State Farm car insurance rates are a key factor for many drivers considering this popular insurance provider. With a long history and a reputation for reliable service, State Farm has earned a loyal customer base. But how do their rates stack up against the competition? What factors influence the cost of your insurance? This guide will delve into the intricacies of State Farm car insurance rates, exploring everything from the factors that affect pricing to tips for securing competitive rates.

Understanding how State Farm calculates car insurance rates is essential for making informed decisions about your coverage. From your driving history to the type of vehicle you own, numerous factors play a role in determining your premium. This article will provide a comprehensive overview of these factors, helping you navigate the complexities of car insurance pricing and find the best value for your needs.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, offering a wide range of coverage options to meet the diverse needs of its customers.

History and Key Milestones

State Farm was founded in 1922 by George J. Mecherle, a farmer from Bloomington, Illinois. The company initially focused on providing auto insurance to farmers, but quickly expanded its offerings to include other types of insurance, such as home, life, and health.

- 1923: State Farm issues its first auto insurance policy.

- 1930s: The company begins offering homeowners insurance and expands its operations across the country.

- 1950s: State Farm introduces its iconic red and white logo and becomes one of the largest insurance companies in the United States.

- 1970s: The company begins offering life insurance and expands into the international market.

- 1990s: State Farm introduces online and mobile insurance services.

- 2000s: The company continues to innovate and expand its product offerings, including auto insurance for young drivers, accident forgiveness, and telematics programs.

Market Position and Customer Base

State Farm is the largest provider of car insurance in the United States, with over 83 million policies in force. The company’s vast customer base is a testament to its commitment to providing affordable and reliable insurance coverage. State Farm is known for its strong customer service, competitive pricing, and a wide range of coverage options.

Factors Influencing State Farm Car Insurance Rates

State Farm, like other insurance providers, uses a complex system to determine your car insurance rates. These rates are influenced by various factors, each contributing to the overall cost of your policy. Understanding these factors can help you make informed decisions about your insurance needs and potentially lower your premiums.

Driving History

Your driving history is a major factor influencing your car insurance rates. A clean driving record with no accidents or violations usually results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates. Insurance companies view drivers with a history of risky behavior as more likely to file claims, leading to higher premiums.

