State Farm car insurance plans have been a staple in the American insurance market for decades, offering a wide range of coverage options and a reputation for reliable customer service. Whether you’re a seasoned driver or just starting out, understanding the different plans and their features can be crucial in finding the right protection for your vehicle and financial well-being.

From basic liability coverage to comprehensive protection, State Farm provides a tailored approach to car insurance, catering to individual needs and budgets. This comprehensive guide explores the various plans, their key features, and factors that influence pricing, helping you make an informed decision about your car insurance needs.

State Farm Car Insurance Overview: State Farm Car Insurance Plans

State Farm is a household name in the United States, synonymous with reliable car insurance. Founded in 1922 by George J. Mecherle, the company has grown into one of the largest and most respected insurance providers in the world.

History and Market Presence

State Farm’s journey began with a simple mission: to provide affordable and accessible car insurance to farmers and rural communities. This focus on customer needs has been a cornerstone of the company’s success, leading to its expansion into a diverse range of insurance products and services, including home, life, and health insurance. Today, State Farm is the largest auto insurer in the United States, with a significant market share across the country.

Mission and Core Values

State Farm’s mission statement emphasizes its commitment to providing “exceptional service and value” to its customers. This commitment is reflected in the company’s core values, which include:

- Customer Focus: State Farm prioritizes understanding and meeting the needs of its customers.

- Integrity: The company operates with honesty and transparency, building trust with its customers.

- Financial Strength: State Farm maintains a strong financial position, ensuring its ability to fulfill its commitments to policyholders.

- Community Involvement: State Farm actively engages with communities, supporting local initiatives and organizations.

Customer Base and Market Share

State Farm boasts a vast customer base, with over 83 million policies in force across various insurance lines. This extensive reach translates into a significant market share in the car insurance industry. In 2022, State Farm held approximately 19% of the U.S. auto insurance market, solidifying its position as the leading provider in the sector.

Types of Car Insurance Plans Offered by State Farm

State Farm offers a wide range of car insurance plans to cater to different needs and budgets. Understanding the different types of coverage available is crucial to ensure you have the right protection in case of an accident.

Liability Coverage

Liability coverage is a fundamental part of car insurance. It helps protect you financially if you cause an accident that results in damage to another person’s property or injuries to others. State Farm offers various levels of liability coverage, and the amount of coverage you need will depend on your individual circumstances.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property if you are at fault in an accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is typically optional but can be very beneficial, especially if you have a newer car or a car with a high loan balance.

- Collision Coverage: This coverage will pay for repairs or replacement of your vehicle, minus your deductible, if you are involved in an accident with another vehicle or object, regardless of who is at fault. This coverage is usually optional, but it can be beneficial if you have a newer car or a car with a high loan balance.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional but can be valuable if you want to ensure your vehicle is protected against a wide range of risks.

- Comprehensive Coverage: This coverage will pay for repairs or replacement of your vehicle, minus your deductible, if it is damaged by something other than a collision, such as theft, vandalism, fire, hail, or a natural disaster. This coverage is usually optional, but it can be beneficial if you have a newer car or a car with a high loan balance.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses.

- Uninsured Motorist Coverage (UM): This coverage will pay for your medical expenses, lost wages, and other damages if you are injured by an uninsured driver.

- Underinsured Motorist Coverage (UIM): This coverage will pay for your medical expenses, lost wages, and other damages if you are injured by an underinsured driver, meaning their insurance coverage is not enough to cover your losses.

Personal Injury Protection (PIP), State farm car insurance plans

Personal injury protection (PIP) coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. It is typically required in certain states, and it can be a valuable addition to your insurance policy.

- Personal Injury Protection (PIP): This coverage will pay for your medical expenses, lost wages, and other damages, regardless of who is at fault in the accident. This coverage is typically required in certain states, and it can be a valuable addition to your insurance policy.

Medical Payments Coverage (MedPay)

Medical payments coverage (MedPay) is similar to PIP but provides more limited coverage. It covers your medical expenses, regardless of who is at fault, but it does not cover lost wages or other damages. MedPay is often an optional coverage that can be added to your policy.

