State farm car insurance az – State Farm car insurance in Arizona stands out as a prominent choice for drivers seeking reliable coverage and competitive rates. State Farm, a leading insurance provider, has a strong presence in the state, offering a wide range of insurance products, including comprehensive car insurance solutions tailored to Arizona’s unique driving environment.

This guide delves into the intricacies of State Farm car insurance in Arizona, providing insights into key aspects such as insurance requirements, rate factors, comparison strategies, and customer experiences. We’ll explore the benefits of choosing State Farm and examine how their services align with the specific needs of Arizona drivers.

State Farm in Arizona: State Farm Car Insurance Az

State Farm is a major insurance provider in Arizona, offering a wide range of insurance products, including car insurance. The company has a long history in the state, with a strong presence and a significant market share.

State Farm’s History and Presence in Arizona

State Farm has been operating in Arizona since 1946. The company has a large network of agents and offices throughout the state, making it easily accessible to Arizona residents. State Farm is one of the largest insurance providers in Arizona, holding a significant market share in the auto insurance sector.

Insurance Products Offered by State Farm in Arizona

State Farm offers a comprehensive range of insurance products in Arizona, including:

- Auto insurance

- Homeowners insurance

- Renters insurance

- Life insurance

- Health insurance

- Business insurance

State Farm’s car insurance policies in Arizona cover a variety of aspects, including:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

State Farm also offers a variety of discounts to Arizona drivers, such as:

- Safe driving discounts

- Good student discounts

- Multi-policy discounts

- Defensive driving discounts

State Farm’s Customer Service and Claims Handling in Arizona, State farm car insurance az

State Farm is known for its excellent customer service and claims handling processes. The company has a dedicated team of customer service representatives available to assist Arizona residents with their insurance needs. State Farm’s claims handling process is designed to be efficient and straightforward. The company has a network of authorized repair shops throughout Arizona, making it convenient for customers to get their vehicles repaired after an accident. State Farm also offers online and mobile tools to make it easy for customers to manage their policies and file claims.

Arizona Car Insurance Laws and Regulations

Driving in Arizona requires you to have car insurance to protect yourself and others on the road. The state mandates specific types of coverage to ensure financial responsibility in case of accidents.

Mandatory Car Insurance Coverage

Arizona requires all drivers to carry at least the following minimum insurance coverage:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries you cause to others in an accident. The minimum required coverage is $25,000 per person and $50,000 per accident.

- Property Damage Liability: Covers damages you cause to another person’s vehicle or property. The minimum required coverage is $10,000 per accident.

- Uninsured Motorist Coverage: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers medical expenses, lost wages, and other damages for injuries you sustain. The minimum required coverage is $25,000 per person and $50,000 per accident.

Penalties for Driving Without Insurance

Driving without the minimum required insurance in Arizona is illegal and can result in severe penalties, including:

- Fines: You can face fines of up to $500 for driving without insurance, and the fine can be doubled for repeat offenses.

- License Suspension: Your driver’s license can be suspended for up to 90 days if you’re caught driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Jail Time: In some cases, you may face jail time for driving without insurance, especially if you’re involved in an accident.

Unique Car Insurance Regulations in Arizona

Arizona has specific regulations related to uninsured motorist coverage:

- Uninsured Motorist Coverage (UM): Arizona law requires all insurance companies to offer UM coverage, which protects you if you’re injured by an uninsured or hit-and-run driver. You can choose to waive UM coverage, but you must sign a waiver form acknowledging that you’re doing so.

- Underinsured Motorist Coverage (UIM): UIM coverage protects you if you’re injured by a driver who has insurance but not enough to cover your losses. Arizona law requires insurance companies to offer UIM coverage, but you can choose to waive it.

Factors Influencing Car Insurance Rates in Arizona

Your car insurance rates in Arizona are determined by a variety of factors, each playing a role in shaping your final premium. Understanding these factors can help you make informed decisions to potentially lower your costs.

Age and Driving Experience

Your age and driving experience are among the most significant factors affecting your car insurance rates. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience and higher likelihood of accidents. As you gain more experience and age, your rates tend to decrease. This is because insurance companies statistically see a decrease in accident rates among older drivers.

