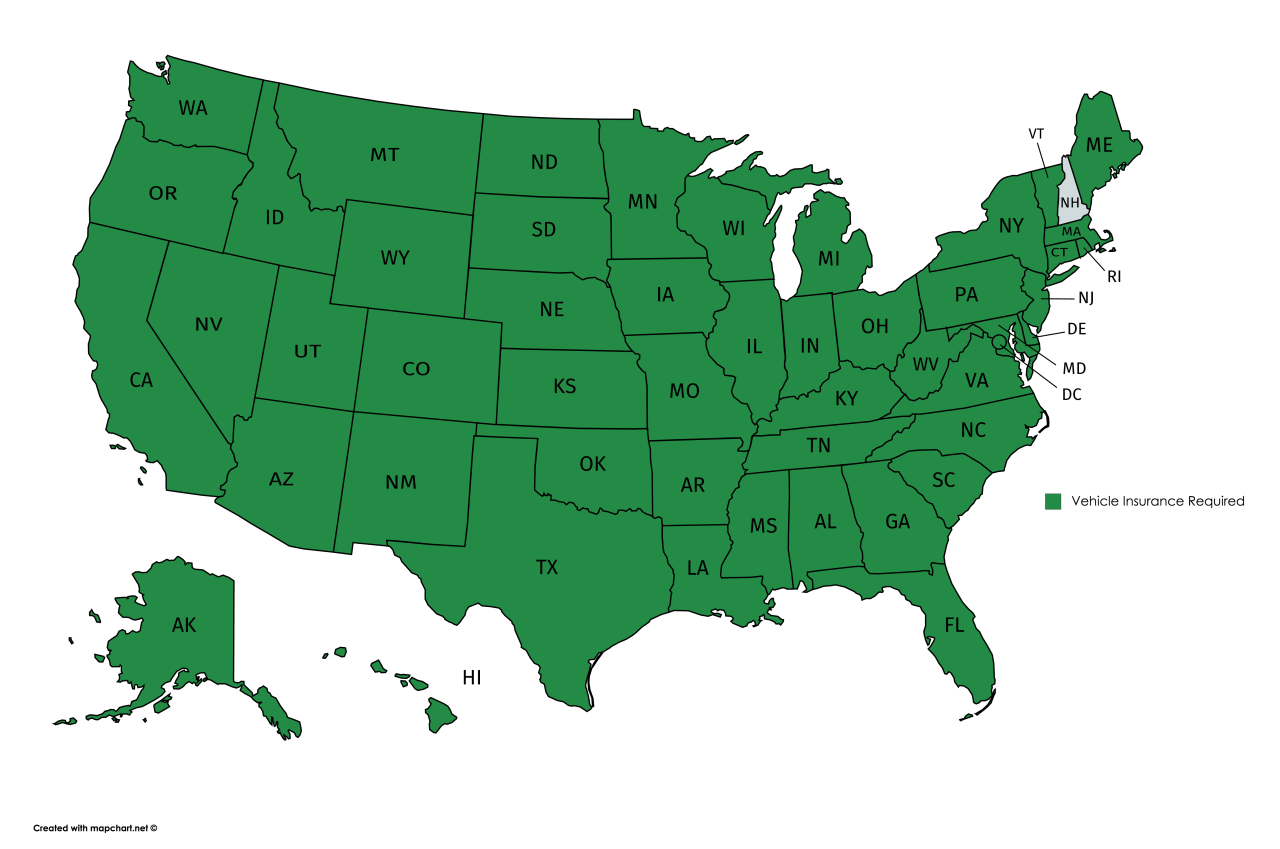

Does every state require auto insurance? The answer is a resounding yes. In the United States, driving without auto insurance is a serious offense, punishable by fines, license suspension, and even jail time. This underscores the critical importance of having adequate auto insurance coverage to protect yourself, your passengers, and others on the road.

Each state has its own set of minimum auto insurance requirements, mandating specific levels of coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. These requirements ensure that drivers can financially compensate for any damages or injuries they may cause in an accident. However, it’s crucial to understand that these minimums may not be sufficient for everyone’s needs.

The Importance of Auto Insurance

Auto insurance is a crucial financial safety net that protects you and others from the potential financial devastation of accidents. While it might seem like an unnecessary expense, it is a legal requirement in all 50 states and the District of Columbia, and failing to obtain it can lead to serious consequences.

