State farm renters insurance cost for 0 000 – State Farm Renters Insurance Cost for $100,000 is a common question among renters seeking adequate coverage for their belongings. Understanding the factors that influence this cost, such as location, coverage amount, and personal risk factors, is crucial for making informed decisions. This guide provides a comprehensive overview of State Farm renters insurance, exploring its features, cost estimates, and the process of obtaining a quote.

Renters insurance offers protection against various risks, including theft, fire, and water damage. State Farm is a well-established insurance provider with a reputation for customer service and claims handling. By understanding the nuances of State Farm renters insurance, you can make an informed choice that best suits your needs and budget.

State Farm Renters Insurance Overview

State Farm Renters Insurance offers comprehensive coverage designed to protect your belongings and provide financial security in the event of unforeseen circumstances. It is a valuable investment for renters, safeguarding their personal possessions and offering peace of mind.

Coverage Options

State Farm Renters Insurance provides various coverage options tailored to meet the specific needs of renters. These options include:

- Personal Property Coverage: This coverage protects your belongings against damage or loss due to covered perils, such as fire, theft, or vandalism. The policy typically provides coverage for items like furniture, electronics, clothing, and other personal possessions. The amount of coverage you choose will determine the maximum amount the insurance company will pay for covered losses.

- Liability Coverage: This coverage protects you against lawsuits or claims made by others for injuries or property damage that occur on your rented property. For example, if someone slips and falls on your porch and sustains an injury, your liability coverage could help pay for medical expenses and legal fees. This coverage typically has a limit, which is the maximum amount the insurance company will pay for a single incident.

- Additional Living Expenses: This coverage provides financial assistance if you are unable to live in your rented dwelling due to a covered event. For example, if a fire forces you to relocate temporarily, this coverage can help pay for hotel expenses, meals, and other essential living costs until you can return to your home. The coverage amount will depend on your specific policy.

Situations Where Renters Insurance Would Be Beneficial

Renters insurance offers protection against various risks that could significantly impact your financial well-being. Here are some situations where having renters insurance can prove invaluable:

- Theft: If your belongings are stolen from your apartment or rental property, renters insurance can help replace them. This coverage is essential in areas with high crime rates or if you live in a building with inadequate security measures.

- Fire: Fires can cause devastating damage to property and belongings. Renters insurance can provide financial assistance to cover the cost of replacing lost or damaged items. It can also help with temporary housing expenses if your apartment becomes uninhabitable due to a fire.

- Water Damage: Water damage from burst pipes, leaks, or flooding can cause significant damage to your belongings. Renters insurance can help cover the cost of repairs or replacements. This coverage is particularly important if you live in an older building or an area prone to flooding.

- Liability Claims: If someone is injured on your property, you could be held liable for their injuries. Renters insurance can help cover legal fees and medical expenses associated with such claims. This coverage is essential for protecting yourself from potential financial ruin.

Factors Influencing Renters Insurance Cost

The cost of renters insurance is determined by a combination of factors, including your personal circumstances, the property you’re renting, and the coverage you choose. Understanding these factors can help you get the best possible price for your renters insurance.

Coverage Amount

The amount of coverage you choose is a primary factor influencing your renters insurance cost. The more coverage you need, the higher your premium will be. Coverage amount refers to the maximum amount your insurer will pay for covered losses, such as theft, fire, or water damage.

For example, if you choose a coverage amount of $100,000, your insurer will pay up to $100,000 for covered losses.

You should choose a coverage amount that is sufficient to replace your belongings in the event of a covered loss. Consider the value of your furniture, electronics, clothing, and other personal items. It’s important to have enough coverage to replace everything, including any items that are expensive or irreplaceable.

