State Farm bundle insurance offers a way to consolidate multiple insurance policies under one roof, potentially saving you money and simplifying your coverage. This approach involves combining policies like auto, home, renters, and life insurance, allowing you to benefit from bundled discounts and streamlined management.

Bundling with State Farm can be advantageous for various reasons. By combining your policies, you may qualify for significant discounts, reducing your overall insurance costs. Moreover, managing multiple policies becomes easier with a single provider, simplifying your insurance experience and minimizing the need to navigate different websites or contact multiple agents.

State Farm Bundle Insurance Overview

State Farm, a leading insurance provider, offers a bundle insurance program that allows customers to combine multiple insurance policies under one umbrella. This approach can significantly benefit customers through cost savings, streamlined management, and a simplified experience.

Types of Insurance Policies Included in Bundles

State Farm’s bundle insurance program encompasses a wide range of insurance policies, offering flexibility to meet diverse customer needs. The primary types of insurance policies that can be bundled together include:

- Auto Insurance: Covers damages to your vehicle and injuries to others in case of an accident.

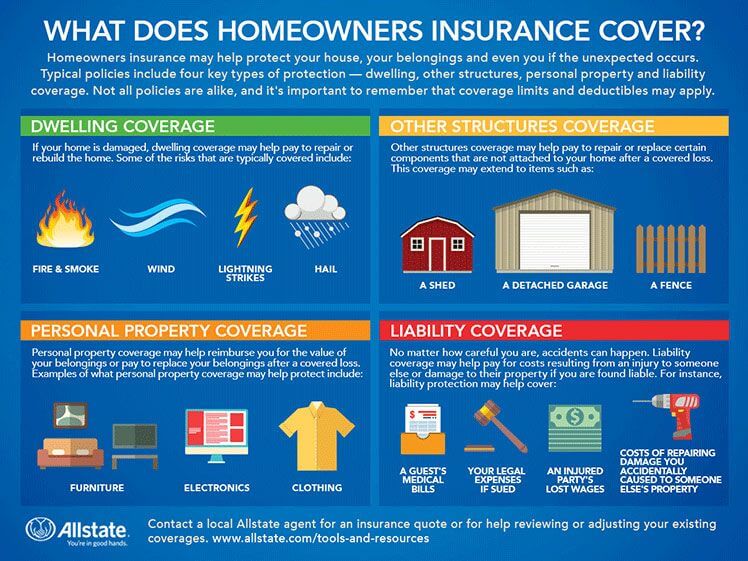

- Homeowners Insurance: Protects your home and its contents against various risks, such as fire, theft, and natural disasters.

- Renters Insurance: Provides coverage for your belongings and liability protection while renting a property.

- Life Insurance: Offers financial protection to your loved ones in the event of your passing.

- Motorcycle Insurance: Covers damages to your motorcycle and injuries to others in case of an accident.

- Boat Insurance: Provides coverage for your boat and its equipment against various risks, such as damage, theft, and liability.

- Condo Insurance: Protects your condo unit and its contents against various risks, such as fire, theft, and natural disasters.

- Umbrella Insurance: Offers additional liability coverage beyond your existing policies, providing extra protection in case of a significant lawsuit.

Benefits of Bundling Insurance Policies

Bundling insurance policies with State Farm offers several advantages, including:

- Discounts: Bundling your policies often leads to significant discounts, as State Farm rewards customers for consolidating their insurance needs.

- Convenience: Managing multiple policies under one account simplifies the process, making it easier to pay premiums, track coverage, and contact customer support.

- Streamlined Communication: Having all your policies with State Farm ensures consistent communication and coordinated support in case of claims.

State Farm Bundle Insurance Discounts

Bundling your insurance policies with State Farm can lead to significant savings. State Farm offers various discounts to incentivize policyholders to combine their insurance needs under one roof.

Factors Affecting Discount Amount

The amount of discount you receive on your bundled insurance policies depends on several factors:

- Policy Type: Bundling different types of insurance, such as auto, home, renters, life, and health, typically results in larger discounts than bundling similar policies (e.g., two auto policies).

- Coverage Levels: Higher coverage levels on your policies generally lead to higher premiums, which can reduce the overall discount percentage.

- Claims History: A clean claims history demonstrates responsible driving and risk management, which can result in larger discounts.

- Location: Discounts may vary based on your location and the associated risk factors.

Comparison with Other Insurance Providers, State farm bundle insurance

State Farm’s bundle insurance discounts are generally competitive with other major insurance providers. However, it’s crucial to compare quotes from multiple insurers to ensure you’re getting the best deal.

- Progressive: Progressive offers a similar bundle discount structure, with varying discounts based on policy types, coverage levels, and claims history.

- Geico: Geico also provides bundle discounts, but their structure and specific discounts may differ from State Farm’s.

- Allstate: Allstate’s bundle discount program is comparable to State Farm’s, with discounts based on similar factors.

“It’s always advisable to shop around and compare quotes from multiple insurance providers before making a decision.”

Bundling Insurance with State Farm

Bundling your insurance policies with State Farm can save you money and simplify your insurance needs. By combining multiple policies under one umbrella, you can take advantage of discounts and enjoy the convenience of managing all your insurance in one place.

