Tractor insurance state farm – Tractor insurance from State Farm is a vital investment for any agricultural or commercial operation that relies on these powerful machines. This comprehensive guide explores the ins and outs of tractor insurance, including the different types of coverage available, key factors influencing premium costs, and the process of filing a claim.

Whether you’re a seasoned farmer or a new tractor owner, understanding the nuances of tractor insurance is crucial. This guide aims to demystify the process, empowering you to make informed decisions about your coverage needs and ensure the protection of your valuable equipment.

Tractor Insurance Basics

Tractor insurance is essential for protecting your investment in this valuable piece of equipment. It safeguards you from financial losses in case of accidents, theft, or other unforeseen events that could damage or destroy your tractor.

Tractor insurance provides financial protection for your tractor, ensuring you can cover repair costs, replacement expenses, or other related liabilities in case of an accident, theft, or other unforeseen events. It is crucial to understand the different types of coverage available and choose the right policy to meet your specific needs.

Types of Tractor Insurance Coverage

Tractor insurance policies offer a range of coverage options to protect your investment. These options can be tailored to your specific needs and the type of tractor you own. Here are some of the most common types of coverage:

- Comprehensive Coverage: This covers damage to your tractor caused by events other than collisions, such as fire, theft, vandalism, or natural disasters. It protects your investment even when you’re not actively using the tractor.

- Collision Coverage: This covers damage to your tractor resulting from a collision with another vehicle or object. It helps pay for repairs or replacement costs, even if you are at fault for the accident.

- Liability Coverage: This protects you from financial responsibility if you are involved in an accident that causes injury or property damage to others. It can cover medical expenses, legal fees, and other related costs.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and property damage costs.

- Medical Payments Coverage: This covers medical expenses for you and your passengers in case of an accident, regardless of fault. It can help pay for hospital bills, doctor’s visits, and other related costs.

- Personal Injury Protection (PIP): This coverage is similar to medical payments coverage but can also cover lost wages and other expenses related to an accident. It is often required by state law.

- Towing and Labor Coverage: This coverage helps pay for towing and labor costs if your tractor breaks down or needs to be transported for repairs.

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, and other roadside emergencies.

Factors Influencing Tractor Insurance Cost

The cost of tractor insurance can vary depending on several factors. Understanding these factors can help you get a better idea of what to expect and potentially find ways to lower your premiums.

- Tractor Type: The type of tractor you own, including its make, model, and horsepower, will significantly impact your insurance premiums. Higher-powered tractors and newer models often have higher premiums due to their value and potential repair costs.

- Tractor Age: Older tractors generally have lower insurance premiums than newer models. This is because older tractors are typically worth less and have a lower risk of costly repairs. However, older tractors may be more prone to breakdowns and require more maintenance.

- Usage: The frequency and intensity of your tractor’s usage will also influence your insurance costs. Tractors used for commercial purposes, such as farming or construction, generally have higher premiums than those used for personal use. The more you use your tractor, the higher the risk of an accident or breakdown.

- Location: Your location can also affect your tractor insurance premiums. Areas with higher rates of theft, vandalism, or accidents may have higher insurance costs. This is because insurance companies assess the risk of loss in different areas.

- Driving Record: Your driving record, including any accidents or violations, can impact your insurance premiums. A clean driving record can lead to lower premiums, while a history of accidents or violations may increase your costs.

- Safety Features: Tractors equipped with safety features, such as anti-theft devices, backup cameras, or rollover protection systems, may qualify for discounts on your insurance premiums. These features can reduce the risk of accidents and theft, making your tractor a safer investment.

- Deductible: The deductible is the amount you agree to pay out-of-pocket in case of a claim. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums. Choose a deductible that you can comfortably afford in case of an accident or other covered event.

- Discounts: Insurance companies offer various discounts to tractor owners, such as good driver discounts, multi-policy discounts, and safety feature discounts. Ask your insurance agent about available discounts to potentially lower your premiums.

State Farm Tractor Insurance

State Farm, a leading insurance provider in the United States, offers comprehensive tractor insurance coverage to protect your valuable investment. Their policies are designed to provide financial protection against a wide range of risks, including accidents, theft, fire, and natural disasters.

State Farm Tractor Insurance Offerings

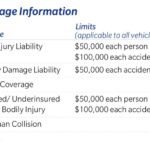

State Farm offers a variety of tractor insurance options to meet the specific needs of their customers. These options include:

- Liability Coverage: This coverage protects you financially if you are found liable for an accident involving your tractor, covering damages to other vehicles or property, as well as medical expenses for injured parties.