- Medical Payments Coverage (MedPay): This coverage will pay for your medical expenses, regardless of who is at fault, but it does not cover lost wages or other damages. This coverage is often an optional coverage that can be added to your policy.

Key Features and Benefits of State Farm Car Insurance Plans

State Farm’s car insurance plans are designed to provide comprehensive coverage and exceptional customer service. The company offers a variety of features and benefits that aim to enhance the customer experience and provide value for money.

Discounts and Savings

State Farm offers a wide range of discounts that can significantly reduce your car insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and loyalty.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits.

- Good Student Discount: Students who maintain a certain GPA can qualify for this discount, acknowledging their commitment to academic excellence.

- Multi-Policy Discount: Bundling your car insurance with other State Farm policies, such as homeowners or renters insurance, can lead to substantial savings.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices, leading to a discount.

24/7 Customer Support

State Farm prioritizes customer service and provides 24/7 support through various channels.

- Phone Support: You can reach a State Farm representative at any time, day or night, for assistance with your policy, claims, or general inquiries.

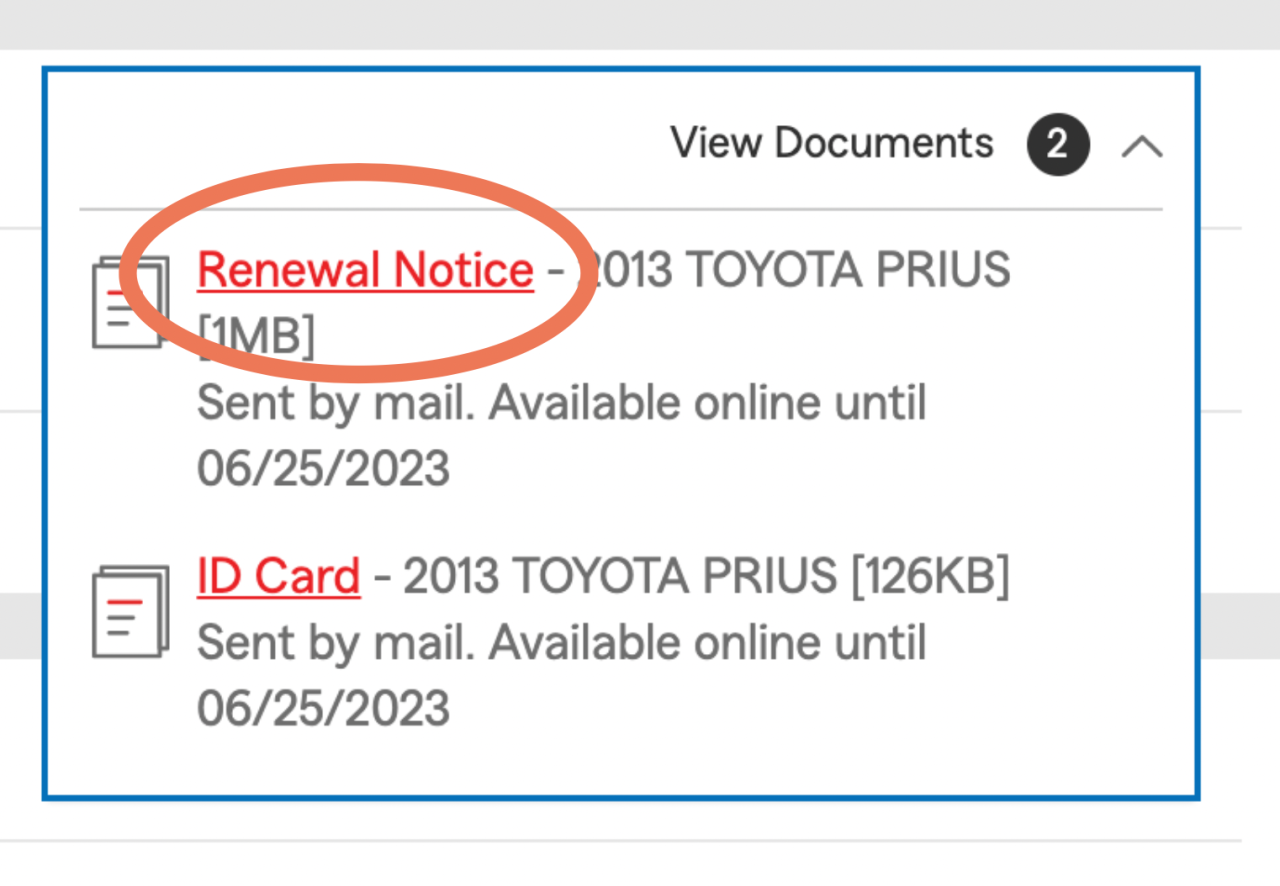

- Online Support: State Farm’s website provides access to policy information, payment options, and other resources. You can also submit claims and manage your policy online.

- Mobile App: The State Farm mobile app offers a convenient way to manage your policy, access your insurance card, file claims, and connect with customer service representatives.

Claims Handling Process

State Farm aims to simplify the claims process and ensure a smooth experience for customers.

- Easy Filing: You can file claims online, through the mobile app, or by phone, making the process convenient and accessible.

- Fast Response: State Farm strives to respond quickly to claims, providing timely updates and assistance to customers.

- Dedicated Claim Representatives: You will be assigned a dedicated claims representative who will guide you through the process, answer questions, and provide support.

State Farm’s Pricing and Cost Factors

Your car insurance premiums are determined by various factors, and State Farm, like other insurance providers, uses these factors to calculate your individual rates. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Influencing State Farm Car Insurance Costs

Several factors play a crucial role in determining your State Farm car insurance rates. These include:

- Your driving history: Your past driving record, including accidents, tickets, and violations, significantly impacts your premium. A clean driving record generally leads to lower rates, while a history of accidents or violations can result in higher premiums.

