Washington State car insurance companies play a crucial role in ensuring drivers are protected on the road. This comprehensive guide explores the intricacies of the Washington State car insurance market, offering valuable insights for navigating the complexities of coverage and finding the best rates.

From understanding mandatory coverage requirements to exploring available discounts, we delve into key considerations for choosing the right car insurance policy. We also examine the top car insurance companies in Washington State, comparing their strengths and weaknesses to help you make an informed decision.

Washington State Car Insurance Market Overview

The Washington State car insurance market is a significant one, driven by a combination of factors including a large population, a high rate of car ownership, and a robust economy. This market is characterized by its competitive nature, with numerous insurance companies vying for customers.

Size and Growth of the Market

The Washington State car insurance market is substantial, with a total premium volume exceeding $10 billion in 2022. This represents a significant portion of the national car insurance market. The market has been experiencing steady growth in recent years, driven by factors such as population growth, increasing car ownership, and rising vehicle values.

Key Factors Influencing the Market

Several key factors influence the Washington State car insurance market, including:

Demographics

Washington State has a diverse population with a relatively high proportion of young adults, who tend to have higher insurance premiums due to their riskier driving habits. The state also has a significant number of older adults, who often have lower insurance premiums due to their more cautious driving habits.

Driving Habits

Washington State’s drivers have a relatively high rate of accidents, contributing to higher insurance premiums. The state’s mountainous terrain and challenging weather conditions can also lead to more accidents.

Regulatory Environment

Washington State has a well-regulated insurance market, with laws and regulations designed to protect consumers and ensure fair competition. The state’s Department of Insurance oversees the insurance industry, ensuring compliance with state laws.

Major Car Insurance Companies

Several major car insurance companies operate in Washington State, including:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers

These companies offer a wide range of insurance products and services, catering to the diverse needs of Washington State drivers.

Key Considerations for Choosing Car Insurance in Washington State: Washington State Car Insurance Companies

Choosing the right car insurance in Washington State involves understanding your needs and the state’s requirements. By carefully considering factors like coverage options, discounts, and the financial stability of insurance companies, you can find a policy that provides adequate protection at a reasonable price.

Mandatory Coverage Requirements in Washington State

Washington State has specific mandatory coverage requirements that all drivers must meet. These requirements ensure that drivers have adequate financial protection in case of an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Washington State requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $10,000 for property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. Washington State requires a minimum of $25,000 per person and $50,000 per accident for UM/UIM coverage.

- Damages to Your Own Vehicle: While not mandatory, it’s highly recommended to have collision and comprehensive coverage. Collision coverage covers damage to your vehicle in an accident, regardless of who is at fault. Comprehensive coverage covers damage to your vehicle from non-accident events like theft, vandalism, or natural disasters.

Factors to Consider When Selecting Car Insurance

When selecting car insurance, it’s crucial to consider various factors beyond the minimum coverage requirements.

- Coverage Options: Explore various coverage options beyond the mandatory requirements, such as:

- Rental Car Reimbursement: Covers rental car expenses while your vehicle is being repaired.

- Medical Payments Coverage (Med Pay): Covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault. (This is mandatory in some states, but not Washington).

- Roadside Assistance: Provides help with services like towing, flat tire changes, and jump starts.

- Discounts: Many insurance companies offer discounts that can lower your premiums. These can include:

- Good Driver Discount: For drivers with a clean driving record.

- Safe Driver Discount: For drivers who complete defensive driving courses.

- Multi-Car Discount: For insuring multiple vehicles with the same company.

- Multi-Policy Discount: For bundling home, life, or other insurance policies with your car insurance.

- Good Student Discount: For students with good grades.

- Anti-theft Device Discount: For vehicles equipped with anti-theft devices.

- Customer Service: It’s important to choose an insurance company with a reputation for excellent customer service. Consider factors like:

- Responsiveness: How quickly does the company respond to inquiries and claims?

- Friendliness: Are the customer service representatives helpful and understanding?

