Lemonade auto insurance states represent a key aspect of this innovative company’s growth and reach. Lemonade, known for its tech-forward approach and user-friendly platform, has disrupted the traditional insurance industry by offering a more streamlined and transparent experience. This article delves into the states where Lemonade operates, exploring its expansion strategy and the factors influencing its presence in specific regions.

Lemonade’s unique business model, centered on AI-powered technology and a focus on customer satisfaction, has attracted a growing number of policyholders. The company’s digital-first approach allows for quick quotes, seamless online claims processing, and a chatbot-driven customer service experience. This focus on efficiency and transparency has contributed to Lemonade’s success, making it a compelling alternative to traditional insurance companies in the states where it operates.

Lemonade Auto Insurance Overview

Lemonade is an insurance company that leverages technology to offer a unique and user-friendly insurance experience. Unlike traditional insurance companies, Lemonade operates with a streamlined, digital-first approach, making the entire process, from application to claims, fast and convenient.

Lemonade’s Business Model

Lemonade’s business model is based on a combination of technology, artificial intelligence, and a unique “give-back” approach.

- AI-Powered Chatbot: Lemonade uses an AI-powered chatbot called “Jim” to handle customer interactions, answer questions, and even process claims. This chatbot allows for 24/7 customer support and instant responses.

- Simplified Application Process: The application process is entirely online and can be completed within minutes. Customers can get a quote and purchase a policy using their mobile device.

- Instant Claims Processing: Lemonade uses AI to quickly assess and approve claims, often within seconds. Customers can file claims through the app and receive payouts instantly in many cases.

- Give-Back Program: Lemonade donates a portion of its profits to charitable causes selected by its policyholders. This gives customers a sense of purpose and social responsibility.

Lemonade’s Target Audience

Lemonade’s target audience is primarily millennials and Gen Z who are tech-savvy, value convenience, and seek transparency in their insurance options.

- Tech-Savvy Consumers: Lemonade’s digital-first approach appeals to consumers who prefer online interactions and mobile-friendly experiences.

- Time-Conscious Individuals: The fast and efficient claims process is attractive to people who want a quick and hassle-free experience.

- Socially Conscious Consumers: Lemonade’s give-back program resonates with individuals who want to make a positive impact through their insurance choices.

Lemonade’s Growth and Customer Satisfaction

Lemonade has experienced significant growth since its inception in 2015.

- Rapid Expansion: Lemonade has expanded its operations to several states in the US and has plans to continue its growth trajectory.

- Strong Customer Retention: Lemonade boasts a high customer retention rate, indicating customer satisfaction with its services.

- Positive Reviews: Lemonade has received generally positive reviews from customers, with praise for its user-friendly platform and efficient claims processing.

States Where Lemonade Operates

Lemonade, a tech-driven insurance company, is currently available in a growing number of states across the United States. The company’s expansion strategy is driven by factors such as market size, regulatory environment, and potential for growth.

Lemonade’s State Availability

The following table provides a list of states where Lemonade offers auto insurance:

| State | Lemonade Availability |

|---|---|

| Arizona | Yes |

| California | Yes |

| Colorado | Yes |

| Connecticut | Yes |

| Georgia | Yes |

| Illinois | Yes |

| Indiana | Yes |

| Iowa | Yes |

| Kentucky | Yes |

| Maryland | Yes |

| Massachusetts | Yes |

| Michigan | Yes |

| Minnesota | Yes |

| Missouri | Yes |

| Nebraska | Yes |

| New Hampshire | Yes |

| New Jersey | Yes |

| New Mexico | Yes |

| New York | Yes |

| North Carolina | Yes |

| Ohio | Yes |

| Oklahoma | Yes |

| Oregon | Yes |

| Pennsylvania | Yes |

| Rhode Island | Yes |

| South Carolina | Yes |

| Tennessee | Yes |

| Texas | Yes |

| Utah | Yes |

| Vermont | Yes |

| Virginia | Yes |

| Washington | Yes |

| Wisconsin | Yes |

Factors Influencing Lemonade’s Expansion

Lemonade’s expansion strategy is influenced by several factors, including:

* Market Size and Growth Potential: Lemonade prioritizes states with large populations and a growing auto insurance market. For example, California, Texas, and New York are among the largest auto insurance markets in the United States.