- Collision Coverage: This coverage helps pay for repairs or replacement of your tractor if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage provides protection against damage to your tractor caused by events other than accidents, such as theft, fire, vandalism, or natural disasters.

- Uninsured Motorist Coverage: This coverage provides protection if you are involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers if you are injured in an accident involving your tractor.

- Custom Equipment Coverage: This coverage provides additional protection for specialized equipment or attachments that are attached to your tractor.

State Farm Tractor Insurance Features

State Farm’s tractor insurance policies include several unique features that can benefit policyholders. These features include:

- Flexible Payment Options: State Farm offers various payment options to fit your budget, including monthly, quarterly, and annual payments.

- 24/7 Customer Service: State Farm provides 24/7 customer service to assist you with any questions or concerns you may have.

- Online Account Management: State Farm offers online account management, allowing you to access your policy information, make payments, and manage your coverage online.

- Discount Opportunities: State Farm offers various discounts to help lower your premium, such as discounts for multiple policies, safe driving records, and safety features on your tractor.

Comparison with Other Insurance Providers

State Farm’s tractor insurance policies are competitive with those offered by other major insurance providers. When comparing State Farm’s policies to those of other companies, it’s important to consider factors such as:

- Coverage Options: Compare the specific coverage options offered by each provider and ensure they meet your individual needs.

- Premium Rates: Obtain quotes from multiple providers to compare premium rates and find the most affordable option.

- Customer Service: Research the customer service reputation of each provider to ensure they have a history of providing excellent service.

- Financial Stability: Consider the financial stability of each provider to ensure they will be able to pay claims in the event of a major loss.

Benefits of Choosing State Farm

Choosing State Farm for your tractor insurance offers several potential benefits, including:

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options to meet the specific needs of tractor owners.

- Competitive Premium Rates: State Farm’s premium rates are competitive with those of other major insurance providers.

- Excellent Customer Service: State Farm has a reputation for providing excellent customer service.

- Strong Financial Stability: State Farm is a financially stable company with a long history of paying claims.

Potential Drawbacks of Choosing State Farm

While State Farm offers many benefits, there are also potential drawbacks to consider, including:

- Availability: State Farm’s availability may vary depending on your location.

- Premium Variations: Premium rates can vary based on factors such as your location, the type of tractor you own, and your driving history.

Understanding Tractor Insurance Coverage

Tractor insurance policies offer various types of coverage to protect you and your investment. These coverages provide financial protection against different risks associated with owning and operating a tractor. Understanding the different types of coverage and their applications is crucial to ensure you have the right protection for your specific needs.

Liability Coverage

Liability coverage is essential for any tractor owner. It protects you financially if you are found legally responsible for causing injury or damage to others while operating your tractor. This coverage helps pay for the following:

- Medical expenses of injured individuals

- Property damage to other vehicles or property

- Legal defense costs

- Judgment awards against you

For example, if your tractor accidentally hits a parked car, liability coverage would help cover the cost of repairs to the car and any medical expenses incurred by the car’s owner.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your tractor if it’s damaged in an accident, regardless of who is at fault. This coverage is helpful in situations where your tractor collides with another vehicle, a fixed object, or even rolls over.

- Repairs to your tractor after an accident

- Replacement cost of your tractor if it’s totaled

- Deductible payment, which is a fixed amount you pay before your insurance covers the rest

For instance, if your tractor collides with a tree while being driven on a farm, collision coverage would help cover the cost of repairing or replacing your tractor.

Comprehensive Coverage

Comprehensive coverage protects your tractor against damage caused by events other than collisions. This coverage can help cover repairs or replacement costs for damages caused by:

- Fire

- Theft

- Vandalism

- Hailstorms

- Flooding

- Natural disasters

For example, if your tractor is damaged by a hailstorm, comprehensive coverage would help pay for the repairs or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your damages. This coverage can help pay for:

- Medical expenses

- Lost wages

- Pain and suffering

- Property damage

For instance, if you are involved in an accident with a driver who doesn’t have insurance and your tractor is damaged, uninsured motorist coverage would help cover the cost of repairs or replacement.

