Compare auto insurance rates by state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of auto insurance can be a daunting task, especially when you consider the wide range of factors that influence premiums. From state-specific regulations to your own driving history, understanding these nuances is crucial to securing the most affordable and comprehensive coverage.

This guide delves into the intricate details of auto insurance pricing, providing a comprehensive overview of the factors that impact rates across different states. We’ll explore how state laws, driving records, vehicle types, and coverage options all play a role in determining your premium. By shedding light on these key aspects, we aim to empower you with the knowledge necessary to make informed decisions about your auto insurance.

Factors Influencing Auto Insurance Rates

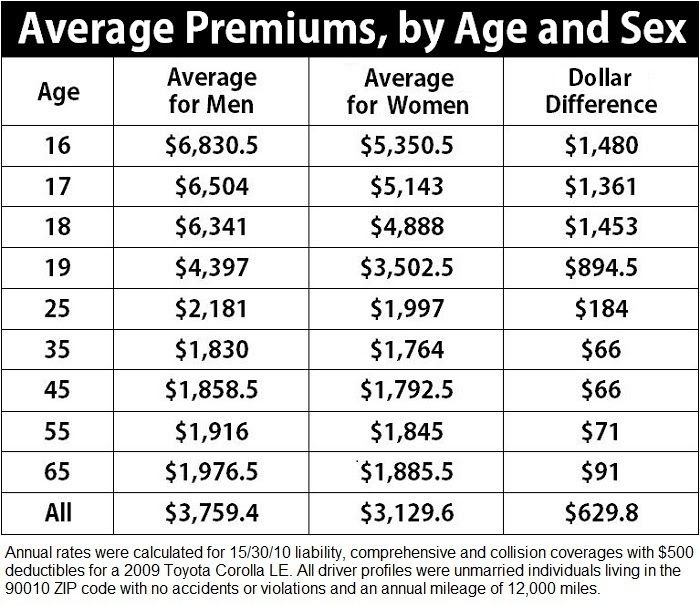

Auto insurance rates are determined by a variety of factors, with some being more significant than others. These factors can vary significantly across different states, leading to diverse rate structures and price differences. Understanding these factors is crucial for drivers seeking the most competitive insurance rates.

Driving History

A driver’s history plays a pivotal role in determining insurance premiums. Insurance companies consider a driver’s past driving record, including accidents, traffic violations, and driving convictions.

- Accidents: Accidents are a major factor influencing insurance rates. Drivers with a history of accidents are deemed higher risk and often face significantly higher premiums. The severity of the accident, such as causing property damage or injuries, also plays a role.

- Traffic Violations: Traffic violations, such as speeding tickets or running red lights, can increase insurance premiums. The severity of the violation and the number of violations within a specific period can impact rates.

- Driving Convictions: Driving convictions, such as driving under the influence (DUI) or reckless driving, have the most significant impact on insurance rates. These convictions indicate a higher risk of future accidents and can lead to significantly increased premiums or even policy cancellation.

Vehicle Type

The type of vehicle you drive significantly influences your insurance rates. Insurance companies assess vehicles based on factors like:

- Vehicle Value: More expensive vehicles typically have higher insurance premiums. This is because they are more costly to repair or replace in the event of an accident.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, often have lower premiums. These features are deemed to reduce the risk of accidents and injuries.

- Vehicle Age: Older vehicles may have lower insurance rates due to their lower value. However, older vehicles with outdated safety features may have higher premiums than newer models with advanced safety technology.

- Vehicle Make and Model: Certain vehicle makes and models are known for their safety ratings, fuel efficiency, and overall reliability. Insurance companies consider these factors when determining premiums, with safer and more reliable vehicles often receiving lower rates.

Coverage Options

The type and amount of coverage you choose directly impacts your insurance premiums.

- Liability Coverage: Liability coverage is essential for protecting you financially in the event of an accident where you are at fault. Higher liability limits provide more financial protection but come with higher premiums.

- Collision Coverage: Collision coverage protects your vehicle in the event of an accident, regardless of fault. This coverage is typically optional but can be essential for newer or more expensive vehicles. Higher deductibles generally result in lower premiums.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. This coverage is optional but can be beneficial for protecting your investment.

