Car insured in another state? It’s a common situation for those who move or travel frequently. While it might seem simple enough, there are important considerations to ensure you’re legally covered and protected on the road. This guide will delve into the complexities of driving with out-of-state insurance, exploring the potential challenges, insurance options, and crucial tips for navigating the process smoothly.

Understanding the nuances of state-specific insurance requirements is paramount. Each state has its own set of rules regarding minimum liability coverage, uninsured motorist coverage, and other essential provisions. Driving a car insured in another state without meeting these requirements can lead to significant legal repercussions, including fines, license suspension, and even imprisonment.

Understanding State-Specific Insurance Requirements

Each state in the US has its own unique set of insurance requirements for drivers. This means that the coverage you need to legally operate a vehicle in one state may not be sufficient in another. It’s crucial to understand these differences to ensure you’re legally compliant and protected while driving.

Minimum Liability Coverage Requirements

The minimum liability coverage requirements vary significantly from state to state. These requirements specify the minimum amount of insurance coverage a driver must have to cover damages or injuries caused to others in an accident. For instance, in some states, the minimum liability coverage for bodily injury might be $25,000 per person and $50,000 per accident, while other states might require higher limits.

- Example: In California, the minimum liability coverage for bodily injury is $15,000 per person and $30,000 per accident, while in New York, it’s $25,000 per person and $50,000 per accident.

Driving a Car Insured in Another State

While it’s perfectly legal to drive a car insured in another state, it can lead to some unexpected challenges. Understanding these potential issues is crucial before you hit the road.

Potential Challenges, Car insured in another state

Driving with out-of-state insurance can present various challenges, potentially impacting your experience on the road and in case of an accident.

- Difficulty Obtaining Roadside Assistance: If you require roadside assistance while driving in a different state, your insurance provider might not be readily available or equipped to handle the situation. This is because roadside assistance services often have limitations based on geographical location. For example, a tow truck might not be available in a remote area or might require additional time to reach you.

- Complications with Claims Processing: Claims processing can become more complex when dealing with out-of-state insurance. Different states have varying regulations and requirements for filing claims. This can result in delays, complications, and even disputes. For example, a state might require specific documentation or have stricter timelines for filing claims compared to your home state.

- Potential Issues with Rental Car Coverage: Your out-of-state insurance might not provide adequate rental car coverage in the event of an accident. Some insurance policies have restrictions on rental car coverage in different states, requiring you to purchase additional coverage locally. This could lead to unexpected expenses and inconvenience.

Insurance Options for Drivers Moving to a New State: Car Insured In Another State

Moving to a new state often involves adjusting to new rules and regulations, and car insurance is no exception. Your current insurance policy might not cover you adequately in your new state, so understanding your options is crucial.

Transferring an Existing Car Insurance Policy

When you move to a new state, you can often transfer your existing car insurance policy. This might seem like the easiest option, but it’s important to consider the potential benefits and drawbacks.

- Benefits:

- Convenience: Transferring your policy is generally a simple process, often involving contacting your current insurer and providing them with your new address and state of residence.

- Potential for lower premiums: If your current insurer offers competitive rates in your new state, you might continue to enjoy lower premiums.

- Familiarity: Sticking with your current insurer can provide a sense of familiarity and comfort, especially if you’ve had a positive experience with them.

- Drawbacks:

- Higher premiums: Your current insurer might not offer the most competitive rates in your new state, potentially leading to higher premiums.

- Limited coverage options: Your existing policy might not include all the coverage options available in your new state, leaving you with potential gaps in protection.

- State-specific requirements: Your current policy might not meet all the state-specific insurance requirements in your new state, leading to legal complications.

Obtaining a New Insurance Policy

Alternatively, you can choose to obtain a new car insurance policy from an insurer in your new state. This offers a fresh start and allows you to explore a wider range of options.

- Benefits:

- Competitive rates: Insurers in your new state might offer more competitive premiums than your current insurer.

- Expanded coverage options: You can access a broader range of coverage options tailored to your specific needs and the requirements in your new state.

