Sr 22 insurance washington state – SR-22 insurance in Washington State is a crucial requirement for drivers who have been convicted of certain traffic offenses or who have had their driving privileges revoked. This type of insurance serves as proof of financial responsibility, ensuring that drivers can cover the costs of any accidents or damages they may cause. Understanding the purpose, requirements, and implications of SR-22 insurance is essential for drivers in Washington State, as failure to comply can result in severe penalties.

This comprehensive guide delves into the intricacies of SR-22 insurance in Washington State, providing valuable insights into obtaining, maintaining, and managing this type of coverage. From understanding the specific requirements and factors influencing costs to exploring strategies for reducing premiums, this resource aims to equip drivers with the knowledge they need to navigate the complexities of SR-22 insurance.

SR-22 Insurance in Washington State

SR-22 insurance is a form of financial responsibility insurance required by the Washington State Department of Licensing (DOL) for certain drivers. This insurance acts as a guarantee that you will be able to pay for any damages or injuries you cause in an accident.

Purpose of SR-22 Insurance

SR-22 insurance serves as a financial responsibility guarantee, ensuring that drivers who have been convicted of certain driving offenses or who have a history of high-risk driving behavior can pay for any damages or injuries they cause in an accident. This insurance provides a safety net for the public and helps to ensure that individuals who pose a higher risk on the road are held accountable for their actions.

Who Needs SR-22 Insurance

The Washington State Department of Licensing (DOL) requires drivers to carry SR-22 insurance in specific situations. These situations typically involve individuals who have been convicted of serious driving offenses, such as:

- Driving Under the Influence (DUI) or Driving While Intoxicated (DWI)

- Hit and Run Accidents

- Reckless Driving

- Multiple Traffic Violations

- Driving without a valid license or insurance

The DOL may also require SR-22 insurance if a driver has been involved in multiple accidents, has a history of insurance cancellations, or has been deemed a high-risk driver.

Consequences of Driving Without SR-22 Insurance

Driving without SR-22 insurance in Washington State can have serious consequences, including:

- Suspension of Driving Privileges: The DOL can suspend your driver’s license if you fail to maintain SR-22 insurance. This suspension can last until you provide proof of SR-22 coverage.

- Fines and Penalties: You may be subject to fines and penalties for driving without SR-22 insurance. The amount of these fines can vary depending on the severity of the offense.

- Jail Time: In some cases, driving without SR-22 insurance can lead to jail time, especially if you are convicted of a serious driving offense.

- Higher Insurance Premiums: Even after obtaining SR-22 insurance, you may face higher insurance premiums for several years.

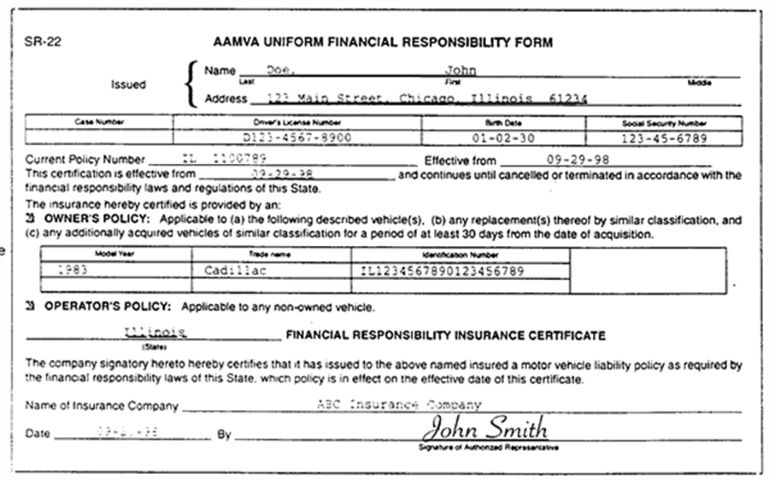

It is crucial to understand that SR-22 insurance is not a separate policy but rather a certificate filed with the DOL by your insurance company, indicating that you have the required financial responsibility coverage.

Obtaining SR-22 Insurance: Sr 22 Insurance Washington State

Getting SR-22 insurance in Washington State is a crucial step after being convicted of a traffic violation that requires it. It serves as proof to the state that you have the required liability insurance coverage.

The Process of Obtaining SR-22 Insurance

The process of obtaining SR-22 insurance typically involves the following steps:

- Contact an insurance provider: Start by contacting an insurance company that offers SR-22 insurance. Many insurance companies in Washington State provide this type of coverage.

- Provide required information: The insurance company will request information about your driving history, including the specific traffic violation that necessitates SR-22 insurance.

- Complete the SR-22 form: The insurance company will file an SR-22 form with the Washington State Department of Licensing (DOL) on your behalf. This form confirms that you have the required insurance coverage.

- Pay the premium: You’ll need to pay the premium for your SR-22 insurance policy. The cost can vary depending on factors such as your driving history, the type of violation, and the coverage limits you choose.

- Maintain continuous coverage: It’s essential to maintain continuous SR-22 insurance coverage for the required period. If your coverage lapses, you may face penalties, such as fines or license suspension.

