State farm auto home insurance – State Farm auto and home insurance, a household name in the insurance industry, has been providing comprehensive coverage and reliable service for over a century. Known for its strong financial stability and commitment to customer satisfaction, State Farm offers a wide range of products tailored to meet the diverse needs of individuals and families across the nation.

This guide delves into the intricacies of State Farm’s auto and home insurance offerings, exploring their coverage options, discounts, customer service, and competitive landscape. We’ll also examine State Farm’s digital presence, commitment to social responsibility, and insights from customer reviews, providing a comprehensive overview of this trusted insurance provider.

State Farm Overview

State Farm is one of the largest and most recognizable insurance companies in the United States, offering a wide range of insurance products, including auto, home, life, and health insurance. The company has a long history of providing reliable and affordable insurance coverage to millions of customers across the country.

History of State Farm

State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois. Mecherle initially focused on providing auto insurance to farmers in the region, recognizing the need for affordable and accessible coverage. The company’s name, State Farm, reflects its commitment to serving the needs of the local community. Over the years, State Farm expanded its product offerings and geographic reach, becoming a national insurance giant.

Mission and Values

State Farm’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” The company’s core values include integrity, customer focus, respect, responsibility, and teamwork. These values guide State Farm’s operations and ensure that customers receive the best possible service and support.

Financial Stability and Ratings

State Farm is known for its strong financial stability and has consistently received high ratings from independent agencies. The company’s financial strength is based on its large asset base, diversified investment portfolio, and prudent risk management practices.

State Farm is rated A+ by A.M. Best, which is the highest financial strength rating assigned by the agency. This rating indicates that State Farm has a very strong ability to meet its financial obligations to policyholders. State Farm also receives high ratings from other independent agencies, such as Moody’s Investors Service and Standard & Poor’s.

Auto Insurance Products and Services

State Farm offers a comprehensive range of auto insurance products and services designed to meet the diverse needs of its customers. From basic liability coverage to comprehensive protection, State Farm provides options to safeguard your vehicle and financial well-being.

Coverage Options

State Farm offers a wide variety of auto insurance coverage options, ensuring you can tailor your policy to your specific needs and budget. Here are some of the key coverage options:

- Liability Coverage: This is the most basic type of auto insurance, covering damage or injury you cause to others in an accident. It includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no or insufficient insurance.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

- Roadside Assistance: This coverage provides help with situations like flat tires, jump starts, and towing.

Discounts and Benefits

State Farm offers various discounts and benefits to help you save money on your auto insurance premiums. Here are some of the common discounts:

- Good Driver Discount: This discount is available to drivers with a clean driving record and no accidents or violations.

- Safe Driver Discount: This discount is available to drivers who have completed a defensive driving course.

- Multi-Policy Discount: This discount is available if you bundle your auto insurance with other State Farm insurance products, such as homeowners or renters insurance.

- Anti-theft Device Discount: This discount is available if your vehicle has anti-theft devices installed, such as an alarm system or immobilizer.

- Student Discount: This discount is available to students who maintain good grades.

Claims Process and Customer Service

State Farm makes filing a claim easy and convenient. You can report a claim online, by phone, or through the State Farm mobile app.

- Online Claim Reporting: You can report a claim online through the State Farm website, providing all the necessary information about the accident.

- Phone Claim Reporting: You can report a claim by calling State Farm’s customer service line, which is available 24/7.

- Mobile App Claim Reporting: You can report a claim through the State Farm mobile app, providing photos and details about the accident.

State Farm has a dedicated team of customer service representatives who are available to assist you with any questions or concerns you may have. They can help you understand your policy, file a claim, and manage your account.

Home Insurance Products and Services

State Farm offers a comprehensive range of home insurance products and services designed to protect your most valuable asset: your home. Their coverage options are tailored to meet the unique needs of different homeowners, ensuring peace of mind and financial security in the event of unexpected events.

Home Insurance Coverage Options

State Farm offers various coverage options to cater to diverse homeowner needs. These options provide financial protection against various risks, such as fire, theft, natural disasters, and liability.