State-Specific Factors

State laws and regulations significantly influence auto insurance rates.

| Factor | Impact on Rates | State Examples |

|---|---|---|

| Minimum Liability Coverage Requirements | Higher minimum coverage requirements generally lead to higher premiums. | Pennsylvania has higher minimum liability limits than Texas, resulting in higher average premiums in Pennsylvania. |

| No-Fault Insurance Laws | States with no-fault insurance laws typically have higher premiums due to increased coverage requirements. | New York has a no-fault insurance system, which contributes to higher average premiums compared to states with traditional fault-based systems. |

| Traffic Density and Accident Rates | States with higher traffic density and accident rates often have higher premiums. | California, with its dense population and high traffic volume, generally has higher premiums than states with lower population density. |

| Insurance Market Competition | States with a competitive insurance market often have lower premiums due to increased competition among insurers. | Texas has a highly competitive insurance market, leading to lower average premiums compared to states with fewer insurance providers. |

State-Specific Regulations and Laws

Each state in the US has its own set of regulations and laws governing auto insurance, which significantly impacts the rates you pay. These regulations can vary widely from state to state, affecting mandatory coverage requirements, available coverage options, and ultimately, the cost of your insurance premiums.

Mandatory Coverage Requirements, Compare auto insurance rates by state

States differ in their mandatory auto insurance coverage requirements, which are the minimum coverages you must have to legally operate a vehicle. These requirements directly influence the cost of your insurance, as you’ll need to pay for at least the minimum mandated coverage.

- Liability Coverage: This is the most common mandatory coverage in all states, covering damages to other people and their property in case of an accident you cause. It’s typically expressed as a limit, like 25/50/25, meaning $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage. The higher the limits, the more expensive the coverage.

- Personal Injury Protection (PIP): Some states require PIP coverage, which pays for medical expenses and lost wages for you and your passengers, regardless of who caused the accident. The availability and limits of PIP coverage vary by state, impacting insurance costs.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you in case you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. The extent of this coverage varies by state, impacting the overall premium.

Impact on Coverage Options and Premiums

State laws also influence the types of coverage options available and the premiums you pay for them.

- No-Fault Insurance: Some states have no-fault insurance systems where you file a claim with your own insurer regardless of who caused the accident. These states may have higher premiums but potentially faster claim processing and fewer lawsuits.

- Deductibles and Coverage Limits: State laws can affect the minimum and maximum deductibles and coverage limits you can choose. Higher deductibles generally mean lower premiums, but you’ll pay more out of pocket in case of an accident. Conversely, higher coverage limits mean higher premiums but more financial protection.

- State-Specific Discounts: Some states offer unique discounts for certain behaviors or characteristics, like good driving records, safe driving courses, or having anti-theft devices. These discounts can significantly impact your premiums.

Average Auto Insurance Rates by State

Auto insurance premiums vary significantly across the United States. Several factors contribute to these differences, including population density, traffic patterns, the cost of living, and state-specific regulations. Understanding these variations can help you compare rates and find the most affordable coverage for your needs.

Average Auto Insurance Rates by State

The following table showcases average annual auto insurance premiums for different states in the United States. These rates are based on data from the National Association of Insurance Commissioners (NAIC) and may vary depending on individual factors such as driving history, vehicle type, and coverage levels.

| State | Average Annual Premium | Average Liability Coverage | Average Collision Coverage |

|---|---|---|---|

| Michigan | $2,868 | $1,200 | $800 |

| Louisiana | $2,624 | $1,000 | $700 |

| New Jersey | $2,432 | $900 | $650 |

| Florida | $2,376 | $850 | $600 |

| Pennsylvania | $2,280 | $800 | $550 |

| California | $2,196 | $750 | $500 |

| Texas | $2,112 | $700 | $450 |

| New York | $2,028 | $650 | $400 |

| Ohio | $1,944 | $600 | $350 |

| Illinois | $1,860 | $550 | $300 |

As you can see, average auto insurance rates can vary significantly from state to state. For example, Michigan has the highest average annual premium, while Illinois has the lowest. These variations are influenced by a number of factors, including the number of accidents, the cost of car repairs, and the prevalence of lawsuits.

Tips for Saving on Auto Insurance

Finding affordable auto insurance can be challenging, but there are several strategies you can implement to reduce your premiums. By understanding the factors that influence your rates and taking proactive steps, you can significantly lower your costs.

