State Farm commercial auto insurance cost is a crucial factor for businesses relying on vehicles for operations. Understanding how State Farm determines these costs can help businesses make informed decisions about their insurance needs. State Farm, a renowned insurance provider with a long history, offers a comprehensive range of coverage options for commercial vehicles. This includes features like liability coverage, collision and comprehensive coverage, and uninsured/underinsured motorist coverage.

Several factors influence the cost of commercial auto insurance, including the type of vehicle, the business’s driving history, the location, and the level of coverage desired. State Farm uses a risk assessment approach to determine premiums, taking into account these factors to provide fair and competitive pricing.

State Farm Auto Insurance Overview

State Farm is a leading provider of auto insurance in the United States, renowned for its reliability, comprehensive coverage, and exceptional customer service. With a rich history spanning over a century, State Farm has earned a reputation for its commitment to customer satisfaction and financial stability.

Coverage Options and Features

State Farm offers a wide range of auto insurance coverage options designed to meet the diverse needs of its policyholders. These options include:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. State Farm offers various liability limits to choose from, ensuring you have adequate protection.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is optional but highly recommended.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-accident events such as theft, vandalism, fire, and natural disasters. This coverage is also optional but can be beneficial.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. It helps cover your medical expenses and vehicle damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of fault. It is mandatory in some states.

- Roadside Assistance: State Farm offers roadside assistance services such as towing, flat tire changes, jump starts, and lockout assistance.

- Rental Car Coverage: This coverage provides you with a rental car if your vehicle is damaged in an accident and is being repaired.

- Accident Forgiveness: This feature allows you to avoid a rate increase after your first at-fault accident. This can be a valuable benefit, especially for new drivers.

Customer Service and Claims Handling

State Farm prioritizes customer service and has a well-established claims handling process.

- 24/7 Customer Support: State Farm offers 24/7 customer support through phone, email, and online chat. This ensures you can access assistance whenever you need it.

- Easy Claims Reporting: State Farm provides multiple channels for reporting claims, including online, mobile app, and phone. The claims process is designed to be straightforward and efficient.

- Dedicated Claims Adjusters: State Farm employs experienced claims adjusters who work diligently to assess damage, process claims, and provide prompt and fair settlements.

- Direct Repair Network: State Farm has a network of preferred repair shops that are equipped to handle repairs quickly and efficiently. This streamlines the repair process and ensures quality workmanship.

Factors Influencing Auto Insurance Costs

Your driving history, the type of vehicle you drive, where you live, and the level of coverage you choose all play a role in determining your auto insurance premium. State Farm, like other insurance companies, considers these factors to assess your risk and calculate your premium.

Factors Affecting Auto Insurance Premiums

Understanding how these factors influence your premium can help you make informed decisions about your auto insurance coverage. Here’s a breakdown of key factors:

| Factor | Description | Impact on Premium |

|---|---|---|

| Driving History | This includes your past driving record, such as accidents, traffic violations, and DUI convictions. | A clean driving record generally leads to lower premiums. Accidents and violations increase your risk and, consequently, your premium. |

| Vehicle Type | The make, model, year, and safety features of your vehicle influence its insurance cost. | Luxury cars, sports cars, and vehicles with advanced safety features tend to be more expensive to insure due to their higher repair costs and potential for greater damage. |

| Location | Your geographic location, including your state and zip code, impacts your premium. | Areas with higher rates of car thefts, accidents, and traffic congestion typically have higher insurance premiums. |

| Coverage Levels | The amount of coverage you choose, such as liability, collision, and comprehensive coverage, directly impacts your premium. | Higher coverage levels provide greater protection but come with higher premiums. |

State Farm’s Pricing Structure

State Farm, a leading auto insurance provider, employs a comprehensive pricing structure that considers various factors to determine premiums for its policyholders. This approach, grounded in actuarial science and risk assessment, aims to ensure fair and competitive rates while maintaining financial stability for the company.