- Dwelling Coverage: This coverage protects the physical structure of your home, including the attached structures like garages and decks, against perils like fire, windstorm, and hail. It covers the cost of repairs or rebuilding in case of damage.

- Other Structures Coverage: This coverage protects detached structures on your property, such as sheds, fences, and swimming pools, from damage caused by covered perils.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and jewelry, from damage or theft. It covers the cost of replacing or repairing these items.

- Liability Coverage: This coverage protects you from financial losses arising from lawsuits or claims made against you for injuries or property damage that occur on your property. For example, if someone is injured while visiting your home, liability coverage helps pay for medical expenses and legal fees.

- Additional Living Expenses Coverage: This coverage helps pay for temporary housing and other expenses if you are unable to live in your home due to a covered loss. It can cover expenses like hotel stays, meals, and transportation.

Discounts and Benefits

State Farm offers a variety of discounts and benefits to help homeowners save money and enhance their coverage.

- Bundling Discounts: State Farm provides discounts for bundling your home and auto insurance policies. This can significantly reduce your overall insurance premiums.

- Safety Features Discounts: Homeowners who have installed safety features like smoke detectors, burglar alarms, and fire sprinklers can qualify for discounts on their premiums. These features help mitigate risks and reduce the likelihood of claims.

- Loyalty Discounts: State Farm rewards long-term customers with loyalty discounts, demonstrating their commitment to customer retention and appreciation.

- Claims Assistance: State Farm offers 24/7 claims assistance to help you navigate the claims process smoothly. They have a dedicated team of claims adjusters who work with you to assess damages, process claims, and provide support throughout the entire process.

- Customer Service: State Farm prioritizes excellent customer service and provides various channels for communication, including phone, email, and online chat. Their dedicated customer service representatives are available to answer questions, address concerns, and provide personalized assistance.

Claims Process

State Farm simplifies the claims process, making it easy for homeowners to report and manage their claims.

- Report the Claim: You can report a claim online, through the State Farm mobile app, or by calling their claims hotline. State Farm will guide you through the initial steps of reporting the claim, gathering necessary information, and scheduling an inspection.

- Claims Assessment: A State Farm claims adjuster will assess the damage to your home and belongings, documenting the extent of the loss and gathering evidence to support your claim.

- Claim Processing: Once the claim is assessed, State Farm will process the claim, review the damage, and determine the amount of compensation you are eligible for. They will work with you to finalize the claim and arrange for repairs or replacement of damaged property.

State Farm’s Competitive Landscape

State Farm is a major player in the insurance market, competing with a range of other companies for customers. To understand State Farm’s position, it’s important to examine its competitive landscape, including its strengths, weaknesses, and how its offerings compare to those of its rivals.

Key Competitors

State Farm faces competition from a wide array of insurance companies, both large and small. Some of its main competitors include:

- Progressive: Known for its online-focused approach and its “Name Your Price” tool, which allows customers to set their desired premium and see what coverage options match.

- Geico: Famous for its humorous advertising, Geico offers a wide range of insurance products, including auto, home, and life insurance.

- Allstate: Allstate is a large, well-established insurer known for its “Good Hands” branding and its focus on customer service.

- USAA: Primarily serving military personnel and their families, USAA offers competitive rates and excellent customer service.

- Liberty Mutual: Liberty Mutual is a large insurer with a strong presence in both personal and commercial insurance markets.

Comparison of Auto and Home Insurance Products

State Farm’s auto and home insurance products are generally competitive in terms of pricing and coverage options. However, specific strengths and weaknesses exist when compared to its competitors.

Auto Insurance

- Strengths:

- State Farm offers a wide range of discounts, including safe driving, good student, and multi-policy discounts.

- Its “Drive Safe & Save” program uses telematics to track driving behavior and offer personalized discounts.

- State Farm has a strong reputation for customer service and claims handling.

- Weaknesses:

- State Farm’s pricing can be higher than some competitors, particularly for drivers with a history of accidents or violations.

