Maryland state minimum auto insurance sets the stage for responsible driving in the state, ensuring drivers have the necessary financial protection in case of accidents. This coverage acts as a safety net, safeguarding both drivers and their assets in the unfortunate event of a collision. It’s crucial to understand the intricacies of Maryland’s minimum insurance requirements to avoid potential legal and financial consequences.

Maryland law mandates specific coverage types and financial responsibility limits, providing a baseline of protection for drivers. These requirements aim to ensure that drivers are financially responsible for any damages or injuries they might cause to others. By adhering to these minimum standards, drivers can contribute to a safer driving environment and protect themselves from significant financial burdens in the event of an accident.

Maryland’s Minimum Auto Insurance Requirements

Maryland law requires all drivers to carry a minimum amount of auto insurance to protect themselves and others in the event of an accident. This insurance coverage ensures that you can pay for damages caused to other people or their property, and it also helps cover your medical expenses if you are injured in an accident.

Financial Responsibility Limits

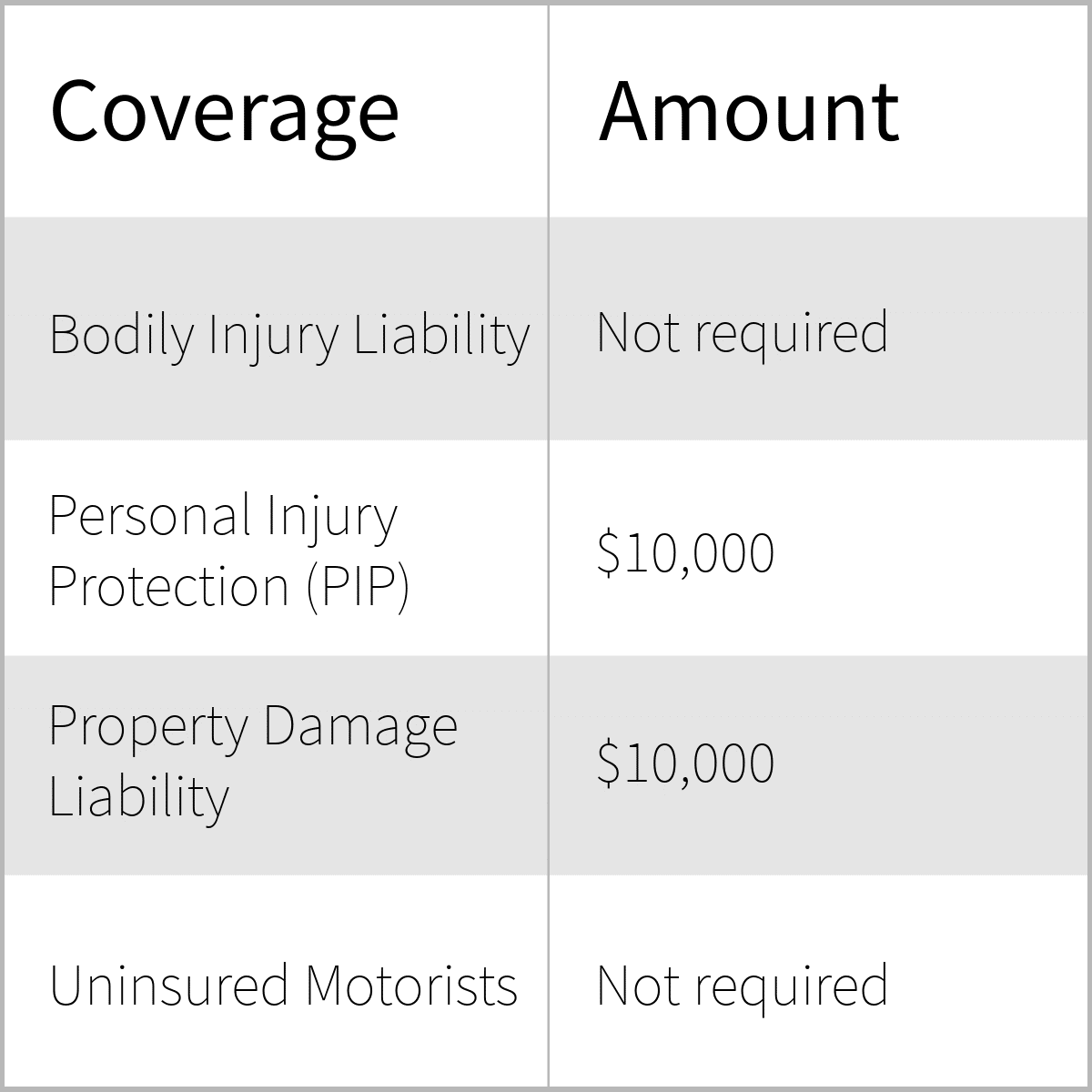

The minimum auto insurance requirements in Maryland are designed to provide financial protection for drivers and their passengers. These requirements specify the minimum amounts of coverage that drivers must have in the event of an accident. Here is a summary of the mandatory coverage types and their financial responsibility limits:

| Coverage Type | Financial Responsibility Limit |

|---|---|

| Bodily Injury Liability per Person | $25,000 |

| Bodily Injury Liability per Accident | $50,000 |

| Property Damage Liability | $20,000 |

| Personal Injury Protection (PIP) | $2,500 |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | $25,000 per person, $50,000 per accident |

