Homeowners insurance quotes state farm – Homeowners insurance quotes from State Farm can be a crucial step in securing peace of mind for your property. State Farm, a household name in insurance, offers a range of homeowners insurance policies designed to protect your home and belongings against unforeseen events. Understanding the nuances of their quotes, coverage options, and pricing strategies can help you make an informed decision about your insurance needs.

This guide delves into the world of State Farm homeowners insurance quotes, providing insights into obtaining quotes, factors influencing pricing, coverage details, customer experiences, and tips for saving money. By exploring these aspects, you can gain a comprehensive understanding of State Farm’s offerings and determine if they align with your specific requirements.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States. With a long history of serving customers and a commitment to providing comprehensive coverage, State Farm has earned a reputation for reliability and customer satisfaction. This overview explores the history of State Farm, the types of homeowners insurance policies it offers, and the key features and benefits that make State Farm a popular choice for homeowners.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. The company began by offering auto insurance to farmers in the Midwest. Over the years, State Farm expanded its product offerings to include homeowners insurance, life insurance, and other financial products. Today, State Farm is one of the largest insurance companies in the world, with millions of customers across the United States.

Types of Homeowners Insurance Policies

State Farm offers a variety of homeowners insurance policies to meet the specific needs of different homeowners. These policies are designed to protect homeowners from financial losses due to covered perils, such as fire, theft, and natural disasters. The most common types of homeowners insurance policies offered by State Farm include:

- HO-3 (Special Form): This is the most comprehensive type of homeowners insurance policy. It provides coverage for both named perils and all-risk perils, meaning it covers damage from most events unless specifically excluded. This policy is suitable for most homeowners.

- HO-5 (Comprehensive Form): Similar to the HO-3 policy, the HO-5 policy provides broad coverage for both named perils and all-risk perils. However, it offers additional coverage for personal property, such as valuable collectibles or jewelry.

- HO-8 (Modified Form): This policy provides coverage for named perils only, meaning it only covers damage from specific events listed in the policy. This policy is typically suitable for older homes or homes with limited value.

- HO-4 (Contents Broad Form): This policy is designed for renters and provides coverage for personal property only. It does not cover the dwelling itself.

- HO-6 (Condominium Unit Owners Form): This policy is designed for condominium owners and provides coverage for the unit itself and personal property. It does not cover the common areas of the condominium building.

Key Features and Benefits of State Farm Homeowners Insurance

State Farm homeowners insurance offers several key features and benefits that make it an attractive option for homeowners. These include:

- Comprehensive Coverage: State Farm homeowners insurance policies provide comprehensive coverage for a wide range of perils, including fire, theft, vandalism, and natural disasters. This ensures that homeowners are protected from financial losses due to unexpected events.

- Flexible Coverage Options: State Farm offers a variety of coverage options to meet the specific needs of different homeowners. This allows homeowners to customize their policy to ensure they have the right amount of coverage for their property and personal belongings.

- Competitive Pricing: State Farm is known for offering competitive pricing on its homeowners insurance policies. The company uses a variety of factors to determine premiums, including the location of the home, the age and condition of the property, and the amount of coverage desired.

- Excellent Customer Service: State Farm has a long history of providing excellent customer service. The company has a network of agents across the country who are available to answer questions and provide assistance with claims.

- Financial Stability: State Farm is a financially stable company with a strong track record of paying claims. This provides homeowners with peace of mind knowing that they will be able to recover from a covered loss.

Obtaining Homeowners Insurance Quotes from State Farm

Getting a homeowners insurance quote from State Farm is straightforward and can be done in a few ways. Whether you prefer the convenience of online tools, the personalized touch of a phone call, or the in-depth consultation with an agent, State Farm offers options to suit your preferences.

Methods for Obtaining Quotes

There are three primary ways to obtain homeowners insurance quotes from State Farm:

- Online: State Farm’s website provides a user-friendly platform for obtaining quotes. You can input your information and receive a personalized quote within minutes. This method offers flexibility and allows you to compare quotes at your own pace.

- Phone: You can contact State Farm directly by phone to request a quote. A representative will guide you through the process and answer any questions you may have. This option is suitable for those who prefer a more personalized approach and direct communication.

- Agent: State Farm has a network of agents across the country. You can schedule an appointment with a local agent to discuss your insurance needs and obtain a quote. This method allows for a more in-depth consultation and personalized advice.

