General liability insurance state farm – General liability insurance with State Farm provides businesses and individuals with crucial protection against financial losses resulting from accidents, injuries, or property damage. This type of insurance acts as a safety net, covering legal costs, medical expenses, and other liabilities that could arise from unexpected events.

Whether you own a small business, operate a large corporation, or are an individual pursuing various ventures, understanding the ins and outs of general liability insurance is essential. State Farm, a renowned insurance provider, offers a comprehensive range of general liability insurance options tailored to meet diverse needs and circumstances.

What is General Liability Insurance?

General liability insurance is a crucial type of coverage that protects businesses and individuals from financial losses arising from third-party claims related to bodily injury, property damage, or personal and advertising injury. It acts as a safety net, shielding you from potential lawsuits and associated costs.

Key Coverage Areas

A typical general liability policy covers a wide range of potential risks, including:

- Bodily Injury: This covers medical expenses, lost wages, and pain and suffering arising from accidents on your property or due to your business activities. For example, if a customer slips and falls in your store, general liability insurance can help cover their medical bills and related costs.

- Property Damage: This covers damage to third-party property caused by your negligence or the negligence of your employees. For example, if a delivery driver accidentally backs into a customer’s car, general liability insurance can help cover the cost of repairs.

- Personal and Advertising Injury: This covers claims related to libel, slander, copyright infringement, and other forms of defamation or false advertising. For example, if you accidentally publish a false statement about a competitor, general liability insurance can help cover legal expenses and potential settlements.

Common Situations Where General Liability Insurance is Beneficial

General liability insurance is valuable in a wide range of situations. Some common scenarios where this coverage can be essential include:

- Businesses: All businesses, regardless of size, face potential risks. General liability insurance is essential for protecting your business from financial losses due to lawsuits. For example, a small bakery might need general liability insurance to cover potential claims from customers who get injured on the premises or if their products cause harm.

- Events and Gatherings: If you’re hosting an event, such as a party, conference, or festival, general liability insurance can protect you from claims arising from accidents or injuries. For example, if a guest trips and falls at a wedding reception, the event organizer’s general liability insurance can help cover the cost of medical expenses and potential lawsuits.

- Professional Services: Professionals such as consultants, contractors, and designers can benefit from general liability insurance to protect them from claims arising from their work. For example, if a contractor’s negligence causes damage to a client’s property, general liability insurance can help cover the cost of repairs and potential legal fees.

- Non-Profit Organizations: Even non-profit organizations need general liability insurance to protect themselves from claims related to their activities. For example, a community center might need general liability insurance to cover claims arising from accidents on their premises or during their programs.

State Farm’s General Liability Insurance Offerings: General Liability Insurance State Farm

State Farm offers a range of general liability insurance policies designed to protect businesses and individuals from financial losses arising from third-party claims. These policies cover various aspects of liability, ensuring peace of mind for policyholders.

General Liability Insurance for Businesses

State Farm’s general liability insurance for businesses provides comprehensive coverage against a wide range of risks. These policies are tailored to meet the specific needs of different businesses, offering flexible options to suit various industries and sizes.

Key Features and Benefits

- Bodily Injury and Property Damage Liability: Covers legal expenses and damages arising from bodily injury or property damage caused by the insured’s negligence, including accidents on the premises, defective products, or professional services.

- Personal and Advertising Injury Liability: Protects against claims of libel, slander, copyright infringement, and other forms of personal and advertising injury.

- Medical Payments Coverage: Provides coverage for medical expenses incurred by third parties injured on the insured’s premises, regardless of fault.

- Defense Costs: Covers legal fees and other expenses associated with defending against liability claims.

- Product Liability Coverage: Protects businesses against claims arising from defective products, including injuries or damages caused by the product’s design, manufacturing, or marketing.

- Completed Operations Liability: Provides coverage for claims arising from work performed by the insured, even after the work is completed.

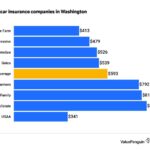

State Farm’s Business General Liability Insurance Compared to Other Providers

State Farm’s general liability insurance offerings are competitive in the market, offering comprehensive coverage and flexible options. Compared to other insurance providers, State Farm’s policies are known for their:

- Competitive Pricing: State Farm’s premiums are generally considered competitive, offering value for the coverage provided.

- Strong Reputation: State Farm has a long-standing reputation for financial stability and customer service, providing peace of mind to policyholders.

- Wide Range of Coverage Options: State Farm offers various policy options to cater to the specific needs of different businesses, ensuring adequate coverage for various industries and sizes.

- Excellent Customer Service: State Farm is known for its responsive and helpful customer service, providing support and guidance throughout the insurance process.

Understanding Coverage Limits and Exclusions

General liability insurance policies have coverage limits, which represent the maximum amount the insurer will pay for covered claims during a policy period. These limits are crucial for understanding your financial exposure in case of a liability claim. It’s also important to be aware of exclusions, which are specific situations or events that are not covered by the policy.

