State farm auto.insurance – State Farm Auto Insurance, a household name in the American insurance landscape, has been a trusted provider for decades. This comprehensive guide explores the intricacies of State Farm’s auto insurance offerings, delving into its history, product range, customer experience, and commitment to innovation. We’ll also analyze pricing strategies, claim processes, and the company’s overall brand perception.

From understanding the various policy options and coverage levels to navigating the claims process and exploring technology-driven solutions, this guide aims to equip readers with the knowledge they need to make informed decisions about their auto insurance needs.

State Farm Auto Insurance Overview

State Farm, a household name in the United States, has a rich history spanning over a century, deeply intertwined with the evolution of the American automotive landscape. Founded in 1922 by G.J. Mecherle, State Farm began as a small insurance agency in Bloomington, Illinois, offering auto insurance to farmers in the region.

State Farm’s History and Growth

State Farm’s early success was driven by its focus on customer service and its innovative approach to insurance. The company pioneered the concept of direct-to-consumer insurance, eliminating the need for intermediaries and making insurance more accessible to a wider audience. This strategy, coupled with its commitment to fair pricing and prompt claims handling, allowed State Farm to rapidly expand its customer base and market share.

Key Facts and Figures

State Farm’s dominance in the auto insurance market is undeniable. As of 2022, it is the largest auto insurer in the United States, boasting a market share exceeding 18%. The company serves over 83 million policyholders across various lines of insurance, including auto, home, life, and health. State Farm’s financial performance has consistently been strong, with annual revenues exceeding $100 billion.

State Farm’s Core Values and Mission

State Farm’s success is rooted in its unwavering commitment to its core values: integrity, customer service, and community involvement. The company’s mission statement emphasizes its dedication to providing “affordable, quality insurance products and financial services to meet the needs of its customers.” This mission is reflected in State Farm’s diverse product offerings, competitive pricing, and extensive network of agents and claims professionals.

Auto Insurance Products and Services

State Farm offers a comprehensive suite of auto insurance products designed to protect you and your vehicle in various situations. These policies are tailored to meet diverse needs and cover a wide range of potential risks.

Liability Coverage

Liability coverage is essential for protecting you financially in case you are responsible for an accident that causes injury or damage to others. State Farm offers various liability coverage options, including:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to people injured in an accident caused by you.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property, such as vehicles or buildings, caused by an accident you are responsible for.

Collision Coverage, State farm auto.insurance

Collision coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage also pays for repairs or replacement, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are injured in an accident caused by a driver who has no insurance or insufficient insurance. This coverage pays for your medical expenses, lost wages, and other damages.

Other Coverage Options

State Farm also offers a range of additional coverage options to enhance your auto insurance protection, including:

- Rental Car Coverage: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Towing and Labor Coverage: This coverage pays for towing and labor costs if your vehicle breaks down or needs roadside assistance.

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, and other roadside emergencies.

Benefits and Features

State Farm’s auto insurance products are designed to provide comprehensive protection and peace of mind. Some key benefits and features include:

- Competitive Rates: State Farm strives to offer competitive rates to its customers, ensuring they get the best value for their insurance.

- Excellent Customer Service: State Farm is known for its excellent customer service, providing prompt and helpful assistance when needed.

- Convenient Payment Options: State Farm offers various convenient payment options, including online payments, automatic payments, and payment plans.

- Discounts: State Farm offers various discounts to help customers save money on their premiums, including safe driving discounts, multi-policy discounts, and good student discounts.

- 24/7 Claims Service: State Farm provides 24/7 claims service, ensuring prompt assistance in case of an accident.

Customer Experience and Service

State Farm prioritizes a positive customer experience throughout the entire insurance journey. From obtaining a quote to managing your policy, State Farm offers various channels and resources to ensure a smooth and convenient experience.

Obtaining a Quote and Purchasing a Policy

State Farm makes it easy to get a quote and purchase an auto insurance policy. You can choose from several methods:

- Online: State Farm’s website provides a user-friendly platform for getting a quote. You can input your vehicle information, driving history, and other relevant details to receive a personalized quote within minutes. You can also purchase a policy directly online.

- Mobile App: The State Farm mobile app offers a convenient way to get a quote, manage your policy, and access other features. The app is available for both Android and iOS devices.

- Phone: State Farm has a dedicated customer service line where you can speak to an agent to obtain a quote and discuss your insurance needs.

- Agent: State Farm has a vast network of local agents who can provide personalized service and guidance throughout the insurance process. You can schedule an appointment with an agent in person or virtually.