- Availability: Can you easily reach the company by phone, email, or online chat?

- Financial Stability: Choose an insurance company with a strong financial rating. This ensures that the company will be able to pay claims in the event of a major disaster or financial crisis. You can check the financial ratings of insurance companies through organizations like AM Best, Standard & Poor’s, and Moody’s.

Tips for Finding the Best Car Insurance Rates

Finding the best car insurance rates in Washington State requires comparison shopping and exploring different options.

- Get Multiple Quotes: Contact several insurance companies and request quotes for similar coverage levels. Compare prices, coverage options, and discounts.

- Shop Around Online: Use online insurance comparison websites to quickly and easily compare quotes from multiple companies.

- Negotiate: Once you’ve found a policy you like, don’t be afraid to negotiate with the insurance company. Ask about potential discounts or ways to lower your premium.

- Review Your Policy Regularly: Make sure your coverage still meets your needs and that you are taking advantage of all available discounts. Consider reviewing your policy at least once a year.

Top Car Insurance Companies in Washington State

Choosing the right car insurance company is crucial in Washington State, given the diverse driving conditions and potential risks. To help you make an informed decision, we’ve compiled a list of the top 5 car insurance companies in Washington State, based on a combination of factors like price, coverage options, customer satisfaction, and financial strength.

Comparing Top Car Insurance Companies in Washington State

To help you choose the best car insurance company for your needs, we’ve created a table comparing the top 5 companies based on key factors:

| Company | Price | Coverage Options | Customer Satisfaction | Financial Strength |

|---|---|---|---|---|

| Geico | Very Competitive | Comprehensive | Above Average | Excellent |

| State Farm | Competitive | Comprehensive | Above Average | Excellent |

| Progressive | Competitive | Comprehensive | Average | Excellent |

| USAA | Competitive | Comprehensive | Excellent | Excellent |

| Farmers | Competitive | Comprehensive | Average | Excellent |

Company Strengths and Weaknesses

- Geico: Geico is known for its competitive pricing and user-friendly online platform. They offer a wide range of coverage options and have a strong financial rating. However, some customers have reported issues with customer service.

- State Farm: State Farm is a well-established company with a reputation for excellent customer service and a wide range of coverage options. Their pricing is generally competitive, but they may not be the cheapest option in all cases.

- Progressive: Progressive is known for its innovative features, such as its “Name Your Price” tool, which allows customers to set their desired premium and then find coverage options that fit their budget. However, their customer service ratings are average.

- USAA: USAA is a highly-rated company that provides excellent customer service and financial strength. However, their membership is limited to active military personnel, veterans, and their families.

- Farmers: Farmers is a large insurance company with a strong financial rating and a wide range of coverage options. However, their pricing can be higher than some of the other companies on this list.

Comparing Quotes from Different Car Insurance Companies, Washington state car insurance companies

When comparing quotes from different car insurance companies, it’s important to consider the following:

- Coverage Options: Make sure you understand the different types of coverage available and choose the options that best meet your needs.

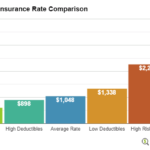

- Deductibles: A higher deductible will typically result in a lower premium, but you’ll have to pay more out of pocket if you have an accident.

- Discounts: Many car insurance companies offer discounts for safe driving, good grades, and other factors.

- Customer Service: Read online reviews and talk to friends and family to get an idea of a company’s customer service reputation.

- Financial Strength: Look for companies with strong financial ratings, as this indicates their ability to pay claims in the event of an accident.

Car Insurance Discounts Available in Washington State

Car insurance discounts can significantly reduce your premium costs. These discounts are offered by most car insurance companies in Washington State and are based on various factors like your driving history, vehicle features, and lifestyle.

Safe Driving Discounts

Safe driving discounts are one of the most common types of car insurance discounts. These discounts reward drivers with a clean driving record, meaning no accidents or traffic violations. The discount amount can vary based on the length of time you have maintained a clean driving record. For example, a driver with five years of accident-free driving might receive a larger discount than someone with only two years.