State Farm’s Pricing Approach

State Farm’s pricing approach relies heavily on actuarial data and risk assessment. Actuarial data, gathered from historical claims and driving records, helps predict future claims and determine the likelihood of accidents. This data is used to create risk profiles for individual policyholders, with factors like driving history, age, location, and vehicle type influencing their premium.

State Farm Discounts and Promotions

State Farm offers a wide range of discounts to help customers save money on their auto insurance premiums. These discounts can significantly reduce your overall cost, making State Farm a competitive choice for your insurance needs.

Discounts Offered by State Farm

State Farm offers a variety of discounts to help customers save money on their auto insurance premiums. These discounts are categorized based on different factors, including safe driving, multiple policies, and other personal attributes.

Safe Driving Discounts

Safe driving discounts are designed to reward customers who demonstrate responsible driving habits. These discounts are typically offered to drivers with clean driving records and no accidents or traffic violations.

- Safe Driver Discount: This is a standard discount offered to drivers with a good driving history. The discount percentage varies depending on the driver’s individual risk profile and the length of time they have maintained a clean driving record.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. This course teaches you valuable techniques to avoid accidents and improve your driving skills, leading to a discount on your auto insurance.

- Accident-Free Discount: If you haven’t been involved in any accidents for a certain period, you may qualify for this discount. The longer you remain accident-free, the higher the discount percentage you can receive.

Multi-Policy Discounts

State Farm rewards customers who bundle their insurance policies with them. If you insure your home, renters, or life insurance with State Farm, you can enjoy significant savings on your auto insurance premiums.

- Multi-Policy Discount: This discount applies when you insure multiple vehicles or other types of insurance with State Farm. The discount percentage increases as you add more policies to your account.

Other Discounts

State Farm offers a variety of other discounts based on your personal characteristics and circumstances.

- Good Student Discount: This discount is available to students who maintain a high GPA. It recognizes the responsible nature of good students and rewards them with lower insurance premiums.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can significantly reduce the risk of theft. State Farm acknowledges this effort by offering a discount on your auto insurance.

- Homeowner Discount: If you own a home, State Farm may offer a discount on your auto insurance. This is because homeowners are often considered more responsible and financially stable, leading to a lower risk profile.

- Paperless Discount: Choosing to receive your insurance documents electronically can save State Farm on printing and mailing costs. They pass on these savings to customers by offering a discount for opting for paperless communication.

- Driver Training Discount: Taking a driver training course, especially for new drivers, can demonstrate your commitment to safe driving practices. State Farm may offer a discount for completing such courses.

Promotional Offers and Special Discounts

State Farm often runs promotional offers and special discounts throughout the year. These offers can vary based on location, time of year, and specific customer demographics. Some common examples include:

- New Customer Discounts: State Farm may offer special discounts to attract new customers to their insurance services. These discounts can include a percentage off your first premium or a specific dollar amount deduction.

- Seasonal Discounts: State Farm may offer discounts during specific seasons, such as summer or winter, to encourage customers to purchase or renew their policies. These discounts could be related to specific driving conditions or seasonal events.

- Referral Discounts: State Farm may offer discounts to existing customers who refer new customers to their services. This incentivizes customers to spread the word about State Farm’s insurance offerings.

Discount Eligibility and Percentage

| Discount Type | Eligibility Criteria | Discount Percentage |

|---|---|---|

| Safe Driver Discount | Clean driving record with no accidents or violations | Varies based on individual risk profile and length of clean record |

| Defensive Driving Course Discount | Completion of a defensive driving course | Varies based on course provider and specific program |

| Accident-Free Discount | No accidents for a specified period | Varies based on the length of accident-free period |

| Multi-Policy Discount | Bundling multiple insurance policies with State Farm | Increases with the number of policies bundled |

| Good Student Discount | Maintaining a high GPA | Varies based on the student’s GPA and academic level |

| Anti-theft Device Discount | Installation of anti-theft devices in the vehicle | Varies based on the type and effectiveness of the device |

| Homeowner Discount | Owning a home | Varies based on the location and value of the home |

| Paperless Discount | Opting for electronic communication | Varies based on the specific program and location |

| Driver Training Discount | Completion of a driver training course | Varies based on the course provider and specific program |

Customer Testimonials and Reviews: State Farm Commercial Auto Insurance Cost

State Farm’s auto insurance pricing and services have garnered a diverse range of customer feedback, encompassing both positive and negative experiences. To understand the customer perspective, we’ll delve into customer reviews and testimonials, analyzing common themes and sentiments expressed.