Essential Information for Quotes

To receive an accurate homeowners insurance quote from State Farm, you will need to provide the following information:

- Your Personal Information: This includes your name, address, contact information, and date of birth.

- Property Information: This includes the address of your home, the year it was built, the square footage, the type of construction (e.g., brick, wood), and any renovations or additions.

- Coverage Details: You’ll need to specify the desired coverage amounts for different aspects of your home, such as dwelling coverage, personal property coverage, and liability coverage.

- Claim History: State Farm will inquire about your past claims history to assess your risk profile.

- Security Features: Information about security features like alarms, fire sprinklers, or security cameras can influence your premium.

Getting a Quote Through the State Farm Website

Here is a step-by-step guide on how to obtain a homeowners insurance quote through the State Farm website:

- Visit the State Farm website: Go to the official State Farm website.

- Navigate to the Homeowners Insurance section: Look for the “Homeowners Insurance” or “Get a Quote” section on the website.

- Enter your basic information: Provide your name, address, and contact information.

- Describe your property: Input details about your home, including the year built, square footage, and construction type.

- Select your coverage options: Choose the coverage levels you desire for your home and belongings.

- Provide your claim history: Indicate if you have any past claims and provide relevant details.

- Submit your request: Once you have entered all the required information, submit your request for a quote.

- Review your quote: State Farm will provide you with a personalized quote based on the information you provided. You can review the quote and make any necessary adjustments to your coverage choices.

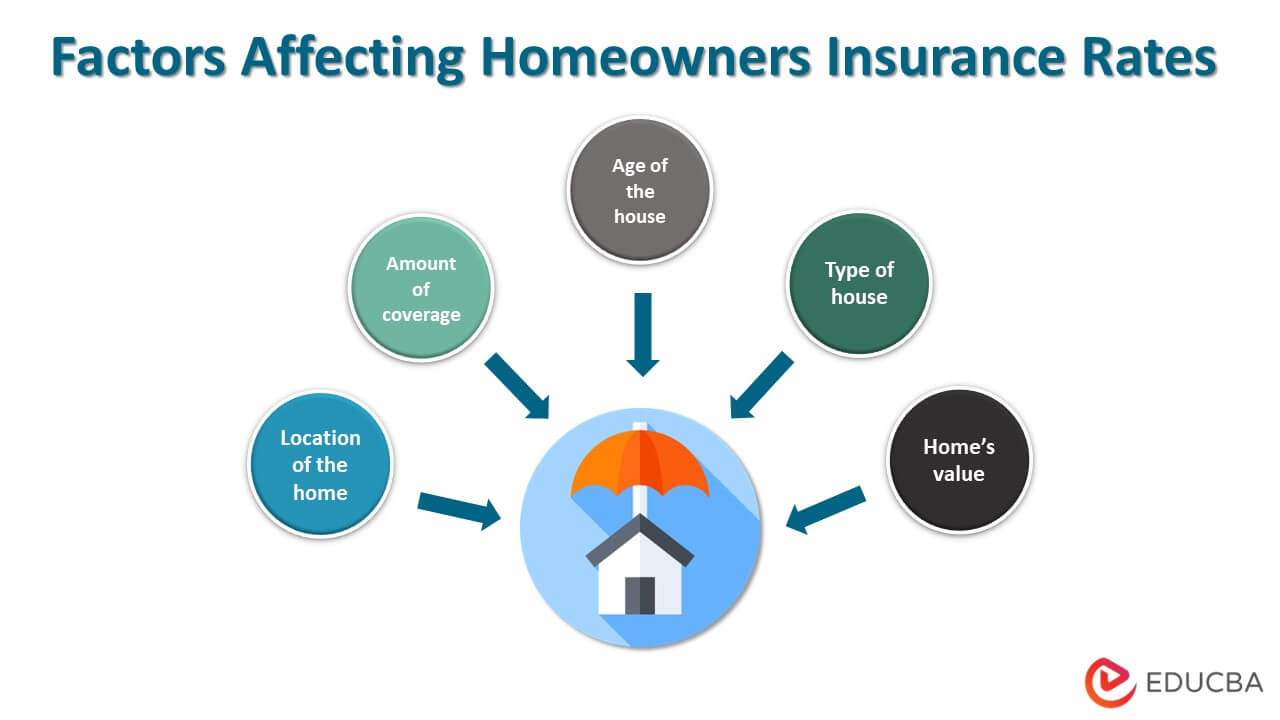

Factors Influencing Homeowners Insurance Quotes

Your homeowners insurance premium is determined by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums. Several key aspects influence the cost of your homeowners insurance, and State Farm considers these factors when calculating your quote.