Coverage Limits

Coverage limits are typically expressed in dollar amounts, such as $1 million per occurrence or $2 million aggregate.

- Per occurrence limit: This limit applies to each separate incident or event that results in a claim. For example, if you have a $1 million per occurrence limit, the insurer will pay a maximum of $1 million for any single incident, regardless of the number of people injured or the extent of damages.

- Aggregate limit: This limit represents the total amount the insurer will pay for all covered claims during the policy period, regardless of the number of occurrences. For example, if you have a $2 million aggregate limit, the insurer will pay a maximum of $2 million for all covered claims during the policy year, even if multiple incidents occur.

Common Exclusions

State Farm’s general liability policies, like many others, have exclusions that specify situations or events not covered.

- Intentional acts: The policy typically does not cover claims arising from intentional acts, such as assault or battery.

- Employee-related claims: General liability policies often exclude claims arising from the actions of your employees, such as workplace injuries. These are usually covered under workers’ compensation insurance.

- Environmental damage: Coverage for environmental damage, such as pollution or contamination, may be excluded or limited.

- Professional services: If you provide professional services, such as legal or medical advice, your general liability policy may exclude claims arising from errors or omissions in your professional services. These claims are usually covered under professional liability insurance.

Consequences of Exceeding Limits or Encountering an Exclusion

If a claim exceeds your policy’s coverage limits, you will be responsible for paying the difference. Similarly, if a claim falls under an exclusion, you will not be covered, and you will have to bear the full financial burden.

For example, if you have a $1 million per occurrence limit and a claim arises for $2 million, you will be responsible for paying the remaining $1 million.

Factors Affecting General Liability Insurance Costs

The cost of your general liability insurance from State Farm is determined by a number of factors, all of which are carefully considered to provide you with a fair and competitive price.

Factors Influencing Premium Pricing, General liability insurance state farm

Your premium is calculated based on your individual risk profile. Here are some of the key factors that State Farm considers:

- Industry and Business Type: Different industries and business types have varying levels of risk. For instance, a construction company would have a higher risk profile compared to a retail store, resulting in a higher premium.

- Business Size and Revenue: Larger businesses with higher revenues often have greater exposure to potential liability claims, leading to higher premiums.

- Location: The geographic location of your business can influence premium costs. Areas with higher crime rates or a greater frequency of natural disasters may have higher premiums.

- Number of Employees: Businesses with a larger workforce typically have a higher risk of workplace accidents and liability claims, potentially leading to higher premiums.

- Claims History: Your past claims history plays a significant role in determining your premium. Businesses with a history of frequent or large claims will generally face higher premiums.

- Safety Practices and Risk Management: State Farm rewards businesses that implement robust safety practices and risk management programs. Businesses with a strong safety record and effective risk management strategies can often secure lower premiums.

- Coverage Limits and Deductibles: The coverage limits and deductibles you choose will also impact your premium. Higher coverage limits provide greater protection but will result in higher premiums. Similarly, lower deductibles mean you pay less out of pocket in case of a claim, but will likely lead to higher premiums.

Impact of Various Factors on Premium Pricing

The table below illustrates how various factors can influence your general liability insurance premium:

| Factor | Impact on Premium | Example |

|—|—|—|

| Industry and Business Type | Higher risk industries (e.g., construction, manufacturing) generally face higher premiums. | A construction company will likely have a higher premium compared to a retail store. |

| Business Size and Revenue | Larger businesses with higher revenues typically have higher premiums. | A large corporation with millions in revenue will have a higher premium compared to a small startup. |

| Location | Areas with higher crime rates or natural disaster risks often have higher premiums. | A business located in a high-crime area may face higher premiums compared to a business in a safer location. |

| Number of Employees | Businesses with a larger workforce may have higher premiums due to increased risk of workplace accidents. | A company with 100 employees will likely have a higher premium compared to a company with 10 employees. |

| Claims History | Businesses with a history of frequent or large claims generally face higher premiums. | A business that has had multiple liability claims in the past may face higher premiums compared to a business with a clean claims history. |

| Safety Practices and Risk Management | Businesses with strong safety practices and risk management programs can often secure lower premiums. | A business with a robust safety program and regular risk assessments may qualify for a premium discount. |

| Coverage Limits and Deductibles | Higher coverage limits and lower deductibles will result in higher premiums. | A business choosing higher coverage limits and a lower deductible will pay a higher premium compared to a business with lower coverage limits and a higher deductible. |

Tips for Minimizing General Liability Insurance Costs

Here are some tips to help you minimize your general liability insurance costs:

- Maintain a Clean Claims History: Preventing claims is the most effective way to keep your premiums low. Implement safety protocols, train employees, and address potential hazards promptly.

- Improve Risk Management: Develop and implement a comprehensive risk management plan. This can include conducting regular safety audits, implementing safety training programs, and reviewing and updating policies and procedures.