Coverage Options and Scenarios

Here is a table summarizing the different coverage options and examples of scenarios where they would be utilized:

| Coverage | Definition | Scenario |

|---|---|---|

| Liability | Protects you against financial responsibility for injuries or damages caused to others. | Your tractor accidentally hits a parked car, causing damage. |

| Collision | Covers repairs or replacement of your tractor after an accident, regardless of fault. | Your tractor collides with a tree while being driven on a farm. |

| Comprehensive | Protects your tractor against damage caused by events other than collisions. | Your tractor is damaged by a hailstorm. |

| Uninsured/Underinsured Motorist | Protects you if you are involved in an accident with an uninsured or underinsured driver. | You are involved in an accident with a driver who doesn’t have insurance, and your tractor is damaged. |

Factors Affecting Tractor Insurance Premiums: Tractor Insurance State Farm

Tractor insurance premiums are calculated based on various factors that assess the risk associated with insuring your tractor. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Tractor Type

The type of tractor you own plays a significant role in determining your insurance premium. Tractors are categorized based on their horsepower, size, and intended use. Higher horsepower tractors, typically used for heavy-duty tasks, are generally considered riskier and therefore attract higher premiums. Similarly, specialized tractors designed for specific agricultural practices, such as harvesting or planting, may have different premium rates compared to general-purpose tractors.

Tractor Age

Older tractors, due to their increased risk of mechanical failure and potential for wear and tear, often carry higher insurance premiums. Newer tractors, with advanced safety features and better maintenance records, tend to have lower premiums.

Tractor Usage

The frequency and intensity of your tractor’s use directly impact your insurance premium. Tractors used for commercial purposes, such as farming or construction, are exposed to more risks and therefore may have higher premiums compared to tractors used for recreational purposes or limited personal use.

Location

Your location can influence your tractor insurance premium. Factors like the prevalence of theft, vandalism, and natural disasters in your area can affect your premium. For instance, areas prone to tornadoes or hailstorms may have higher premiums due to the increased risk of damage to your tractor.

Driver History

Your driving history, including any accidents or violations, can affect your tractor insurance premium. Similar to car insurance, a clean driving record can lead to lower premiums, while a history of accidents or violations may result in higher premiums.

Impact of Factors on Premium Cost

Here’s a table illustrating how each factor can impact your tractor insurance premium:

| Factor | Impact on Premium |

|—|—|

| Tractor Type | Higher horsepower and specialized tractors generally have higher premiums. |

| Tractor Age | Older tractors typically have higher premiums due to increased risk. |

| Tractor Usage | Commercial use often results in higher premiums compared to recreational use. |

| Location | Areas with higher risk of theft, vandalism, or natural disasters may have higher premiums. |

| Driver History | A clean driving record can lead to lower premiums, while a history of accidents or violations may result in higher premiums. |

Strategies for Reducing Tractor Insurance Premiums

Several strategies can help you potentially lower your tractor insurance premiums:

- Maintain your tractor: Regular maintenance and repairs can help reduce the risk of breakdowns and accidents, potentially lowering your premium.

- Invest in safety features: Installing safety features like alarms, GPS tracking systems, or backup cameras can make your tractor less appealing to thieves and can potentially lead to lower premiums.

- Improve your driving record: Maintaining a clean driving record by avoiding accidents and traffic violations can positively impact your premium.

- Consider a higher deductible: Opting for a higher deductible can lower your monthly premium, but you will have to pay more out of pocket in case of an accident.

- Shop around for insurance: Compare quotes from multiple insurance providers to find the best rates and coverage options for your needs.

Filing a Tractor Insurance Claim

Filing a tractor insurance claim with State Farm is a straightforward process. The first step is to report the claim as soon as possible after the incident. This will help ensure a timely and efficient claims process.

Reporting a Tractor Insurance Claim, Tractor insurance state farm

When reporting a claim, you will need to provide State Farm with some basic information, such as your policy number, the date and time of the incident, and a description of what happened. You should also be prepared to answer questions about the location of the incident, the type of damage, and any witnesses.

- You can report a claim online through the State Farm website or mobile app.

- You can also report a claim by phone by calling the number on your insurance card.

- In case of an emergency, you can report a claim by calling State Farm’s 24-hour claims line.

Documentation and Information

To process your claim, State Farm will require some documentation, such as:

- A copy of your insurance policy.

- A police report, if applicable.

- Photos or videos of the damage.

- Estimates from repair shops or other vendors.

- Any other relevant documentation.