Location

Your location significantly impacts your homeowners insurance premium. This is due to the likelihood of natural disasters, crime rates, and the cost of rebuilding in your area. Areas prone to earthquakes, hurricanes, floods, or wildfires will generally have higher premiums than those with lower risks.

- Natural Disasters: Areas with a higher risk of natural disasters, such as hurricanes or earthquakes, typically have higher insurance premiums. Insurance companies consider historical data and projections to assess the likelihood of such events and factor this into their pricing. For example, homeowners in coastal areas might pay more due to the increased risk of hurricanes.

- Crime Rates: Areas with higher crime rates tend to have higher homeowners insurance premiums. Insurance companies consider the likelihood of theft or vandalism when determining premiums. Higher crime rates can result in more claims, leading to higher premiums.

- Cost of Rebuilding: The cost of rebuilding your home in a particular location can also impact your insurance premium. Areas with higher construction costs, such as those with high demand for skilled labor or expensive building materials, will generally have higher premiums.

Analyzing State Farm Homeowners Insurance Coverage

Understanding the specific coverage offered by State Farm homeowners insurance is crucial for making an informed decision. This section delves into the core coverages included in a standard policy, along with optional add-ons that can be customized to meet your individual needs.

Standard Homeowners Insurance Coverage

State Farm’s standard homeowners insurance policy provides coverage for a range of perils that could damage your property or cause financial loss. These core coverages are designed to protect your home and belongings from unexpected events.

| Coverage Type | Description | Exclusions | Premium Impact |

|---|---|---|---|

| Dwelling Coverage | Protects your home’s structure, including the attached garage, from damage caused by covered perils such as fire, windstorm, and hail. | Typically excludes damage caused by earthquakes, floods, and wear and tear. | Higher dwelling coverage leads to higher premiums. |

| Other Structures Coverage | Covers detached structures on your property, such as sheds, fences, and detached garages, against covered perils. | Similar exclusions to dwelling coverage, such as earthquakes, floods, and wear and tear. | Increased coverage for other structures results in higher premiums. |

| Personal Property Coverage | Provides coverage for your belongings, including furniture, electronics, clothing, and personal items, against covered perils. | Excludes items not specifically listed on your policy, such as valuables exceeding specific limits, and items not permanently attached to your home. | Higher coverage limits for personal property generally lead to higher premiums. |

| Loss of Use Coverage | Offers financial assistance for additional living expenses incurred if your home becomes uninhabitable due to a covered peril. | Excludes expenses not directly related to your home’s uninhabitability, such as non-essential living expenses. | Higher coverage limits for loss of use generally lead to higher premiums. |

| Liability Coverage | Protects you against financial losses arising from accidents that occur on your property or due to your negligence. | Excludes intentional acts, business-related activities, and certain types of professional liability. | Higher liability limits generally lead to higher premiums. |

Optional Homeowners Insurance Coverage

State Farm offers various optional coverages that can be added to your policy to provide more comprehensive protection. These optional coverages cater to specific risks and circumstances, allowing you to customize your policy based on your individual needs and preferences.

- Flood Insurance: Covers damage caused by flooding, which is typically excluded from standard homeowners insurance policies. It’s essential for homes located in flood-prone areas. Flood insurance is typically provided through the National Flood Insurance Program (NFIP).

- Earthquake Insurance: Protects against damage caused by earthquakes, which are often excluded from standard homeowners policies. It’s crucial for homes located in earthquake-prone regions.

- Personal Liability Umbrella Coverage: Provides additional liability protection beyond the limits of your standard homeowners policy, offering broader coverage for potential claims.

- Scheduled Personal Property Coverage: Offers higher coverage limits for specific valuable items, such as jewelry, artwork, and collectibles, that exceed the standard personal property coverage limits.

Customer Experience and Reviews of State Farm

State Farm is one of the largest and most well-known insurance providers in the United States. Its reputation is built on its long history, widespread network of agents, and extensive advertising campaigns. However, the true measure of any insurance company lies in the experiences of its customers. This section delves into customer reviews and testimonials to understand the strengths and weaknesses of State Farm’s homeowners insurance, particularly in terms of customer service, claims processing, and overall satisfaction.