Comparing Insurance Providers

It’s wise to compare different insurance providers to find the best SR-22 insurance policy for your needs. Here’s a breakdown of factors to consider:

- Premium rates: Compare premium rates from different insurance companies to find the most affordable option.

- Coverage options: Ensure the insurance provider offers the required coverage limits and any additional coverage you may need.

- Customer service: Research the company’s reputation for customer service and responsiveness.

- Financial stability: Consider the insurance company’s financial stability to ensure they’ll be able to pay claims in the future.

Tips for Finding Affordable SR-22 Insurance

Here are some strategies to help you find affordable SR-22 insurance in Washington State:

- Shop around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Improve your driving record: A clean driving record can significantly reduce your insurance premiums.

- Consider bundling policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Take a defensive driving course: Completing a defensive driving course can sometimes result in a discount on your insurance premiums.

- Ask about discounts: Inquire about any available discounts, such as good student discounts, safe driver discounts, or discounts for having multiple vehicles insured with the same company.

SR-22 Insurance Requirements

In Washington State, the Department of Licensing (DOL) mandates SR-22 insurance for drivers who have been convicted of certain traffic offenses. This requirement ensures that drivers with a history of risky driving behavior maintain financial responsibility to cover potential damages caused by accidents.

Minimum Coverage Amounts

The minimum coverage amounts required for SR-22 insurance in Washington State are the same as the state’s minimum liability insurance requirements. These amounts ensure that drivers have sufficient financial protection to cover damages to other people and their property in case of an accident. The minimum coverage amounts are:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

It’s important to note that these are minimum requirements, and drivers may choose to purchase higher coverage limits to provide more comprehensive protection.

Duration of SR-22 Requirement

The duration of the SR-22 requirement depends on the specific traffic offense that triggered it. The DOL sets the duration based on the severity of the offense and the driver’s driving history. For example, a driver convicted of a DUI may be required to maintain SR-22 insurance for three years, while a driver convicted of a speeding ticket may only need it for one year.

The DOL will notify the driver when the SR-22 requirement expires. It is crucial to maintain continuous coverage for the entire duration of the requirement. Failure to do so can result in fines, license suspension, or even revocation.

SR-22 Insurance Costs

The cost of SR-22 insurance in Washington State can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially save money on your insurance premiums.

Factors Influencing SR-22 Insurance Costs

Several factors can influence the cost of SR-22 insurance in Washington State. These factors include:

- Driving History: Your driving history is a major factor in determining your insurance premiums. A history of traffic violations, accidents, or DUI convictions will significantly increase your SR-22 insurance costs.

- Age and Gender: Insurance companies often consider age and gender when setting rates. Younger drivers, especially males, typically pay higher premiums due to their higher risk of accidents.

- Vehicle Type: The type of vehicle you drive also affects your insurance rates. Sports cars and high-performance vehicles are generally more expensive to insure than sedans or SUVs.

- Location: Where you live can influence your insurance costs. Areas with higher crime rates or a greater frequency of accidents tend to have higher insurance premiums.

- Credit Score: Surprisingly, your credit score can also impact your insurance rates. Insurers use credit scores as an indicator of financial responsibility. A lower credit score may result in higher premiums.

- Insurance Company: Different insurance companies have different rating systems and pricing structures. It’s essential to compare quotes from multiple insurers to find the best rates for your situation.

Average Cost of SR-22 Insurance in Washington State

The average cost of SR-22 insurance in Washington State can vary widely, but it’s generally higher than standard car insurance. A study by the Insurance Information Institute (III) found that the average cost of SR-22 insurance in Washington State was around $1,500 per year. However, individual costs can range from $500 to $3,000 or more, depending on the factors mentioned above.

Comparing SR-22 Insurance Costs in Washington State with Other States, Sr 22 insurance washington state

Washington State’s SR-22 insurance costs are generally in line with the national average. According to the III, the average cost of SR-22 insurance across the United States is around $1,600 per year. However, some states, like Florida and California, tend to have higher average costs due to factors such as a higher volume of traffic and accidents.

Strategies for Lowering SR-22 Insurance Costs

While SR-22 insurance costs are generally higher than standard car insurance, there are several strategies you can employ to potentially lower your premiums:

- Improve Your Driving Record: Avoid traffic violations, accidents, and DUI convictions. A clean driving record will significantly improve your insurance rates.

- Shop Around for Quotes: Get quotes from multiple insurance companies to compare rates and find the best deal.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Maintain a Good Credit Score: A good credit score can help you qualify for lower insurance rates.

- Take Defensive Driving Courses: Completing defensive driving courses can demonstrate your commitment to safe driving and potentially earn you discounts on your insurance premiums.

- Consider a Higher Deductible: Choosing a higher deductible can lower your monthly premiums. However, you’ll be responsible for paying more out-of-pocket in case of an accident.

- Maintain a Safe Driving Environment: Ensure your vehicle is properly maintained and that you’re driving defensively. Safe driving habits can help prevent accidents and lower your insurance costs.

SR-22 Insurance and Driving Record

Your driving record is a crucial factor in determining the cost of SR-22 insurance in Washington State. Insurance companies carefully evaluate your driving history to assess the risk you pose as a driver.