- Your age and gender: Statistically, younger and inexperienced drivers are considered higher risk, leading to potentially higher premiums. Similarly, gender can also play a role in pricing, as insurance companies may consider historical claims data based on gender.

- Your vehicle: The make, model, year, and safety features of your car influence your premium. Cars with advanced safety features may receive lower rates compared to older models with fewer safety features. Additionally, luxury cars or high-performance vehicles are often associated with higher insurance costs due to their potential for higher repair expenses.

- Your location: The location where you live, including the state, city, and even neighborhood, can affect your premium. Areas with higher crime rates or a greater number of accidents tend to have higher insurance rates.

- Your coverage choices: The type and amount of coverage you choose will impact your premium. Comprehensive and collision coverage, which protect against damage to your vehicle from events like accidents, theft, or natural disasters, typically increase your premium. However, these coverages offer valuable protection against significant financial losses.

- Your credit score: In some states, insurance companies may use your credit score as a factor in determining your premiums. This practice is controversial, but it’s based on the idea that people with good credit are more likely to be responsible drivers and less likely to file claims.

Comparison to Other Major Providers

State Farm is a major player in the car insurance market, and its pricing is generally competitive. However, it’s essential to compare quotes from several insurance providers to ensure you’re getting the best rate. Other major providers, such as Geico, Progressive, and Allstate, often offer competitive rates, and comparing their quotes with State Farm’s can help you find the most suitable option.

Estimated State Farm Car Insurance Costs

The table below provides estimated costs for State Farm car insurance for different car models, driving profiles, and locations. Please note that these are just estimates and actual rates may vary based on individual circumstances and specific factors:

| Car Model | Driving Profile | Location | Estimated Monthly Premium |

|---|---|---|---|

| Toyota Camry | 35-year-old male, clean driving record | Chicago, IL | $100 – $150 |

| Honda Civic | 25-year-old female, one speeding ticket | Los Angeles, CA | $120 – $180 |

| Ford F-150 | 40-year-old male, minor accident in past 5 years | New York, NY | $150 – $220 |

Customer Experience and Reviews

State Farm is one of the largest and most well-known insurance companies in the United States, and its car insurance plans are popular among many drivers. To gain a deeper understanding of the company’s customer experience, we’ll delve into customer reviews, testimonials, and independent assessments to explore the pros and cons of choosing State Farm for your car insurance needs.