Tips for a Smooth Claims Process

Here are some tips for ensuring a smooth and efficient claims process:

- Report the claim promptly after the incident.

- Be prepared to provide all the necessary documentation and information.

- Be honest and accurate in your reporting.

- Cooperate with the claims adjuster.

- Keep records of all communication with State Farm.

Tractor Safety and Maintenance

Operating a tractor can be a rewarding experience, but it’s crucial to prioritize safety and maintenance to prevent accidents and ensure longevity. By adhering to safety practices and maintaining your tractor regularly, you can minimize risks and enjoy years of reliable performance.

Tractor Safety Practices

Adhering to safety practices while operating a tractor is essential for protecting yourself and others.

- Familiarize yourself with the tractor’s controls and operating procedures. Thoroughly understand the location and function of all levers, pedals, and gauges before starting the tractor.

- Always wear appropriate clothing and footwear. Loose clothing or jewelry can become entangled in moving parts. Wear sturdy shoes with good traction to prevent slipping.

- Inspect the tractor before each use. Check the tire pressure, fluid levels, and any visible damage. Ensure all safety devices, such as the PTO shield, are in place and working properly.

- Use caution when operating near slopes or ditches. Avoid operating on steep slopes or near drop-offs. If necessary, use a spotter to guide you and ensure a safe path.

- Be aware of your surroundings. Watch out for obstacles, pedestrians, and other traffic. Use caution when crossing roads or highways.

- Never leave a tractor unattended with the engine running. Turn off the engine and engage the parking brake when leaving the tractor, even for short periods.

- Use caution when attaching or detaching implements. Ensure the implement is securely attached before starting the tractor. Use proper lifting techniques to avoid injury.

- Never ride on the tractor’s hitch or implement. This is extremely dangerous and can result in serious injury.

- Avoid operating the tractor under the influence of alcohol or drugs. Alcohol and drugs impair judgment and reaction time, making it dangerous to operate heavy machinery.

Tractor Maintenance

Regular tractor maintenance is essential for ensuring safe and efficient operation. Neglecting maintenance can lead to breakdowns, accidents, and increased repair costs.

- Follow the manufacturer’s recommended maintenance schedule. This schedule Artikels the necessary inspections, fluid changes, and other maintenance tasks.

- Inspect the tractor regularly for any signs of wear or damage. Pay close attention to tires, brakes, lights, and fluid levels.

- Change engine oil and filters regularly. Dirty oil can reduce engine performance and lead to premature wear.

- Check and adjust tire pressure. Proper tire pressure is essential for traction, fuel efficiency, and tire longevity.

- Clean and lubricate moving parts. This helps to prevent rust and corrosion, ensuring smooth operation.

- Inspect and maintain the hydraulic system. Check for leaks, worn hoses, and proper fluid levels.

- Service the battery regularly. Ensure the battery terminals are clean and the battery is properly charged.

Tractor Safety Checklist

Before operating your tractor, take a few minutes to review this safety checklist:

- Inspect the tractor for any visible damage or leaks.

- Check the tire pressure and ensure the tires are in good condition.

- Verify that all fluid levels are within the recommended range.

- Inspect the brakes and ensure they are functioning properly.

- Check the lights and ensure they are working.

- Inspect the PTO shield and ensure it is in place and working properly.

- Make sure all safety devices, such as the rollover protection structure (ROPS), are in place and working.

- Wear appropriate clothing and footwear.

- Be aware of your surroundings and use caution when operating near slopes, ditches, or roads.

- Never leave the tractor unattended with the engine running.

Conclusion

In conclusion, securing tractor insurance from State Farm provides valuable peace of mind and financial protection for your agricultural or commercial operations. By understanding the different coverage options, factors influencing premiums, and the claims process, you can make informed decisions that safeguard your investment and ensure the smooth running of your business.

Frequently Asked Questions

What types of tractors does State Farm insure?

State Farm offers insurance for a wide range of tractors, including farm tractors, utility tractors, and compact tractors. They can also insure other agricultural equipment like combines, balers, and planters.

What are the typical deductibles for tractor insurance?

Deductibles for tractor insurance vary depending on factors like the coverage type, tractor value, and your location. You’ll work with your State Farm agent to determine the best deductible for your needs.

Does State Farm offer discounts on tractor insurance?

Yes, State Farm may offer discounts for factors like safety features on your tractor, multiple policies with them, and good driving history.