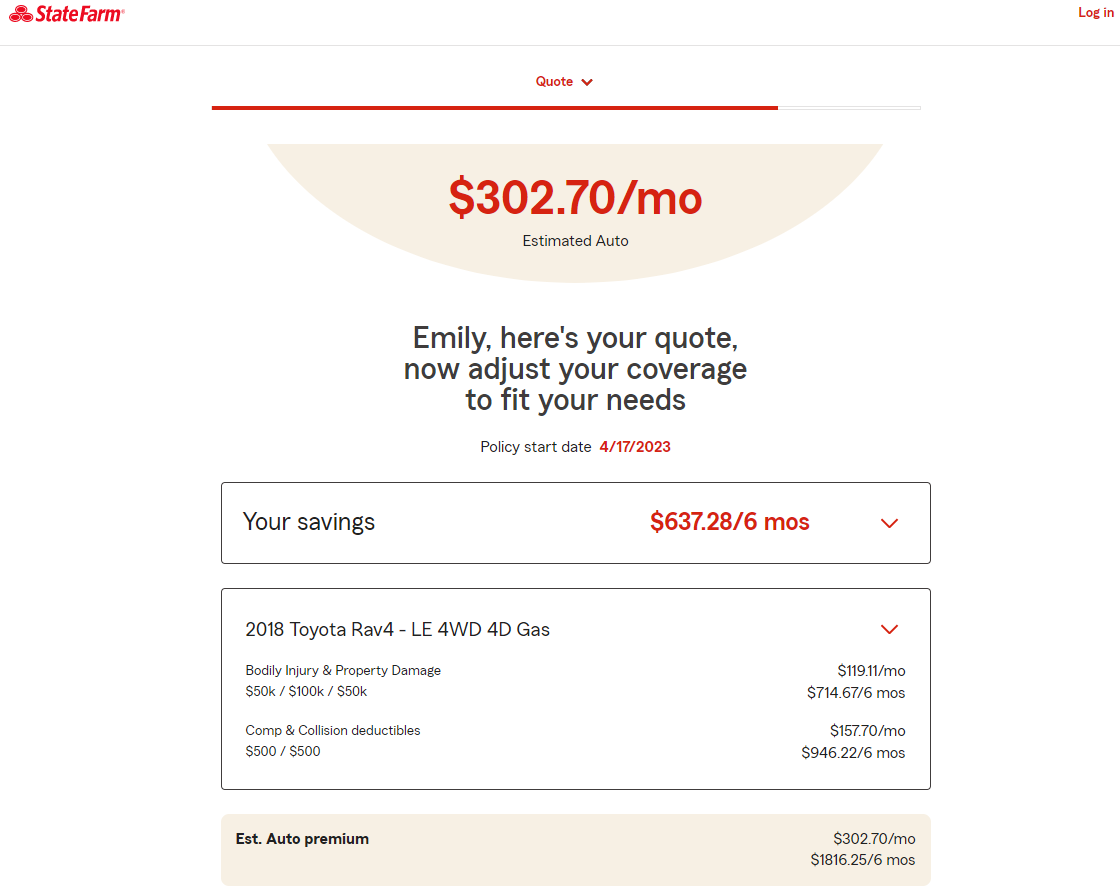

- Your coverage options: The types of coverage you choose, such as liability, collision, and comprehensive, will affect your premium. Higher coverage limits generally result in higher premiums.

- Your age and gender: Statistics show that younger drivers are more likely to be involved in accidents, so they may pay higher premiums. Gender can also play a role in pricing.

- Your credit history: In some states, insurance companies use credit history to assess risk. A good credit history can lead to lower premiums.

Types of Coverage Offered by State Farm

State Farm offers a variety of coverage options to protect you and your vehicle in the event of an accident or other unforeseen circumstances. These include:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object. It typically covers damage to your own vehicle, regardless of who is at fault.