- Potential for discounts: New insurers might offer discounts that your current insurer doesn’t provide, leading to cost savings.

- Drawbacks:

- Additional paperwork: Obtaining a new policy requires completing new paperwork and providing additional information.

- New insurer relationship: Building a relationship with a new insurer can take time and effort.

- Potential for higher initial premiums: Depending on your driving history and other factors, you might face higher premiums initially.

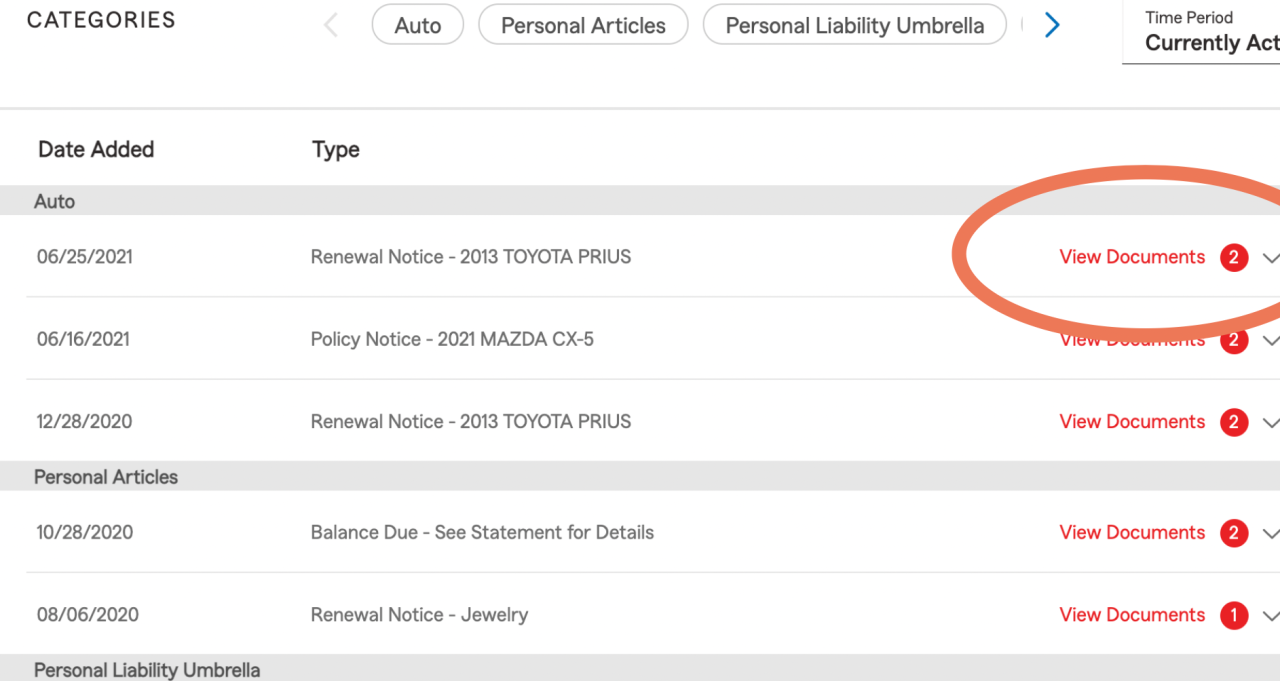

Comparing Insurance Options

To make an informed decision, it’s essential to compare different insurers and their offerings. Consider the following factors:

| Insurer Name | Coverage Options | Premium Range | Discounts Offered |

|---|---|---|---|

| Insurer A | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | $50-$100 per month | Safe driver, good student, multi-car, multi-policy |

| Insurer B | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection, Roadside Assistance | $60-$120 per month | Safe driver, good student, multi-car, multi-policy, anti-theft device |

| Insurer C | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection, Rental Reimbursement | $45-$90 per month | Safe driver, good student, multi-car, multi-policy, accident forgiveness |

Remember that these are just examples, and actual premiums and discounts can vary based on your individual circumstances.

