Average cost of car insurance in Washington State is influenced by a variety of factors, making it crucial to understand the intricacies of pricing to secure the best coverage at a reasonable rate. From your driving history and age to the type of vehicle you drive and your credit score, various elements contribute to the final cost of your car insurance policy. Even your location within Washington State can impact your premium, as insurance companies assess risk based on accident statistics and other factors specific to different regions.

Navigating the complexities of car insurance in Washington can be challenging, but with the right information, you can make informed decisions and find a policy that meets your needs and budget. This guide explores the key factors influencing car insurance costs, provides a breakdown of average costs by coverage type, and offers tips for securing discounts and savings. We’ll also discuss the minimum insurance requirements in Washington, helping you understand your legal obligations and avoid potential penalties.

Factors Influencing Car Insurance Costs in Washington State

Several factors influence the cost of car insurance in Washington State. These factors are evaluated by insurance companies to determine the risk associated with insuring a particular driver and their vehicle.

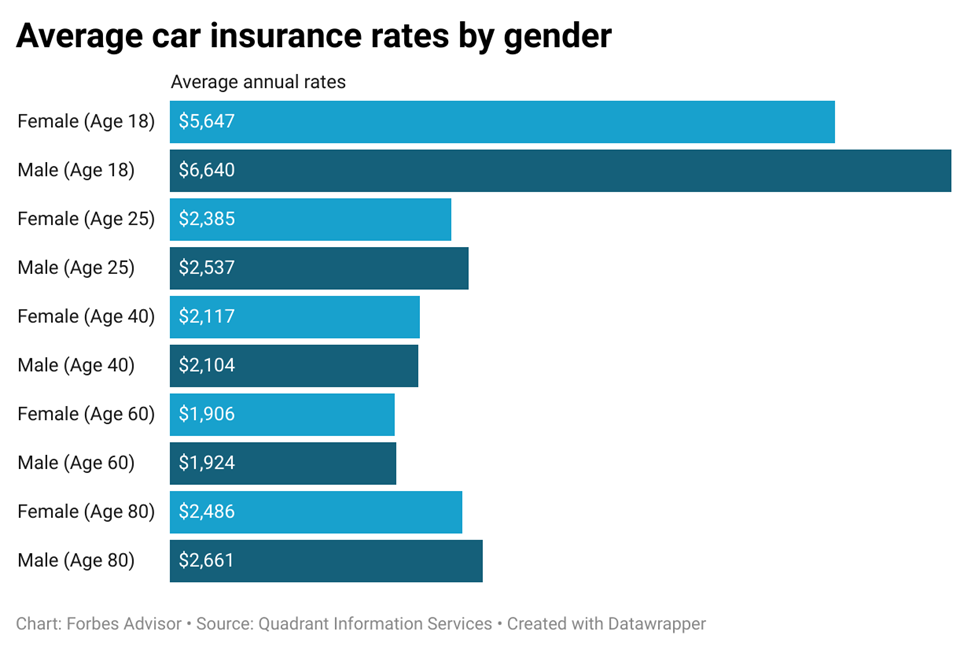

Age

Age is a significant factor in determining car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for younger drivers. As drivers gain experience and age, their premiums typically decrease.

Driving History

A clean driving record is crucial for obtaining lower car insurance rates. Accidents, traffic violations, and DUI convictions significantly increase premiums. Insurance companies consider the severity and frequency of past driving offenses when calculating rates. Drivers with multiple accidents or serious violations can expect to pay significantly higher premiums.

Vehicle Type

The type of vehicle you drive also impacts your car insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of accidents. Vehicles with safety features like anti-lock brakes and airbags can often qualify for discounts.

Credit Score

In Washington State, insurance companies can use your credit score to determine your car insurance rates. This practice is based on the idea that people with good credit are more financially responsible and less likely to file claims. However, this practice has been controversial, and some states have banned it.