Location

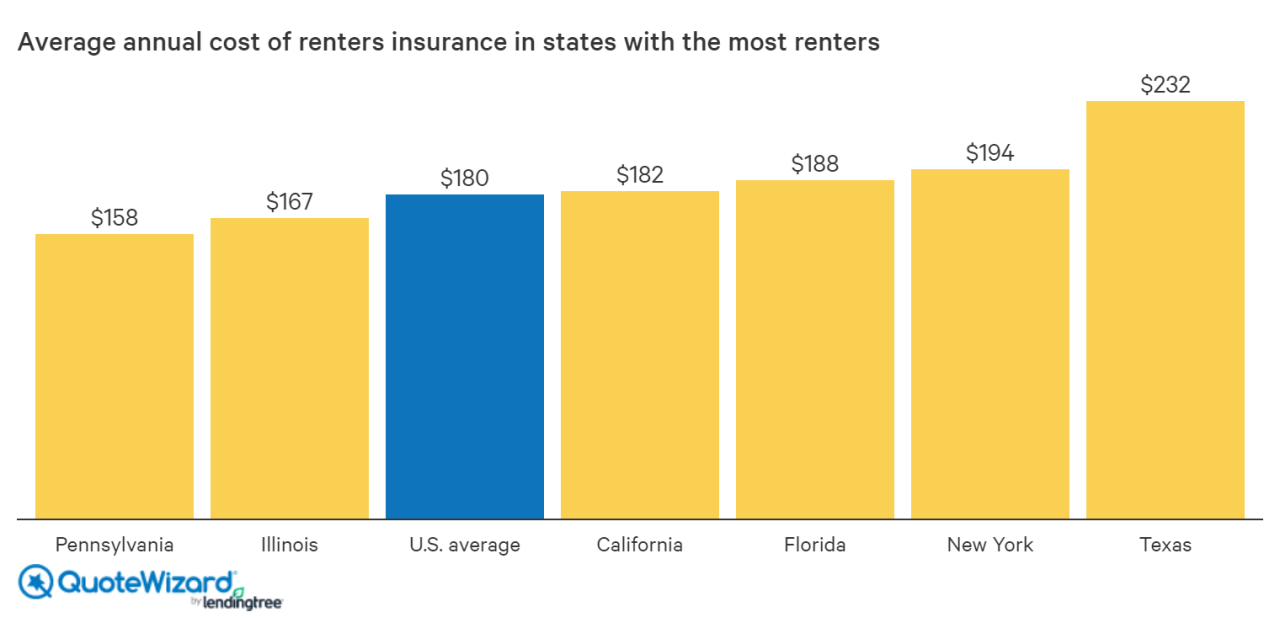

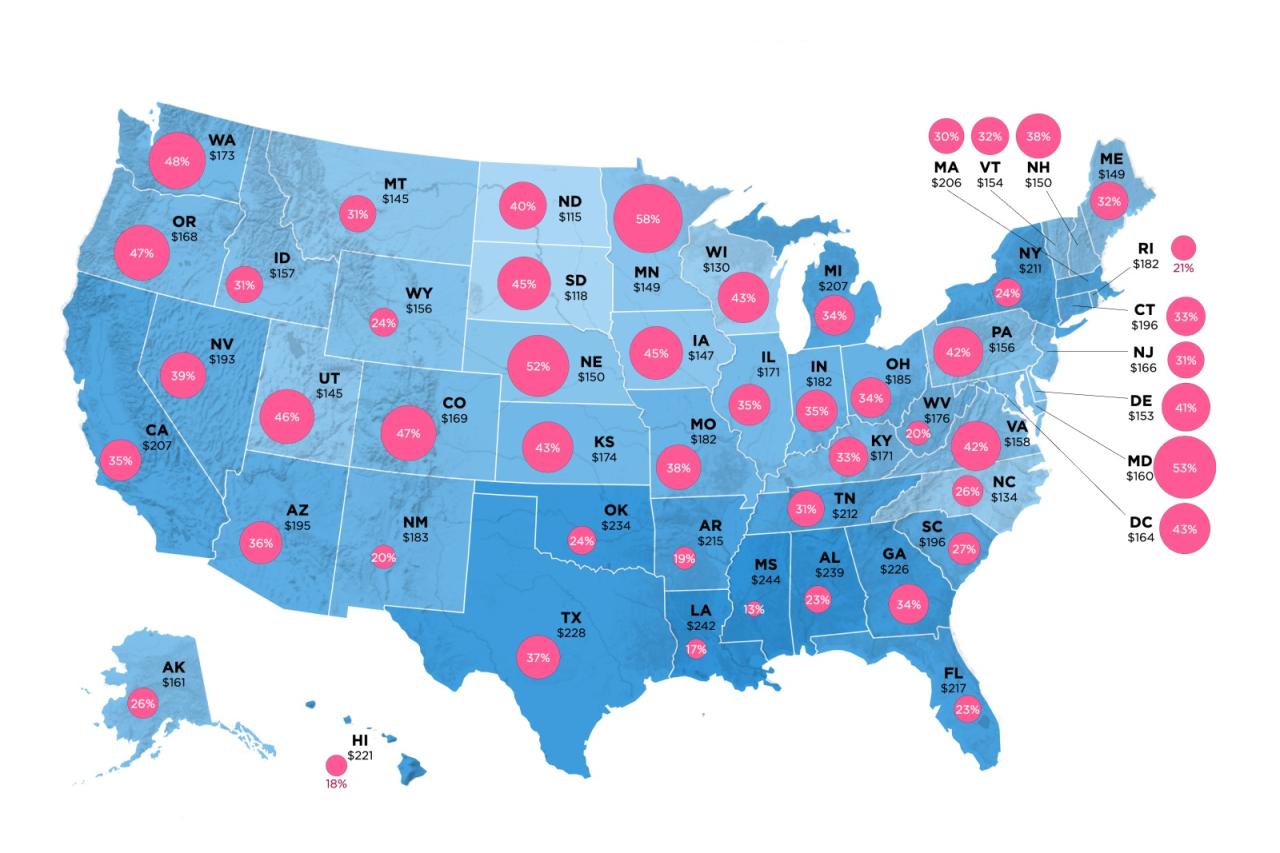

The location of your rental property can also impact your renters insurance cost. Insurance companies consider factors such as crime rates, the risk of natural disasters, and the cost of living in your area.

For instance, renters living in areas with high crime rates or a history of natural disasters may pay higher premiums.

It’s important to research the risks associated with your location and discuss these factors with your insurance agent to ensure you have adequate coverage.

Personal Risk Factors

Your personal risk factors can also influence your renters insurance cost. These factors include your credit score, claims history, and the age of your belongings.

- A good credit score can lead to lower premiums, as insurance companies view it as an indicator of financial responsibility.

- A history of filing claims may result in higher premiums, as it suggests a higher risk of future claims.

- Older belongings may be worth less, so you may be able to get lower premiums on them.

Deductibles and Discounts

Deductibles and discounts are two important factors that can affect your renters insurance cost.

- A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium.

- Discounts can help you lower your premium. Insurance companies offer various discounts, such as those for safety features in your rental property, multiple policies, or being a good driver.

State Farm Renters Insurance for $100,000 Coverage

Renters insurance is essential for protecting your belongings in case of unexpected events like fire, theft, or natural disasters. State Farm is a well-known and reputable insurance provider, offering renters insurance policies with various coverage options. Understanding the cost of State Farm renters insurance with $100,000 coverage is crucial for making informed decisions about your insurance needs.

Estimated Cost Range for $100,000 Coverage

The estimated cost range for State Farm renters insurance with $100,000 coverage can vary significantly depending on various factors. Generally, you can expect to pay between $15 and $35 per month for this coverage level. However, this is just an estimate, and your actual premium will be determined by your individual circumstances and location.

Factors Influencing Renters Insurance Cost

Several factors can influence the cost of your State Farm renters insurance, including:

- Location: The cost of renters insurance varies significantly based on your location. Areas with higher crime rates or a greater risk of natural disasters typically have higher premiums. For instance, living in a coastal area prone to hurricanes will likely result in higher premiums compared to a less risky inland location.