Customer Interaction Channels

State Farm offers a variety of channels for customers to interact with them, including:

- Website: The State Farm website provides comprehensive information about their products and services, including FAQs, policy details, and online claim filing.

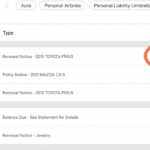

- Mobile App: The State Farm mobile app allows customers to manage their policies, view their coverage details, make payments, and access other features.

- Phone: State Farm has a dedicated customer service line available 24/7 to answer questions, resolve issues, and provide assistance with policy changes.

- Email: Customers can contact State Farm through email for inquiries or assistance with specific requests.

- Social Media: State Farm is active on various social media platforms, where customers can find updates, ask questions, and engage with the company.

- Agent: Local agents provide personalized service and support, helping customers understand their policies and navigate the insurance process.

Customer Service Reputation

State Farm consistently ranks highly for customer service in the insurance industry. According to J.D. Power, State Farm has received high ratings for customer satisfaction in auto insurance.

“State Farm consistently ranks highly for customer satisfaction in the insurance industry. According to J.D. Power, State Farm has received high ratings for customer satisfaction in auto insurance.”

- J.D. Power: State Farm has consistently received high ratings for customer satisfaction in auto insurance from J.D. Power.

- Consumer Reports: State Farm also receives positive reviews from Consumer Reports, highlighting their responsiveness and ease of doing business.

- Testimonials: Many customers share positive testimonials about their experiences with State Farm, praising their agents, claims handling, and overall customer service.

Pricing and Affordability

State Farm is known for its competitive pricing and a wide range of discounts, making auto insurance more affordable for many drivers. Understanding how State Farm calculates premiums is crucial for finding the best policy for your needs and budget.

Factors Influencing Premiums

Several factors contribute to the cost of your State Farm auto insurance premium. These factors are carefully considered to ensure you pay a fair price based on your individual risk profile.

- Driving Record: Your driving history, including accidents, traffic violations, and driving under the influence convictions, significantly impacts your premium. A clean driving record often translates to lower premiums, while a history of incidents can increase them.

- Vehicle Type: The type of vehicle you drive plays a vital role in determining your premium. Higher-value cars, luxury vehicles, and sports cars typically have higher premiums due to their repair costs and theft risk. Conversely, less expensive and older cars usually have lower premiums.

- Location: Your location, specifically the state and city you reside in, impacts your premium. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance premiums. State regulations and insurance laws also influence pricing.

- Age and Gender: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk can lead to higher premiums. Gender also plays a role, as certain demographics have different accident rates.

- Coverage Levels: The level of coverage you choose, such as liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage, directly impacts your premium. Higher coverage levels generally result in higher premiums.

- Credit Score: In some states, insurance companies can use your credit score to determine your premium. This practice is controversial, but it reflects the belief that individuals with good credit are more likely to be responsible drivers. However, this practice is not universal and varies by state.

Comparison to Competitors

State Farm’s pricing is generally competitive within the insurance market. However, it’s crucial to compare quotes from multiple insurance companies to ensure you’re getting the best value. Factors like your specific needs, driving history, and location can significantly influence which insurer offers the most affordable rates.

- Online Comparison Tools: Websites like Insurance.com, Bankrate.com, and NerdWallet allow you to compare quotes from various insurers simultaneously, including State Farm. This provides a comprehensive overview of available options and helps you identify the most competitive prices.

- Direct Comparisons: Contacting several insurance companies directly and providing them with your information allows for personalized quotes and helps you understand their specific offerings. This approach can be time-consuming but ensures you receive tailored pricing information.

Discounts and Cost-Saving Options

State Farm offers various discounts and cost-saving options to help customers lower their premiums. These discounts can significantly reduce your overall insurance costs.

- Safe Driving Discounts: Maintaining a clean driving record with no accidents or violations can qualify you for significant discounts. These discounts reward responsible driving behavior.

- Multi-Policy Discounts: Bundling your auto insurance with other policies like homeowners or renters insurance can lead to substantial discounts. This strategy encourages customers to consolidate their insurance needs with State Farm.

- Good Student Discounts: Students who maintain good grades in school can often qualify for discounts. This reflects the belief that academically successful individuals are more responsible and have lower risk profiles.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can reduce your premium. This reflects the lower risk of theft and damage for vehicles equipped with such features.

- Driver Training Discounts: Completing a defensive driving course can lead to discounts. This reflects the belief that drivers who receive additional training are more aware and skilled, reducing their risk of accidents.