State Farm Rate Comparison with Competitors: State Farm Car Insurance Rate

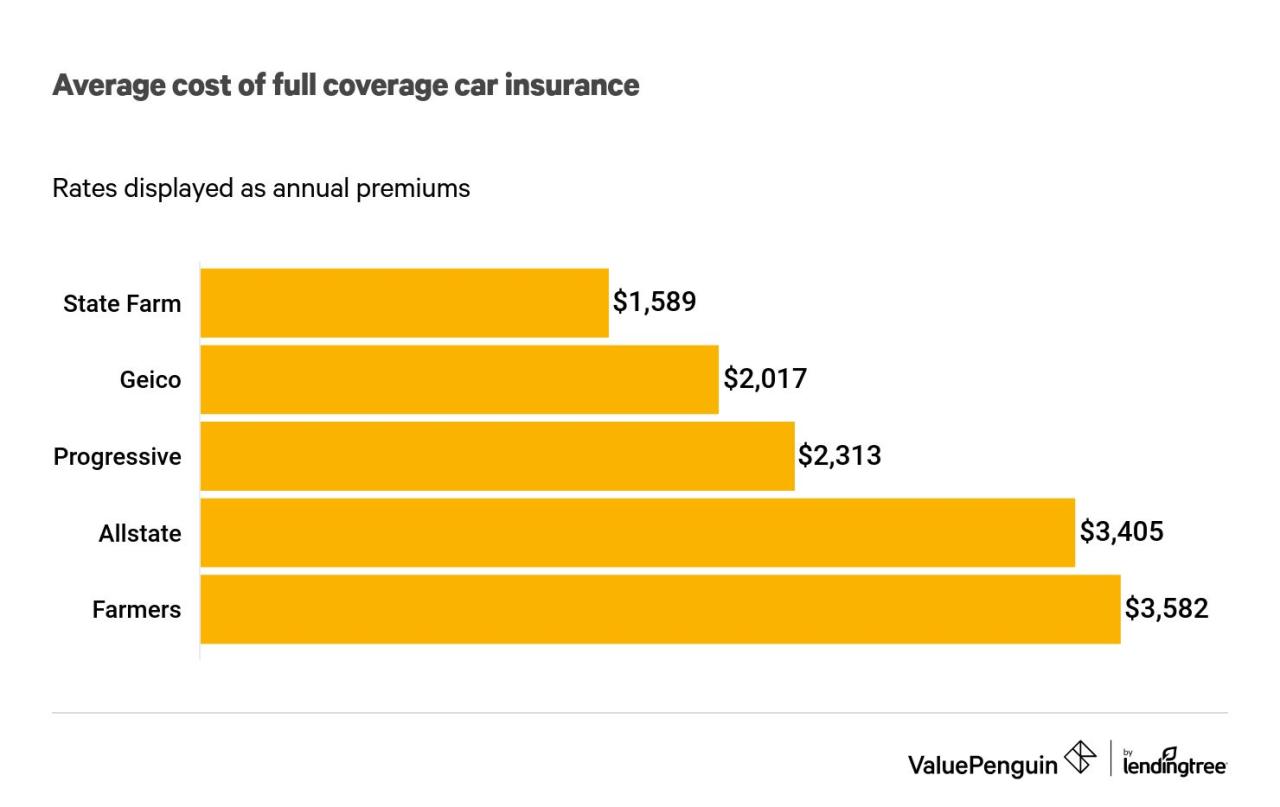

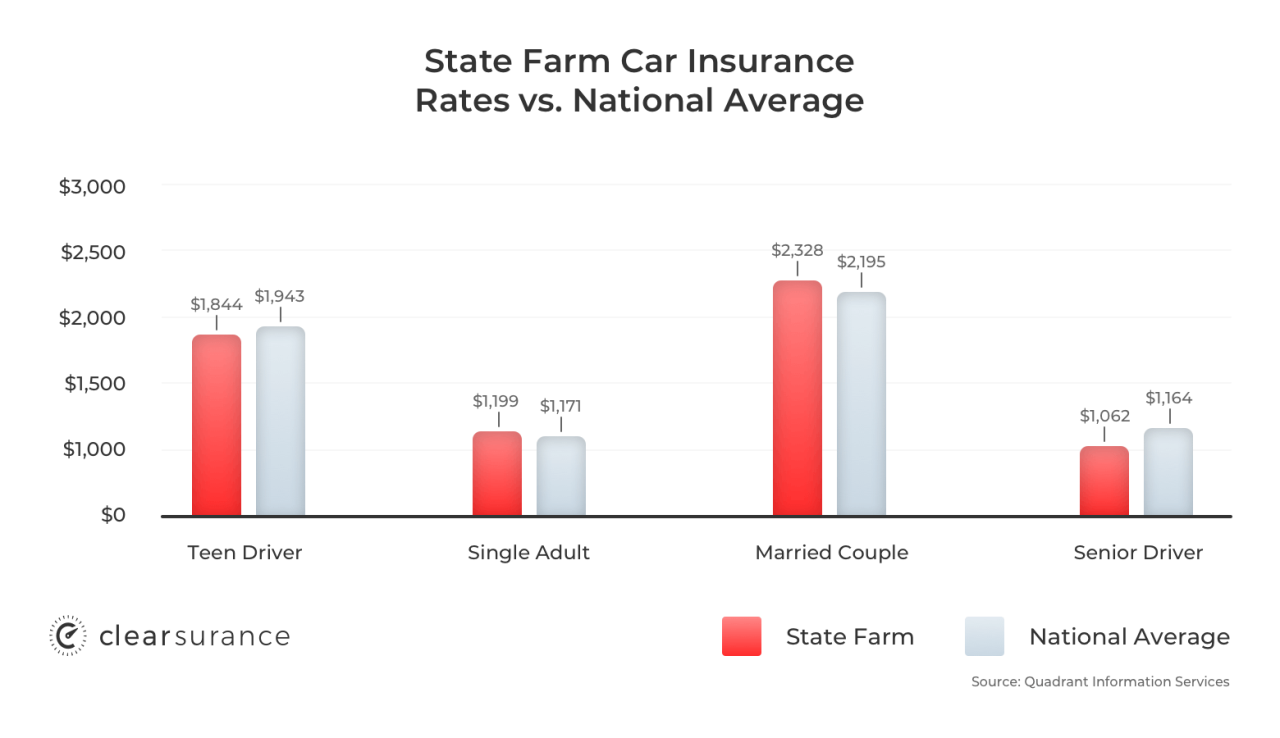

To help you make an informed decision, we’ll compare State Farm’s car insurance rates with those of major competitors like Geico, Progressive, and Allstate. This comparison will highlight the potential cost differences across various vehicle types and driver profiles, providing you with valuable insights into the competitive landscape.