- Its online tools and digital experience can be less user-friendly compared to some competitors, such as Progressive.

Home Insurance

- Strengths:

- State Farm offers comprehensive coverage options, including protection against various perils like fire, theft, and natural disasters.

- It provides a range of endorsements and add-ons to customize coverage to meet specific needs.

- State Farm’s claims handling process is generally efficient and customer-focused.

- Weaknesses:

- State Farm’s home insurance premiums can be higher than some competitors, especially for homes in high-risk areas.

- Its online tools for managing home insurance policies can be less intuitive compared to some competitors.

Key Differentiators

State Farm differentiates itself from its competitors through several key factors:

- Strong Brand Reputation: State Farm has built a strong brand reputation over decades, known for its reliability, customer service, and community involvement.

- Extensive Agent Network: State Farm has a vast network of local agents, providing personalized service and support to customers.

- Financial Stability: State Farm is a financially strong company, providing customers with confidence in its ability to meet their insurance needs.

- Focus on Customer Service: State Farm emphasizes customer service and claims handling, aiming to provide a positive experience for policyholders.

Strengths and Weaknesses

State Farm’s overall strengths and weaknesses can be summarized as follows:

Strengths

- Strong brand reputation and customer loyalty.

- Extensive agent network for personalized service.

- Competitive pricing and coverage options.

- Focus on customer service and claims handling.

- Financial stability and a strong track record.

Weaknesses

- Pricing can be higher than some competitors in certain situations.

- Digital tools and online experience may lag behind some competitors.

- Limited availability of specialized coverage options in certain areas.

Customer Experience and Reviews

State Farm is one of the largest insurance companies in the United States, and its customer experience is a key factor in its success. The company has a long history of providing quality insurance products and services, and it has consistently received positive customer feedback. However, like any large company, State Farm has its share of complaints and issues.

Customer Satisfaction Ratings

Customer satisfaction ratings are a key indicator of a company’s overall performance. State Farm has consistently ranked highly in customer satisfaction surveys. According to J.D. Power, State Farm ranked among the top insurers in the United States for customer satisfaction in 2023. The company also received high marks from the American Customer Satisfaction Index (ACSI) in 2023. These ratings suggest that State Farm is generally doing a good job of meeting the needs of its customers.

Customer Reviews and Testimonials

Customer reviews and testimonials can provide valuable insights into a company’s customer experience. State Farm receives a high volume of positive reviews from customers who are satisfied with its products and services. Many customers praise the company’s friendly and helpful customer service representatives, its competitive pricing, and its efficient claims processing.

Notable Complaints and Issues

While State Farm generally receives positive feedback from its customers, there are some notable complaints and issues that have been reported. Some customers have complained about long wait times for customer service, while others have experienced difficulties with claims processing.

State Farm’s Digital Presence and Technology

State Farm has made significant investments in its digital presence and technology to enhance customer experience and streamline operations. This includes a robust website and mobile app, as well as various innovative tools and features designed to improve customer engagement and satisfaction.

Website and Mobile App Functionalities

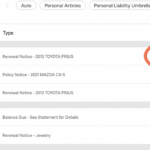

State Farm’s website and mobile app offer a comprehensive suite of services, allowing customers to manage their insurance policies, make payments, file claims, access policy documents, and get personalized quotes.

- Website: The website provides detailed information about State Farm’s insurance products, services, and resources. Users can obtain quotes, compare coverage options, and manage their existing policies online. The website also includes a dedicated section for claims, allowing customers to report incidents, track claim status, and access claim-related documents.

- Mobile App: State Farm’s mobile app extends these functionalities to a mobile platform, enabling customers to access their insurance information and services on the go. The app allows users to view policy details, make payments, report claims, access roadside assistance, and receive personalized notifications.

Technology to Enhance Customer Experience, State farm auto home insurance

State Farm leverages technology to enhance customer experience in several ways:

- Personalized Communication: State Farm utilizes data analytics to personalize communication with customers, providing relevant information and offers based on individual needs and preferences. This includes targeted email campaigns, personalized mobile app notifications, and tailored online content.