- Coverage Amount: The amount of coverage you choose directly impacts your premium. Higher coverage amounts generally result in higher premiums. Since you are considering $100,000 coverage, this will fall within the mid-range of coverage options, resulting in a moderate premium.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums. Choosing a higher deductible can be a good strategy to lower your monthly payments, but it also means you will have to pay more out of pocket in case of a claim.

- Personal Circumstances: Your personal circumstances, such as your credit score, claims history, and the age and condition of your belongings, can also affect your premium. A good credit score and a clean claims history can lead to lower premiums. Additionally, having newer and more valuable belongings may result in higher premiums.

Comparison with Other Insurance Providers

It is always a good idea to compare quotes from multiple insurance providers before making a decision. While State Farm is a reputable company, other insurance providers may offer more competitive rates for your specific needs. Factors such as your location, coverage requirements, and personal circumstances can significantly impact pricing across different providers.

Obtaining a Quote and Policy

Getting a renters insurance quote from State Farm is straightforward and can be done online, over the phone, or in person. You’ll need to provide some basic information about yourself, your rental property, and your belongings.

Once you have a quote, you can customize your coverage and choose a deductible that suits your needs and budget.

Customizing Coverage and Choosing a Deductible

State Farm offers various coverage options to tailor your policy to your specific needs. You can choose the level of coverage you want for your personal belongings, liability, and additional living expenses.

- Personal Property Coverage: This covers your belongings against damage or theft. You can choose a coverage amount that reflects the value of your possessions.

- Liability Coverage: This protects you if someone is injured or their property is damaged on your premises. You can choose a coverage amount that reflects your risk tolerance.

- Additional Living Expenses: This covers the costs of living elsewhere if your rental property becomes uninhabitable due to a covered event. You can choose a coverage amount that reflects your monthly expenses.

Your deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but you’ll pay more in the event of a claim.

Key Aspects of the Policy Document

The policy document is a legal contract that Artikels your coverage, terms, and conditions. It’s essential to review the document carefully before signing it.