Driving History

Your driving record plays a crucial role in determining your car insurance rates. A clean driving record with no accidents, violations, or DUI convictions will result in lower premiums. However, any incidents, such as speeding tickets, accidents, or DUI charges, can significantly increase your rates. Insurance companies consider your driving history a reliable indicator of your risk as a driver.

Vehicle Type

The type of vehicle you drive also influences your car insurance rates. Certain vehicles, such as luxury cars, sports cars, and high-performance vehicles, are more expensive to repair and replace, leading to higher insurance premiums. Conversely, less expensive and commonly driven vehicles often have lower insurance costs.

Location

Your location in Arizona can significantly impact your car insurance rates. Areas with higher crime rates, traffic congestion, and a greater number of accidents tend to have higher insurance premiums. This is because insurance companies face a higher risk of claims in these areas.

Credit History

In Arizona, insurance companies are allowed to use your credit history as a factor in determining your car insurance rates. This is based on the idea that individuals with good credit are more likely to be responsible and financially stable, making them less risky to insure. However, this practice is controversial, and some states have banned it.

Coverage Options

The type and amount of coverage you choose can also affect your car insurance rates. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums. However, these coverage options provide greater financial protection in the event of an accident or damage to your vehicle.

Deductible

Your deductible is the amount you agree to pay out of pocket in the event of an accident or claim. A higher deductible will generally result in lower premiums, as you are taking on more financial responsibility. However, it is important to choose a deductible that you can comfortably afford.

Discounts

There are several discounts available that can help you lower your car insurance rates in Arizona. These include:

- Good student discount

- Safe driver discount

- Multi-car discount

- Multi-policy discount

- Anti-theft device discount

- Defensive driving course discount

- Telematics discount

To qualify for these discounts, you may need to meet certain criteria, such as maintaining a good driving record, having a good credit history, or installing an anti-theft device in your vehicle.

Comparing Car Insurance Quotes in Arizona

Finding the best car insurance deal in Arizona involves comparing quotes from different insurance providers. This process ensures you get the most competitive rates and coverage options tailored to your needs.

Using Online Comparison Tools

Online comparison tools are a convenient and efficient way to compare car insurance quotes from multiple providers. These tools allow you to enter your personal information and vehicle details, and they will generate a list of quotes from different insurance companies.

- Ease of Use: Online comparison tools are user-friendly and often require minimal effort to use. You can enter your information and get a list of quotes within minutes.

- Multiple Quotes: These tools allow you to compare quotes from multiple insurance providers simultaneously, saving you time and effort.

- Personalized Results: Comparison tools use your specific information to generate personalized quotes, ensuring you receive relevant options.

Contacting Insurance Agents Directly

While online comparison tools are helpful, contacting insurance agents directly can provide more personalized advice and insights. Insurance agents can help you understand different coverage options and tailor a policy that meets your specific needs.

- Personalized Guidance: Agents can answer your questions and provide personalized recommendations based on your situation.

- Negotiating Rates: Agents may have access to exclusive discounts or promotions that you might not find online.

- Building Relationships: Building a relationship with an insurance agent can be beneficial in the long run, as they can assist you with future policy adjustments or claims.

Key Factors to Consider When Comparing Quotes

When comparing car insurance quotes, it’s essential to consider key factors that influence your overall costs and coverage. These factors include:

- Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay for a covered loss. Higher coverage limits generally result in higher premiums.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower premiums.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features, and multiple policy bundling.

Tip: Carefully review the coverage options, deductibles, and discounts offered by each insurance provider before making a decision.

Customer Reviews and Experiences with State Farm in Arizona

Customer reviews and feedback provide valuable insights into the overall customer experience with State Farm in Arizona. Analyzing these reviews can help potential customers make informed decisions about choosing State Farm as their car insurance provider.

Claims Processing Experiences

Customer reviews highlight both positive and negative experiences with State Farm’s claims processing in Arizona. Some customers praise the company for its prompt and efficient claims handling, with representatives being responsive and helpful throughout the process. Others express frustration with delays in processing claims, difficulties in communicating with representatives, and challenges in receiving fair settlements.

