State farm.homeowners insurance – State Farm Homeowners Insurance offers comprehensive protection for your home and belongings, providing peace of mind in the event of unforeseen circumstances. State Farm’s policies are designed to cover a wide range of potential risks, from fire and theft to natural disasters and liability claims.

This guide delves into the key features, benefits, and considerations associated with State Farm homeowners insurance, providing a comprehensive understanding of its offerings. We’ll explore the different coverage options, pricing factors, customer service aspects, and the claims process, helping you make informed decisions about your insurance needs.

State Farm Homeowners Insurance Overview: State Farm.homeowners Insurance

State Farm is a leading provider of homeowners insurance in the United States, offering comprehensive coverage to protect your home and belongings. With a wide range of policies and services, State Farm aims to provide peace of mind and financial security in case of unexpected events.

Coverage Offered

State Farm homeowners insurance policies typically cover a variety of risks, including:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and foundation, against perils like fire, windstorm, and hail.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, appliances, clothing, and electronics, against similar perils.

- Liability Coverage: This provides financial protection if someone is injured on your property or if you are held liable for damages caused by you or your family members.

- Additional Living Expenses Coverage: This helps cover the costs of temporary housing and other expenses if your home becomes uninhabitable due to a covered event.

Advantages of Choosing State Farm

- Strong Financial Stability: State Farm is a financially sound company with a long history of providing reliable insurance coverage.

- Wide Network of Agents: State Farm has a vast network of local agents who can provide personalized advice and assistance.

- Competitive Rates: State Farm often offers competitive rates for homeowners insurance, making it an attractive option for many homeowners.

- Variety of Coverage Options: State Farm offers a range of policy options to meet the specific needs of different homeowners.

- Excellent Customer Service: State Farm is known for its commitment to providing excellent customer service, with dedicated claims representatives available 24/7.

Disadvantages of Choosing State Farm

- Limited Online Options: While State Farm offers online quotes and policy management tools, some customers may prefer more comprehensive online services.

- Potential for Higher Deductibles: State Farm’s deductibles can be higher than those offered by some competitors, which could impact your out-of-pocket costs in case of a claim.

- Varying Agent Experiences: The quality of service you receive from a State Farm agent can vary depending on the individual agent.

Key Coverage Options

State Farm offers a range of coverage options within its homeowners insurance policies, allowing you to tailor your protection to meet your specific needs and budget. Understanding the different types of coverage available is crucial for making informed decisions about your insurance.

Coverage Options

Here is a table summarizing the key coverage options provided by State Farm homeowners insurance:

| Coverage Option | Description | Limits | Potential Cost |

|---|---|---|---|

| Dwelling Coverage | Protects the physical structure of your home, including the attached structures, against perils such as fire, windstorm, and hail. | Varies based on the value of your home and the chosen coverage amount. | Higher coverage amounts typically result in higher premiums. |

| Personal Property Coverage | Covers your belongings inside your home, such as furniture, appliances, clothing, and electronics, against covered perils. | Typically a percentage of your dwelling coverage, but can be adjusted based on your needs. | Higher coverage amounts typically result in higher premiums. |

| Liability Coverage | Protects you financially if someone is injured on your property or you are found liable for damages caused by you or a member of your household. | Varies based on your individual needs and risk factors. | Higher coverage amounts typically result in higher premiums. |

| Additional Living Expenses Coverage | Provides financial assistance for temporary housing and other living expenses if your home becomes uninhabitable due to a covered peril. | Typically a percentage of your dwelling coverage, but can be adjusted based on your needs. | Higher coverage amounts typically result in higher premiums. |

| Medical Payments Coverage | Covers medical expenses for guests who are injured on your property, regardless of fault. | Varies based on your individual needs and risk factors. | Higher coverage amounts typically result in higher premiums. |

| Personal Property Replacement Cost Coverage | Provides coverage for the full replacement cost of your belongings, without deducting for depreciation. | Available as an optional endorsement. | May increase your premium. |

| Scheduled Personal Property Coverage | Provides additional coverage for specific valuable items, such as jewelry, art, and collectibles. | Available as an optional endorsement. | May increase your premium. |

Importance of Customization

It is crucial to customize your homeowners insurance coverage based on your individual needs and risk factors. For example, if you live in an area prone to natural disasters, you may want to consider increasing your dwelling coverage and purchasing additional coverage for specific perils. Similarly, if you have valuable possessions, you may want to consider purchasing scheduled personal property coverage.