Customer Service

Customer service is a crucial aspect of the insurance experience, especially during challenging situations like filing a claim. Reviews suggest that State Farm’s customer service is generally considered to be good, with many customers praising the responsiveness and helpfulness of agents and representatives. Positive feedback often highlights the personalized attention provided by local agents, who are familiar with their communities and clients’ specific needs.

- Positive Experiences: Many customers report positive interactions with State Farm agents, describing them as knowledgeable, friendly, and proactive in addressing their concerns. They appreciate the personal touch and the ability to build relationships with their agents.

- Accessibility and Responsiveness: Customers often praise the accessibility of State Farm’s customer service channels, including phone, email, and online chat. They appreciate the quick response times and the ability to reach a representative who can assist them efficiently.

- Problem Resolution: Some customers highlight the effectiveness of State Farm’s customer service in resolving issues. They report positive experiences with claims handling, policy adjustments, and other matters that require customer support.

However, there are also instances of negative customer service experiences. Some customers complain about difficulties in getting through to representatives, long wait times, and inconsistent levels of service. In some cases, customers report feeling frustrated by the lack of personalized attention and the sense of being treated like a number.

Claims Process

The claims process is a critical test of an insurance company’s efficiency and customer focus. State Farm’s claims process is generally regarded as being straightforward and relatively efficient. Customers often appreciate the clear communication, timely processing, and fair settlements offered by the company.

- Transparency and Communication: Customers often praise State Farm’s transparency and communication throughout the claims process. They appreciate the clear explanations of their coverage, the regular updates on the status of their claims, and the prompt responses to their inquiries.

- Efficiency and Timeliness: State Farm’s claims processing is generally considered to be efficient, with customers reporting that their claims are handled promptly and without unnecessary delays. This is particularly important for homeowners who need to get their homes repaired or rebuilt quickly.

- Fair Settlements: Customers generally report that State Farm offers fair settlements for their claims. They appreciate the company’s willingness to work with them to reach an amicable resolution and the transparency in the settlement process.

Despite the generally positive feedback, some customers have reported negative experiences with State Farm’s claims process. These experiences often involve delays in processing, difficulties in reaching representatives, and disagreements over the amount of the settlement.

Overall Satisfaction

Overall, customer satisfaction with State Farm’s homeowners insurance is generally positive. The company’s reputation for reliability, financial stability, and customer service is reflected in the positive reviews and testimonials from many satisfied customers. However, there are also customers who have had negative experiences with the company, particularly in relation to customer service and claims processing. These negative experiences are often attributed to specific agents or representatives, rather than systemic issues within the company.

Comparison with Other Insurance Providers

Comparing State Farm’s customer experience with other major insurance providers is essential for understanding its relative strengths and weaknesses. While State Farm consistently ranks among the top insurance companies in terms of customer satisfaction, its performance varies depending on the specific aspect of the customer experience being considered.

- Customer Service: State Farm’s customer service is generally regarded as being good, but it can be inconsistent depending on the agent or representative. Some customers report positive experiences with the company’s local agents, while others find it difficult to get through to representatives or experience long wait times.

- Claims Process: State Farm’s claims process is generally considered to be efficient and straightforward, with customers often praising the company’s transparency and communication. However, there have been instances of delays in processing, difficulties in reaching representatives, and disagreements over the amount of the settlement.

- Overall Satisfaction: Overall, State Farm is generally considered to be a good insurance provider with a positive reputation for customer satisfaction. However, its performance varies depending on the specific aspect of the customer experience being considered. It is important to consider the individual experiences of customers when making a decision about whether or not to choose State Farm as your insurance provider.

Comparing State Farm Quotes to Competitors: Homeowners Insurance Quotes State Farm

When deciding on homeowners insurance, comparing quotes from different providers is crucial to find the best coverage at the most competitive price. State Farm is a well-known insurer, but it’s essential to consider other options and weigh their offerings against State Farm’s.

This section provides a comparative analysis of homeowners insurance quotes from State Farm and its competitors, highlighting key differences and factors to consider when making your decision.