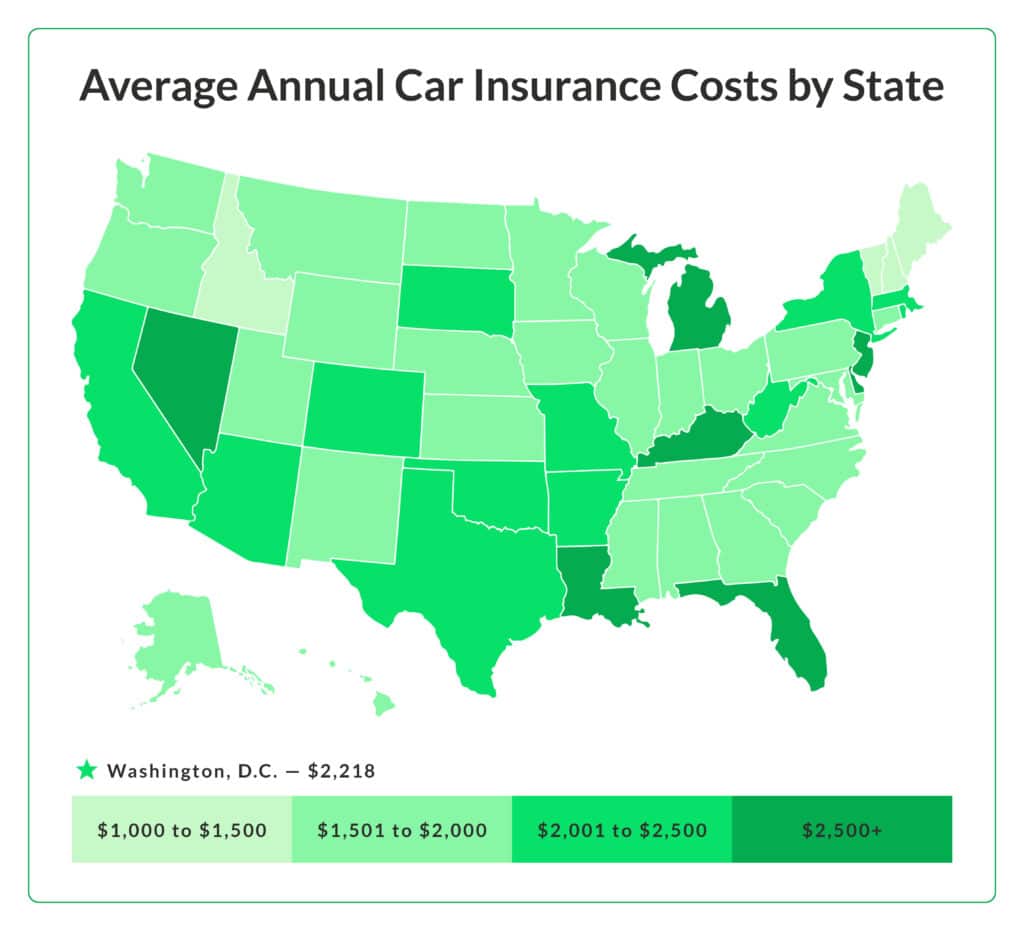

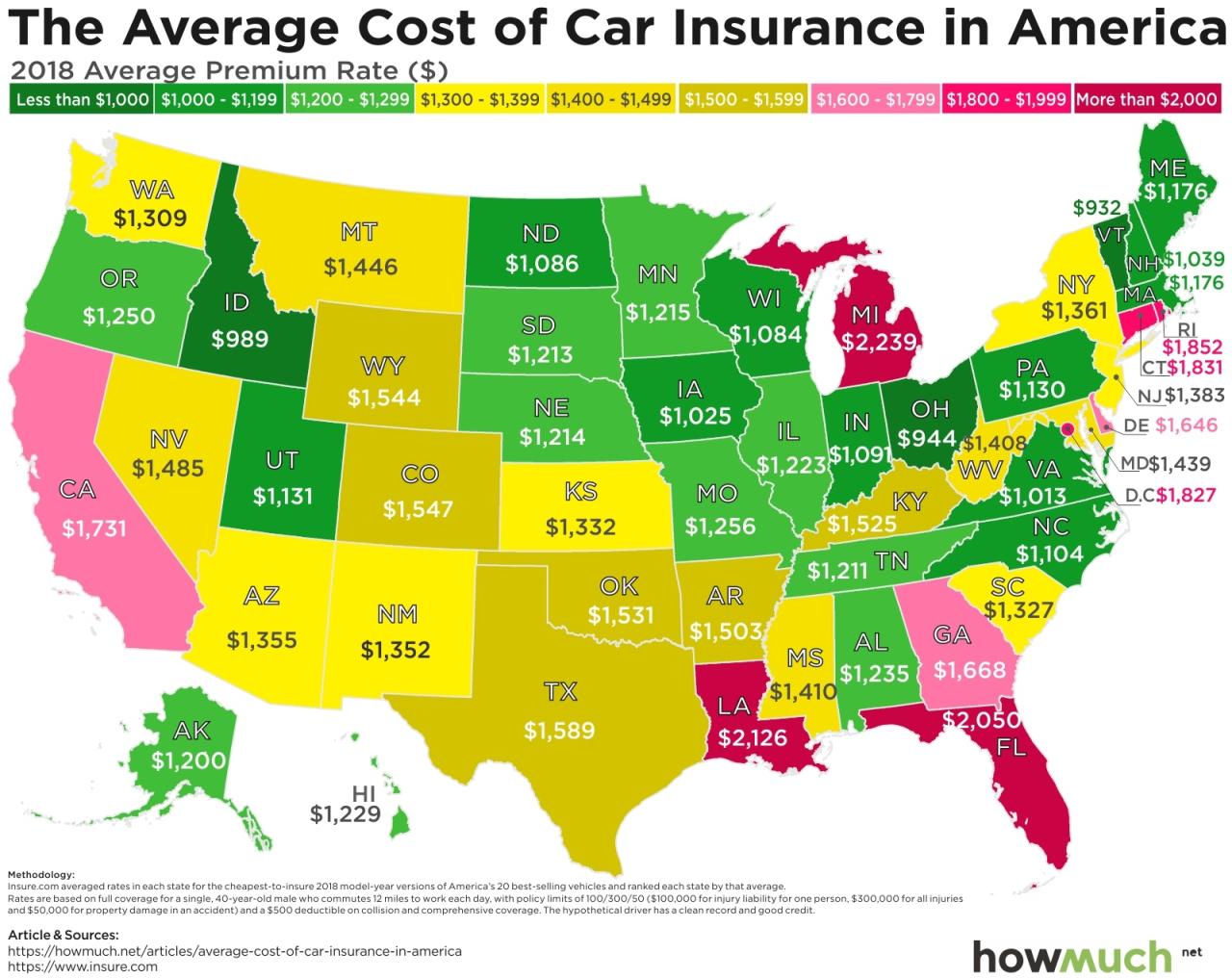

Geographic Location

The location where you live in Washington State can also influence your car insurance premiums. Areas with higher rates of accidents, theft, and vandalism tend to have higher insurance costs. For example, urban areas with heavy traffic congestion may have higher premiums compared to rural areas.

Average Car Insurance Costs by Coverage Type

Understanding the different types of car insurance coverage and their associated costs is crucial for making informed decisions about your policy. This section will delve into the average costs for common coverage types in Washington State, providing insights into how these costs vary across different insurance companies.