Pricing and Cost Factors

The cost of homeowners insurance is determined by a variety of factors, and State Farm, like other insurance companies, uses these factors to calculate your premiums. Understanding these factors can help you make informed decisions about your coverage and potentially lower your insurance costs.

Factors Influencing Premiums

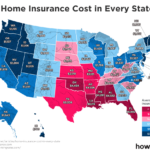

- Location: Your location is a significant factor influencing your premium. Areas prone to natural disasters like earthquakes, hurricanes, or wildfires generally have higher premiums due to the increased risk of damage. For example, living in coastal areas with hurricane risks will likely result in higher premiums than living in inland areas with less risk.

- Property Value: The value of your home is directly related to your premium. Higher-valued homes typically require more insurance coverage and thus have higher premiums. This is because the cost of rebuilding or replacing a more expensive home is greater.

- Coverage Levels: Your chosen coverage levels significantly impact your premium. Higher coverage limits, such as for dwelling, personal property, and liability, generally lead to higher premiums. However, it’s essential to balance coverage levels with your budget and the potential risks associated with your home.

- Risk History: Your past claims history and risk factors influence your premium. For example, having a history of claims, such as water damage or theft, could lead to higher premiums. Similarly, factors like the age of your home, its construction materials, and the presence of safety features can impact your risk profile and, therefore, your premium.

Comparison with Other Providers

State Farm is a major homeowners insurance provider, and its pricing is generally competitive with other companies like Allstate, Liberty Mutual, and Nationwide. However, it’s essential to compare quotes from multiple providers to find the best rates for your specific needs and situation.

“The best way to find the best rate is to shop around and compare quotes from multiple insurance companies.”

You can use online comparison tools or work with an independent insurance agent to get quotes from various providers. This will allow you to compare coverage levels, premiums, and discounts offered by each company and choose the best option for your individual needs.

Customer Experience and Service

State Farm is known for its strong customer service, aiming to provide a positive and seamless experience for its policyholders. This commitment is reflected in their diverse range of online tools, mobile apps, and customer support channels, designed to simplify policy management and address customer needs efficiently.

Online Tools and Mobile Apps

State Farm offers a comprehensive suite of online tools and mobile apps designed to empower customers with greater control and convenience in managing their insurance policies.

- State Farm website: The website allows customers to access their policy information, make payments, file claims, and receive personalized recommendations. They can also find agents, explore coverage options, and get quotes online.

- State Farm mobile app: The app offers a user-friendly interface for managing policies on the go. Customers can view policy details, pay bills, file claims, track claim status, contact customer service, and access roadside assistance.

Customer Support Channels

State Farm provides multiple customer support channels to ensure accessibility and responsiveness to customer needs.

- Phone: Customers can reach State Farm’s customer service representatives via phone, providing immediate assistance for inquiries and claims.

- Email: For non-urgent inquiries, customers can contact State Farm via email, allowing for a detailed and documented communication channel.

- Live chat: The website and app offer live chat support, providing instant communication with customer service agents for real-time assistance.

- Social media: State Farm maintains active social media profiles, allowing customers to engage with the company, ask questions, and provide feedback.

Strengths and Weaknesses of State Farm’s Customer Service

State Farm’s customer service is generally well-regarded, receiving positive feedback for its responsiveness, helpfulness, and accessibility. However, like any large insurance company, State Farm faces challenges in consistently delivering a perfect customer experience.