Factors You Can Control to Reduce Premiums

Your auto insurance premiums are based on a variety of factors, some of which you can control. Here are some key areas where you can make changes to lower your rates:

- Improve Your Driving Record: A clean driving record is essential for lower premiums. Avoid traffic violations, accidents, and other driving infractions.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can lead to lower premiums. Consider increasing your deductible if you can afford to pay a larger amount in the event of a claim.

- Maintain a Good Credit Score: Your credit score can impact your insurance rates in some states. Maintaining a good credit score can help you qualify for lower premiums.

- Choose a Safe Vehicle: Certain vehicles are considered safer than others and may result in lower insurance premiums.

- Bundle Your Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Shop Around for Quotes: Don’t settle for the first quote you receive. Compare rates from multiple insurers to find the best deal.

- Take Advantage of Discounts: Many insurers offer discounts for various factors, such as good student discounts, safe driver discounts, and multi-car discounts. Ask your insurer about available discounts and ensure you’re taking advantage of all eligible ones.

Comparing Quotes and Negotiating with Insurers

Getting quotes from multiple insurers is essential for finding the best rates. Here’s a guide to help you effectively compare quotes and negotiate with insurers:

- Use Online Comparison Tools: Several online tools allow you to compare quotes from multiple insurers simultaneously. This can save you time and effort.

- Contact Insurers Directly: In addition to online comparison tools, contact insurers directly to obtain personalized quotes. This allows you to discuss specific needs and ask questions about coverage options.

- Be Prepared to Negotiate: Once you have quotes from multiple insurers, don’t be afraid to negotiate. Explain your needs and ask if they can offer better rates or discounts.

- Review Your Policy Regularly: Once you’ve chosen an insurer, review your policy regularly to ensure you’re still getting the best rates and coverage. Your needs may change over time, so it’s important to adjust your policy accordingly.

Understanding Auto Insurance Coverage Options

Auto insurance is a crucial aspect of responsible car ownership, protecting you financially from various risks associated with driving. Understanding the different types of coverage available is essential for choosing a policy that adequately meets your needs and budget. This section delves into the common types of auto insurance coverage, highlighting their benefits and drawbacks.

Liability Coverage

Liability coverage is the most fundamental type of auto insurance, providing financial protection if you cause an accident that results in injuries or property damage to others. It covers medical expenses, lost wages, and property repair costs incurred by the other party involved.

Liability coverage typically comprises two parts:

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to others in an accident caused by you. The coverage limits are typically expressed as a per-person limit and a per-accident limit, such as 25/50/10, meaning $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle, in an accident caused by you. The coverage limit is typically expressed as a single amount, such as $25,000.

Liability coverage is mandatory in most states, and the minimum required limits vary. It’s important to have sufficient liability coverage to protect yourself from significant financial losses in the event of a serious accident.

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

Collision coverage is optional but often recommended for newer vehicles or those with significant loan balances. The deductible is the amount you pay out of pocket before your insurance company covers the remaining costs.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses if your vehicle is damaged by events other than a collision, such as theft, vandalism, fire, hail, or natural disasters. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

Comprehensive coverage is optional but can be beneficial for newer vehicles or those with high value. It’s essential to consider the potential risks in your area, such as hailstorms or theft, when deciding whether to purchase this coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you from financial losses if you’re involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses, lost wages, and property damage, up to the coverage limits of your policy.

This coverage is crucial in states with a high percentage of uninsured drivers. It can help mitigate financial hardship if you’re injured by a driver who cannot afford to pay for your damages.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage is mandatory in some states and optional in others.

PIP coverage can be particularly beneficial if you have a high deductible on your health insurance or if you are self-employed. It can help ensure you receive prompt medical treatment and financial support while recovering from an injury.