Understanding Maryland’s Minimum Coverage

Maryland’s minimum auto insurance requirements are designed to protect you and others on the road. By understanding these coverages and their purpose, you can ensure you have adequate protection in case of an accident.

The Importance of Each Mandatory Coverage

Maryland’s minimum auto insurance requirements consist of four primary coverages. Each plays a crucial role in safeguarding drivers and their assets in the event of an accident.

- Bodily Injury Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries to another person. It pays for the other driver’s medical expenses, lost wages, and pain and suffering. This coverage is essential as it helps to cover the costs associated with injuries caused by your negligence.

- Property Damage Liability Coverage: This coverage protects you financially if you cause an accident that damages another person’s property, such as their vehicle. It pays for the cost of repairs or replacement of the damaged property. This coverage is important as it ensures you can cover the financial burden of damages caused by your actions.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your own medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. This coverage is crucial as it provides financial protection for your own well-being in the event of an accident, even if you are not at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you financially if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and other related costs. This coverage is essential as it provides a safety net in case you are involved in an accident with a driver who does not have adequate insurance.

Consequences of Driving Without Minimum Coverage, Maryland state minimum auto insurance

Driving without minimum insurance coverage in Maryland is illegal and can result in severe consequences.

- Fines and Penalties: You can face significant fines and penalties for driving without minimum insurance coverage.

- License Suspension: Your driver’s license can be suspended until you obtain the required insurance.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Financial Responsibility: You are personally liable for any damages or injuries you cause in an accident, even if you are not at fault. This can lead to substantial financial burdens, including legal fees and medical expenses.

Real-World Examples of Minimum Coverage Benefits

Minimum auto insurance coverage can be invaluable in various real-world scenarios.

- Accident with Injuries: If you cause an accident that results in injuries to another driver, your bodily injury liability coverage will help pay for their medical expenses, lost wages, and pain and suffering. This coverage can prevent you from facing significant financial hardship due to the accident.

- Property Damage: If you accidentally back into another vehicle, your property damage liability coverage will help pay for the repairs or replacement of the damaged vehicle. This coverage ensures you can cover the costs associated with the damage you caused.

- Uninsured Driver: If you are involved in an accident with an uninsured driver, your uninsured motorist coverage will help cover your medical expenses, lost wages, and other related costs. This coverage is crucial as it protects you from financial ruin due to the actions of an uninsured driver.

Additional Coverage Options: Maryland State Minimum Auto Insurance

Maryland’s minimum auto insurance requirements provide basic protection in case of an accident. However, you might want to consider purchasing additional coverage options to enhance your financial security and peace of mind. These optional coverages can help protect you from various unexpected costs associated with accidents, theft, or natural disasters.

Types of Optional Coverage

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s typically required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It’s typically required if you have a loan or lease on your vehicle.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident or covered event. It’s especially helpful if you rely on your vehicle for work or daily errands.

- Roadside Assistance: This coverage provides assistance with situations like flat tires, dead batteries, and lockouts. It can save you time and money in emergencies.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help cover your medical expenses and vehicle damage.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault, if you’re injured in an accident.

Benefits and Drawbacks of Additional Coverage

Purchasing additional coverage offers several benefits, such as financial protection from unexpected costs, peace of mind knowing you’re covered in various situations, and potentially lower out-of-pocket expenses. However, it’s important to consider the drawbacks as well. Additional coverage can increase your insurance premiums, and it may not be necessary if you have a high deductible or can afford to cover potential costs out of pocket.

Comparing Optional Coverage Options

| Coverage | Description | Cost | Potential Benefits |

|---|---|---|---|

| Collision Coverage | Pays for repairs or replacement of your vehicle after an accident, regardless of fault. | Varies based on vehicle type, driving history, and other factors. | Protects your vehicle from damage in an accident. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. | Varies based on vehicle type, driving history, and other factors. | Protects your vehicle from damage caused by events other than accidents. |

| Rental Reimbursement | Pays for a rental car while your vehicle is being repaired after an accident or covered event. | Varies based on the daily rental rate and the length of the repair period. | Provides transportation while your vehicle is being repaired. |

| Roadside Assistance | Provides assistance with situations like flat tires, dead batteries, and lockouts. | Varies based on the level of coverage and the service provider. | Saves you time and money in emergencies. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Varies based on the level of coverage and your driving history. | Protects you from financial losses caused by uninsured or underinsured drivers. |

| Medical Payments Coverage (Med Pay) | Pays for your medical expenses, regardless of fault, if you’re injured in an accident. | Varies based on the coverage amount and your driving history. | Provides financial protection for medical expenses after an accident. |

Factors Affecting Insurance Costs

Understanding the factors that influence Maryland’s minimum auto insurance premiums is crucial for making informed decisions about your coverage. Several factors play a significant role in determining your insurance costs, and it’s essential to be aware of these factors to manage your premiums effectively.