Claims Process and Customer Support

State Farm understands that being involved in an accident can be a stressful experience. That’s why they’ve designed their claims process to be as simple and efficient as possible. With a focus on customer satisfaction, State Farm aims to provide support and guidance throughout the entire claims journey.

Filing a Claim with State Farm

Filing a claim with State Farm is a straightforward process. You can start by contacting them through various channels, including their website, mobile app, or by calling their customer service hotline. Once you’ve reported the incident, a claims adjuster will be assigned to your case. The adjuster will guide you through the necessary steps, including gathering information about the accident and providing documentation.

- Online: State Farm’s website allows you to file a claim online, providing a convenient and accessible option for customers.

- Mobile App: The State Farm mobile app enables you to file a claim directly from your smartphone, simplifying the process even further.

- Phone: You can reach State Farm’s customer service hotline to report an accident and begin the claims process.

Claims Handling Process

Once you’ve filed a claim, State Farm will initiate the claims handling process. This involves investigating the accident, assessing the damage, and determining the extent of coverage. State Farm’s claims adjusters are trained professionals who will work diligently to ensure a fair and efficient resolution.

- Investigation: State Farm will gather information about the accident, including witness statements, police reports, and photographs of the damage.

- Damage Assessment: A qualified professional will assess the damage to your vehicle and determine the cost of repairs or replacement.

- Coverage Determination: The claims adjuster will review your policy to determine the extent of coverage and any applicable deductibles.

- Payment: Once the claim is approved, State Farm will process the payment, either directly to the repair shop or to you, depending on the circumstances.

Communication Channels

State Farm prioritizes communication throughout the claims process. They will keep you informed about the progress of your claim, answer your questions, and address any concerns you may have.

- Phone: You can contact your claims adjuster directly by phone to discuss the status of your claim.

- Email: State Farm will provide regular updates via email, keeping you informed about the progress of your claim.

- Online Portal: You can access your claim information and track its progress through State Farm’s online portal.

Reputation for Fair and Efficient Claims Handling

State Farm has a long-standing reputation for handling claims fairly and efficiently. They are committed to providing excellent customer service and resolving claims promptly. This reputation is built on their commitment to:

- Transparency: State Farm provides clear and concise information about the claims process, ensuring that customers understand their rights and responsibilities.

- Objectivity: State Farm’s claims adjusters are trained to assess claims objectively and fairly, ensuring that customers receive the compensation they deserve.

- Efficiency: State Farm strives to resolve claims as quickly as possible, minimizing the inconvenience for their customers.

Technology and Innovation: State Farm Auto.insurance

State Farm recognizes the importance of technology in today’s digital world and has invested heavily in developing innovative solutions to enhance the customer experience. The company leverages technology to streamline processes, improve efficiency, and provide a more personalized and convenient service.

Digital Tools and Platforms

State Farm offers a comprehensive suite of digital tools and platforms designed to make insurance management easier for customers. These tools allow policyholders to access their insurance information, manage their policies, file claims, and connect with customer support representatives all from the comfort of their homes.

- State Farm Mobile App: This app provides a convenient way for customers to access their insurance information, make payments, file claims, find nearby agents, and get roadside assistance. It also features interactive tools like a claims tracker and a vehicle damage estimator.

- State Farm Website: The State Farm website offers a wide range of online services, including policy management, quote requests, claims filing, and access to educational resources. Customers can also use the website to find local agents and explore various insurance products.

- Virtual Assistant: State Farm has integrated a virtual assistant into its digital platforms, allowing customers to get quick answers to their questions and complete basic tasks without having to speak to a representative.

Commitment to Innovation

State Farm is constantly looking for ways to improve its services through innovation. The company has a dedicated team of engineers and developers who are constantly working on new technologies and solutions to enhance the customer experience.

- Telematics: State Farm offers Drive Safe & Save, a telematics program that uses a device plugged into the vehicle to track driving habits and provide personalized feedback. This program can help customers improve their driving skills and potentially earn discounts on their insurance premiums.

- Artificial Intelligence (AI): State Farm is using AI to automate tasks, improve accuracy, and personalize customer interactions. For example, AI-powered chatbots can assist customers with basic inquiries and claims filing, while AI algorithms can help identify potential fraud and streamline the claims process.

- Blockchain Technology: State Farm is exploring the potential of blockchain technology to enhance security, transparency, and efficiency in its operations. For instance, blockchain could be used to streamline the claims process by providing a secure and tamper-proof record of transactions.

