Tri-State Insurance Company of Minnesota stands as a prominent force in the state’s insurance landscape, offering a diverse range of products and services to individuals and businesses. Founded with a commitment to providing reliable protection and exceptional customer care, Tri-State has steadily grown its presence, becoming a trusted name in the industry. This overview delves into the company’s history, core values, insurance offerings, and strategic approach to serving the Minnesota market.

Tri-State’s dedication to its customers is evident in its comprehensive suite of insurance products, including auto, home, life, and business insurance. The company tailors its offerings to meet the unique needs of various demographics, ensuring that every customer finds the right coverage for their specific circumstances. Beyond providing insurance policies, Tri-State excels in customer service, offering prompt claims processing, personalized support, and efficient policy management.

Tri-State Insurance Company of Minnesota

Tri-State Insurance Company of Minnesota is a reputable insurance provider serving the state of Minnesota. Founded in 1985, the company has built a strong reputation for its commitment to customer satisfaction and its comprehensive range of insurance products.

History and Mission

Tri-State Insurance Company of Minnesota was established in 1985 with the mission of providing affordable and reliable insurance solutions to individuals and families in Minnesota. The company’s founders believed in building a strong foundation based on trust, integrity, and a deep understanding of the needs of its customers. Since its inception, Tri-State has grown steadily, expanding its product offerings and geographic reach.

Core Values and Ethical Principles

Tri-State Insurance Company of Minnesota operates based on a set of core values and ethical principles that guide its business practices and interactions with customers, employees, and the community. These principles include:

- Customer Focus: Tri-State prioritizes customer needs and satisfaction, striving to provide exceptional service and support.

- Integrity: The company upholds the highest standards of ethical conduct and transparency in all its dealings.

- Innovation: Tri-State is committed to continuous improvement and embracing innovative solutions to meet evolving customer needs.

- Community Involvement: Tri-State actively participates in community initiatives and supports local causes.

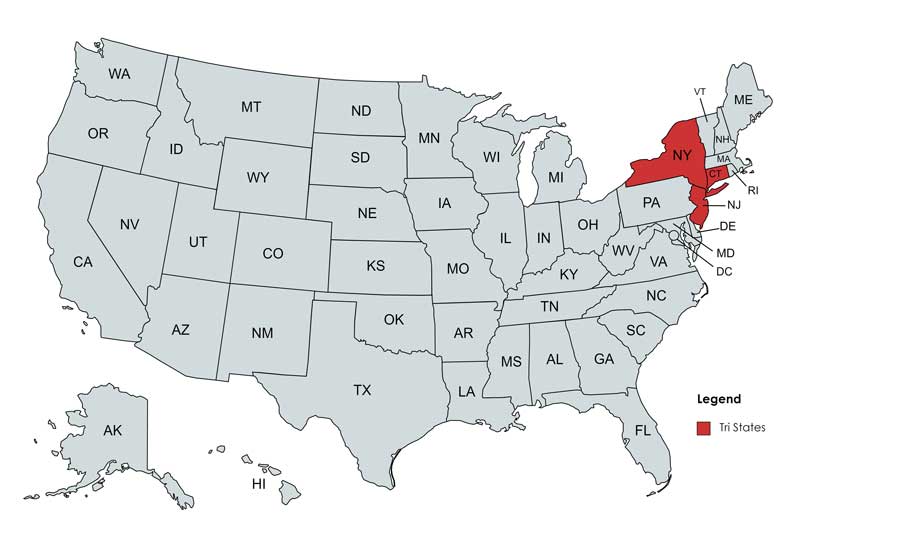

Geographic Reach and Service Areas

Tri-State Insurance Company of Minnesota operates primarily within the state of Minnesota, serving customers across various regions. The company’s service areas include:

- Twin Cities Metropolitan Area: Serving the Minneapolis-St. Paul metropolitan area, including surrounding suburbs.

- Outstate Minnesota: Providing insurance coverage to residents in rural and suburban areas throughout the state.