Age and Driving Experience

Your age and driving experience are key factors in determining your insurance rates. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. As a result, insurance companies often charge higher premiums for younger drivers. Conversely, older drivers with a long and safe driving history typically receive lower rates due to their reduced risk profile.

Driving History

Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, having a history of accidents, speeding tickets, or other traffic offenses can lead to significantly higher rates. Insurance companies consider your driving history as a reliable indicator of your risk as a driver.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Some vehicles are considered more expensive to repair or replace, and insurance companies reflect this in their rates. For example, sports cars and luxury vehicles often have higher premiums compared to more affordable and reliable vehicles. The safety features of your vehicle also play a role. Vehicles with advanced safety technologies like anti-lock brakes and airbags can qualify for lower premiums due to their reduced risk of accidents.

Location

The location where you live can significantly impact your insurance rates. Insurance companies assess the risk of accidents in different areas. Areas with high crime rates or heavy traffic congestion may have higher premiums due to the increased likelihood of accidents. Urban areas with dense populations and limited parking spaces often have higher premiums compared to more rural areas.

Credit History

In some states, including Maryland, insurance companies can use your credit history to assess your risk. This practice is controversial, and some argue that it is unfair and discriminatory. However, insurance companies maintain that credit history is a reliable indicator of financial responsibility, which can be a predictor of responsible driving behavior.

Other Factors

Other factors can also influence your insurance premiums, including your gender, marital status, and occupation. While these factors may have a smaller impact than the ones mentioned above, it’s important to be aware of their potential influence.

Finding Affordable Insurance

Finding affordable auto insurance in Maryland that meets the state’s minimum requirements is crucial. By understanding your options and taking strategic steps, you can secure coverage that fits your budget without compromising on essential protection.

Comparing Quotes

Obtaining quotes from multiple insurance companies is the foundation of finding the best deal. To effectively compare quotes, consider these factors:

- Coverage Levels: While Maryland mandates minimum coverage, consider whether additional coverage options, such as collision or comprehensive, are worth the extra cost for your situation.

- Deductibles: Higher deductibles generally lead to lower premiums, but you’ll pay more out-of-pocket if you need to file a claim. Choose a deductible you can comfortably afford.

- Discounts: Many insurance companies offer discounts for good driving records, safety features, multiple policies, and other factors. Explore available discounts to potentially lower your premium.

- Customer Service: Look beyond price. Consider the insurer’s reputation for customer service, claims processing speed, and overall satisfaction.

Utilizing Resources

Several resources can aid your search for affordable insurance:

- Online Comparison Websites: Websites like Policygenius, Insurify, and QuoteWizard allow you to compare quotes from multiple insurers in one place.

- Independent Insurance Agents: These agents represent various insurance companies and can provide personalized recommendations based on your needs.

- Maryland Insurance Administration (MIA): The MIA offers resources and guidance on Maryland’s insurance requirements and consumer protection.

Online Tools and Services

Online tools and services can help you find the best insurance options tailored to your specific needs:

- Insurance Calculators: These tools estimate your premium based on your driving history, vehicle information, and coverage preferences.

- Personalized Recommendations: Some websites use algorithms to analyze your profile and suggest insurance companies that align with your requirements.

- Online Quotes and Applications: Many insurers offer online quote forms and applications, streamlining the process of obtaining coverage.

Last Recap

Navigating the complexities of Maryland’s minimum auto insurance requirements can seem daunting, but understanding the basics is crucial for responsible driving. By meeting the state’s minimum insurance standards, drivers not only fulfill their legal obligations but also ensure they have the financial protection needed in the event of an accident. While minimum coverage offers a foundation, considering additional coverage options tailored to individual needs can provide greater peace of mind and comprehensive financial security on the road.

Query Resolution

How much does Maryland’s minimum auto insurance cost?

The cost of Maryland’s minimum auto insurance varies depending on factors like age, driving history, vehicle type, and location. It’s best to get quotes from multiple insurance companies to compare prices and find the most affordable option.

What happens if I get into an accident and only have minimum coverage?

If you get into an accident and only have minimum coverage, you may be liable for any damages or injuries exceeding your coverage limits. This could result in significant out-of-pocket expenses and potential legal issues.

Can I get a discount on my insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records. Maintaining a safe driving history can significantly reduce your insurance premiums.