State Farm Homeowners Insurance Company is a leading provider of insurance in the United States, known for its reliable coverage and competitive pricing. Founded in 1922, State Farm has built a reputation for its commitment to customer service and financial stability, making it a trusted choice for homeowners across the country.

State Farm offers a comprehensive suite of homeowners insurance policies designed to protect your home and belongings from a wide range of risks, including fire, theft, and natural disasters. Their policies are customizable to meet your specific needs and budget, with a variety of coverage options, deductibles, and discounts available.

State Farm Overview

State Farm is a leading insurance provider in the United States, offering a wide range of insurance products, including homeowners insurance. The company’s roots go back to 1922, when it was founded by G.J. Mecherle in Bloomington, Illinois. Mecherle’s vision was to create an insurance company that focused on the needs of its policyholders, offering affordable and reliable coverage. This customer-centric approach has been a cornerstone of State Farm’s success.

Founding Principles and Key Milestones

State Farm’s founding principles emphasized mutual respect, integrity, and a commitment to community. These values have guided the company’s growth and development over the years. State Farm’s early years were marked by a focus on auto insurance, but the company quickly expanded into other areas, including homeowners insurance, life insurance, and health insurance. Some of State Farm’s key milestones include:

- 1922: State Farm Mutual Automobile Insurance Company was founded by G.J. Mecherle in Bloomington, Illinois.

- 1924: State Farm introduces its first homeowners insurance policy, known as the “Farmowner’s Policy”.

- 1930s: State Farm expands its coverage to include other types of property, including commercial buildings.

- 1940s: State Farm begins offering life insurance.

- 1950s: State Farm becomes the largest auto insurer in the United States.

- 1960s: State Farm expands into the international market.

- 1970s: State Farm introduces its first homeowners insurance policy with comprehensive coverage.

- 1980s: State Farm becomes the largest insurance company in the United States.

- 1990s: State Farm introduces its first online insurance quote and purchase options.

- 2000s: State Farm continues to expand its product offerings and services, including mobile apps and online account management.

- 2010s: State Farm continues to innovate, focusing on customer service and technology.

State Farm’s Current Position in the Homeowners Insurance Market

State Farm is currently one of the largest homeowners insurance providers in the United States. The company is known for its comprehensive coverage options, competitive pricing, and excellent customer service. State Farm offers a variety of homeowners insurance policies to meet the needs of different customers, including those with standard homes, luxury homes, and rental properties. The company also provides a wide range of additional coverage options, such as flood insurance, earthquake insurance, and personal liability coverage. State Farm’s commitment to innovation and customer satisfaction has helped it maintain its position as a leading player in the homeowners insurance market.

Homeowners Insurance Coverage

State Farm offers a comprehensive range of homeowners insurance coverage designed to protect your home and belongings from various risks. Understanding the different types of coverage and their limitations is crucial to ensure you have adequate protection. This section will delve into the various coverage options offered by State Farm and compare them with those offered by other major insurers.

Dwelling Coverage

Dwelling coverage is the most fundamental part of homeowners insurance. It protects your home’s structure, including the attached structures like garages and decks, against covered perils. These perils can include fire, lightning, windstorms, hail, vandalism, and theft.

The amount of dwelling coverage you need depends on the replacement cost of your home. It’s important to ensure that your coverage is sufficient to rebuild your home in case of a total loss.

Other Structures Coverage

This coverage protects detached structures on your property, such as sheds, fences, and swimming pools. It operates similarly to dwelling coverage, covering damage from covered perils. The amount of coverage is typically a percentage of your dwelling coverage.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry. This coverage typically applies to your belongings both inside and outside your home.

The amount of personal property coverage you need depends on the value of your belongings. You can choose to insure your belongings at actual cash value (ACV) or replacement cost value (RCV). ACV coverage pays the depreciated value of your belongings, while RCV coverage pays the full replacement cost.