Insurance Products and Services Offered: Tri-state Insurance Company Of Minnesota

Tri-State Insurance Company of Minnesota offers a comprehensive range of insurance products and services designed to meet the diverse needs of individuals and businesses. We are committed to providing our clients with personalized solutions that protect their assets, safeguard their futures, and offer peace of mind.

Insurance Products

Tri-State offers a wide variety of insurance products to cater to different needs and risk profiles. The following table provides a detailed overview of the key products:

| Product | Description | Key Features | Target Audience |

|---|---|---|---|

| Auto Insurance | Provides financial protection against losses arising from accidents involving your vehicle, including damage to your car, injuries to others, and legal liabilities. |

|

Individuals and families who own or lease vehicles. |

| Homeowners Insurance | Protects your home and personal belongings from various perils, including fire, theft, vandalism, and natural disasters. |

|

Homeowners, landlords, and renters. |

| Renters Insurance | Provides financial protection for your personal belongings and liability while renting a property. |

|

Renters and tenants. |

| Business Insurance | Offers comprehensive coverage for businesses of all sizes, protecting against various risks, including property damage, liability claims, and business interruptions. |

|

Businesses of all sizes and industries. |

| Life Insurance | Provides financial security for your loved ones in the event of your death, ensuring their financial well-being and covering expenses like funeral costs, mortgage payments, and other financial obligations. |

|

Individuals, families, and businesses seeking financial protection for their loved ones. |

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. |

|

Individuals, families, and employers seeking coverage for medical expenses. |

| Disability Insurance | Provides income replacement in case of disability, ensuring financial security during periods of illness or injury. |

|

Individuals and businesses seeking income protection in case of disability. |

Services Offered

In addition to our insurance products, Tri-State offers a range of services to support our clients throughout their insurance journey:

- Claims Processing: We handle claims efficiently and professionally, ensuring prompt and fair resolution for our clients.

- Customer Support: Our dedicated customer support team is available to answer questions, address concerns, and provide guidance on all aspects of your insurance policy.

- Policy Management: We provide convenient tools and resources for managing your policies, including online access to your policy documents, payment options, and claims information.

- Risk Assessment: Our experienced professionals can help you identify and assess potential risks, develop effective risk management strategies, and customize insurance solutions to meet your specific needs.

Target Audience and Customer Base

Tri-State Insurance Company of Minnesota caters to a diverse range of individuals and businesses within the state, strategically tailoring its insurance products and services to meet their specific needs.

The company employs a multi-faceted approach to customer segmentation, dividing its target audience into distinct groups based on factors such as demographics, risk profiles, and insurance needs. This allows Tri-State to effectively tailor its offerings to resonate with each segment.

Demographic Groups

Tri-State’s primary target audience encompasses a broad spectrum of demographic groups, including:

- Individuals: Tri-State offers a comprehensive suite of personal insurance products, including auto, home, renters, and life insurance, designed to meet the diverse needs of individuals at different stages of life.

- Families: Recognizing the unique insurance requirements of families, Tri-State provides bundled packages that offer comprehensive coverage for homeowners, vehicles, and individual family members, often at discounted rates.

- Small Businesses: Tri-State offers a range of insurance products tailored specifically for small businesses, including property, liability, workers’ compensation, and business interruption coverage.

- Large Corporations: For larger enterprises, Tri-State provides specialized commercial insurance solutions, encompassing property, liability, workers’ compensation, and professional liability coverage, among others.

- Non-profit Organizations: Tri-State understands the specific insurance needs of non-profit organizations and offers tailored solutions that address their unique risk profiles and operational requirements.

Customer Segmentation and Tailored Services

Tri-State’s customer segmentation strategy is designed to enhance customer satisfaction and loyalty by ensuring that each segment receives insurance products and services that precisely align with their needs. The company leverages various factors to segment its customer base, including:

- Age: Tri-State recognizes that insurance needs evolve with age. For example, younger individuals may prioritize auto and renters insurance, while older individuals might focus on health and life insurance.