Legal Requirements and Consequences, Does every state require auto insurance

Driving without auto insurance in the United States is illegal and can result in severe penalties, including fines, license suspension, and even jail time. In addition to legal consequences, driving without insurance can also lead to significant financial burdens in the event of an accident. If you are found at fault for an accident and don’t have insurance, you could be held personally liable for all damages, including medical bills, property repairs, and legal fees. This could potentially bankrupt you, even if you are not at fault for the accident.

State-Specific Auto Insurance Requirements

Each state in the United States has its own set of minimum auto insurance requirements that drivers must meet. These requirements vary significantly from state to state, so it is essential to understand the specific laws in your state.

State Minimum Liability Coverage Requirements

The table below lists the minimum liability coverage requirements for each state. Liability coverage is designed to protect you financially if you cause an accident that results in injuries or property damage to others.

| State | Minimum Liability Coverage Requirements | Other Required Coverages | Penalties for Driving Without Insurance |

|---|---|---|---|

| Alabama | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Alaska | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Arizona | 15/30/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Arkansas | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| California | 15/30/5 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Colorado | 25/50/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Connecticut | 20/40/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Delaware | 30/60/20 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Florida | 10/20/10 | Personal Injury Protection (PIP) | Suspension of driver’s license and vehicle registration |

| Georgia | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Hawaii | 20/40/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Idaho | 25/50/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Illinois | 20/40/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Indiana | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Iowa | 20/40/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Kansas | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Kentucky | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Louisiana | 15/30/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Maine | 50/100/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Maryland | 30/60/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Massachusetts | 20/40/5 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Michigan | 20/40/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Minnesota | 30/60/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Mississippi | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Missouri | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Montana | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Nebraska | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Nevada | 15/30/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| New Hampshire | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| New Jersey | 15/30/5 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| New Mexico | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| New York | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| North Carolina | 30/60/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| North Dakota | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Ohio | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Oklahoma | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Oregon | 25/50/20 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Pennsylvania | 15/30/5 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Rhode Island | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| South Carolina | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| South Dakota | 25/50/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Tennessee | 25/50/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Texas | 30/60/25 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Utah | 25/65/15 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Vermont | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Virginia | 25/50/20 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Washington | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| West Virginia | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Wisconsin | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

| Wyoming | 25/50/10 | Uninsured/Underinsured Motorist Coverage | Suspension of driver’s license and vehicle registration |

The numbers represent the minimum amount of coverage required for bodily injury liability per person, bodily injury liability per accident, and property damage liability. For example, 25/50/25 means that you must have at least $25,000 in coverage for bodily injury per person, $50,000 in coverage for bodily injury per accident, and $25,000 in coverage for property damage.

It is important to note that these are just the minimum requirements. You may want to consider purchasing more coverage than the minimum, especially if you have a lot of assets to protect.

No-Fault Insurance Systems

Twelve states, including Florida, Michigan, New Jersey, New York, Pennsylvania, and others, have “no-fault” insurance systems. In these states, drivers are required to carry personal injury protection (PIP) coverage, which covers their own medical expenses and lost wages regardless of who caused the accident. No-fault systems are designed to streamline the claims process and reduce the number of lawsuits.

In contrast, traditional liability insurance systems require drivers to prove that the other driver was at fault before they can receive compensation for their injuries. This can lead to lengthy and costly legal battles.

Variations in Insurance Requirements

Auto insurance requirements can vary based on several factors, including vehicle type, driver age, and driving history.

Vehicle Type

The type of vehicle you drive can affect your insurance premiums. For example, sports cars and luxury vehicles are typically more expensive to insure than sedans or SUVs. This is because these vehicles are more likely to be involved in accidents and more expensive to repair.

Driver Age

Young drivers are statistically more likely to be involved in accidents than older drivers. As a result, they often pay higher insurance premiums. Once drivers reach a certain age, their premiums may decrease because they are considered to be more experienced and less risky.

Driving History

Your driving history can also impact your insurance premiums. Drivers with a history of accidents, speeding tickets, or DUI convictions will generally pay higher premiums than drivers with a clean driving record.