* Regulatory Environment: Lemonade seeks states with a regulatory environment that is conducive to its business model, which emphasizes technology and customer-centricity. The company prefers states with a regulatory framework that allows for innovation and flexibility.

* Competition: Lemonade assesses the competitive landscape in each state, considering the presence of established insurers and the potential for differentiation. The company aims to enter markets where it can offer a unique value proposition to consumers.

Regulatory Environment for Insurance in Lemonade’s Operating States

The regulatory environment for insurance varies significantly across the United States. States have different laws and regulations governing insurance companies, including licensing requirements, pricing practices, and consumer protection measures.

* Licensing Requirements: Each state has its own licensing requirements for insurance companies, which may include financial stability tests, background checks on executives, and compliance with state insurance codes.

* Pricing Practices: States regulate insurance pricing practices to ensure fairness and prevent discrimination. This includes rules on how insurers can set rates based on factors such as age, driving history, and vehicle type.

* Consumer Protection Measures: States have consumer protection laws that aim to safeguard policyholders’ rights and interests. These laws may include provisions on policy cancellation, claims handling, and dispute resolution.

Lemonade’s ability to operate in a particular state depends on its compliance with the state’s insurance regulations. The company must obtain the necessary licenses and approvals and adhere to all applicable laws and rules.

Lemonade’s Auto Insurance Offerings: Lemonade Auto Insurance States

Lemonade offers a comprehensive range of auto insurance coverage designed to protect you and your vehicle in case of accidents, theft, or other unforeseen events. Their policies include essential coverages as well as optional add-ons, allowing you to customize your policy to meet your specific needs.

Types of Auto Insurance Coverage

Lemonade provides a variety of auto insurance coverages, including:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-collision events, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, available in some states, helps pay for your medical expenses and lost wages if you are injured in an accident, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged and needs repairs.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Lemonade’s Auto Insurance Rates Compared to Traditional Insurers

Lemonade’s auto insurance rates are generally competitive with those of traditional insurers. However, rates can vary significantly based on factors such as your driving history, location, vehicle type, and coverage options.

In some cases, Lemonade may offer lower rates than traditional insurers, especially for drivers with clean driving records and good credit scores.

To get an accurate comparison of Lemonade’s rates, it’s best to get quotes from multiple insurers, including Lemonade and traditional insurers, and compare them side-by-side.

Lemonade’s Auto Insurance Premiums

Lemonade’s auto insurance premiums are calculated based on a variety of factors, including:

- Driving History: Your driving record, including accidents, violations, and driving experience, is a major factor in determining your premium.

- Location: Your location, including the state and zip code, can affect your premium due to differences in traffic density, accident rates, and other factors.

- Vehicle Type: The make, model, year, and value of your vehicle influence your premium. Higher-value vehicles generally have higher premiums.

- Coverage Options: The type and amount of coverage you choose will impact your premium. More comprehensive coverage usually means higher premiums.

- Credit Score: In some states, your credit score can be considered when calculating your premium. A higher credit score generally leads to lower premiums.

Lemonade’s Auto Insurance Discounts

Lemonade offers various discounts to help lower your premiums, such as:

- Safe Driving Discounts: These discounts are offered to drivers with clean driving records, such as those who haven’t had any accidents or violations in a certain period.

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing.

- Multi-Policy Discount: You can save money by bundling your auto insurance with other Lemonade insurance policies, such as renters or homeowners insurance.

- Telematics Discount: Some states offer discounts for using a telematics device that tracks your driving habits and provides feedback on your driving behavior.

Lemonade’s Customer Experience

Lemonade’s customer experience is a key differentiator for the company, as it aims to provide a seamless and enjoyable experience for its policyholders. The company’s digital-first approach, coupled with its innovative use of technology, has garnered significant attention and praise from both customers and industry experts.