- Positive Experiences: Many customers appreciate the speed and efficiency of State Farm’s claims processing. They highlight the responsiveness of representatives and the ease of filing claims online or over the phone.

- Negative Experiences: Some customers report delays in processing claims, difficulty in reaching representatives, and dissatisfaction with the settlement amounts offered. These experiences can be frustrating and lead to negative reviews.

Customer Service Interactions

Customer service is a crucial aspect of the insurance experience. Reviews reveal a mixed bag of experiences with State Farm’s customer service in Arizona. Some customers commend the company for its friendly and helpful representatives, who are readily available to answer questions and address concerns. Others criticize the company for long wait times, unresponsive representatives, and difficulties in resolving issues.

- Positive Experiences: Customers appreciate the friendly and helpful nature of State Farm representatives. They highlight the ease of reaching representatives and the promptness of responses.

- Negative Experiences: Some customers report long wait times on hold, difficulty in reaching representatives, and frustration with the resolution of issues. These experiences can lead to negative reviews and dissatisfaction with the company.

Pricing and Value for Money

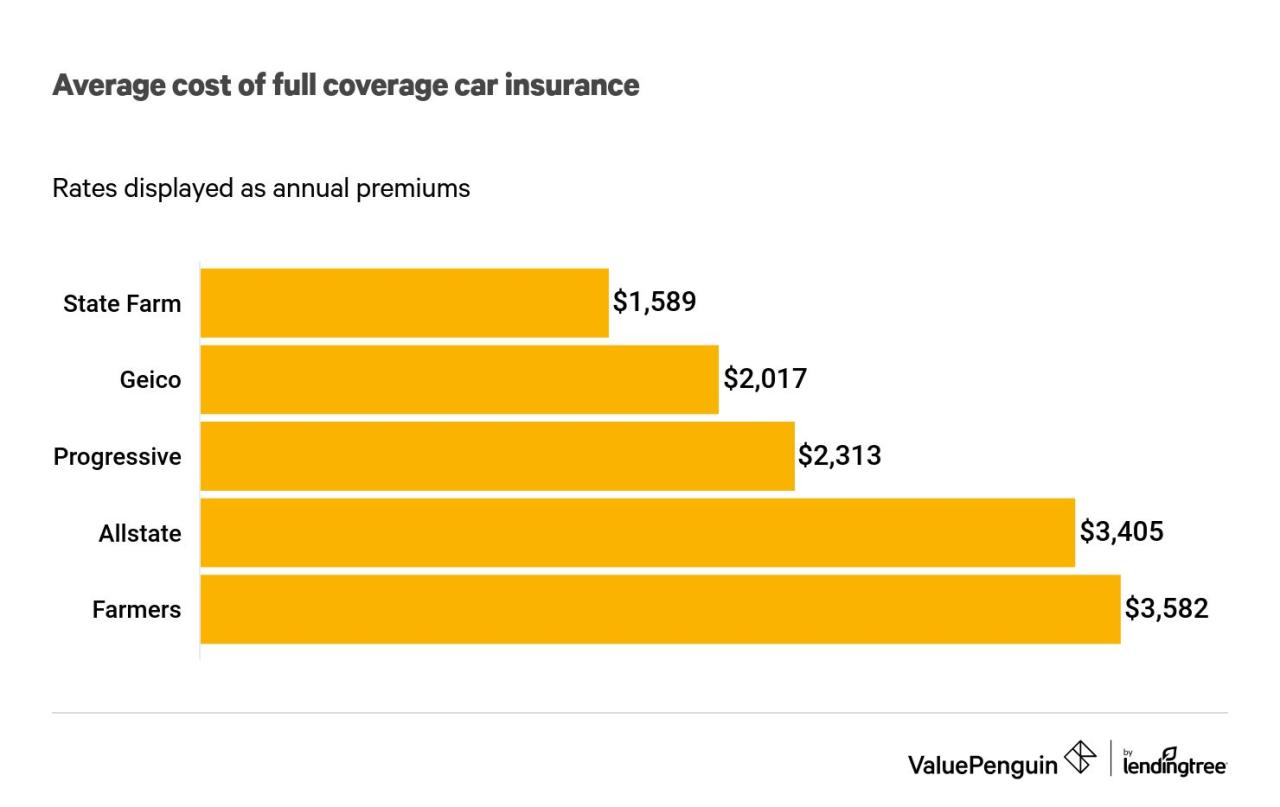

Pricing is a key factor for many customers when choosing car insurance. Reviews on State Farm in Arizona highlight a range of opinions regarding the company’s pricing and value for money. Some customers find State Farm’s rates competitive and affordable, while others consider them higher than other providers.