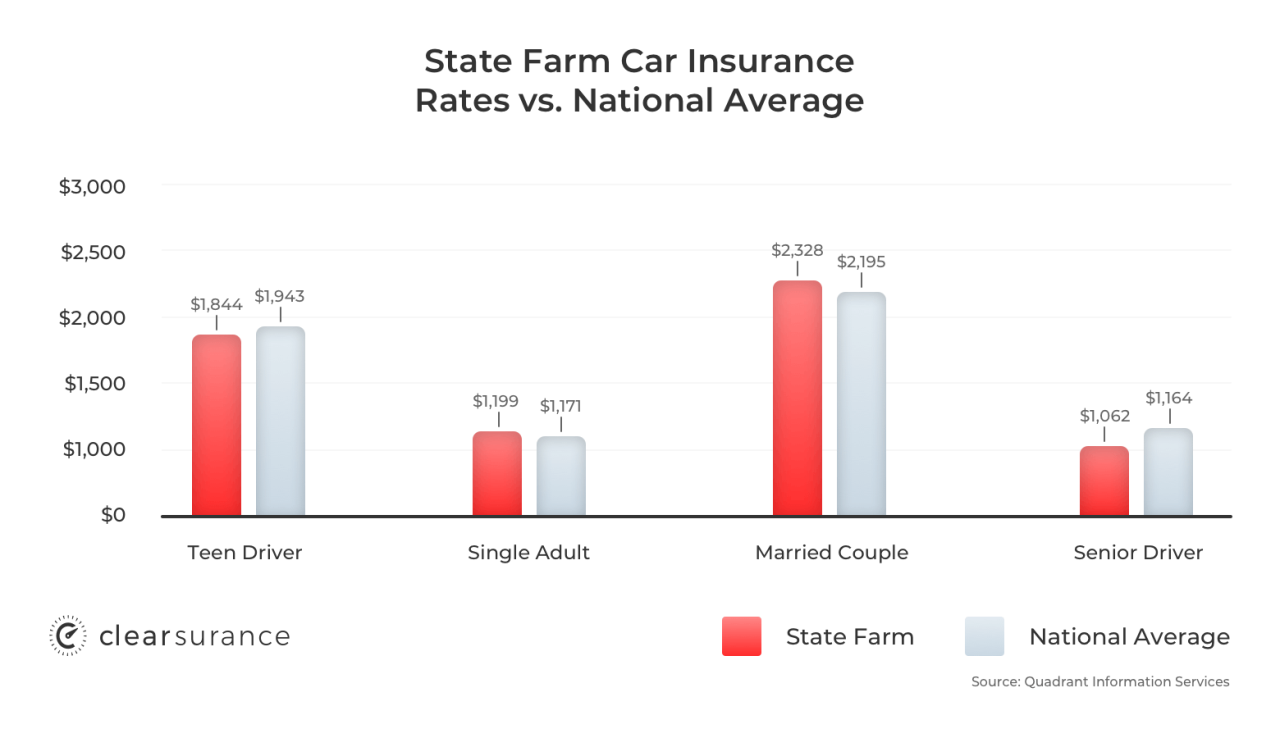

Customer Feedback Analysis

A comprehensive review of customer feedback reveals that State Farm’s auto insurance pricing is often a point of contention. While some customers praise the competitive pricing, others find it to be relatively high compared to other providers. Customer reviews highlight factors like individual driving history, location, and vehicle type as key determinants of pricing.