Lemonade’s Digital-First Approach

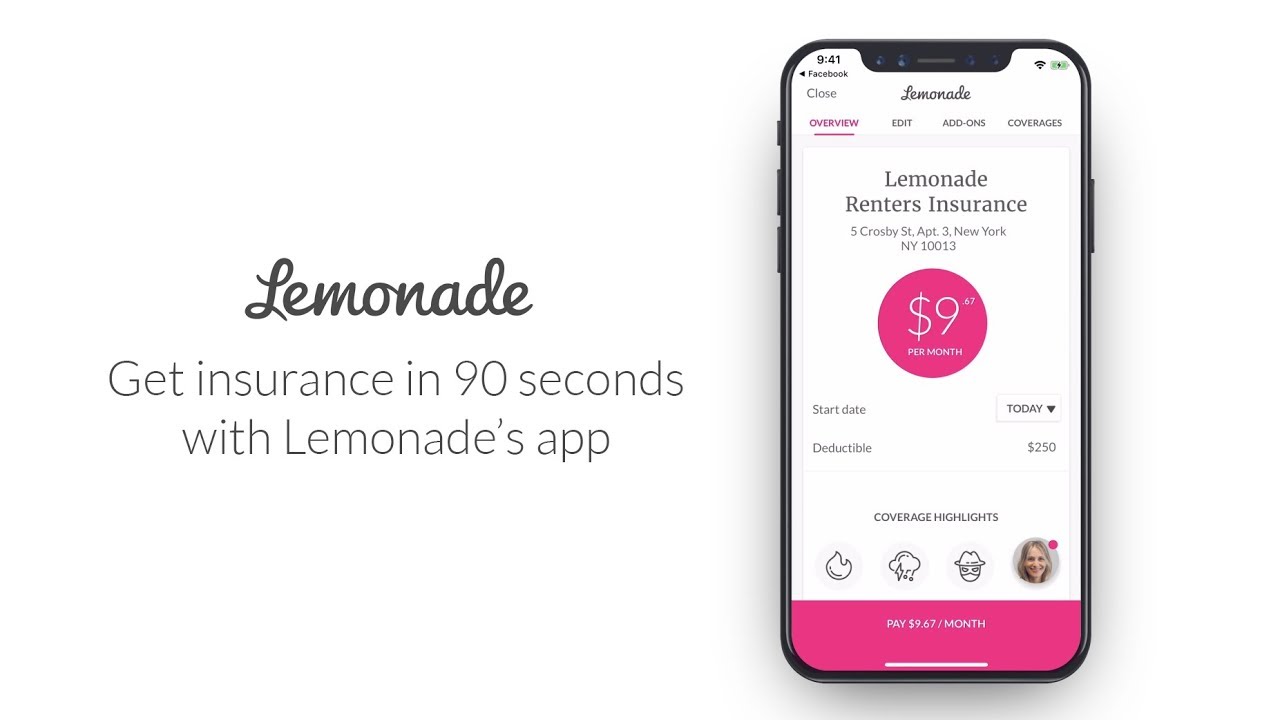

Lemonade’s digital-first approach is evident in every aspect of its customer experience. The company’s mobile app is the central hub for all interactions, from obtaining quotes and purchasing policies to filing claims and managing account information. The app’s intuitive design and user-friendly interface make it easy for customers to navigate and complete tasks quickly.

- Mobile App: Lemonade’s mobile app is the primary platform for interacting with the company. It allows users to get quotes, purchase policies, manage their accounts, and file claims, all within the app. The app is designed to be user-friendly and intuitive, with a focus on providing a seamless and enjoyable experience. The app’s features include:

- Real-time policy management

- Instant claims filing

- Chatbot assistance

- Personalized policy recommendations

- 24/7 access to account information

- Chatbot: Lemonade’s chatbot, known as “AI Jim,” is a key component of the company’s digital-first approach. AI Jim is available 24/7 to answer customer questions, provide support, and guide them through various processes, such as filing claims or updating policy information. The chatbot’s ability to understand natural language and provide accurate and timely responses makes it a valuable tool for customers.

- Online Claims Process: Lemonade’s claims process is completely digital. Customers can file claims through the mobile app or website, providing all necessary information and supporting documentation. Lemonade’s AI-powered claims processing system then reviews the claim and makes a decision within seconds for most claims. If additional information is required, the company’s customer support team will reach out to the customer.

Customer Reviews and Testimonials

Lemonade has received generally positive customer reviews and testimonials, with many customers praising the company’s user-friendly app, quick claims processing, and excellent customer service. Customers appreciate the transparency and efficiency of Lemonade’s digital-first approach, which contrasts sharply with the traditional, often cumbersome, processes of many other insurance companies. On popular review platforms like Trustpilot, Lemonade has an average rating of 4.5 out of 5 stars, with many customers highlighting the company’s ease of use, quick claims processing, and excellent customer service.