Reputation and Brand Perception

State Farm is one of the most recognized and trusted insurance brands in the United States, known for its strong reputation and positive brand perception. This reputation is built on a foundation of consistent customer satisfaction, effective marketing campaigns, and a commitment to providing quality insurance products and services.

Factors Contributing to State Farm’s Brand Perception

The positive perception of State Farm is a result of several key factors:

- Strong Marketing Campaigns: State Farm has a long history of memorable and effective marketing campaigns, often featuring iconic characters like Jake from State Farm and the State Farm agents. These campaigns have helped to create a sense of familiarity and trust among consumers. For example, the “Like a Good Neighbor” campaign has been running for decades and is widely recognized by consumers. It emphasizes the company’s commitment to being there for customers in their time of need.

- High Customer Satisfaction: State Farm consistently ranks high in customer satisfaction surveys. This is attributed to factors such as responsive customer service, efficient claims processing, and a focus on providing personalized insurance solutions. For example, in the J.D. Power 2023 U.S. Auto Insurance Satisfaction Study, State Farm ranked second overall, demonstrating its strong commitment to customer satisfaction.

- Industry Awards and Recognition: State Farm has received numerous awards and recognitions for its financial stability, customer service, and innovation. This recognition further reinforces the company’s reputation as a reliable and trustworthy insurance provider. For example, State Farm has been named one of the “World’s Most Ethical Companies” by Ethisphere Institute for several years, showcasing its commitment to ethical business practices.

Industry Trends and Future Outlook

The auto insurance industry is constantly evolving, driven by technological advancements, shifting customer expectations, and evolving regulatory landscapes. State Farm, a leading insurer, is actively adapting to these trends to maintain its competitive edge and position itself for future success.

Technological Advancements

Technological advancements are profoundly impacting the auto insurance industry, leading to new opportunities and challenges.

- Telematics: Telematics devices and smartphone apps collect data on driving behavior, allowing insurers to offer personalized rates based on individual risk profiles. State Farm’s Drive Safe & Save program utilizes telematics to reward safe drivers with discounts.

- Artificial Intelligence (AI): AI is being used for tasks such as fraud detection, claims processing, and customer service. State Farm is leveraging AI to streamline its operations and improve customer experience.

- Autonomous Vehicles: The emergence of autonomous vehicles is expected to significantly disrupt the auto insurance industry. State Farm is actively researching and developing insurance products for self-driving cars.

Changing Customer Expectations

Customers are demanding more personalized, convenient, and digital-centric insurance experiences.

- Digital-First Experiences: Customers expect to be able to manage their insurance policies online or through mobile apps. State Farm has invested heavily in its digital platforms to provide a seamless customer experience.

- Personalized Service: Customers want insurance products and services tailored to their individual needs. State Farm offers a range of coverage options and discounts to meet diverse customer requirements.

- Transparency and Communication: Customers expect clear and concise communication from their insurers. State Farm is committed to providing transparent and timely information to its policyholders.

Regulatory Changes

Regulatory changes are impacting the auto insurance industry, driving new requirements and influencing pricing models.

- Data Privacy Regulations: Regulations like the General Data Protection Regulation (GDPR) are raising concerns about data privacy and security. State Farm is ensuring compliance with these regulations to protect customer data.

- Climate Change: The increasing frequency and severity of weather events are impacting insurance premiums. State Farm is adjusting its pricing models to reflect these risks.

- Ride-Sharing and Mobility Services: The rise of ride-sharing and mobility services is challenging traditional insurance models. State Farm is exploring new coverage options for these services.

Last Recap

In conclusion, State Farm Auto Insurance stands as a major player in the industry, boasting a rich history, diverse product offerings, and a commitment to customer satisfaction. Their focus on technology and innovation ensures they remain competitive and adaptable to the evolving needs of the modern driver. Whether you’re a seasoned driver or a first-time policyholder, understanding the ins and outs of State Farm’s offerings can empower you to make informed choices and secure the coverage that best suits your needs.

FAQ Resource

What are the main types of auto insurance coverage offered by State Farm?

State Farm offers a range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How can I get a quote for State Farm auto insurance?

You can get a quote online, through the State Farm mobile app, by calling an agent, or by visiting a local State Farm office.

What factors affect my auto insurance premium with State Farm?

Factors that influence your premium include your driving record, vehicle type, location, age, and credit score.

Does State Farm offer discounts on auto insurance?

Yes, State Farm offers various discounts, such as good driver discounts, safe driver discounts, multi-policy discounts, and more.

How do I file a claim with State Farm?

You can file a claim online, through the State Farm mobile app, by calling an agent, or by visiting a local State Farm office.