Table Illustrating Key Features of Auto Insurance Coverage

| Coverage Type | What It Covers | Benefits | Drawbacks |

|---|---|---|---|

| Liability | Damages to others’ property or injuries caused by you | Protects you from financial losses in the event of an accident | Doesn’t cover your own vehicle damages |

| Collision | Damages to your vehicle in an accident, regardless of fault | Covers repairs or replacement of your vehicle | Can be expensive, especially for newer vehicles |

| Comprehensive | Damages to your vehicle from events other than collisions | Protects against theft, vandalism, fire, hail, etc. | May not be necessary if you have an older vehicle |

| Uninsured/Underinsured Motorist | Damages caused by uninsured or underinsured drivers | Protects you from financial losses when the other driver is at fault | May not cover all your losses if the other driver’s coverage is insufficient |

| Personal Injury Protection (PIP) | Your medical expenses and lost wages, regardless of fault | Provides prompt medical treatment and financial support | May have a limited coverage amount |

The Role of Insurance Companies

Insurance companies play a pivotal role in determining auto insurance rates, influencing not only the cost but also the coverage options available to drivers. Different insurance companies employ diverse pricing strategies and offer varying coverage packages, which significantly impact the final cost of auto insurance.

Pricing Strategies and Coverage Options

The pricing strategies employed by insurance companies are multifaceted and depend on various factors, including company size, financial stability, and risk assessment methodologies. Larger insurance companies often have greater resources to invest in data analytics and sophisticated risk models, allowing them to refine their pricing strategies and offer competitive rates. Conversely, smaller insurance companies may focus on specific niche markets or regions, potentially offering more personalized coverage options.

- Bundling discounts: Many insurance companies offer discounts for bundling multiple insurance policies, such as auto, home, and renters insurance. These discounts can significantly reduce the overall cost of insurance.

- Safe driving discounts: Insurance companies often reward safe drivers with discounts, such as good driver discounts, accident-free discounts, and defensive driving course discounts.

- Vehicle safety features: Vehicles equipped with advanced safety features, such as anti-theft systems, airbags, and electronic stability control, are often considered lower risk and may qualify for discounts.

- Credit history: While controversial, some insurance companies use credit history as a factor in determining insurance rates. The rationale is that individuals with good credit history tend to be more responsible overall, including their driving habits.

Company Size and Financial Stability

The size and financial stability of an insurance company can also influence auto insurance rates. Larger, financially stable companies often have more resources to pay claims and can potentially offer more competitive rates due to economies of scale. However, smaller, regional insurance companies may offer more personalized service and potentially lower rates in specific areas.

- Financial strength ratings: Independent rating agencies, such as A.M. Best and Standard & Poor’s, assess the financial strength of insurance companies based on factors like capital adequacy, investment performance, and claims-paying ability. A high financial strength rating indicates a company is financially sound and likely to meet its obligations to policyholders.

- Claims handling: The efficiency and responsiveness of an insurance company’s claims handling process can also impact policyholders. A company with a history of prompt and fair claim settlements may be perceived as more reliable and could potentially offer more favorable rates.

Impact on Auto Insurance Rates

The impact of different insurance companies on auto insurance rates varies depending on the state, the individual’s driving history, and the specific vehicle being insured. However, it is generally true that competition among insurance companies can drive down rates. When multiple insurance companies operate in a state, they often compete for customers by offering more competitive pricing and coverage options.

- State regulations: State regulations can also influence the impact of insurance companies on auto insurance rates. Some states have regulations that limit the factors insurance companies can use to determine rates, such as credit history or driving history. These regulations can help to ensure that rates are more equitable and prevent discrimination.

- Market share: The market share of an insurance company in a particular state can also impact rates. Companies with a larger market share may have more bargaining power with auto repair shops and other vendors, potentially leading to lower costs and more competitive rates.

Impact of Driving History on Rates: Compare Auto Insurance Rates By State

Your driving history plays a crucial role in determining your auto insurance premiums. Insurance companies assess your past driving behavior to gauge the risk you pose as a driver. A clean driving record typically leads to lower premiums, while accidents, violations, and claims can significantly increase your rates.

Impact of Accidents and Violations

Accidents and violations are significant factors that influence your auto insurance premiums. Insurance companies view these incidents as indicators of your driving skills and risk-taking tendencies.

- Accidents: Even a single accident can lead to a substantial increase in your premiums. The severity of the accident, your level of fault, and the cost of repairs all contribute to the impact on your rates. For example, a minor fender bender might result in a 10-15% increase, while a more serious accident involving injuries or property damage could lead to a 25-50% hike or more.

- Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, also significantly impact your premiums. These violations indicate a disregard for traffic laws and increase your risk of future accidents. The severity of the violation and the number of violations you have accumulated directly influence the extent of the premium increase.

Impact of Claims

Filing claims for accidents or other incidents can also affect your auto insurance premiums.

- Claims History: Insurance companies track your claims history to assess your risk profile. Even if you are not at fault for an accident, filing a claim can still impact your rates. This is because it demonstrates that you have experienced an event that required insurance coverage.

- Frequency and Severity: The frequency and severity of your claims also play a role. Multiple claims within a short period can indicate a higher risk of future accidents, leading to higher premiums. Similarly, claims involving significant damage or injuries will likely result in larger premium increases.

Potential Increase in Premiums Based on Driving Violations

The following table provides a general idea of how certain driving violations can impact your auto insurance premiums:

| Violation | Potential Premium Increase |

|---|---|

| Speeding Ticket (10-15 mph over the limit) | 10-20% |

| Reckless Driving | 25-50% |

| DUI/DWI | 50-100% or more |

Note: These are just general estimates, and actual premium increases can vary significantly depending on factors such as your insurance company, state, driving record, and other factors.

Improving Your Driving Record

There are several steps you can take to improve your driving record and potentially lower your auto insurance premiums:

- Drive Safely: The most effective way to lower your premiums is to avoid accidents and violations. Be a responsible driver, follow traffic laws, and practice defensive driving techniques.

- Attend Defensive Driving Courses: Completing a defensive driving course can demonstrate to insurance companies that you are committed to improving your driving skills. Some insurance companies offer discounts for completing these courses.

- Maintain a Clean Driving Record: Avoid accumulating additional violations or accidents. Each incident adds to your risk profile and can lead to higher premiums.

- Consider a Driving Safety App: Some driving safety apps can monitor your driving behavior and provide feedback to help you improve. This data can be used to support your request for a discount from your insurance company.

The Influence of Vehicle Type and Value

Your car’s type and value play a significant role in determining your auto insurance premiums. Insurance companies assess these factors to understand the potential risk associated with insuring your vehicle.

Factors Influencing Premiums Based on Vehicle Type and Value

The make, model, and safety features of your car directly impact your insurance rates.

- Vehicle Make and Model: Some car models are known for their safety features, reliability, and overall performance, leading to lower insurance premiums. Conversely, models with a history of accidents or high repair costs tend to have higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and electronic stability control are generally considered safer and thus attract lower insurance rates.

- Vehicle Value: The value of your car is a crucial factor. Higher-value vehicles are more expensive to repair or replace in case of an accident, leading to higher insurance premiums.

Examples of How Vehicle Type and Value Affect Insurance Costs

Here are some examples illustrating how different vehicle types and values influence insurance premiums:

- Sports Cars vs. Sedans: Sports cars, known for their speed and performance, are often associated with higher risk and thus have higher insurance premiums compared to sedans.

- Luxury Vehicles vs. Economy Cars: Luxury vehicles, with their higher repair costs and replacement values, typically attract higher insurance premiums than economy cars.

- New Cars vs. Used Cars: New cars, with their advanced safety features and higher value, may have lower insurance premiums than older used cars. However, this can vary depending on the specific car model and its safety features.

Outcome Summary

Ultimately, finding the best auto insurance rates requires a multifaceted approach. By understanding the factors that influence pricing, comparing quotes from multiple insurers, and taking advantage of available discounts, you can secure a policy that meets your needs without breaking the bank. Armed with this knowledge, you can navigate the world of auto insurance with confidence, knowing that you have the power to make informed decisions and achieve significant savings.

Common Queries

What are the main factors that affect auto insurance rates?

Several factors influence auto insurance rates, including your driving history, vehicle type, location, coverage options, and the insurance company you choose.

How can I lower my auto insurance premiums?

You can lower your premiums by maintaining a good driving record, choosing a safe vehicle, increasing your deductible, bundling insurance policies, and shopping around for competitive rates.

What are the different types of auto insurance coverage?

Common types of auto insurance coverage include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each type offers different levels of protection and comes with varying costs.

How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy annually, or whenever there’s a significant life change, such as a new vehicle, a move, or a change in your driving record. This ensures your coverage remains adequate and your premiums are competitive.