Average Costs for Common Coverage Types

The cost of car insurance in Washington State can vary significantly depending on the type of coverage you choose. Here’s a breakdown of the average costs for common coverage types:

- Liability Coverage: This coverage is legally required in Washington State and protects you financially if you cause an accident that injures someone or damages their property. The average cost for liability coverage in Washington State is around $500-$1,000 per year, depending on the limits of coverage you choose.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. The average cost for collision coverage in Washington State is around $300-$600 per year, depending on the age, make, and model of your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. The average cost for comprehensive coverage in Washington State is around $200-$400 per year, depending on the value of your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. The average cost for uninsured/underinsured motorist coverage in Washington State is around $100-$200 per year.

Average Costs by Insurance Company

The average cost of car insurance can also vary significantly between different insurance companies in Washington State. Here’s a comparison of the average costs for common coverage types across several major insurance companies:

| Insurance Company | Liability Coverage (Average Annual Cost) | Collision Coverage (Average Annual Cost) | Comprehensive Coverage (Average Annual Cost) | Uninsured/Underinsured Motorist Coverage (Average Annual Cost) |

|---|---|---|---|---|

| State Farm | $550-$1,000 | $350-$650 | $250-$450 | $120-$220 |

| Geico | $500-$950 | $300-$600 | $200-$400 | $100-$200 |

| Progressive | $525-$975 | $325-$625 | $225-$425 | $110-$210 |

| Allstate | $575-$1,050 | $375-$675 | $275-$475 | $130-$230 |

Note: These are just average costs and your actual premium will depend on various factors such as your driving record, age, location, and the specific coverage you choose.

Discounts and Savings Opportunities

Lowering your car insurance premiums in Washington State can be achieved through various discounts offered by insurance companies. By understanding these discounts and how to qualify for them, you can significantly reduce your overall insurance costs.

Common Car Insurance Discounts in Washington State

Discounts are a significant way to lower your car insurance premiums. Many insurance companies offer discounts based on various factors, including your driving record, vehicle features, and lifestyle. Here are some of the most common discounts available in Washington State:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits. It is usually granted to drivers who have not been involved in accidents or received traffic violations within a specific timeframe. This discount can significantly reduce your premiums, reflecting your safe driving behavior.

- Safe Driver Course Discount: Completing a defensive driving course, such as those offered by the American Automobile Association (AAA) or the National Safety Council, can qualify you for a discount. These courses teach safe driving practices and help you understand traffic laws, ultimately leading to safer driving habits and lower insurance premiums.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount is a common practice among insurance companies, rewarding you for insuring multiple vehicles with them.

- Anti-theft Device Discount: Installing anti-theft devices, such as car alarms or immobilizers, can significantly reduce the risk of your vehicle being stolen. Insurance companies recognize this and offer discounts to policyholders who have these devices installed.

- Good Student Discount: Many insurance companies offer discounts to students who maintain good academic standing. This discount reflects the assumption that good students are more responsible and less likely to be involved in accidents.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts. Staying with the same insurance company for an extended period can earn you a discount on your premiums.

Leveraging Discounts to Lower Premiums, Average cost of car insurance in washington state

To maximize your savings, you should actively seek out and leverage these discounts.

- Review Your Policy Regularly: Make sure you are taking advantage of all available discounts. Your insurance company may have new discounts or updated eligibility criteria, so reviewing your policy periodically is essential.

- Ask About Available Discounts: Don’t hesitate to ask your insurance agent about all the discounts you may qualify for. They can provide information about specific discounts and help you determine your eligibility.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations, as these can negatively impact your premiums and make you ineligible for certain discounts.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings.

- Shop Around for Quotes: Compare quotes from different insurance companies to ensure you are getting the best rates and discounts.

Choosing the Right Car Insurance Policy

Finding the right car insurance policy in Washington can feel overwhelming with so many options available. It’s important to take the time to compare quotes, understand your coverage needs, and find a policy that fits your budget and driving habits.

Comparing Car Insurance Quotes

To get the best car insurance rates, it’s essential to compare quotes from multiple providers. You can do this online, by phone, or by visiting insurance agencies in person. Here are some tips for comparing quotes effectively:

- Use an online comparison tool: Many websites allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort.