Lemonade’s Customer Experience Compared to Traditional Insurers

Lemonade’s customer experience stands out from traditional insurers in several key ways. Traditional insurers often rely on complex paper-based processes, long wait times, and limited digital options. Lemonade, on the other hand, has embraced a fully digital approach, offering customers a streamlined and convenient experience. The company’s mobile app, chatbot, and online claims process are all designed to make insurance more accessible and efficient. This digital-first approach has allowed Lemonade to reduce overhead costs, which it passes on to customers in the form of lower premiums.

- Digital-First Approach: Lemonade’s digital-first approach contrasts sharply with the traditional, often cumbersome, processes of many other insurance companies. Traditional insurers often rely on complex paper-based processes, long wait times, and limited digital options. Lemonade’s digital-first approach offers customers a streamlined and convenient experience.

- Transparency and Efficiency: Lemonade’s digital-first approach makes the insurance process more transparent and efficient. Customers can easily track their policies, file claims, and manage their accounts online. The company’s AI-powered claims processing system allows for quick and efficient claims resolution.

- Customer Service: Lemonade’s customer service is highly rated by customers. The company’s chatbot, AI Jim, is available 24/7 to answer customer questions and provide support. Lemonade also offers a dedicated customer support team that is available to assist customers with more complex issues.

Lemonade’s Impact on the Auto Insurance Industry

Lemonade’s entry into the auto insurance market has shaken up the traditional industry, challenging established players with its innovative approach and technology-driven platform. The company’s disruptive model, characterized by its user-friendly digital experience, AI-powered claims processing, and philanthropic mission, has garnered significant attention and sparked debate about the future of insurance.

Impact on Traditional Insurance Companies

Lemonade’s success has forced traditional insurance companies to re-evaluate their strategies and adapt to the changing landscape. Here are some key impacts:

- Increased Competition: Lemonade’s competitive pricing and streamlined customer experience have put pressure on traditional insurers to offer more attractive rates and improve their digital offerings.

- Focus on Digital Transformation: The rise of Lemonade has accelerated the adoption of digital technologies by traditional insurance companies. Many have invested in developing their own online platforms and mobile apps to enhance customer convenience and efficiency.

- Shift in Customer Expectations: Lemonade’s emphasis on transparency and customer satisfaction has raised the bar for the entire industry. Traditional insurers are now expected to provide similar levels of service and responsiveness.

The Future of Lemonade, Lemonade auto insurance states

Lemonade’s future growth hinges on its ability to continue innovating and expanding its product offerings. Key factors include:

- Expanding into New Markets: Lemonade is actively seeking to expand its geographic reach, targeting new markets with its digital-first approach.

- Developing New Products: The company is exploring opportunities to expand beyond auto insurance, potentially venturing into other lines of insurance like homeowners, renters, and health insurance.

- Leveraging AI and Data: Lemonade’s success is tied to its ability to leverage AI and data to personalize pricing, improve claims processing, and enhance customer experience.

Implications for Consumers and the Broader Insurance Landscape

Lemonade’s success has significant implications for consumers and the broader insurance landscape:

- Increased Consumer Choice: Lemonade provides consumers with an alternative to traditional insurance companies, offering greater choice and flexibility.

- Improved Customer Experience: Lemonade’s focus on digital convenience and transparency has set a new standard for customer experience in the insurance industry.

- Potential for Lower Premiums: Lemonade’s efficient operations and use of technology have the potential to drive down premiums for consumers.

Closure

Lemonade’s expansion into new states reflects its commitment to expanding its reach and providing its innovative insurance solutions to a wider audience. As the company continues to grow and refine its offerings, it’s poised to play a significant role in shaping the future of the insurance industry. Whether you’re seeking affordable rates, a convenient digital experience, or a company committed to social impact, Lemonade’s presence in specific states could be a game-changer for your insurance needs.

Expert Answers

What are Lemonade’s main competitors in the states where it operates?

Lemonade competes with established insurance companies like Geico, Progressive, State Farm, and Allstate in the states where it operates. It also faces competition from other newer, tech-focused insurers like Root and Metromile.

Does Lemonade offer discounts on auto insurance?

Yes, Lemonade offers various discounts on auto insurance, including discounts for good driving records, multiple policyholders, safety features, and more. The specific discounts available may vary depending on the state.

How can I contact Lemonade customer service?

You can contact Lemonade customer service through its mobile app, website, or by phone. They also offer a chatbot for quick assistance.