- Shop Around for Quotes: Get quotes from multiple insurers to compare prices and coverage options. This will help you find the best value for your needs.

- Consider Bundling Policies: Combining your general liability insurance with other business insurance policies, such as workers’ compensation or property insurance, can often result in discounts.

- Ask About Discounts: Inquire about available discounts, such as those for safety programs, good credit history, or membership in industry associations.

Filing a Claim with State Farm

If you need to file a general liability claim with State Farm, understanding the process can help ensure a smooth experience. Knowing the steps involved and how to effectively communicate with State Farm can make a significant difference in the outcome of your claim.

Filing a General Liability Claim

The first step is to report the incident to State Farm as soon as possible. You can do this by calling their customer service line or logging into your online account. State Farm will then guide you through the necessary steps, including gathering information and documentation.

- Report the Incident: Immediately notify State Farm about the incident. Provide all relevant details, including the date, time, location, and a description of what happened. The quicker you report the incident, the better.

- Gather Documentation: Collect all relevant documentation, such as police reports, medical records, witness statements, and photographs. This documentation will help support your claim and demonstrate the nature of the incident.

- File a Claim: Once you have gathered the necessary information, you can file a formal claim with State Farm. You can do this online, by phone, or by mail. State Farm will provide you with a claim number and a claims adjuster who will be your primary point of contact.

- Cooperate with the Claims Adjuster: The claims adjuster will investigate the incident and determine the extent of your coverage. It is essential to be honest and cooperate fully with the claims adjuster. Provide them with all requested information and documents in a timely manner.

- Negotiate a Settlement: Once the investigation is complete, the claims adjuster will make a settlement offer. You have the right to negotiate this offer. If you disagree with the offer, you can appeal the decision.

Communicating with State Farm

Effective communication is key to a successful claim process. Be clear, concise, and honest in your communications with State Farm. Keep detailed records of all interactions, including dates, times, and the names of the people you spoke with. If you have any questions or concerns, don’t hesitate to ask. State Farm’s claims representatives are there to help you navigate the process.

“It’s always a good idea to keep a record of all communication with State Farm, including emails, phone calls, and letters. This will help you track the progress of your claim and ensure that all information is accurate.”

Importance of General Liability Insurance for Businesses

General liability insurance is a vital component of risk management for businesses of all sizes. It acts as a financial safety net, safeguarding your company from the potential financial consequences of unforeseen events that could lead to lawsuits or property damage.

Why General Liability Insurance is Crucial

General liability insurance is essential for businesses because it provides financial protection against a wide range of risks that could arise from everyday operations. Without adequate liability coverage, businesses face significant financial exposure, which could lead to bankruptcy or closure.

Potential Risks Faced by Businesses Without Adequate Liability Coverage

- Customer Injuries: A customer slips and falls on your property, resulting in a lawsuit for medical expenses and pain and suffering.

- Property Damage: Your business’s negligence causes damage to a customer’s property, leading to a claim for repairs or replacement.

- Product Liability: A defective product manufactured or sold by your business causes injury to a consumer, resulting in a product liability lawsuit.

- Advertising Injury: Your business’s advertising campaign infringes on someone’s intellectual property rights, leading to a lawsuit for copyright infringement or defamation.

- Employee Negligence: An employee’s actions cause harm to a third party, resulting in a lawsuit against your business.

Financial Protection Provided by General Liability Insurance

General liability insurance provides financial protection by covering the costs associated with legal defense, settlements, and judgments. This includes:

- Legal Defense Costs: General liability insurance covers the cost of hiring attorneys to defend your business in a lawsuit.

- Settlement Costs: If a lawsuit is settled out of court, general liability insurance can cover the settlement amount.

- Judgment Costs: If a lawsuit goes to trial and a judgment is rendered against your business, general liability insurance can cover the judgment amount.

Last Recap

General liability insurance with State Farm is a vital component of risk management for individuals and businesses alike. By understanding the coverage options, factors influencing costs, and claims procedures, you can ensure you have the appropriate protection in place. State Farm’s expertise and commitment to customer satisfaction make them a trusted partner in safeguarding your financial well-being and peace of mind.

FAQ

What is the difference between general liability insurance and professional liability insurance?

General liability insurance covers claims related to bodily injury, property damage, and personal injury, while professional liability insurance, also known as errors and omissions insurance, protects professionals from claims arising from negligence or mistakes in their work.

How much does general liability insurance from State Farm typically cost?

The cost of general liability insurance varies based on factors such as the business type, size, location, and risk profile. It’s best to contact State Farm directly for a personalized quote.

What are some common exclusions in State Farm’s general liability policies?

Common exclusions may include intentional acts, criminal activity, employee-related claims covered by workers’ compensation, and environmental damage.

What happens if my claim exceeds the coverage limits of my policy?

If your claim exceeds the policy limits, you will be responsible for the remaining costs. It’s crucial to have adequate coverage limits to protect your financial well-being in case of a significant claim.