- Automated Processes: State Farm has implemented automated processes for tasks like policy renewals, payment reminders, and claims processing, reducing manual effort and improving efficiency. This allows for faster response times and a more seamless customer experience.

- Digital Tools and Resources: State Farm provides customers with access to digital tools and resources, such as online claim filing, mobile app-based roadside assistance, and digital policy documents. These tools simplify interactions and empower customers to manage their insurance needs independently.

Innovative Features and Tools

State Farm has introduced several innovative features and tools to further enhance customer experience:

- Drive Safe & Save: This program utilizes telematics technology to track driving habits and reward safe drivers with discounts. Customers can opt to install a device in their car or use their smartphone to monitor their driving behavior.

- State Farm Virtual Assistant: State Farm’s virtual assistant, accessible through the mobile app and website, provides instant answers to common insurance questions, guides users through tasks, and helps them navigate the platform.

- State Farm Connected Home: This service allows customers to monitor and control their home security systems, thermostats, and other smart devices through a mobile app. This can help prevent potential damage and reduce insurance premiums.

State Farm’s Social Responsibility and Sustainability

State Farm is a company deeply committed to social responsibility and sustainability, recognizing that its success is intertwined with the well-being of its communities and the environment. This commitment is evident in its numerous initiatives, community involvement, and environmental practices.

Community Involvement and Philanthropic Efforts

State Farm actively engages in various philanthropic activities, supporting causes that align with its values. These efforts are aimed at improving the lives of individuals and communities, promoting education, and fostering economic development.

- State Farm Neighborhood of Good® Program: This program supports local organizations that address community needs, such as education, safety, and economic empowerment. State Farm provides grants and resources to these organizations, empowering them to make a positive impact in their communities.

- State Farm Youth Advisory Council: This council brings together young leaders from across the country to engage in discussions on important social issues and develop solutions to address them. The council’s insights and recommendations contribute to State Farm’s social responsibility initiatives.

- State Farm’s Disaster Relief Efforts: State Farm provides significant financial and logistical support to disaster-stricken communities, helping them rebuild and recover. This includes providing grants, deploying mobile claims centers, and offering resources to affected individuals and families.

Environmental Sustainability

State Farm recognizes the importance of environmental sustainability and strives to minimize its impact on the planet. It has implemented various initiatives to promote energy efficiency, reduce waste, and support sustainable practices.

- Energy Efficiency Initiatives: State Farm has implemented energy-saving measures in its offices and facilities, such as using energy-efficient lighting and appliances, and promoting the use of renewable energy sources. These efforts contribute to reducing the company’s carbon footprint.

- Waste Reduction and Recycling Programs: State Farm has implemented comprehensive waste reduction and recycling programs across its operations, diverting waste from landfills and promoting responsible disposal practices. This includes recycling paper, plastic, and electronic waste.

- Support for Sustainable Practices: State Farm encourages its employees, agents, and customers to adopt sustainable practices in their daily lives. This includes promoting energy conservation, responsible consumption, and support for environmental organizations.

Final Conclusion: State Farm Auto Home Insurance

Whether you’re seeking dependable auto insurance to protect your vehicle or comprehensive home insurance to safeguard your biggest investment, State Farm stands ready to provide peace of mind. With its long history, strong financial backing, and commitment to customer satisfaction, State Farm remains a leading choice for insurance needs across the country.

Expert Answers

What types of discounts are available for State Farm auto insurance?

State Farm offers a wide range of discounts for auto insurance, including safe driver discounts, multi-policy discounts, good student discounts, and more. Contact your local State Farm agent for a personalized quote and to learn about available discounts.

What are the benefits of bundling auto and home insurance with State Farm?

Bundling your auto and home insurance with State Farm can lead to significant savings through multi-policy discounts. It also simplifies your insurance management, offering a single point of contact for both policies.

How can I file a claim with State Farm?

You can file a claim with State Farm online, through their mobile app, or by contacting your local agent. State Farm provides a streamlined claims process with dedicated customer service representatives available to assist you every step of the way.