- Contact insurers directly: You can also contact insurance companies directly to get a quote. Be sure to ask about any discounts or special offers they may have.

- Provide accurate information: When requesting quotes, be honest and accurate with your information, including your driving history, vehicle details, and coverage needs.

- Consider your coverage needs: Don’t just focus on price. Make sure you understand the coverage options available and choose a policy that meets your needs.

Factors to Consider When Choosing a Policy

When choosing a car insurance policy, consider the following factors:

- Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay for covered losses. Higher limits generally mean higher premiums, but provide more financial protection in case of a serious accident.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but you’ll need to pay more in case of a claim.

- Customer Service: Consider the insurer’s reputation for customer service. Look for companies that are known for their responsiveness, helpfulness, and ease of communication.

- Discounts: Many insurers offer discounts for good driving records, safety features, multiple policy discounts, and other factors. Be sure to ask about available discounts when getting quotes.

Popular Car Insurance Companies in Washington

Here’s a table comparing key features and pricing of popular car insurance companies in Washington State:

| Company | Average Annual Premium | Coverage Options | Discounts | Customer Service Rating |

|---|---|---|---|---|

| State Farm | $1,200 | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, safe vehicle, multi-policy, student, etc. | 4.5/5 |

| Geico | $1,100 | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, safe vehicle, multi-policy, military, etc. | 4.0/5 |

| Progressive | $1,050 | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, safe vehicle, multi-policy, homeowner, etc. | 3.5/5 |

| Farmers | $1,300 | Comprehensive, collision, liability, uninsured/underinsured motorist | Good driver, safe vehicle, multi-policy, bundling, etc. | 4.0/5 |

Note: Average annual premiums are estimates and may vary based on individual factors like driving history, vehicle type, and coverage needs.

Understanding Insurance Requirements in Washington

It’s crucial to understand the insurance requirements in Washington State to ensure you’re legally compliant and protected on the road. Failing to meet these requirements can result in serious consequences, including fines, license suspension, and even jail time.

Minimum Car Insurance Requirements in Washington State

Washington State requires all drivers to carry a minimum amount of liability insurance, which protects others in case of an accident caused by you. This coverage is commonly referred to as “Financial Responsibility” insurance. Here’s a breakdown of the minimum coverage requirements:

- Liability Coverage: This protects others in case of an accident you cause. It covers bodily injury and property damage.

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

- Uninsured/Underinsured Motorist Coverage: This protects you and your passengers if you’re hit by a driver who doesn’t have insurance or has insufficient coverage.

- Bodily Injury: $25,000 per person, $50,000 per accident

- Property Damage: $10,000 per accident

Consequences of Driving Without Proper Insurance Coverage

Driving without the required minimum insurance coverage in Washington State can lead to significant penalties and legal consequences. Here’s what you could face:

- Fines: You could be fined up to $1,000 for driving without insurance, and your license could be suspended for up to six months.

- License Suspension: If you’re involved in an accident without insurance, your license will likely be suspended.

- Jail Time: In some cases, driving without insurance could lead to jail time, especially if you’re involved in a serious accident.

- Financial Responsibility: You could be held personally liable for all damages and injuries caused by an accident, even if you weren’t at fault. This could include medical expenses, property damage, and lost wages.

Last Word

Ultimately, finding the right car insurance policy in Washington involves a balance of coverage, affordability, and peace of mind. By understanding the factors that influence pricing, comparing quotes from different providers, and taking advantage of available discounts, you can ensure you have the protection you need without breaking the bank. Remember to regularly review your policy and make adjustments as needed to ensure it continues to meet your evolving needs.

Detailed FAQs: Average Cost Of Car Insurance In Washington State

What is the average cost of car insurance in Washington State?

The average cost of car insurance in Washington State varies depending on factors like age, driving history, and vehicle type. However, it’s estimated that the average annual premium for full coverage car insurance is around $2,000.

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a new car purchase, a change in driving habits, or a change in your credit score.