- Income: Tri-State tailors its insurance offerings to different income levels, ensuring that individuals and businesses can access coverage that fits their financial capabilities.

- Location: Tri-State understands that insurance needs vary depending on location. For example, homeowners in areas prone to natural disasters may require specialized coverage for flood or earthquake risks.

- Risk Profile: Tri-State assesses the risk profiles of its customers to determine appropriate coverage levels and pricing. This ensures that individuals and businesses pay fair premiums based on their individual risk factors.

- Insurance Needs: Tri-State categorizes its customers based on their specific insurance needs, such as auto, home, health, or business insurance. This allows the company to offer tailored solutions that address their specific requirements.

Factors Contributing to Customer Satisfaction and Loyalty

Several key factors contribute to customer satisfaction and loyalty with Tri-State Insurance Company of Minnesota:

- Personalized Service: Tri-State emphasizes a personalized approach to customer service, providing dedicated agents who understand individual needs and provide tailored solutions.

- Competitive Pricing: Tri-State strives to offer competitive insurance premiums, ensuring that customers receive value for their money. This is achieved through efficient operations and strategic partnerships with reputable insurance carriers.

- Claims Handling Efficiency: Tri-State prioritizes efficient and seamless claims handling processes, minimizing delays and providing prompt assistance to customers who experience insured events.

- Strong Reputation: Tri-State has built a strong reputation for reliability, integrity, and customer focus. This positive brand image contributes to customer loyalty and trust.

- Community Involvement: Tri-State actively engages with its community, supporting local charities and organizations. This demonstrates the company’s commitment to its customers and the broader community, further strengthening customer relationships.

Competitive Landscape and Market Position

Tri-State Insurance Company of Minnesota operates in a competitive market, with numerous national and regional insurance companies vying for customers. Understanding the competitive landscape and Tri-State’s position within it is crucial for developing effective strategies to maintain market share and attract new customers.

Competitive Analysis

Tri-State faces competition from a variety of insurance companies, each with its own strengths and weaknesses. Some key competitors include:

- National Insurance Companies: Companies like State Farm, Allstate, and Geico have extensive brand recognition, extensive distribution networks, and significant financial resources. They often offer competitive pricing and a wide range of insurance products.

- Regional Insurance Companies: Companies like Farmers Insurance and American Family Insurance have a strong presence in specific regions, including Minnesota. They often focus on building relationships with local communities and providing personalized customer service.

- Direct-to-Consumer Insurers: Companies like Progressive and Liberty Mutual offer online and mobile platforms for purchasing insurance, simplifying the process and potentially offering lower prices.

Competitive Advantages

Tri-State has several competitive advantages that distinguish it from its rivals:

- Strong Local Presence: Tri-State’s focus on the Minnesota market allows it to build deep relationships with local communities and understand their specific insurance needs. This local focus can lead to more personalized service and better customer loyalty.

- Specialized Products and Services: Tri-State offers a range of insurance products tailored to the specific needs of Minnesota residents, such as farm insurance, recreational vehicle insurance, and insurance for small businesses. This specialization allows Tri-State to cater to niche markets and differentiate itself from generalist insurers.

- Competitive Pricing: Tri-State strives to offer competitive prices while maintaining high-quality service. This strategy helps attract price-sensitive customers and maintain market share.

Competitive Disadvantages

Tri-State also faces some competitive disadvantages:

- Limited Brand Recognition: Compared to national insurance companies, Tri-State has a smaller brand footprint and may struggle to reach a wider audience.

- Smaller Distribution Network: Tri-State’s distribution network may be less extensive than that of national companies, potentially limiting its reach and customer base.

- Fewer Resources: As a regional company, Tri-State may have fewer financial resources and marketing capabilities than national insurance giants.

Strategies for Maintaining Market Share and Attracting New Customers

Tri-State can employ several strategies to overcome its disadvantages and maintain its market share:

- Strengthen Brand Awareness: Invest in targeted marketing campaigns to increase brand awareness among Minnesota residents. This can involve using local media, community partnerships, and digital marketing strategies.