| Review Source | Customer Experience | Rating |

|---|---|---|

| Trustpilot | “I’ve been with State Farm for years, and I’ve always been happy with their service. Their rates are competitive, and their customer service is excellent.” | 5/5 |

| Google Reviews | “I was initially drawn to State Farm because of their reputation, but I was disappointed with their pricing. I found a better deal with another provider.” | 2/5 |

| Yelp | “State Farm has been great for me. They’ve always been there when I needed them, and their claims process is smooth and efficient.” | 4/5 |

Comparison to Competitors

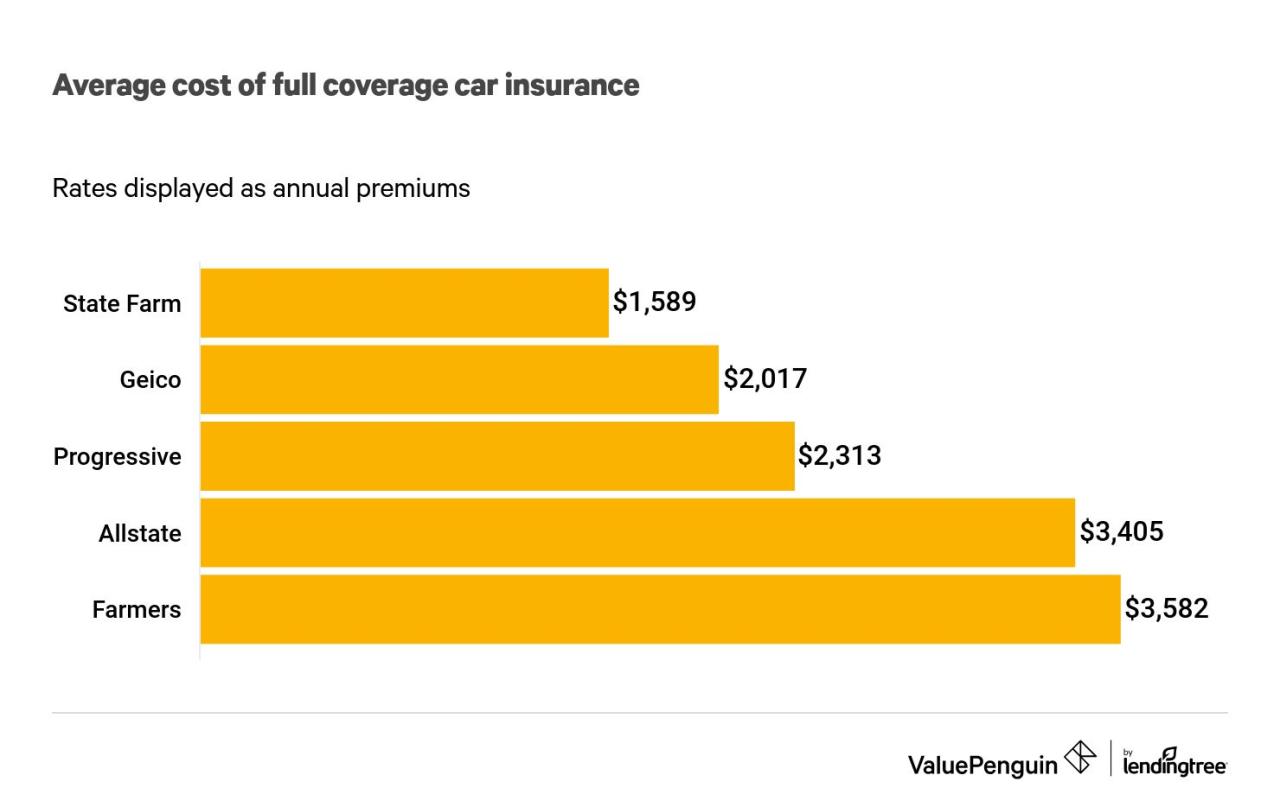

Choosing the right auto insurance provider can be a daunting task, with numerous options available. To help you make an informed decision, we’ll compare State Farm’s auto insurance pricing and offerings to other major players in the market, such as Geico, Progressive, and Allstate.