Good Student Discounts

Good student discounts are offered to students who maintain a certain grade point average (GPA). This discount acknowledges the responsibility and maturity demonstrated by good academic performance. To qualify for this discount, you’ll need to provide proof of your academic record, such as a transcript or report card. The specific GPA requirement for this discount can vary depending on the insurance company.

Multi-Car Discounts

If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount reflects the reduced risk associated with insuring multiple vehicles with the same company. The more vehicles you insure, the larger the discount you’ll receive.

Other Discounts

- Anti-theft Device Discounts: Installing anti-theft devices, like alarms or GPS trackers, can make your vehicle less appealing to thieves. This reduction in risk is often rewarded with a discount on your insurance premium.

- Defensive Driving Course Discounts: Completing a defensive driving course demonstrates your commitment to safe driving practices. This can result in a discount on your car insurance premium.

- Loyalty Discounts: Some insurance companies reward customers who have been with them for a certain period. This loyalty discount is a way of thanking long-term customers for their business.

- Paperless Billing Discounts: Choosing to receive your insurance documents electronically instead of by mail can save the insurance company money on printing and postage costs. This savings is often passed on to the customer in the form of a discount.

- Bundling Discounts: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you can often receive a discount. This bundling discount is a way of rewarding customers who consolidate their insurance needs with one company.

Understanding Car Insurance Policies in Washington State

Car insurance is a necessity in Washington State, as it protects you financially in the event of an accident. Understanding the different types of coverage available is crucial to ensuring you have adequate protection. This section will explain the various types of car insurance coverage, including their purpose and what they cover. It will also emphasize the importance of carefully reviewing the terms and conditions of your policy to ensure you understand your coverage and limitations.

Types of Car Insurance Coverage

Car insurance policies in Washington State typically offer various types of coverage, each designed to protect you against different types of risks. These coverages can be purchased individually or as part of a comprehensive package. Understanding the different types of coverage is essential to determining the level of protection that best suits your needs and budget.

- Liability Coverage: This is the most basic type of car insurance and is required by law in Washington State. It covers damages to other people and their property if you are at fault in an accident. Liability coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other driver and passengers in the event of an accident caused by you. The coverage limits are typically expressed as two numbers, such as 25/50/10. The first number (25) represents the maximum amount paid per person injured in an accident, the second number (50) represents the total maximum amount paid for all injuries in an accident, and the third number (10) represents the maximum amount paid for property damage.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in an accident caused by you. The coverage limit is typically expressed as a single number, such as $10,000, which represents the maximum amount paid for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Collision coverage is optional but highly recommended, especially if you have a loan or lease on your vehicle. The coverage limit is typically the actual cash value (ACV) of your vehicle, which is the amount it would be worth on the open market at the time of the accident.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than an accident, such as theft, vandalism, fire, hail, or natural disasters. Comprehensive coverage is optional, but it can be beneficial if your vehicle is new or has a high value. The coverage limit is typically the ACV of your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. It pays for your medical expenses, lost wages, and other damages. Uninsured/underinsured motorist coverage is optional, but it is highly recommended, especially if you live in an area with a high percentage of uninsured drivers.

- Personal Injury Protection (PIP): This coverage, also known as no-fault coverage, pays for your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident. PIP coverage is required in Washington State, and the minimum coverage limit is $10,000. It is important to note that PIP coverage does not cover property damage to your vehicle.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit. Med Pay coverage is optional and can be a valuable addition to your policy, especially if you have a high deductible on your health insurance.

Car Insurance Claims Process in Washington State

Filing a car insurance claim in Washington State can be a stressful experience, but understanding the process can help you navigate it more smoothly. The following steps Artikel the general process and provide tips for a successful claim.

Steps Involved in Filing a Car Insurance Claim

This section details the steps involved in filing a car insurance claim in Washington State, from reporting the accident to receiving compensation.

- Report the Accident: Immediately after an accident, contact your insurance company to report the incident. Provide details such as the date, time, location, and parties involved.