State Farm Rate Comparison with Competitors

When it comes to car insurance, price is a crucial factor. While State Farm is a well-established and reputable insurer, it’s essential to compare its rates with other leading companies to see how they stack up. This comparison will provide you with a clearer understanding of the competitive landscape and help you determine if State Farm offers the best value for your specific needs.

| Company | Vehicle Type | Driver Profile | Average Annual Premium |

|---|---|---|---|

| State Farm | 2020 Honda Civic | 30-year-old male with a clean driving record | $1,200 |

| Geico | 2020 Honda Civic | 30-year-old male with a clean driving record | $1,100 |

| Progressive | 2020 Honda Civic | 30-year-old male with a clean driving record | $1,300 |

| Allstate | 2020 Honda Civic | 30-year-old male with a clean driving record | $1,400 |

| State Farm | 2022 Toyota Camry | 40-year-old female with a clean driving record | $1,500 |

| Geico | 2022 Toyota Camry | 40-year-old female with a clean driving record | $1,400 |

| Progressive | 2022 Toyota Camry | 40-year-old female with a clean driving record | $1,600 |

| Allstate | 2022 Toyota Camry | 40-year-old female with a clean driving record | $1,700 |

| State Farm | 2021 Ford F-150 | 50-year-old male with a minor accident on record | $2,000 |

| Geico | 2021 Ford F-150 | 50-year-old male with a minor accident on record | $1,900 |

| Progressive | 2021 Ford F-150 | 50-year-old male with a minor accident on record | $2,100 |

| Allstate | 2021 Ford F-150 | 50-year-old male with a minor accident on record | $2,200 |

Remember, these are just average rates, and your actual premium may vary based on several factors. It’s crucial to obtain personalized quotes from multiple insurers to compare rates and coverage options tailored to your specific needs. By taking the time to compare, you can ensure you’re getting the best value for your car insurance.

Customer Testimonials and Reviews

Customer feedback plays a crucial role in understanding the overall customer experience with State Farm car insurance. Analyzing reviews and testimonials provides valuable insights into customer satisfaction levels, particularly regarding pricing and value.

Customer Satisfaction with Rate Transparency and Value, State farm car insurance rate

Customer reviews highlight a mixed bag when it comes to State Farm’s rate transparency and value proposition. While some customers praise the company for its competitive rates and clear explanations of pricing factors, others express frustration with perceived inconsistencies and a lack of transparency in rate calculations.

- Positive Reviews: Many customers appreciate the straightforward approach State Farm takes in explaining how their rates are determined. They value the personalized quotes and the ability to compare different coverage options.

- Negative Reviews: Some customers complain about unexpected rate increases, citing a lack of clarity in the pricing methodology. Others feel that State Farm’s rates are not always competitive compared to other insurers.

Common Areas of Praise and Criticism Regarding Pricing

Customer reviews often center around specific aspects of State Farm’s pricing practices. Understanding these common themes can help potential customers make informed decisions.

- Praise for Discounts: Many customers appreciate the wide range of discounts offered by State Farm, including those for good driving records, safety features, and bundling multiple insurance policies.

- Criticism of Rate Increases: Some customers express dissatisfaction with unexpected rate increases, particularly after years of consistent driving history and no claims. They often feel that the increases are not justified by their driving record or changes in their coverage.

- Mixed Feedback on Customer Service: While many customers find State Farm agents helpful and responsive, some complain about difficulties in getting their questions answered or resolving issues related to pricing.

Tips for Obtaining Competitive State Farm Rates

Securing the best possible car insurance rate with State Farm requires a proactive approach. By understanding the factors that influence pricing and implementing these tips, you can optimize your policy and potentially save money.

Maintaining a Good Driving Record

A clean driving record is paramount for obtaining favorable car insurance rates. State Farm, like most insurers, rewards drivers with a history of safe driving.