It is important to understand the specific auto insurance requirements in your state and to purchase the right amount of coverage to protect yourself and your family.

Factors Affecting Auto Insurance Rates

Auto insurance premiums are not one-size-fits-all. Several factors come into play, determining how much you’ll pay for coverage. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor influencing your insurance rates. A clean driving record with no accidents or violations will typically lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Driving History | Lower rates for a clean record; higher rates for accidents, tickets, and DUI convictions. | A driver with no accidents in the past five years will likely have a lower premium than a driver with two accidents in the same period. | Maintain a clean driving record by adhering to traffic laws, driving defensively, and avoiding risky behaviors. |

Age

Age is another significant factor influencing auto insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk leads to higher premiums for younger drivers. As drivers age and gain experience, their premiums tend to decrease.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Age | Higher rates for younger drivers, lower rates for older drivers. | A 20-year-old driver will likely pay more than a 40-year-old driver with a similar driving record. | Consider adding a young driver to an existing policy as a named insured to benefit from lower rates. |

Gender

In the past, insurance companies often charged women lower premiums than men, citing statistics showing women are generally safer drivers. However, this practice is now largely prohibited in many countries due to gender discrimination laws.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Gender | May be a factor in some areas but is generally prohibited due to gender discrimination laws. | Some insurers may still consider gender in certain regions, but this is becoming less common. | Ensure you’re not being discriminated against based on gender. |

Credit Score

Your credit score may seem unrelated to driving, but insurers often use it to assess your risk. A good credit score can indicate financial responsibility, which insurers associate with responsible driving behavior.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Credit Score | Lower rates for higher credit scores, higher rates for lower credit scores. | A driver with a high credit score of 750 or above may receive lower rates than a driver with a score below 600. | Maintain a good credit score by paying bills on time, keeping credit utilization low, and avoiding unnecessary credit applications. |

Vehicle Type

The type of vehicle you drive plays a significant role in your insurance rates. Higher-performance vehicles, SUVs, and luxury cars are generally more expensive to repair or replace, leading to higher premiums.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Vehicle Type | Higher rates for expensive or high-performance vehicles, lower rates for less expensive and basic vehicles. | A driver with a sports car will likely pay more than a driver with a compact sedan. | Consider the insurance cost when choosing a vehicle. |

Location

Where you live significantly impacts your auto insurance rates. Areas with higher crime rates, traffic congestion, and a greater number of accidents tend to have higher premiums.

| Factor | Impact on Rates | Examples | Recommendations |

|---|---|---|---|

| Location | Higher rates in high-risk areas, lower rates in low-risk areas. | A driver living in a city with a high accident rate will likely pay more than a driver living in a rural area with low traffic. | If possible, consider moving to a lower-risk area to potentially reduce your premiums. |

The Role of the Financial Responsibility Law

The Financial Responsibility Law is a crucial aspect of auto insurance in every state. It aims to ensure that drivers have the financial means to cover damages caused by accidents they may be responsible for. These laws require drivers to prove their ability to pay for potential costs, such as medical expenses, property damage, and legal fees.

The Financial Responsibility Law serves as a safety net for both drivers and the public. It helps to prevent drivers who cannot afford to pay for their actions from causing harm without consequence. By requiring drivers to demonstrate their financial responsibility, the law helps to create a safer driving environment for everyone.

Minimum Financial Responsibility Requirements

Each state has established minimum financial responsibility requirements that drivers must meet. These requirements specify the minimum amount of insurance coverage drivers need to carry to be considered financially responsible. This coverage typically includes:

- Bodily Injury Liability: This coverage protects you if you cause an accident that injures another person. It covers medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: This coverage protects you if you cause an accident that damages another person’s property. It covers the cost of repairs or replacement.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance.

The minimum financial responsibility requirements vary from state to state. For example, in California, drivers must carry at least $15,000 in bodily injury liability coverage per person, $30,000 per accident, and $5,000 in property damage liability coverage. In Texas, the minimum requirements are $30,000 for bodily injury liability per person, $60,000 per accident, and $25,000 for property damage liability.

Consequences of Failing to Meet Financial Responsibility Requirements

Failing to meet the minimum financial responsibility requirements in your state can have serious consequences. These consequences can include:

- License Suspension: Your driver’s license can be suspended if you are involved in an accident and do not have the required insurance coverage.