Personal Liability Coverage

Personal liability coverage protects you from financial losses arising from accidents that occur on your property. For example, if someone is injured on your property, this coverage can help pay for their medical expenses and legal fees.

The amount of personal liability coverage you need depends on your individual circumstances. Most insurers offer coverage limits ranging from $100,000 to $1 million.

Medical Payments Coverage

Medical payments coverage provides coverage for medical expenses incurred by guests who are injured on your property, regardless of fault. This coverage is typically limited to a specific amount, such as $1,000 or $5,000.

Loss of Use Coverage

Loss of use coverage provides financial assistance if your home becomes uninhabitable due to a covered peril. This coverage can help pay for temporary housing, meals, and other living expenses while your home is being repaired or rebuilt.

Additional Living Expenses Coverage

This coverage is similar to loss of use coverage and helps pay for additional expenses incurred while your home is being repaired or rebuilt. This coverage can be helpful if you have to move to a more expensive hotel or need to hire a temporary caregiver for your children.

Coverage Comparisons

State Farm’s homeowners insurance coverage options are comparable to those offered by other major insurers. However, there can be differences in coverage limits, deductibles, and premiums. It’s essential to compare quotes from multiple insurers to find the best coverage for your needs and budget.

For example, some insurers may offer higher coverage limits for certain perils, such as windstorms or earthquakes. Others may have lower deductibles or offer discounts for certain safety features.

Ultimately, the best homeowners insurance policy for you will depend on your individual circumstances and preferences.

Policy Features and Options

State Farm homeowners insurance policies offer a range of features and options that can be customized to meet your individual needs and budget. Understanding these features and options can help you choose the policy that best suits your specific circumstances and ensure you have adequate coverage.

Deductibles

The deductible is the amount you pay out-of-pocket for covered losses before your insurance kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Impact on Premiums: Choosing a higher deductible can significantly reduce your premium costs, as you are assuming more of the financial risk. Conversely, a lower deductible means you pay less out-of-pocket for covered losses, but you’ll pay more in premiums.

- Factors to Consider: When deciding on your deductible, consider your risk tolerance and financial situation. If you are comfortable with a higher out-of-pocket expense in the event of a claim, a higher deductible can save you money on premiums. However, if you are concerned about the potential for significant losses, a lower deductible may be more suitable.

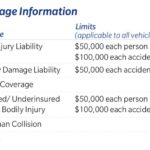

Coverage Limits

Coverage limits represent the maximum amount your insurance company will pay for a covered loss.

- Impact on Premiums: Higher coverage limits typically mean higher premiums. This is because you are paying for more protection in case of a major event.

- Factors to Consider: When determining coverage limits, consider the value of your home and belongings. Ensure your limits are adequate to cover the cost of rebuilding or replacing your home and possessions in the event of a covered loss.

Discounts

State Farm offers a variety of discounts that can reduce your premium costs.

- Types of Discounts: Common discounts include:

- Bundling Discounts: Bundling your homeowners insurance with other State Farm policies, such as auto insurance, can often result in significant savings.

- Safety Features: Installing safety features like smoke detectors, burglar alarms, or fire sprinklers can qualify you for discounts.

- Loyalty Discounts: Being a long-term State Farm customer can earn you a loyalty discount.

- Payment Discounts: Paying your premium annually or semi-annually may qualify you for a discount.

- Impact on Premiums: Taking advantage of available discounts can lead to substantial savings on your premium.

- Factors to Consider: Explore all the discounts offered by State Farm and see if you qualify for any.

Policy Options and Add-ons

State Farm offers a range of policy options and add-ons to customize your coverage.

- Guaranteed Replacement Cost Coverage: This option ensures that your home will be rebuilt or replaced with materials of similar kind and quality, regardless of inflation or rising construction costs.

- Personal Property Coverage: This coverage extends beyond your home to protect your personal belongings, including jewelry, electronics, and valuable collections.

- Identity Theft Coverage: This add-on provides financial and legal support if you become a victim of identity theft.