- Comprehensive Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged due to events other than a collision, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It can help cover medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related expenses if you are injured in an accident, regardless of who is at fault. It is typically required in some states.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault. It is typically offered as an additional option.

Obtaining a State Farm Car Insurance Quote

Getting a quote from State Farm is a simple and straightforward process. Here are the steps involved:

- Visit the State Farm website: Go to the State Farm website and click on the “Get a Quote” button.

- Enter your information: Provide your basic information, such as your name, address, date of birth, and driving history.

- Provide vehicle details: Enter information about your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number).

- Choose your coverage options: Select the types of coverage you need and the desired coverage limits.

- Review your quote: Once you have entered all the necessary information, State Farm will generate a personalized quote for your car insurance. You can review the quote and make any necessary adjustments.

- Contact a State Farm agent: If you have any questions or need further assistance, you can contact a State Farm agent directly. They can help you understand your quote and choose the right coverage for your needs.

Comparing State Farm Quotes to Competitors

Finding the best car insurance rates can be a time-consuming process. While State Farm is a well-known and reputable insurer, it’s essential to compare its quotes with those of other major insurance providers to find the most suitable coverage and price for your needs.

Comparing State Farm Quotes to Competitors

To make an informed decision, it’s crucial to compare State Farm’s car insurance quotes with those of other leading insurance providers. Here’s a breakdown of some key factors to consider:

- Price: State Farm is known for its competitive pricing, but other insurers like Geico, Progressive, and USAA may offer lower rates depending on your specific circumstances.

- Coverage Options: State Farm provides a comprehensive range of coverage options, but competitors like Liberty Mutual and Nationwide may offer unique features or specialized coverage that might better suit your needs.

- Customer Service: State Farm has a strong reputation for customer service, but other insurers like Erie Insurance and Amica Mutual Insurance have also received high ratings for their customer satisfaction.

- Financial Strength: State Farm has a solid financial rating, indicating its ability to meet its obligations. Other reputable insurers like Allstate and Travelers also have excellent financial strength.

- Discounts: State Farm offers various discounts, including good driver, safe driver, and multi-policy discounts. However, other insurers may have different discount programs or offer unique discounts that could save you money.

Analyzing the Pros and Cons of Choosing State Farm

Here’s a breakdown of the advantages and disadvantages of choosing State Farm over its competitors:

Pros

- Strong Brand Reputation: State Farm is a well-known and trusted insurance provider with a long history of reliability.

- Wide Availability: State Farm operates in all 50 states, making it a convenient option for most drivers.

- Competitive Pricing: State Farm generally offers competitive rates, especially for drivers with good driving records.

- Comprehensive Coverage Options: State Farm provides a wide range of coverage options to meet various needs.

- Excellent Customer Service: State Farm has a reputation for providing excellent customer service and support.

Cons

- Potential for Higher Rates: While State Farm offers competitive rates, other insurers may offer lower premiums depending on your specific circumstances.

- Limited Customization: State Farm may have fewer customization options for coverage compared to some competitors.

- Limited Availability of Certain Discounts: State Farm may not offer all the discounts available from other insurers.

Comparing Key Features and Pricing Across Different Insurance Providers

Here’s a table comparing key features and pricing across different insurance providers:

| Insurance Provider | Average Annual Premium | Coverage Options | Discounts | Customer Service Rating | Financial Strength Rating |

|---|---|---|---|---|---|

| State Farm | $1,450 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Multi-Policy, Defensive Driving, Good Student | 4.5 out of 5 | A+ |

| Geico | $1,380 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Multi-Policy, Defensive Driving, Good Student, Military | 4.3 out of 5 | A+ |

| Progressive | $1,420 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Multi-Policy, Defensive Driving, Good Student, Homeowner | 4.2 out of 5 | A+ |

| USAA | $1,250 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Multi-Policy, Defensive Driving, Good Student, Military | 4.8 out of 5 | A+ |

| Liberty Mutual | $1,480 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Multi-Policy, Defensive Driving, Good Student, Homeowner | 4.1 out of 5 | A+ |

*Note: These are average annual premiums based on national data and may vary depending on individual factors such as driving history, vehicle type, location, and coverage options.

