State farm car insurence – State Farm car insurance is a well-known name in the industry, providing coverage for millions of drivers across the United States. Founded in 1922, State Farm has grown into one of the largest insurance providers, known for its diverse product offerings and strong customer service. This comprehensive guide will delve into the key aspects of State Farm car insurance, from its history and features to its customer experience and competitive landscape. We’ll explore what makes State Farm stand out in the market and how its offerings compare to other major insurance providers.

State Farm car insurance offers a wide range of coverage options, catering to different needs and budgets. Whether you’re looking for basic liability coverage or comprehensive protection, State Farm has policies to suit your requirements. The company also offers a variety of discounts, helping you save on your premiums. Beyond coverage, State Farm prioritizes customer satisfaction, providing convenient service channels and a user-friendly mobile app. We’ll examine the company’s claims handling process and explore customer feedback to provide a comprehensive overview of the State Farm experience.

State Farm Overview: State Farm Car Insurence

State Farm Insurance is one of the largest and most well-known insurance companies in the United States. With a long history and a commitment to customer service, State Farm has earned a reputation for reliability and stability.

History of State Farm Insurance

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Mecherle’s vision was to provide affordable and accessible auto insurance to the growing number of car owners in the country. He believed that insurance should be fair and equitable, and he designed State Farm’s policies to reflect these principles.

Core Insurance Products

State Farm offers a wide range of insurance products to meet the needs of its customers. Its core offerings include:

- Auto Insurance: State Farm is known for its comprehensive auto insurance coverage, which includes liability, collision, and comprehensive coverage. They also offer various discounts and add-ons to personalize policies.

- Home Insurance: State Farm provides homeowners insurance that protects against a variety of risks, including fire, theft, and natural disasters. They also offer specialized coverage for valuable possessions and liability protection.

- Life Insurance: State Farm offers a range of life insurance products, including term life, whole life, and universal life insurance. These policies provide financial security for families in the event of the insured’s death.

- Renters Insurance: For renters, State Farm provides coverage for personal belongings, liability, and additional living expenses in case of a covered loss.

- Business Insurance: State Farm offers a variety of business insurance solutions, including property, liability, and workers’ compensation coverage.

Financial Strength and Customer Satisfaction

State Farm is consistently ranked among the most financially sound insurance companies in the United States. They have a strong track record of paying claims and maintaining a high level of financial stability. This stability is reflected in their high ratings from independent agencies like A.M. Best and Standard & Poor’s.

State Farm also consistently receives high marks for customer satisfaction. They are known for their friendly and helpful agents, their efficient claims process, and their commitment to resolving customer issues promptly. Several surveys and rankings consistently place State Farm among the top insurance providers in terms of customer satisfaction.

Car Insurance Features

State Farm offers a comprehensive range of car insurance features designed to meet the diverse needs of its policyholders. From essential coverage options to valuable discounts and personalized services, State Farm aims to provide comprehensive protection and peace of mind on the road.

Coverage Options

State Farm offers a variety of coverage options to tailor your car insurance policy to your specific needs. These options include:

- Liability Coverage: This coverage protects you financially if you are found at fault in an accident that causes damage to another person’s property or injuries to another person. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in a collision, regardless of who is at fault. You can choose a deductible, which is the amount you pay out of pocket before your insurance kicks in.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. You can also choose a deductible for comprehensive coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages. It can help pay for medical expenses, lost wages, and property damage.

Discounts and Pricing Structure

State Farm offers a variety of discounts to help policyholders save money on their car insurance premiums. These discounts can include:

- Safe Driving Discounts: For drivers with a clean driving record and no accidents or traffic violations.

- Good Student Discounts: For students who maintain a certain grade point average.

- Multi-Policy Discounts: For bundling multiple insurance policies, such as home, auto, and life insurance, with State Farm.

- Anti-theft Device Discounts: For vehicles equipped with anti-theft devices, such as alarms or tracking systems.

- Defensive Driving Course Discounts: For drivers who complete a certified defensive driving course.