Comparison of Homeowners Insurance Quotes

To make an informed decision, it’s helpful to compare quotes from various insurers side-by-side. The following table showcases a hypothetical comparison of State Farm’s quotes against three other major providers:

| Insurance Provider | Premium | Coverage Details | Key Features |

|---|---|---|---|

| State Farm | $1,200/year | $250,000 dwelling coverage, $100,000 personal property coverage, $100,000 liability coverage | Discounts for bundling, claims forgiveness, 24/7 customer service |

| Progressive | $1,100/year | $250,000 dwelling coverage, $100,000 personal property coverage, $100,000 liability coverage | Name-your-price tool, discounts for home safety features, online policy management |

| Allstate | $1,300/year | $250,000 dwelling coverage, $100,000 personal property coverage, $100,000 liability coverage | Ride-sharing coverage, identity theft protection, disaster preparedness resources |

| Geico | $1,050/year | $250,000 dwelling coverage, $100,000 personal property coverage, $100,000 liability coverage | Easy online quote process, discounts for good driving records, 24/7 claims service |

It’s important to note that these are hypothetical examples, and actual quotes will vary depending on factors such as your location, home value, coverage options, and individual risk profile.

Advantages and Disadvantages of Choosing State Farm

Advantages:

- Strong financial stability: State Farm is a highly rated insurer with a strong financial track record, providing peace of mind in case of a major claim.

- Wide network of agents: State Farm has a vast network of local agents, offering personalized service and assistance.

- Bundling discounts: State Farm offers discounts for bundling homeowners insurance with other policies, such as auto insurance.

- Claims forgiveness: State Farm’s claims forgiveness program can help you avoid premium increases after a first-time claim.

Disadvantages:

- Potentially higher premiums: In some cases, State Farm’s premiums may be higher compared to competitors.

- Limited online options: While State Farm offers online quotes, some policy management features may require interaction with an agent.

- Varying customer service experiences: Customer service experiences can vary depending on the agent and location.

Tips for Saving on State Farm Homeowners Insurance

Saving money on your homeowners insurance premiums is a smart move. By understanding the factors that influence your rates and implementing some strategies, you can potentially lower your monthly costs and keep more money in your pocket.

Bundling Policies

Bundling your homeowners insurance with other policies, such as auto insurance, can lead to significant discounts. State Farm, like many insurers, offers multi-policy discounts to reward customers for their loyalty and consolidate their coverage. This bundling strategy often results in a more substantial overall discount than you’d receive by purchasing each policy separately.

Increasing Deductibles, Homeowners insurance quotes state farm

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. By increasing your deductible, you agree to take on more financial responsibility in the event of a claim. In exchange for this increased financial responsibility, insurers often offer lower premiums. However, ensure your chosen deductible aligns with your financial situation and ability to cover potential costs.

Making Home Improvements

Investing in home improvements that enhance security and reduce the risk of damage can positively impact your homeowners insurance premiums. Installing security systems, smoke detectors, fire sprinklers, or impact-resistant windows can demonstrate your commitment to safeguarding your property, leading to potential discounts.

Credit Score Impact

Your credit score can surprisingly play a role in determining your homeowners insurance premiums. Insurers may use your credit score as a proxy for assessing your financial responsibility. A higher credit score often indicates a lower risk to insurers, potentially leading to lower premiums.

Claims History

Your claims history is another crucial factor influencing your premiums. Filing numerous claims, especially for minor incidents, can signal to insurers that you are more likely to file future claims. This can result in higher premiums as insurers perceive you as a higher risk. However, if you have a clean claims history, you are likely to receive lower premiums.

Closure

Navigating the world of homeowners insurance can feel overwhelming, but with careful research and a clear understanding of your needs, you can find the right coverage at the right price. State Farm offers a comprehensive suite of homeowners insurance products, and by comparing their quotes to competitors, considering factors like coverage details and customer reviews, you can make an informed decision that protects your home and your financial well-being.

Commonly Asked Questions

How do I get a homeowners insurance quote from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent. Each method requires you to provide information about your home, such as its address, size, and age.

What factors affect my homeowners insurance premium?

Factors like your home’s location, value, coverage options, personal risk factors, credit score, and claims history can influence your premium. State Farm takes these factors into account when calculating your individual quote.

What are the benefits of bundling my homeowners and auto insurance with State Farm?

Bundling your policies with State Farm can often result in discounts, making your insurance more affordable. You can also enjoy the convenience of having all your insurance needs managed by one provider.

How can I improve my homeowners insurance coverage?

You can enhance your coverage by adding optional endorsements, such as flood insurance, earthquake insurance, or personal liability coverage. These additions can provide extra protection for specific risks.