- Competitive Pricing: Some customers find State Farm’s rates to be competitive and offer good value for the coverage provided. They appreciate the company’s discounts and flexible payment options.

- Higher Rates: Other customers report higher rates compared to other providers, making them reconsider their choice. They may find the value proposition less attractive compared to competitors.

State Farm’s Digital and Online Services in Arizona

State Farm, a leading insurance provider in Arizona, offers a comprehensive suite of digital and online services to make managing car insurance policies convenient and efficient. These services are designed to cater to the needs of modern customers who prefer digital interactions and self-service options.

State Farm Website

State Farm’s website is a central hub for accessing various insurance-related services. It provides a user-friendly interface that allows policyholders to view and manage their policies, make payments, file claims, and access important documents.

The website also features a comprehensive knowledge base with FAQs, articles, and guides on various insurance topics, helping customers find answers to their questions quickly. State Farm’s website also allows customers to get personalized quotes, compare coverage options, and purchase insurance policies online, streamlining the entire process.

State Farm Mobile App

The State Farm mobile app is a powerful tool that empowers customers to manage their insurance policies on the go. It offers a wide range of features, including:

- Viewing policy details and coverage information

- Making payments and tracking payment history

- Filing claims and tracking their progress

- Accessing roadside assistance services

- Contacting customer support

- Managing multiple policies in one place

The app also provides personalized insights and recommendations based on the customer’s insurance needs, helping them make informed decisions.

Online Payment Options

State Farm offers a variety of secure and convenient online payment options to make it easy for customers to pay their insurance premiums. Customers can choose to pay online through the State Farm website or mobile app using a credit card, debit card, or bank account. They can also set up automatic payments to ensure their premiums are paid on time.

Comparison with Other Providers

State Farm’s digital offerings are generally considered to be among the best in the industry. They offer a wide range of features and functionalities, comparable to other major insurance providers in Arizona. However, some providers may offer more advanced features, such as real-time policy updates, personalized risk assessments, or integration with third-party apps. It’s essential to compare the digital services of different providers to find the best fit for your individual needs.

State Farm’s Community Involvement in Arizona

State Farm is deeply committed to giving back to the communities it serves, including Arizona. The company actively participates in a variety of charitable initiatives and programs designed to support local organizations and causes. These efforts reflect State Farm’s dedication to improving the lives of Arizonans.

State Farm’s Charitable Contributions in Arizona

State Farm’s commitment to the Arizona community is evident in its substantial charitable contributions. The company has a long history of supporting a wide range of organizations, including those focused on education, healthcare, and disaster relief. For instance, State Farm has donated millions of dollars to organizations like the Boys & Girls Clubs of America, the American Red Cross, and the United Way, all of which have a significant presence in Arizona. These contributions have helped these organizations to expand their services and reach more people in need.

Last Word

Navigating the world of car insurance in Arizona can feel overwhelming, but with a thorough understanding of your options and the right guidance, finding the best coverage at the right price is achievable. By considering the factors discussed in this guide, including State Farm’s offerings, Arizona’s insurance regulations, and your personal needs, you can make an informed decision that provides peace of mind on the road.

Quick FAQs

How do I get a car insurance quote from State Farm in Arizona?

You can obtain a quote online through their website, by calling a State Farm agent, or by visiting a local office.

What discounts are available for State Farm car insurance in Arizona?

State Farm offers various discounts, including safe driver, good student, multi-policy, and defensive driving discounts. Check with your local agent for a complete list of available discounts.

What are the steps for filing a car insurance claim with State Farm in Arizona?

You can file a claim online, through the State Farm mobile app, or by contacting a State Farm agent. They’ll guide you through the process and provide support throughout the claim resolution.