- Flood Insurance: If you live in a flood-prone area, you may want to consider purchasing flood insurance as a separate policy, as standard homeowners insurance policies generally do not cover flood damage.

Customer Experience and Service: State Farm Homeowners Insurance Company

State Farm is known for its commitment to providing excellent customer service. The company strives to make the insurance process as smooth and stress-free as possible for its policyholders.

Customer Reviews and Testimonials

Customer satisfaction is a key indicator of a company’s success. State Farm consistently receives positive feedback from its customers. Many customers praise the company’s friendly and helpful agents, as well as its efficient claims process. Here are some examples of customer testimonials:

“I’ve been with State Farm for over 20 years and have always been happy with their service. My agent is always available to answer my questions and help me with any issues.” – John Smith, State Farm customer

“I recently had to file a claim after a tree fell on my roof. The process was so easy and stress-free. The State Farm adjuster was very professional and helpful, and I was able to get my roof repaired quickly.” – Mary Jones, State Farm customer

Claims Process and Customer Support Channels, State farm homeowners insurance company

State Farm’s claims process is designed to be simple and straightforward. Customers can file claims online, over the phone, or through their mobile app. The company has a dedicated team of claims adjusters who are available to assist customers 24/7.

State Farm offers various customer support channels to ensure customers can reach them easily. These include:

- Phone: Customers can call State Farm’s customer service line for assistance with a variety of issues, including claims, policy changes, and general inquiries.

- Online: State Farm’s website offers a wealth of information and resources for customers, including online policy management tools, claims filing, and FAQs.

- Mobile App: The State Farm mobile app allows customers to manage their policies, file claims, and access other features on the go.

- Social Media: State Farm is active on various social media platforms, providing customers with another channel to connect with the company and receive support.

Comparison with Competitors

State Farm’s customer experience is generally considered to be among the best in the industry. The company consistently ranks high in customer satisfaction surveys. For example, in J.D. Power’s 2023 U.S. Home Insurance Satisfaction Study, State Farm ranked among the top performers.

State Farm’s commitment to customer service is one of the key factors that differentiates it from its competitors. The company’s focus on building strong relationships with its customers, providing personalized service, and making the insurance process as easy as possible has helped it earn a reputation for excellence.

Financial Strength and Stability

When considering an insurance provider, financial stability is paramount. State Farm, being a mutual company, operates with a focus on long-term sustainability and the interests of its policyholders. Its financial performance and ratings reflect this commitment.

Financial Performance and Ratings

State Farm’s financial strength is consistently recognized by independent rating agencies. These agencies assess an insurer’s ability to meet its financial obligations, considering factors like capital adequacy, claims-paying ability, and overall financial health.

- A.M. Best, a leading insurance rating agency, assigns State Farm an “A++” (Superior) rating, indicating its exceptional financial strength and ability to meet its policyholder obligations.

- Standard & Poor’s, another reputable agency, awards State Farm an “AA+” rating, signifying its strong financial position and capacity to honor its commitments.

- Moody’s, a global credit rating agency, rates State Farm “Aa1,” highlighting its high creditworthiness and solid financial standing.

These consistent top ratings from respected agencies demonstrate State Farm’s robust financial health and its ability to meet its policyholder obligations.

Claims-Paying Ability

State Farm’s financial strength directly translates into its claims-paying ability. The company has a long history of promptly and fairly settling claims, demonstrating its commitment to its policyholders. Its strong financial position allows it to readily handle large claims and unexpected events, ensuring policyholders receive the support they need.

Comparison with Other Insurance Giants

State Farm consistently ranks among the top insurance companies in terms of financial strength. It maintains a strong capital base, enabling it to withstand market fluctuations and economic downturns. Compared to other insurance giants, State Farm’s financial stability is considered exceptional, placing it among the most financially secure insurance providers in the industry.

Pricing and Affordability

State Farm’s homeowners insurance pricing is influenced by various factors, including the property’s location, age, size, and construction materials. The company uses a sophisticated rating system to determine premiums, taking into account the likelihood of potential risks and claims.