Impact of Traffic Violations and Accidents

Traffic violations and accidents significantly impact your SR-22 insurance premiums. Each violation or accident adds to your risk profile, leading to higher premiums.

For instance, a DUI conviction can result in a substantial increase in your SR-22 insurance costs, as it indicates a higher likelihood of future accidents.

Here’s a breakdown of how different traffic violations and accidents affect SR-22 insurance premiums:

- Moving violations: Speeding tickets, reckless driving, and other moving violations can lead to increased premiums. The severity of the violation and the frequency of violations influence the premium increase.

- Accidents: Accidents, even those not resulting in a ticket, can increase your SR-22 insurance costs. The severity of the accident, the number of accidents, and the driver’s fault play a role in determining the premium increase.

- DUI/DWI: DUI/DWI convictions have the most significant impact on SR-22 insurance premiums. These convictions indicate a high-risk driver and can result in substantial premium increases, sometimes even exceeding 100%.

Improving Your Driving Record

Maintaining a clean driving record is crucial for reducing your SR-22 insurance costs. Here are some tips to improve your driving record:

- Avoid traffic violations: Adhering to traffic laws and driving safely reduces your risk of receiving tickets. This helps maintain a clean driving record and lowers your SR-22 insurance premiums.

- Take defensive driving courses: Completing a defensive driving course can demonstrate to insurance companies your commitment to safe driving. Some insurance companies may offer discounts for completing such courses.

- Maintain a safe driving history: Consistent safe driving behavior over time helps build a good driving record, leading to lower SR-22 insurance premiums.

SR-22 Insurance and Financial Responsibility

SR-22 insurance is more than just a document; it’s a crucial component of fulfilling your financial responsibility as a driver in Washington State. This insurance acts as proof that you’re financially prepared to cover the costs associated with any accidents you might cause. By obtaining SR-22 insurance, you demonstrate to the state that you’re taking responsibility for your driving record and are committed to protecting yourself and others on the road.

SR-22 Insurance and Accident Protection

SR-22 insurance serves as a safety net for both you and other parties involved in an accident. In the event of an accident, your SR-22 insurance policy guarantees that you have sufficient coverage to handle the financial repercussions, including:

- Medical expenses: Your SR-22 insurance policy covers medical bills for injuries sustained by you or others involved in the accident.

- Property damage: If you cause damage to another vehicle or property, your SR-22 insurance will cover the repair or replacement costs.

- Lost wages: If you or someone else is unable to work due to injuries sustained in the accident, your SR-22 insurance policy may cover lost wages.

- Legal fees: If you’re sued as a result of the accident, your SR-22 insurance will cover legal fees associated with defending yourself against the lawsuit.

Consequences of Failing to Meet Financial Responsibility Requirements

Failing to maintain SR-22 insurance or meet financial responsibility requirements in Washington State can have serious consequences. These consequences include:

- License suspension: The Washington State Department of Licensing (DOL) can suspend your driver’s license if you fail to maintain SR-22 insurance. You’ll be unable to legally drive until you comply with the requirements.

- Fines and penalties: The DOL can impose fines and penalties for failing to maintain SR-22 insurance. These penalties can be substantial and can add up quickly.

- Increased insurance premiums: Even after you’ve met the requirements and your license is reinstated, your insurance premiums may be significantly higher than they were before. This is because insurance companies view drivers with a history of driving violations as higher risks.

- Difficulty obtaining insurance: Some insurance companies may be hesitant to insure you if you have a history of driving violations and have previously failed to meet financial responsibility requirements.

Outcome Summary

SR-22 insurance in Washington State is a vital aspect of responsible driving. By understanding the purpose, requirements, and implications of this insurance, drivers can ensure they meet their financial obligations and maintain their driving privileges. Whether you’re newly required to obtain SR-22 insurance or seeking ways to manage its costs, this guide has provided valuable insights to navigate this process successfully. Remember to consult with insurance providers and the Washington State Department of Licensing for the most up-to-date information and personalized guidance.

Frequently Asked Questions

How long do I need to carry SR-22 insurance in Washington State?

The duration of the SR-22 requirement varies depending on the specific offense or reason for its imposition. Typically, it can range from one to three years. Contact the Washington State Department of Licensing for details related to your specific case.

What happens if I cancel my SR-22 insurance before the required period?

Canceling SR-22 insurance before the required period can result in penalties, including fines, license suspension, or even revocation. It’s crucial to maintain your SR-22 coverage for the duration specified by the Washington State Department of Licensing.

Can I get SR-22 insurance even if I have a poor driving record?

While a poor driving record may increase your premiums, most insurance providers offer SR-22 insurance. However, it’s important to shop around and compare quotes from different insurers to find the most affordable option. Be prepared to provide details of your driving history and any past offenses.

What are some tips for finding affordable SR-22 insurance in Washington State?

To find affordable SR-22 insurance, consider the following tips: shop around and compare quotes from multiple insurance providers, maintain a good driving record, consider increasing your deductible, bundle your insurance policies, and inquire about discounts for safe driving or other factors.