- Coverage Limits: This Artikels the maximum amount State Farm will pay for each type of coverage.

- Deductible: This specifies the amount you’ll pay out-of-pocket for each claim.

- Exclusions: This lists events or situations not covered by your policy. It’s crucial to understand what’s not covered to avoid surprises.

- Conditions: This Artikels your responsibilities as a policyholder, such as providing prompt notice of claims and cooperating with investigations.

It’s also essential to ask any questions you have about your policy before you sign it. State Farm’s customer service representatives can provide clarification on any aspect of your policy.

Benefits of State Farm Renters Insurance

Choosing State Farm for your renters insurance can provide you with a range of benefits, ensuring peace of mind and financial protection. State Farm has a long-standing reputation for providing excellent customer service and handling claims efficiently, making it a reliable choice for renters.

State Farm’s Customer Service and Claims Handling, State farm renters insurance cost for 0 000

State Farm is known for its exceptional customer service and claims handling process. The company prioritizes customer satisfaction and aims to provide a seamless experience. State Farm’s customer service representatives are available 24/7 to assist with policy inquiries, claims reporting, and other needs. The company’s claims process is designed to be efficient and transparent, with dedicated claims adjusters working to resolve issues promptly.

Unique Features and Benefits of State Farm Renters Insurance

State Farm offers several unique features and benefits that can enhance your renters insurance policy. These features provide additional protection and peace of mind, making State Farm a compelling choice for renters.

- Personal Property Replacement Cost Coverage: State Farm offers personal property replacement cost coverage, which helps ensure you receive enough money to replace your belongings at their current market value, regardless of their age or depreciation. This can be particularly beneficial for newer items that have depreciated less.

- Identity Theft Protection: State Farm includes identity theft protection as part of its renters insurance policy. This coverage provides financial assistance and support services if you become a victim of identity theft. It can help cover costs associated with restoring your credit and resolving the issue.

- Discounts and Bundling Options: State Farm offers various discounts that can help lower your renters insurance premium. These discounts may include multi-policy discounts for bundling your renters insurance with other policies like auto insurance or home insurance. Additionally, you may be eligible for discounts based on safety features in your apartment building or your own personal safety habits.

Comparing Renters Insurance Options

Choosing the right renters insurance can be overwhelming, especially with the many providers and plans available. Comparing different options helps you find the best coverage at a price that fits your budget.

Comparison of Renters Insurance Options

To help you make an informed decision, we’ve compiled a table comparing State Farm renters insurance to other reputable providers. The table showcases coverage amounts, estimated costs, and key features to highlight the differences and help you identify the best fit for your needs.

| Insurance Provider | Coverage Amount | Estimated Cost | Key Features |

|---|---|---|---|

| State Farm | $100,000 | $15-$25 per month | – Personal property coverage – Liability coverage – Additional living expenses – Coverage for certain natural disasters – Discounts for safety features |

| Liberty Mutual | $100,000 | $12-$20 per month | – Personal property coverage – Liability coverage – Additional living expenses – Coverage for certain natural disasters – Discounts for safety features and bundled policies |

| Allstate | $100,000 | $14-$22 per month | – Personal property coverage – Liability coverage – Additional living expenses – Coverage for certain natural disasters – Discounts for safety features and good driving records |

| USAA | $100,000 | $10-$18 per month | – Personal property coverage – Liability coverage – Additional living expenses – Coverage for certain natural disasters – Discounts for military service and bundled policies |

Final Thoughts

Ultimately, the cost of State Farm renters insurance for $100,000 coverage can vary based on individual circumstances and location. However, by carefully considering the factors that influence premiums and exploring different coverage options, you can find a policy that provides the necessary protection at a reasonable price. State Farm’s reputation for customer service and claims handling adds further value to their offerings, making them a reputable choice for renters seeking comprehensive insurance.

Key Questions Answered: State Farm Renters Insurance Cost For 0 000

What factors determine the cost of State Farm renters insurance?

Factors like your location, coverage amount, personal risk factors, deductible, and any available discounts influence the cost.

Can I customize my coverage with State Farm renters insurance?

Yes, State Farm allows you to customize your coverage to meet your specific needs. You can choose different coverage amounts for personal property, liability, and additional living expenses.

How do I obtain a quote for State Farm renters insurance?

You can get a quote online, over the phone, or by visiting a State Farm agent. Provide your details, including your location, coverage preferences, and desired deductible.

What are the benefits of choosing State Farm for renters insurance?

State Farm is known for its customer service, claims handling process, and various discounts and benefits. They also offer additional features like identity theft protection.