Strengths

- Availability of multiple communication channels: State Farm offers a variety of channels for customers to reach out, ensuring accessibility and convenience.

- Responsive and helpful customer service representatives: Customers generally report positive experiences with State Farm’s representatives, who are knowledgeable and dedicated to resolving issues.

- User-friendly online tools and mobile app: The online tools and mobile app are designed for ease of use, simplifying policy management and claim filing.

Weaknesses

- Long wait times for phone calls: Customers sometimes experience long wait times when calling customer service, particularly during peak hours.

- Limited availability of live chat support: Live chat support may not be available 24/7, potentially hindering real-time assistance for certain inquiries.

- Inconsistency in customer service experiences: While generally positive, customer experiences can vary depending on the agent or representative contacted.

Comparison with Competitors

| Feature | State Farm | Competitor A | Competitor B |

|---|---|---|---|

| Online Tools | Comprehensive website and mobile app | Basic website with limited features | Advanced online platform with integrated tools |

| Customer Support Channels | Phone, email, live chat, social media | Phone, email, limited online chat | Phone, email, 24/7 live chat, social media |

| Customer Service Responsiveness | Generally responsive, with potential wait times | Variable responsiveness, with occasional delays | Highly responsive, with minimal wait times |

| Claim Filing Process | Streamlined online and mobile app options | Paper-based claim filing with limited online options | Fully digital claim filing with 24/7 support |

Claims Process and Customer Satisfaction

State Farm’s homeowners insurance claims process is designed to be straightforward and supportive, aiming to help policyholders navigate the complexities of recovering from unexpected events. From reporting the claim to receiving the final settlement, State Farm offers a comprehensive and transparent approach to ensure a smooth and efficient experience.

Claims Reporting and Initial Assessment

Policyholders can report claims through various channels, including online, phone, or mobile app. Once a claim is reported, State Farm will initiate an initial assessment to determine the nature and extent of the damage. This involves gathering information about the incident, including the date, time, and cause of the loss.

Investigation and Damage Evaluation

Following the initial assessment, State Farm will dispatch an independent adjuster to inspect the property and evaluate the damage. The adjuster will document the extent of the loss, take photographs, and gather evidence to support the claim.

Claim Settlement and Payment

After the investigation and damage evaluation are complete, State Farm will provide the policyholder with a settlement offer. The offer will reflect the estimated cost of repairs or replacement, taking into account the policy coverage and any applicable deductibles.

Customer Support and Assistance

Throughout the claims process, State Farm provides dedicated customer support to assist policyholders. This includes answering questions, providing updates on the claim status, and facilitating communication with contractors or other relevant parties. State Farm also offers resources and guidance to help policyholders navigate the recovery process.

Industry Standards and Competitor Practices

State Farm’s claims handling process is generally considered to be in line with industry standards and comparable to competitor practices. However, specific aspects of the claims process, such as the timeframes for investigation and settlement, may vary depending on the complexity of the claim and the individual circumstances.

Customer Satisfaction and Reviews

Customer satisfaction with State Farm’s claims handling process is generally positive, with many policyholders praising the company’s responsiveness, communication, and overall support. However, there are also instances where policyholders have expressed dissatisfaction with the claims process, citing issues such as delays in processing or disagreements over settlement amounts.

Discounts and Bundling Options

State Farm offers a variety of discounts to help homeowners save money on their insurance premiums. These discounts can be applied to both new and existing policies, and they can help you save a significant amount of money over the life of your policy.

Discounts Available

State Farm offers a wide range of discounts to homeowners, including:

- Safety Features: Installing safety features in your home, such as smoke detectors, fire alarms, and security systems, can qualify you for discounts.

- Loyalty Programs: State Farm offers discounts to customers who have been insured with them for a certain period of time.