Customer Satisfaction Levels

Customer satisfaction with State Farm car insurance is generally positive, with many customers praising the company’s friendly and responsive customer service, efficient claims handling, and competitive pricing.

- State Farm consistently ranks highly in customer satisfaction surveys conducted by independent organizations like J.D. Power and the American Customer Satisfaction Index (ACSI).

- In J.D. Power’s 2023 U.S. Auto Insurance Satisfaction Study, State Farm received an above-average score for overall satisfaction, ranking among the top performers in the industry.

- The ACSI also gives State Farm a positive rating for customer satisfaction, reflecting the company’s commitment to providing a positive experience for its policyholders.

Comparing State Farm Car Insurance Plans to Competitors

State Farm is a major player in the car insurance market, but it’s not the only option. Comparing State Farm’s plans to those offered by its competitors can help you find the best coverage at the most affordable price. Let’s take a look at how State Farm stacks up against some of its biggest rivals, including Geico, Progressive, and Allstate.

Key Similarities and Differences

It’s important to understand that all car insurance companies offer similar types of coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. However, there are some key differences in terms of pricing, features, and customer service that can make one company a better fit for your needs than another.

Coverage Options

- Liability Coverage: All four companies offer liability coverage, which protects you financially if you cause an accident that injures someone or damages their property. The amount of coverage you need will depend on your individual circumstances, but it’s generally recommended to have at least the minimum amount required by your state.

- Collision Coverage: Collision coverage pays for repairs to your car if you’re involved in an accident, regardless of who is at fault. This coverage is optional, but it’s a good idea to have it if you have a newer car or if you can’t afford to pay for repairs out of pocket.

- Comprehensive Coverage: Comprehensive coverage pays for damage to your car that’s not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is also optional, but it can be helpful if you live in an area with a high risk of these types of incidents.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s a good idea to have this coverage, as it can help you recover from significant financial losses.

Pricing and Cost Factors

| Company | Average Annual Premium | Factors Affecting Price |

|---|---|---|

| State Farm | $1,400 | Driving history, age, location, car model, coverage levels |

| Geico | $1,300 | Driving history, age, location, car model, coverage levels |

| Progressive | $1,350 | Driving history, age, location, car model, coverage levels |

| Allstate | $1,450 | Driving history, age, location, car model, coverage levels |

It’s important to note that these are just average premiums and your actual price will vary depending on your individual circumstances. All four companies use similar factors to determine your premium, including your driving history, age, location, car model, and coverage levels. You can get a free quote from each company to compare their prices.

Features and Benefits

- Discounts: All four companies offer a variety of discounts, such as good driver discounts, safe driver discounts, multi-policy discounts, and more. These discounts can significantly reduce your premium.

- Customer Service: All four companies have a good reputation for customer service. However, it’s always a good idea to read reviews and talk to friends and family to get a sense of their experiences with each company.

- Mobile Apps: All four companies have mobile apps that allow you to manage your policy, file claims, and access other features. These apps can be very convenient and can save you time and hassle.

Epilogue

Ultimately, choosing the right car insurance plan involves considering your individual circumstances, driving habits, and financial priorities. State Farm offers a variety of options to meet diverse needs, with a focus on providing comprehensive coverage, competitive pricing, and exceptional customer service. By understanding the key aspects of their plans, you can make a well-informed decision that aligns with your specific requirements and ensures peace of mind on the road.

Essential FAQs

What are the discounts offered by State Farm car insurance?

State Farm offers a wide range of discounts, including safe driving discounts, multi-policy discounts, good student discounts, and more. The specific discounts available will vary depending on your individual circumstances and location.

How do I file a claim with State Farm car insurance?

You can file a claim online, through the State Farm mobile app, or by calling their customer service line. State Farm provides 24/7 support for claims filing.

Does State Farm offer roadside assistance?

Yes, State Farm offers optional roadside assistance coverage, which can provide assistance with services like towing, jump starts, and tire changes.