State Farm’s pricing structure is competitive and varies based on factors such as your driving record, vehicle type, location, and coverage options. It’s important to compare quotes from multiple insurance providers to find the best rate for your needs.

State Farm’s pricing structure is designed to be transparent and fair, reflecting the individual risk factors associated with each policyholder.

Customer Experience

State Farm prioritizes a positive customer experience across all touchpoints. The company offers a variety of channels for customers to access information, manage their policies, and file claims. State Farm’s commitment to customer satisfaction is evident in its consistently high ratings and positive reviews.

Customer Service Channels

State Farm offers a range of customer service channels to cater to diverse preferences and needs.

| Channel | Description |

|---|---|

| Online | State Farm’s website provides access to a comprehensive range of services, including policy management, claim filing, and customer support. The website features a user-friendly interface and helpful resources, such as FAQs and tutorials. |

| Phone | Customers can reach State Farm’s customer service representatives via phone for assistance with a wide range of inquiries. State Farm provides dedicated phone lines for specific needs, such as claims reporting or policy changes. |

| In-Person | State Farm maintains a network of local agents who provide personalized service and support. Agents can assist customers with policy selection, claim filing, and other insurance-related matters. |

Customer Testimonials and Reviews

State Farm’s claims handling process is highly regarded by customers. Many testimonials and reviews highlight the company’s responsiveness, efficiency, and empathy in resolving claims.

“I recently had to file a claim after a minor accident. The entire process was smooth and stress-free. State Farm’s representatives were incredibly helpful and kept me informed every step of the way. I highly recommend their services.” – John S.

“State Farm’s claims handling team went above and beyond to assist me after a major storm damaged my home. They were prompt, professional, and ensured I received the necessary support to recover from the incident.” – Sarah M.

Mobile App Features

State Farm’s mobile app is a convenient and user-friendly platform that allows customers to manage their insurance needs on the go.

- Policy Management: View policy details, make payments, and update contact information.

- Claim Filing: Report claims, track their progress, and communicate with adjusters.

- Roadside Assistance: Request roadside assistance, such as towing or jump starts.

- Digital ID Cards: Access digital copies of insurance cards for easy presentation.

- Find Agents: Locate nearby State Farm agents for in-person assistance.

The mobile app enhances customer convenience by providing 24/7 access to essential insurance services, simplifying tasks, and reducing the need for phone calls or in-person visits.

Competitive Landscape

The car insurance market is highly competitive, with numerous players vying for customers. State Farm, being one of the largest insurance providers in the US, faces competition from both established players and emerging insurers. Understanding State Farm’s competitive landscape is crucial to assess its strengths and weaknesses and identify opportunities for growth.

State Farm’s Key Competitors

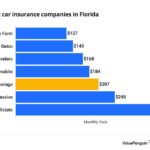

State Farm’s primary competitors include other large national insurance companies such as Geico, Progressive, Allstate, and Liberty Mutual. These companies offer similar products and services, targeting a broad customer base. Regional insurers also pose competition, particularly in specific geographic markets.

Comparison of Offerings

State Farm differentiates itself through its comprehensive product offerings, strong customer service, and extensive agent network. Here’s a comparison of State Farm’s offerings with its competitors:

- Product Range: State Farm offers a wide range of car insurance products, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It also provides additional coverage options like roadside assistance, rental car reimbursement, and accident forgiveness. Compared to competitors, State Farm’s product portfolio is considered comprehensive, offering various options to meet diverse customer needs.

- Pricing: State Farm’s pricing is generally competitive, with rates varying based on factors such as driving history, vehicle type, and location. While Geico and Progressive are known for their aggressive pricing strategies, State Farm aims to balance competitive rates with comprehensive coverage and customer service.

- Customer Service: State Farm is known for its strong customer service, with a network of agents available to provide personalized assistance. Its 24/7 customer support and online tools offer convenience and accessibility. Compared to competitors, State Farm emphasizes a personalized approach, with agents acting as trusted advisors to customers.