- File a Claim: Your insurance company will guide you through the claim filing process. They will typically provide you with a claim form to complete and submit.

- Provide Documentation: Gather all relevant documentation, including police reports, medical records, and repair estimates. Submit these documents to your insurance company to support your claim.

- Insurance Company Investigation: Your insurance company will investigate the claim to determine liability and assess the damage. This may involve interviewing witnesses and reviewing evidence.

- Negotiate Settlement: Once the investigation is complete, your insurance company will present a settlement offer. You can negotiate this offer if you feel it is not fair or sufficient.

- Receive Compensation: If you accept the settlement offer, you will receive compensation for your losses. This may include medical expenses, lost wages, and vehicle repairs.

Documentation Required for a Car Insurance Claim

This section Artikels the essential documentation needed when filing a car insurance claim in Washington State, ensuring a smooth and efficient process.

- Police Report: In most cases, a police report is required for accidents involving injuries or significant property damage.

- Medical Records: If you sustained injuries, provide copies of your medical records, including treatment plans and bills.

- Repair Estimates: Obtain estimates from qualified repair shops for any vehicle damage.

- Photos and Videos: Take pictures or videos of the accident scene, vehicle damage, and any injuries sustained.

- Witness Information: Collect contact information from any witnesses to the accident.

Communicating with Your Insurance Company

This section discusses effective communication with your insurance company, ensuring a smooth and transparent claims process.

- Be Prompt: Respond to your insurance company’s requests for information in a timely manner.

- Be Clear and Concise: Clearly communicate your needs and expectations, providing accurate and detailed information.

- Document Everything: Keep a record of all communication with your insurance company, including dates, times, and summaries of conversations.

- Be Patient: The claims process can take time, so be patient and understand that investigations and assessments may require time.

Tips for Handling a Car Insurance Claim

This section offers practical tips to effectively handle a car insurance claim in Washington State, maximizing your chances of a fair and successful outcome.

- Know Your Policy: Understand your insurance policy coverage and limits before filing a claim.

- Be Prepared: Gather all necessary documentation and information before contacting your insurance company.

- Be Honest: Provide accurate and truthful information to your insurance company.

- Seek Legal Advice: If you feel overwhelmed or unsure about the process, consult with a lawyer specializing in insurance claims.

Resources for Car Insurance Information in Washington State

Navigating the world of car insurance can feel overwhelming, especially when you’re trying to find the best coverage for your needs in Washington State. Thankfully, there are various resources available to help you understand your options and make informed decisions. This section will highlight some key resources, including government agencies, consumer protection organizations, and online tools.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights. The Washington State Department of Insurance (DOI) is your primary source for information and assistance related to car insurance.

- Washington State Department of Insurance (DOI): The DOI provides a wealth of information on car insurance requirements, consumer rights, and how to file complaints. Their website offers resources such as brochures, guides, and FAQs. You can also contact them directly via phone or email for assistance.

- Website: [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/)

- Phone: (360) 684-4600

- Email: [insurance.help@insurance.wa.gov](mailto:insurance.help@insurance.wa.gov)

Ultimate Conclusion

Navigating the world of car insurance in Washington State can be daunting, but with the right information and resources, finding the best coverage at the right price is achievable. By understanding the market, considering your needs, and comparing quotes from multiple companies, you can secure the protection you deserve while ensuring peace of mind on the road.

Essential Questionnaire

What is the minimum car insurance coverage required in Washington State?

Washington State requires drivers to carry liability insurance, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get the best car insurance rates in Washington State?

To find the best rates, compare quotes from multiple companies, consider discounts, and shop around for the best deals. It’s also essential to review your coverage needs and adjust them as necessary.

What are some common car insurance discounts available in Washington State?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and defensive driving course discounts. Check with individual companies for specific discount offerings.

What are the steps involved in filing a car insurance claim in Washington State?

Report the accident to your insurance company promptly, gather necessary documentation, and follow their instructions for filing a claim. Be prepared to provide details about the accident and any injuries or damages.