- Avoid Traffic Violations: Every speeding ticket, reckless driving citation, or accident can significantly increase your premiums.

- Complete Defensive Driving Courses: Participating in defensive driving courses demonstrates your commitment to safe driving practices and can often earn you discounts.

- Report Accidents Promptly and Accurately: Delaying reporting an accident or providing inaccurate information can negatively impact your rate.

Choosing the Right Coverage Options and Add-ons

Carefully evaluating your coverage needs and selecting the right options can significantly impact your premiums.

- Deductible: A higher deductible generally translates to lower premiums. Consider your financial situation and risk tolerance when choosing a deductible.

- Liability Coverage: Ensure you have sufficient liability coverage to protect yourself financially in case of an accident. Higher liability limits typically mean higher premiums, but provide greater protection.

- Optional Add-ons: While add-ons like roadside assistance, rental car coverage, and gap insurance can be beneficial, they can also increase your premium. Carefully assess your individual needs before adding these options.

Exploring Discounts and Promotional Offers

State Farm offers various discounts that can help you save on your car insurance.

- Good Student Discount: This discount is available to students with good grades.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record can qualify you for this discount.

- Anti-theft Device Discount: Installing anti-theft devices in your car can lower your premiums.

- Loyalty Discount: Long-term State Farm customers may be eligible for loyalty discounts.

State Farm’s Customer Service and Claims Process

State Farm is renowned for its comprehensive customer service offerings and efficient claims handling process. The company strives to provide a seamless and supportive experience for its policyholders, ensuring they receive prompt assistance and fair compensation in case of an accident or incident.

Customer Service Channels and Availability

State Farm offers a wide range of customer service channels to cater to the diverse needs of its policyholders. These channels provide convenient and accessible avenues for obtaining information, resolving queries, and reporting claims.

- Phone Support: State Farm maintains a dedicated customer service hotline that is available 24/7, allowing policyholders to reach a representative at any time.

- Online Portal: The State Farm website offers a user-friendly online portal where policyholders can access their account information, manage policies, and submit claims.

- Mobile App: State Farm’s mobile app provides on-the-go access to policy information, claims reporting, and other services.

- Local Agents: State Farm has a vast network of local agents across the country, offering personalized support and assistance to policyholders in their communities.

State Farm’s Claims Process

State Farm’s claims process is designed to be efficient and straightforward. The company aims to minimize the stress and inconvenience associated with filing a claim by providing clear guidance and support throughout the process.

- Reporting a Claim: Policyholders can report a claim through any of the available customer service channels, including phone, online portal, or mobile app.

- Initial Assessment: Upon receiving a claim, State Farm will conduct an initial assessment to gather information about the incident and determine the extent of the damage.

- Claim Investigation: State Farm may conduct an investigation to gather further information and verify the details of the claim.

- Claim Adjustment: Once the investigation is complete, State Farm will adjust the claim based on the policy coverage and the extent of the damage.

- Payment Processing: Upon claim approval, State Farm will process the payment and issue a check or electronic transfer to the policyholder.

Customer Experiences with Claims Resolution

State Farm has a strong reputation for its customer-centric approach to claims resolution. The company strives to provide fair and timely compensation to policyholders, ensuring their satisfaction with the claims process.

“I was involved in a car accident and was very worried about the claims process. However, State Farm made it incredibly easy. Their customer service was exceptional, and they kept me informed throughout the entire process. I was very happy with the outcome and would definitely recommend State Farm to others.” – Sarah, a satisfied State Farm customer.

End of Discussion

By understanding the factors that influence State Farm car insurance rates, you can take steps to secure competitive pricing and ensure you have the coverage you need. Remember to compare quotes from multiple insurers, maintain a good driving record, and explore available discounts to minimize your costs. With careful planning and informed decision-making, you can find the best possible car insurance rates for your individual situation.

Key Questions Answered

How can I get a free quote for State Farm car insurance?

You can get a free quote online, over the phone, or by visiting a State Farm agent in person.

What discounts are available for State Farm car insurance?

State Farm offers a variety of discounts, including good driver discounts, multi-policy discounts, and safe driver discounts.

What is the State Farm claims process like?

You can file a claim online, over the phone, or by visiting a State Farm agent. State Farm has a reputation for handling claims efficiently and fairly.