State Farm’s Pricing Structure

State Farm’s pricing structure is based on a comprehensive assessment of factors that influence the risk of a claim. These factors include:

- Property Location: Areas prone to natural disasters like hurricanes, earthquakes, or wildfires generally have higher premiums due to the increased risk of damage.

- Property Age and Condition: Older homes with outdated electrical wiring or plumbing systems may be considered riskier than newer homes, leading to higher premiums.

- Property Size and Construction: Larger homes and those built with more expensive materials typically have higher premiums.

- Home Security Features: Homes equipped with security systems, fire alarms, and other safety features may qualify for discounts, as they reduce the likelihood of claims.

- Claims History: Individuals with a history of claims may face higher premiums, reflecting their increased risk profile.

Comparison with Other Insurers

State Farm’s rates are generally competitive with those of other major insurance companies. However, it’s important to compare quotes from multiple insurers to find the best value for your specific needs. Factors like coverage options, discounts, and customer service can influence the overall cost of insurance.

Cost-Saving Strategies

Homeowners seeking affordable insurance can consider these strategies:

- Shop Around: Obtain quotes from multiple insurers to compare prices and coverage options.

- Improve Home Security: Installing security systems, smoke detectors, and fire alarms can qualify for discounts.

- Maintain Your Home: Regular maintenance and repairs can reduce the risk of damage and claims, potentially lowering premiums.

- Consider Deductibles: Choosing a higher deductible can lower your premium, but you’ll be responsible for paying more out-of-pocket in case of a claim.

- Bundle Policies: Combining homeowners and auto insurance with the same insurer can often lead to discounts.

Digital Tools and Technology

State Farm recognizes the importance of embracing technology to enhance customer experience and streamline operations. They have invested heavily in developing user-friendly online and mobile platforms that empower policyholders to manage their insurance needs conveniently.

Online and Mobile Platforms

State Farm’s online and mobile platforms offer a comprehensive suite of tools for policy management, claims reporting, and communication.

- Policyholders can access their policy documents, make payments, update contact information, and view claim status online or through the State Farm mobile app.

- The mobile app also allows for convenient features like roadside assistance requests, finding nearby agents, and receiving personalized notifications.

Digital Tools for Claims Reporting and Communication

State Farm’s digital tools simplify the claims process, allowing policyholders to report claims and communicate with adjusters quickly and efficiently.

- Policyholders can submit claims online or through the mobile app, providing detailed information and uploading photos or videos of the damage.

- State Farm uses digital tools to streamline communication, enabling real-time updates and progress reports through email, text messages, and the mobile app.

- This digital approach allows for faster processing times and increased transparency, improving the overall claims experience.

Impact of Technology on Customer Experience

State Farm’s commitment to digital innovation has significantly enhanced the customer experience.

- Policyholders can now manage their insurance needs anytime, anywhere, eliminating the need for traditional phone calls or in-person visits.

- The user-friendly platforms and intuitive interfaces provide a seamless and efficient experience, making it easier for policyholders to navigate their insurance journey.

- The digital tools have also contributed to faster processing times and improved communication, resulting in greater customer satisfaction.

Final Review

Choosing the right homeowners insurance is an important decision, and State Farm provides a strong foundation for protecting your most valuable asset. With its long history, financial strength, and commitment to customer satisfaction, State Farm remains a top contender in the homeowners insurance market. By understanding the various coverage options, policy features, and pricing considerations, you can make an informed choice that aligns with your individual needs and ensures peace of mind.

Query Resolution

How do I get a quote for State Farm homeowners insurance?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

What are the factors that affect my State Farm homeowners insurance premium?

Factors like your home’s location, age, and value, as well as your credit score and claims history, can influence your premium.

Does State Farm offer discounts on homeowners insurance?

Yes, State Farm offers various discounts for factors like safety features, bundling policies, and being a good driver.