Evaluating State Farm’s Customer Service and Claims Process

When considering an insurance provider, customer service and the claims process are crucial factors. State Farm, known for its extensive network and reputation, strives to provide exceptional support to its policyholders. This section delves into customer testimonials, the claims process, and unique benefits offered by State Farm.

Customer Testimonials and Reviews

Customer satisfaction is a key indicator of a company’s performance. State Farm consistently receives positive feedback from its customers, highlighting its commitment to providing excellent service.

Here are some key takeaways from customer reviews:

- Responsive and helpful agents: Many customers praise State Farm’s agents for their prompt responses, helpfulness, and willingness to address concerns.

- Efficient claims handling: Customers appreciate the streamlined claims process and the swiftness with which claims are processed.

- Strong online presence: State Farm’s online platform allows customers to manage their policies, file claims, and access information conveniently.

State Farm’s Claims Process

State Farm aims to make the claims process as straightforward and hassle-free as possible.

- Reporting a claim: Policyholders can report claims online, through the mobile app, or by phone.

- Claim assessment: Once a claim is reported, a State Farm representative will assess the damage and determine the coverage.

- Repair or replacement: State Farm provides options for repairs or replacement depending on the nature of the claim.

- Payment processing: Once the claim is approved, payment is processed promptly and efficiently.

Unique Customer Support Features

State Farm goes beyond traditional customer service by offering unique benefits:

- 24/7 roadside assistance: Policyholders can access roadside assistance services, including jump starts, tire changes, and towing, anytime.

- Dedicated claims specialists: State Farm assigns dedicated claims specialists to handle each claim, providing personalized support and guidance.

- Online claim tracking: Policyholders can track the status of their claims online, ensuring transparency and communication.

Exploring State Farm’s Discounts and Promotions

State Farm offers a variety of discounts and promotions to help you save money on your car insurance. These discounts can be applied to your policy based on your individual circumstances and driving habits. By understanding the different types of discounts available, you can potentially lower your premium and make your car insurance more affordable.

Discounts Based on Vehicle Features

State Farm offers discounts for vehicles equipped with certain safety features. These features can help reduce the risk of accidents and injuries, making your car safer and potentially lowering your insurance premiums.

- Anti-theft Device Discount: This discount is available if your car is equipped with an anti-theft device, such as an alarm system, immobilizer, or tracking device. This feature can help deter theft and reduce the risk of your car being stolen.

- Airbag Discount: State Farm offers a discount for vehicles with airbags, which can significantly reduce the severity of injuries in a collision.

- Anti-lock Brake System (ABS) Discount: This discount is available for vehicles equipped with ABS, which can help prevent skidding and maintain control during braking.

- Daytime Running Lights Discount: This discount applies to vehicles with daytime running lights, which improve visibility and reduce the risk of accidents.

Discounts Based on Driving Habits

State Farm offers discounts for safe drivers who demonstrate responsible driving habits. These discounts can be earned by maintaining a clean driving record and participating in certain programs.

- Good Driver Discount: This discount is available to drivers with a clean driving record, meaning they haven’t been involved in any accidents or received any traffic violations.

- Defensive Driving Course Discount: Taking a defensive driving course can help you learn safe driving techniques and improve your driving skills. State Farm offers a discount for completing such a course.

- Safe Driver Program Discount: State Farm may offer a discount for participating in their Safe Driver Program, which uses telematics devices to track your driving habits and reward safe driving behavior.

Discounts Based on Other Factors

State Farm offers a variety of other discounts that can help you save on your car insurance. These discounts are based on factors such as your age, education, occupation, and where you live.

- Multi-policy Discount: You can save money by bundling your car insurance with other insurance policies from State Farm, such as homeowners, renters, or life insurance.