Tips for Ensuring Proper Coverage While Driving in Another State

Navigating the complexities of car insurance when you’re living in a state different from where your car is insured can be tricky. To ensure you’re adequately protected while driving in another state, it’s crucial to understand the specific requirements and take necessary steps to comply with them.

Contacting Your Insurance Provider

The first and most important step is to inform your insurance provider about your change in residency. This is crucial because your insurance policy might not automatically extend full coverage to another state. Failing to notify your insurance company could result in gaps in your coverage, leaving you vulnerable in case of an accident.

- Provide them with your new address and the date of your move.

- Confirm if your current policy covers you in the new state.

- Inquire about any necessary policy adjustments or additional coverage options to ensure you’re fully protected.

Carrying Necessary Documents

It’s always a good idea to carry essential documents when driving in another state, especially when your car is insured elsewhere. These documents can be crucial for verification purposes, especially if you’re involved in an accident or encounter a traffic stop.

- A copy of your insurance policy: This provides proof of coverage and details of your policy’s coverage limits.

- Proof of residency: This could be a utility bill, lease agreement, or voter registration card, demonstrating your current address in the new state.

Legal Implications of Driving Without Proper Insurance

Driving without proper insurance is not only financially irresponsible but also carries serious legal consequences. Depending on the state, you could face hefty fines, license suspension, or even imprisonment. It’s crucial to understand the legal ramifications of driving uninsured and prioritize obtaining adequate insurance coverage to avoid potential legal issues.

Penalties for Driving Without Insurance

Driving without the minimum required insurance in a particular state is a serious offense, often resulting in significant penalties. These penalties can vary depending on the state and the severity of the offense, but they typically include:

- Fines: The most common penalty for driving without insurance is a hefty fine. The amount of the fine can range from a few hundred dollars to thousands of dollars, depending on the state and the number of offenses. For example, in California, a first offense for driving without insurance can result in a fine of $100 to $1,000, while subsequent offenses can lead to fines of up to $2,000.

- License Suspension: Driving without insurance can lead to the suspension of your driver’s license. The duration of the suspension can vary depending on the state and the number of offenses. In some states, a first offense might result in a short suspension, while repeated offenses could lead to a longer suspension or even permanent revocation of your license.

- Imprisonment: In some cases, driving without insurance can result in imprisonment, particularly if it is a repeat offense or if the driver is involved in an accident. For example, in Texas, driving without insurance can lead to a jail sentence of up to 180 days, along with fines. However, imprisonment is typically reserved for repeat offenders or those who cause accidents resulting in injuries or damage.

Real-World Examples of Legal Issues

There have been numerous cases where drivers faced legal issues due to inadequate insurance coverage.

“In a recent case in Florida, a driver was involved in a car accident and found to be driving without insurance. The driver was charged with a misdemeanor and fined $500. Additionally, their driver’s license was suspended for six months.”

“In another case in New York, a driver was pulled over for a traffic violation and found to be driving without insurance. The driver was issued a ticket and fined $1,000. Their license was also suspended for 90 days.”

These examples demonstrate the real-world consequences of driving without insurance and highlight the importance of ensuring adequate coverage to avoid legal trouble.

Final Conclusion

Navigating the complexities of driving with out-of-state insurance requires careful planning and awareness. By understanding the potential challenges, exploring available insurance options, and following essential tips, you can ensure you’re adequately covered and protected while driving in another state. Remember, staying informed and proactive is key to a safe and smooth driving experience, no matter where you go.

Questions and Answers

What happens if I get into an accident while driving in another state with out-of-state insurance?

Your insurance company should still cover you, but you might face challenges with claims processing and potential delays. It’s crucial to contact your insurance provider immediately after an accident and follow their instructions carefully.

Can I get a new insurance policy in the new state while keeping my existing one?

Yes, you can have multiple insurance policies. However, it’s important to ensure that your new policy provides adequate coverage and meets the minimum requirements of the new state. You should also inform your existing insurer about the change in residency.

What if I’m only driving in another state temporarily?

Most states have reciprocity agreements, allowing you to drive with your home state’s insurance for a limited period. However, it’s always best to contact your insurer and verify the specific terms and conditions for temporary travel.