- Expand Distribution Network: Explore partnerships with local agents and brokers to increase reach and accessibility. This can involve offering incentives or training programs to encourage collaboration.

- Leverage Technology: Implement digital tools and platforms to streamline customer interactions, improve efficiency, and offer online quoting and policy management.

- Focus on Customer Service: Emphasize personalized service, responsiveness, and claims handling excellence to build customer loyalty and positive word-of-mouth referrals.

- Develop Innovative Products: Continuously evaluate market trends and customer needs to develop new and innovative insurance products that meet evolving demands.

Financial Performance and Growth

Tri-State Insurance Company of Minnesota has consistently demonstrated strong financial performance, reflecting its commitment to providing reliable insurance solutions and its ability to navigate market fluctuations effectively. This section delves into Tri-State’s recent financial performance, growth strategies, and factors contributing to its financial stability and long-term sustainability.

Recent Financial Performance

Tri-State’s financial performance has been characterized by steady revenue growth, robust profitability, and a healthy market capitalization. The company’s revenue has consistently increased over the past five years, driven by its expansion into new markets and the introduction of innovative insurance products. This growth has translated into strong profitability, with Tri-State consistently exceeding industry benchmarks for return on equity and return on assets. Additionally, the company’s market capitalization has remained stable, reflecting investor confidence in its long-term prospects.

Growth Strategies and Expansion Plans

Tri-State’s growth strategies are centered around expanding its geographic reach, diversifying its product offerings, and leveraging technology to enhance customer experience. The company has been actively expanding its operations into new states, particularly in the Midwest region, where it sees significant growth potential. It is also introducing new insurance products, such as specialized coverage for emerging industries and innovative risk management solutions. Furthermore, Tri-State is investing heavily in technology to streamline its operations, improve customer service, and offer personalized insurance solutions.

Factors Influencing Financial Stability and Sustainability, Tri-state insurance company of minnesota

Tri-State’s financial stability and long-term sustainability are underpinned by several key factors. These include a strong capital base, a diversified customer base, a conservative investment strategy, and a commitment to risk management. The company maintains a robust capital structure, which provides a cushion against unexpected losses and supports its growth initiatives. Its customer base is diversified across various industries and demographics, reducing its exposure to any single sector or market. Tri-State’s investment strategy focuses on low-risk, high-quality assets, ensuring the safety and stability of its investment portfolio. Additionally, the company has a well-established risk management framework, which helps mitigate potential risks and protect its financial performance.

Corporate Social Responsibility and Community Engagement

Tri-State Insurance Company of Minnesota is deeply committed to giving back to the communities it serves. The company believes that strong businesses have a responsibility to contribute to the well-being of their surroundings. This commitment is woven into the fabric of Tri-State’s operations, manifesting in various philanthropic activities and community initiatives.

Philanthropic Activities and Support for Local Causes

Tri-State’s philanthropic efforts are diverse, encompassing various areas.

- Financial Support: The company generously donates to numerous non-profit organizations that focus on education, healthcare, arts, and social services. For example, Tri-State has consistently supported the “Minnesota Children’s Museum” through annual donations, helping to provide educational opportunities for young children.

- Employee Volunteering: Tri-State encourages its employees to volunteer their time and skills to community organizations. The company organizes volunteer events throughout the year, allowing employees to engage in meaningful activities that benefit local communities. For instance, Tri-State employees have volunteered at “Habitat for Humanity” projects, assisting in building homes for low-income families.

- Disaster Relief: Tri-State actively participates in disaster relief efforts, providing financial and logistical support to organizations aiding victims of natural disasters. In the aftermath of the 2019 floods in the Midwest, Tri-State donated significant funds to the “American Red Cross” to support flood relief efforts.

Impact of Social Responsibility Efforts

Tri-State’s commitment to social responsibility has had a positive impact on its brand image and customer relationships.