- Bundling: You can save money by bundling your homeowners insurance with other State Farm insurance products, such as auto insurance, life insurance, and renters insurance.

- Other Discounts: State Farm also offers discounts for various other factors, such as being a good student, having a good driving record, and being a member of certain organizations.

Most Valuable Discounts

The most valuable discounts for homeowners are typically those that are based on safety features and bundling.

Installing safety features can significantly reduce the risk of a claim, which is why insurance companies offer discounts for them.

Bundling your homeowners insurance with other insurance products can also save you money, as insurance companies often offer discounts for multiple policies.

Discount Eligibility Criteria

Here is a table outlining the available discounts and their eligibility criteria:

| Discount | Eligibility Criteria |

|---|---|

| Safety Features | Installing smoke detectors, fire alarms, and security systems |

| Loyalty Programs | Being insured with State Farm for a certain period of time |

| Bundling | Bundling your homeowners insurance with other State Farm insurance products |

| Other Discounts | Good student, good driving record, membership in certain organizations |

Reputation and Financial Stability

State Farm is a well-known and respected name in the insurance industry, with a long history of providing homeowners insurance. To understand if State Farm is a good fit for your needs, it’s important to consider its reputation and financial strength.

Industry Ratings and Customer Reviews

Industry ratings and customer reviews provide valuable insights into State Farm’s performance as a homeowners insurance provider.

- AM Best, a leading insurance rating agency, assigns State Farm an A++ (Superior) financial strength rating, indicating its exceptional ability to meet its financial obligations.

- J.D. Power, a renowned customer satisfaction research firm, consistently ranks State Farm highly for customer satisfaction in homeowners insurance.

- Consumer Reports, a consumer advocacy organization, also gives State Farm high marks for customer satisfaction and claims handling.

- The Better Business Bureau (BBB), a non-profit organization that accredits businesses, gives State Farm an A+ rating, reflecting its commitment to ethical business practices.

State Farm generally receives positive feedback from customers, with many praising its strong customer service, efficient claims handling, and competitive pricing.

Financial Strength and Ability to Meet Claims Obligations

State Farm’s financial strength is a crucial factor for homeowners, as it ensures the company can fulfill its claims obligations even during challenging economic times.

- State Farm holds a substantial amount of assets, exceeding $300 billion as of 2022. This strong financial position allows the company to readily handle unexpected claims and financial shocks.

- The company has a long history of profitability, consistently generating positive earnings, which further strengthens its financial resilience.

- State Farm has a strong capital adequacy ratio, which measures its ability to cover potential losses, indicating its financial stability and ability to meet its obligations.

State Farm’s commitment to financial stability is evident in its consistent performance and its ability to meet its financial obligations, providing peace of mind to its policyholders.

Comparison with Other Major Insurance Companies

State Farm’s financial strength and reputation compare favorably to other major insurance companies in the industry.

- State Farm consistently ranks among the top insurance companies in terms of financial strength and customer satisfaction, demonstrating its strong standing within the industry.

- While other reputable companies like Allstate, Liberty Mutual, and Nationwide also have strong financial positions, State Farm’s long-standing reputation and commitment to customer service make it a highly competitive choice.

State Farm’s reputation and financial stability are key factors that contribute to its strong position in the homeowners insurance market.

State Farm vs. Competitors

Choosing the right homeowners insurance policy can be a complex decision, and it’s essential to compare options from different providers. State Farm is a major player in the homeowners insurance market, but it’s crucial to understand how its offerings stack up against other reputable companies like Nationwide, Liberty Mutual, and Allstate.