- Good Student Discount: Students with good grades may qualify for a discount on their car insurance. This discount is available to high school and college students who maintain a certain GPA.

- Homeowner Discount: Homeowners often qualify for a discount on their car insurance.

- Occupation Discount: Certain occupations may be eligible for a discount, such as teachers, doctors, or nurses.

- Mature Driver Discount: Drivers over a certain age may qualify for a discount.

- Military Discount: State Farm offers a discount for active military personnel and veterans.

- Loyalty Discount: You may be eligible for a discount if you’ve been a State Farm customer for a certain period of time.

Analyzing State Farm’s Financial Stability and Reputation

When considering an insurance provider, financial stability and reputation are paramount. State Farm, with its long history and strong financial standing, has consistently demonstrated its reliability and trustworthiness. This section explores State Farm’s financial ratings, its historical track record, and its commitment to customer satisfaction.

State Farm’s Financial Ratings

Financial ratings agencies play a crucial role in evaluating the financial health of insurance companies. These ratings are based on factors such as capital adequacy, investment performance, and claims-paying ability. State Farm consistently receives high ratings from leading agencies, reflecting its strong financial position.

- A.M. Best: State Farm holds an A+ (Superior) rating from A.M. Best, a leading credit rating agency specializing in the insurance industry. This rating signifies State Farm’s exceptional financial strength and its ability to meet its long-term obligations.

- Standard & Poor’s: State Farm also maintains an A+ (Strong) rating from Standard & Poor’s, a globally recognized credit rating agency. This rating reflects State Farm’s robust financial performance and its commitment to sound risk management practices.

- Moody’s: Moody’s, another prominent credit rating agency, assigns State Farm an A1 rating. This rating indicates State Farm’s high creditworthiness and its ability to manage its financial obligations effectively.

These high ratings from reputable agencies underscore State Farm’s strong financial foundation, providing assurance to policyholders that their coverage is backed by a financially stable and reliable company.

State Farm’s History and Reputation

State Farm has a rich history dating back to 1922, when it was founded in Bloomington, Illinois. The company has consistently grown and expanded its services over the years, becoming one of the largest and most trusted insurance providers in the United States.

“State Farm is built on a foundation of strong financial strength, a commitment to customer service, and a long history of providing reliable insurance solutions.”

State Farm’s commitment to customer satisfaction is evident in its consistently high rankings in customer satisfaction surveys. For example, J.D. Power consistently ranks State Farm highly in its annual customer satisfaction surveys for auto insurance. This consistent high performance is a testament to State Farm’s dedication to providing a positive customer experience.

Evidence of State Farm’s Reliability and Trustworthiness

State Farm’s financial strength, coupled with its long history and commitment to customer satisfaction, provide compelling evidence of its reliability and trustworthiness. The company’s ability to weather economic downturns and its consistent performance in customer satisfaction surveys demonstrate its commitment to fulfilling its obligations to its policyholders.

In addition, State Farm’s extensive network of agents provides a personalized and convenient customer service experience. Agents are readily available to answer questions, provide support, and help policyholders navigate the insurance process.

State Farm’s financial stability, coupled with its reputation for customer satisfaction, provides policyholders with peace of mind knowing that their coverage is backed by a reliable and trustworthy company.

End of Discussion

Ultimately, choosing the right car insurance provider is a personal decision. By comparing State Farm’s quotes with other major insurers, considering their customer service, and evaluating their discounts and promotions, you can find the best fit for your needs and ensure you have the protection you deserve.

FAQ

How do I get a State Farm car insurance quote?

You can obtain a quote online, through their mobile app, or by contacting a local State Farm agent.

What discounts are available with State Farm car insurance?

State Farm offers a variety of discounts, including good driver, safe driver, multi-car, and bundling discounts.

What is State Farm’s claims process like?

State Farm offers a straightforward claims process that can be initiated online, through their mobile app, or by contacting a claims representative.