- Agent Network: State Farm has a vast agent network across the US, providing local access and personalized service. This network allows for face-to-face interactions, fostering trust and building relationships with customers. While some competitors have expanded their online presence, State Farm continues to prioritize its agent network as a key differentiator.

Impact of Emerging Technologies

Emerging technologies like telematics, artificial intelligence (AI), and data analytics are transforming the car insurance industry. These technologies enable insurers to assess risk more accurately, personalize pricing, and enhance customer experience. State Farm has been actively embracing these advancements:

- Telematics: State Farm offers Drive Safe & Save, a telematics program that uses a mobile app to track driving behavior and reward safe drivers with discounts. This program leverages data to personalize pricing and promote safer driving habits, aligning with the industry’s shift towards usage-based insurance.

- AI and Data Analytics: State Farm utilizes AI and data analytics to automate processes, improve risk assessment, and personalize customer interactions. By leveraging data insights, State Farm can tailor its offerings to individual customer needs and provide more efficient and personalized service.

Future Trends

The car insurance industry is undergoing a significant transformation, driven by technological advancements and evolving consumer preferences. Two prominent trends are the rise of autonomous vehicles and the increasing adoption of telematics. These trends are reshaping the landscape of risk, pricing, and customer expectations.

Autonomous Vehicles, State farm car insurence

The emergence of autonomous vehicles (AVs) presents both opportunities and challenges for the insurance industry. AVs are expected to reduce accidents significantly due to their advanced safety features and ability to react faster than humans. This could lead to lower insurance premiums for AV owners, as the risk of accidents is reduced.

However, AVs also introduce new complexities. For example, who is liable in an accident involving an AV? Is it the manufacturer, the owner, or the software developer? The legal and regulatory framework surrounding AVs is still evolving, and insurance companies need to adapt their policies and procedures to address these emerging issues.

Telematics

Telematics is the use of technology to collect and analyze data from vehicles. This data can provide valuable insights into driver behavior, vehicle usage, and driving conditions. Insurance companies can use telematics to offer usage-based insurance (UBI) programs, which adjust premiums based on actual driving behavior.

For example, drivers who demonstrate safe driving habits, such as avoiding hard braking and speeding, can earn lower premiums. Telematics also enables insurers to develop more personalized insurance products tailored to individual drivers’ needs.

State Farm’s Adaptation

State Farm is well-positioned to navigate these trends and remain a leader in the insurance industry. The company has already made significant investments in telematics and is actively exploring the potential of AVs. State Farm’s commitment to innovation and customer-centricity will be crucial in adapting to the evolving market.

“We are committed to providing our customers with the best possible insurance solutions, regardless of how they choose to get around.” – State Farm CEO

Marketing Campaign

State Farm can leverage future trends to develop innovative marketing campaigns that resonate with target audiences. A potential campaign could focus on the safety and convenience of AVs, highlighting State Farm’s expertise in this emerging area.

The campaign could use a combination of digital marketing, social media, and traditional media to reach potential customers. The messaging should emphasize State Farm’s commitment to providing comprehensive coverage and peace of mind, even in a world of autonomous vehicles.

Closing Notes

As the car insurance landscape continues to evolve, State Farm is adapting to meet the changing needs of drivers. The company is investing in technology and innovation to provide more personalized and convenient services. From telematics to autonomous vehicles, State Farm is positioning itself for the future of the industry. By understanding State Farm’s history, its current offerings, and its future plans, you can make an informed decision about whether this insurance provider is the right fit for your needs.

Clarifying Questions

What types of car insurance coverage does State Farm offer?

State Farm offers a variety of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and medical payments coverage (MedPay).

How do I get a car insurance quote from State Farm?

You can get a quote online, over the phone, or by visiting a local State Farm agent.

Does State Farm offer discounts on car insurance?

Yes, State Farm offers a variety of discounts, such as good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts.

What is State Farm’s claims handling process like?

State Farm has a streamlined claims handling process that can be initiated online, over the phone, or through the mobile app. The company aims to resolve claims quickly and fairly.

How can I contact State Farm customer service?

You can contact State Farm customer service by phone, email, or through their website. They also have a 24/7 claims reporting line.