Comparison of Key Features, Pricing, and Customer Service

This section will delve into a side-by-side comparison of State Farm’s homeowners insurance with its competitors, focusing on key features, pricing, and customer service aspects.

| Feature | State Farm | Nationwide | Liberty Mutual | Allstate |

|---|---|---|---|---|

| Coverage Options | Comprehensive coverage options, including dwelling, personal property, liability, and additional living expenses. | Offers a range of coverage options, with a focus on customization. | Provides extensive coverage options, including specialized coverage for valuable items. | Offers comprehensive coverage, with a strong emphasis on disaster protection. |

| Pricing | Prices vary based on location, coverage, and risk factors. | Known for competitive pricing, with discounts for bundling and safety features. | Pricing can be competitive, with a focus on providing value for money. | Prices can be higher than some competitors, but they often offer strong discounts. |

| Customer Service | Offers a wide range of customer service channels, including online, phone, and mobile app. | Known for its responsive and helpful customer service. | Provides excellent customer service, with a focus on resolving issues quickly. | Offers a variety of customer service channels, but response times can vary. |

Strengths and Weaknesses of State Farm

State Farm boasts several strengths that contribute to its success in the homeowners insurance market.

- Strong Brand Reputation: State Farm is a well-known and trusted brand with a long history of providing reliable insurance services. This reputation for reliability and customer satisfaction can be a significant advantage.

- Extensive Agent Network: State Farm has a vast network of agents across the country, offering personalized service and local expertise. This allows customers to easily access support and guidance from experienced professionals.

- Competitive Pricing: State Farm generally offers competitive pricing, especially when considering discounts for bundling policies and safety features. This can make it an attractive option for budget-conscious homeowners.

However, State Farm also has some weaknesses to consider.

- Limited Customization: While State Farm offers a range of coverage options, it may not be as flexible as some competitors in terms of customization. This can limit the ability to tailor policies to specific needs.

- Claims Process: While State Farm has a generally positive reputation for handling claims, some customers have reported challenges with the claims process, including delays and difficulty in reaching representatives. This can be a significant concern for homeowners facing a disaster.

- Digital Experience: State Farm’s digital experience, while improving, can still lag behind some competitors in terms of user-friendliness and functionality. This can be a disadvantage for tech-savvy customers who prefer online self-service options.

Conclusion

State Farm is a well-established and reputable homeowners insurance provider with a strong financial standing and a vast network of agents. Its comprehensive coverage options, competitive pricing, and excellent customer service make it a strong contender for homeowners seeking insurance. However, it’s crucial to consider your specific needs and compare quotes from multiple insurers to find the best fit for your situation.

Factors to Consider When Choosing Homeowners Insurance, State farm.homeowners insurance

The decision of choosing a homeowners insurance provider should be based on a comprehensive evaluation of your needs and priorities. Here are some key factors to consider:

- Coverage Options: Ensure the policy covers your specific needs, including dwelling, personal property, liability, and additional living expenses.

- Pricing and Cost Factors: Compare quotes from different insurers based on your property’s value, location, and coverage options.

- Customer Service and Claims Process: Research the insurer’s reputation for handling claims promptly and efficiently.

- Discounts and Bundling Options: Explore available discounts for home security systems, fire alarms, and bundling with other insurance policies.

- Financial Stability and Reputation: Choose an insurer with a strong financial rating and a positive track record of customer satisfaction.

Wrap-Up

State Farm homeowners insurance offers a robust and reliable solution for protecting your most valuable asset – your home. By carefully considering your individual needs, you can customize a policy that provides the appropriate coverage and peace of mind. Whether you’re a first-time homeowner or seeking to optimize your existing insurance plan, State Farm’s comprehensive approach and commitment to customer service make it a strong contender in the homeowners insurance market.

FAQ Guide

What are the common types of coverage included in State Farm homeowners insurance?

State Farm homeowners insurance typically includes coverage for dwelling, personal property, liability, and additional living expenses.

How do I get a quote for State Farm homeowners insurance?

You can obtain a quote online, by phone, or through a State Farm agent. You’ll need to provide information about your property, coverage preferences, and personal details.

Does State Farm offer discounts for homeowners insurance?

Yes, State Farm offers various discounts for homeowners insurance, including those for safety features, bundling policies, and loyalty programs.