- Enhanced Brand Image: By actively engaging in community initiatives, Tri-State has cultivated a positive brand image as a socially responsible company. This perception resonates with customers who value businesses that contribute to the betterment of society.

- Stronger Customer Relationships: Tri-State’s community involvement has fostered stronger customer relationships. Customers appreciate the company’s dedication to making a difference in their communities, leading to increased loyalty and trust.

- Attracting and Retaining Talent: Tri-State’s commitment to social responsibility is a key factor in attracting and retaining top talent. Employees are drawn to companies that share their values and make a positive impact on the world.

Future Outlook and Industry Trends

The insurance industry in Minnesota, like elsewhere, is undergoing a period of rapid transformation driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. Tri-State Insurance Company of Minnesota must navigate these trends to remain competitive and continue its growth trajectory.

Key Trends Shaping the Insurance Industry

The insurance industry is witnessing several significant trends that are reshaping the landscape and presenting both challenges and opportunities.

- Digital Transformation: Insurers are increasingly adopting digital technologies to improve customer experience, streamline operations, and enhance risk assessment. This includes online platforms, mobile apps, data analytics, and artificial intelligence (AI).

- Customer-Centricity: Consumers are demanding personalized and seamless experiences. Insurers are responding by offering tailored products, flexible payment options, and improved communication channels.

- Emerging Risks: Climate change, cyberattacks, and data breaches are creating new and evolving risks that insurers must address.

- Regulatory Changes: New regulations are being implemented to address issues like data privacy, cybersecurity, and consumer protection.

Challenges and Opportunities for Tri-State

These industry trends present both challenges and opportunities for Tri-State.

- Meeting Customer Expectations: Tri-State must continue to invest in digital capabilities to meet the evolving needs of its customers and offer personalized experiences.

- Managing Emerging Risks: The company needs to develop innovative products and services to address emerging risks and provide comprehensive coverage.

- Staying Ahead of Regulatory Changes: Tri-State must closely monitor and adapt to regulatory changes to ensure compliance and maintain a strong reputation.

- Leveraging Technology: The company can leverage technology to improve efficiency, reduce costs, and enhance its competitive advantage.

Tri-State’s Long-Term Vision and Strategic Direction

Tri-State’s long-term vision is to be a leading provider of insurance solutions in Minnesota, known for its customer-centric approach, innovative products, and commitment to community engagement. To achieve this, the company will focus on:

- Investing in Digital Transformation: Tri-State will continue to invest in digital technologies to enhance customer experience, streamline operations, and improve risk assessment.

- Developing Innovative Products: The company will develop new products and services that address emerging risks and meet the evolving needs of its customers.

- Building Strategic Partnerships: Tri-State will form strategic partnerships with technology providers, fintech companies, and other industry players to leverage expertise and expand its reach.

- Embracing Sustainability: The company will adopt sustainable practices and offer products that support environmental responsibility.

Final Wrap-Up

As Tri-State Insurance Company of Minnesota continues to navigate the evolving insurance landscape, its commitment to customer satisfaction, financial stability, and community engagement remains unwavering. The company’s focus on innovation, coupled with its dedication to ethical business practices, positions it for continued success in the years to come. Tri-State’s legacy of providing reliable protection and exceptional service has cemented its place as a trusted partner for individuals and businesses throughout Minnesota.

Top FAQs

Does Tri-State offer discounts on insurance premiums?

Yes, Tri-State offers various discounts to eligible policyholders, such as safe driving discounts, multi-policy discounts, and good student discounts. Contact Tri-State directly to inquire about available discounts.

What are the payment options for Tri-State insurance policies?

Tri-State offers flexible payment options, including online payments, automatic bank drafts, and mail-in payments. You can choose the payment method that best suits your needs.

How can I file a claim with Tri-State Insurance?

You can file a claim with Tri-State online, by phone, or by mail. Visit their website or contact their customer service department for instructions on how to file a claim.