Comparison of Key Features and Pricing

This table provides a side-by-side comparison of average premiums, key features, and customer satisfaction ratings for State Farm and its competitors.

| Insurance Provider | Average Premium | Key Features | Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | $1,200 | Drive Safe & Save, Accident Forgiveness, 24/7 Customer Service | 82% |

| Geico | $1,150 | Easy Online Quotes, 24/7 Claims Service, Multi-Policy Discounts | 85% |

| Progressive | $1,100 | Name Your Price, Snapshot Program, 24/7 Roadside Assistance | 80% |

| Allstate | $1,250 | Drive Safe & Save, Accident Forgiveness, 24/7 Customer Service | 78% |

Please note that average premiums can vary based on individual factors like driving history, location, and vehicle type. The table provides a general overview of pricing and features for comparison purposes.

Tips for Saving on Auto Insurance

Saving money on your auto insurance is a common goal, and with State Farm, you have several options to help lower your premiums. By implementing some simple strategies, you can potentially reduce your costs without compromising the protection you need.

Improving Your Driving Habits

Safe driving is not only a responsible act but also a way to save on your insurance. By adopting good driving habits, you can demonstrate to insurers that you are a low-risk driver, potentially leading to lower premiums.

- Maintain a Clean Driving Record: Avoiding traffic violations, such as speeding tickets, reckless driving, or DUI offenses, is crucial. These incidents can significantly increase your insurance rates.

- Practice Defensive Driving: Being aware of your surroundings, anticipating potential hazards, and maintaining a safe distance from other vehicles can help you avoid accidents.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts with State Farm.

Optimizing Coverage Levels, State farm commercial auto insurance cost

Understanding your insurance needs and selecting the right coverage levels can help you save money. By avoiding unnecessary coverage or adjusting your policy to match your specific requirements, you can potentially lower your premiums.

- Review Your Coverage Regularly: Your insurance needs can change over time. Periodically review your policy to ensure you have the right coverage for your current situation, such as if you’ve paid off your car loan or made significant changes to your vehicle.

- Consider Deductibles: A higher deductible means you pay more out-of-pocket in case of an accident but could result in lower premiums. Choose a deductible that balances your financial risk tolerance with potential savings.

- Explore Optional Coverage: Evaluate the necessity of optional coverages like collision and comprehensive, considering your vehicle’s age and value. If your car is older, you might opt for lower coverage levels, potentially reducing your premium.

Negotiating Your Premium

Don’t hesitate to negotiate your premium with State Farm. By discussing your options and exploring potential discounts, you might be able to secure a more favorable rate.

- Shop Around for Quotes: Getting quotes from multiple insurance companies can help you understand the market rates and negotiate a better deal with State Farm.

- Bundle Your Policies: Combining your auto insurance with other policies, such as home or renters insurance, with State Farm can often lead to discounts.

- Ask About Discounts: State Farm offers a variety of discounts, including good driver, safe vehicle, multi-car, and student discounts. Inquire about these options and see if you qualify.

Concluding Remarks

By understanding the factors influencing State Farm’s commercial auto insurance costs and exploring available discounts and promotions, businesses can optimize their coverage and potentially save on premiums. State Farm’s commitment to customer service and claims handling processes further enhances its reputation as a reliable insurance provider.

FAQ Section

What types of commercial vehicles does State Farm insure?

State Farm offers coverage for a wide range of commercial vehicles, including trucks, vans, cars, and motorcycles, depending on the specific business needs and usage.

How can I get a quote for State Farm commercial auto insurance?

You can obtain a quote online, over the phone, or by visiting a local State Farm agent. Providing accurate information about your vehicle, business, and coverage requirements will ensure you receive a personalized quote.

Does State Farm offer discounts for commercial auto insurance?

Yes, State Farm provides various discounts for commercial auto insurance, such as safe driving discounts, multi-policy discounts, and good driver discounts. Contact your local agent to learn about available discounts.

What are the benefits of choosing State Farm for commercial auto insurance?

State Farm offers comprehensive coverage options, competitive pricing, and excellent customer service. They have a strong reputation for handling claims efficiently and fairly.