- Vehicle Registration Cancellation: Your vehicle registration can be canceled if you do not have the required insurance coverage.

- Fines: You may face fines or penalties for driving without the required insurance coverage.

In addition to these consequences, you may also be held personally liable for any damages caused by an accident if you do not have adequate insurance coverage. This could mean having to pay for medical bills, property damage, and legal fees out of your own pocket.

Resources and Information for Drivers: Does Every State Require Auto Insurance

Navigating the complex world of auto insurance can be daunting, but thankfully, numerous resources are available to help drivers understand their state’s requirements, coverage options, and financial responsibility laws. This section will provide a comprehensive list of reliable resources, contact information for relevant agencies, and links to helpful online tools.

State Departments of Motor Vehicles (DMVs)

Each state’s DMV is the primary source of information regarding auto insurance requirements and other vehicle-related regulations. The DMV website typically contains detailed information on minimum liability coverage limits, proof of insurance requirements, and procedures for filing complaints.

- Website: Most state DMVs have user-friendly websites that provide access to online services, downloadable forms, and frequently asked questions (FAQs).

- Phone Number: The DMV phone number is listed on their website and is typically available for general inquiries and assistance.

- Physical Address: DMV offices are usually located in major cities within the state, and their addresses can be found on their website.

State Insurance Regulators

State insurance regulators oversee the insurance industry within their respective states. They are responsible for ensuring that insurance companies comply with state laws and regulations, protecting consumers from unfair practices.

- Website: State insurance regulators often have websites that provide information about auto insurance laws, consumer rights, and complaint procedures.

- Phone Number: The insurance regulator’s phone number is typically listed on their website and is available for inquiries and complaints.

- Physical Address: The physical address of the insurance regulator’s office can be found on their website.

Consumer Protection Agencies

Consumer protection agencies are government agencies that advocate for consumer rights and provide resources to protect consumers from unfair business practices. They can assist drivers with resolving insurance disputes and filing complaints against insurance companies.

- Website: Consumer protection agencies usually have websites that offer information on consumer rights, complaint filing procedures, and resources for resolving consumer disputes.

- Phone Number: The consumer protection agency’s phone number is listed on their website and is available for inquiries and assistance.

- Physical Address: The physical address of the consumer protection agency’s office can be found on their website.

Online Resources for Comparing Insurance Quotes

Several online platforms allow drivers to compare insurance quotes from multiple companies simultaneously. These platforms provide a convenient way to find the most competitive rates and coverage options based on individual needs.

- Websites: Websites like [website name], [website name], and [website name] allow drivers to compare quotes from multiple insurers, customize their coverage, and receive personalized advice.

- Features: These platforms often offer features such as quote comparison tools, coverage explanations, and customer reviews.

Online Resources for Filing Complaints

Drivers can file complaints against insurance companies online through various platforms. These platforms provide a streamlined process for reporting issues and seeking resolution.

- Websites: Websites like [website name] and [website name] allow drivers to file complaints against insurance companies and track their progress.

- Features: These platforms often offer features such as complaint filing forms, progress tracking tools, and access to consumer resources.

Closure

In conclusion, understanding the auto insurance requirements in your state is essential for responsible driving. While every state mandates some form of auto insurance, the specific coverage levels and penalties for non-compliance vary. By carefully evaluating your individual needs and comparing quotes from different insurance providers, you can ensure you have the right coverage to protect yourself and others on the road. Remember, driving without proper insurance can have serious consequences, both financially and legally.

Essential FAQs

What are the most common types of auto insurance coverage?

The most common types of auto insurance coverage include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability insurance protects you against financial losses if you cause an accident, while collision and comprehensive coverage cover damage to your own vehicle. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

What factors influence my auto insurance rates?

Several factors can affect your auto insurance rates, including your driving history, age, gender, credit score, vehicle type, and location. Maintaining a clean driving record, choosing a safe vehicle, and living in a low-risk area can help lower your premiums.

How can I find the best auto insurance rates?

To find the best auto insurance rates, it’s essential to compare quotes from multiple insurers. You can use online comparison tools or contact insurance agents directly. Be sure to provide accurate information about your driving history, vehicle, and coverage needs to ensure you get an accurate quote.