Steps to Bundle Insurance with State Farm

To bundle your insurance policies with State Farm, follow these steps:

- Get a Quote: Start by obtaining quotes for the insurance policies you wish to bundle. You can do this online, over the phone, or by visiting a local State Farm agent. When requesting quotes, provide accurate information about your vehicles, property, and coverage needs.

- Compare Coverage Options: Once you have received quotes for each policy, carefully compare the coverage options and pricing. Consider factors like deductibles, limits, and coverage types. State Farm offers a variety of coverage options, so choose the ones that best meet your individual needs and budget.

- Finalize the Bundling Process: Once you’ve decided on the policies and coverage options, finalize the bundling process. This typically involves signing a contract and providing payment information. You can finalize the process online, over the phone, or in person with a State Farm agent.

Real-World Examples of State Farm Bundle Insurance Savings

Imagine getting a significant discount on your insurance premiums just by combining your policies with State Farm. That’s the power of bundling! By combining your auto, home, renters, or other insurance policies with State Farm, you can save a substantial amount of money.

Bundle Insurance Savings Examples

The potential savings you can achieve by bundling your insurance policies with State Farm vary based on factors such as the specific policies you choose, your coverage levels, and your claim history. Here are some hypothetical examples illustrating the potential savings you might experience:

| Policy Combination | Coverage Levels | Estimated Discount |

|---|---|---|

| Auto and Home | Comprehensive and Collision on Auto, Standard Homeowners | 15-25% |

| Auto and Renters | Comprehensive and Collision on Auto, Standard Renters | 10-15% |

| Auto and Life | Comprehensive and Collision on Auto, $250,000 Life Insurance | 5-10% |

Bundling your insurance policies with State Farm can lead to significant savings, potentially reducing your overall insurance costs by 10% or more.

Impact of Coverage Levels and Claim History on Savings

Your coverage levels and claim history can influence the discounts you receive when bundling your insurance policies with State Farm.

For example, individuals with higher coverage levels on their auto policies, such as comprehensive and collision, may qualify for larger discounts when bundling with other insurance policies. Similarly, those with a clean driving record and no recent claims may also be eligible for more significant savings.

It’s important to remember that the actual savings you receive may vary based on your individual circumstances. Contact your local State Farm agent for a personalized quote to determine your potential savings.

Considerations When Bundling Insurance with State Farm

While bundling insurance with State Farm can offer significant savings, it’s crucial to weigh the potential downsides and ensure you’re getting the best coverage for your needs.

Potential Downsides of Bundling Insurance

Bundling insurance policies can offer substantial discounts, but it’s essential to be aware of potential drawbacks before making a decision.

- Limited Choice: Bundling often means sticking with one insurer for all your policies, potentially limiting your choice of coverage options and limiting your ability to compare different rates and features.

- Potential for Higher Overall Costs: While individual policies might be cheaper when bundled, the overall cost might be higher than if you purchased policies separately, especially if you have unique needs or require specialized coverage.

- Reduced Flexibility: Bundling can make it more challenging to adjust or cancel individual policies, as changes to one policy may affect the entire bundle.

Comparing Coverage Options

It’s crucial to compare coverage options across different insurers, even when bundling. Ensure that the bundled policies provide adequate protection for all your assets and liabilities.

- Review Coverage Limits: Ensure the coverage limits for each policy within the bundle meet your individual needs and risk tolerance.

- Compare Deductibles: Analyze the deductibles for each policy and choose the right balance between premium cost and out-of-pocket expenses.

- Assess Exclusions and Limitations: Carefully review the policy documents to understand any exclusions or limitations that might affect your coverage.

Factors Influencing the Decision to Bundle

Several factors can influence your decision to bundle insurance with State Farm.

- Individual Needs: Consider your specific needs and risk tolerance. If you have multiple vehicles, a home, and other assets, bundling might be beneficial.

- Financial Circumstances: Evaluate your budget and affordability. Bundling can offer savings, but ensure the overall cost is within your financial means.

- Convenience and Simplicity: Bundling can streamline your insurance management, providing a single point of contact for all your policies.

Closure

Ultimately, the decision to bundle insurance with State Farm should be based on your individual needs and financial situation. By carefully considering the potential benefits and drawbacks, you can determine if bundling is the right choice for you. Whether you’re seeking to save money, streamline your insurance management, or both, State Farm’s bundled insurance offers a compelling option worth exploring.

Detailed FAQs: State Farm Bundle Insurance

What are the typical discounts offered for bundling insurance with State Farm?

State Farm offers a range of discounts for bundling, often exceeding 10% or even reaching 20% depending on the specific policies combined and your individual circumstances.

Can I bundle insurance policies with State Farm if I already have policies with another provider?

Yes, you can typically switch existing policies to State Farm and bundle them together. However, it’s essential to compare quotes and coverage options from both your current provider and State Farm to ensure you’re getting the best value.

How does State Farm’s bundle insurance compare to other insurance providers?

State Farm is known for its competitive bundling discounts, but it’s crucial to compare quotes from various providers to find the best deal. Consider factors like coverage levels, deductibles, and customer service when making your decision.