Insurance state, a crucial element in the American economic landscape, governs the intricate workings of the insurance industry. It sets the stage for how insurance products are offered, regulated, and accessed by individuals and businesses alike. This intricate system ensures fairness, protects consumers, and fosters a stable market where individuals and businesses can navigate risk with confidence.

From setting licensing requirements for insurance companies to defining consumer protection measures, state governments play a vital role in shaping the insurance industry. They also oversee the resolution of disputes and ensure that insurance products are priced fairly and are accessible to those who need them.

Insurance Regulation and State Laws

The insurance industry is heavily regulated by state governments, which play a crucial role in protecting consumers and ensuring the financial stability of insurance companies. State insurance regulators establish and enforce rules governing the conduct of insurance companies, the types of insurance products they can offer, and the rates they can charge.

State-Specific Insurance Laws and Regulations

Each state has its own unique set of insurance laws and regulations. These laws cover various aspects of insurance, including:

- Licensing and qualification requirements for insurance agents and brokers

- Financial solvency requirements for insurance companies

- Consumer protection regulations, such as unfair trade practices and fraud prevention

- Rate regulation, including limits on premium increases and requirements for rate filings

- Coverage mandates, which require insurance companies to offer specific types of coverage, such as auto insurance or health insurance

For example, some states have laws requiring insurance companies to offer coverage for specific types of risks, such as earthquake insurance in California or flood insurance in coastal areas. Other states may have regulations that limit the amount of money that insurance companies can charge for certain types of insurance, such as auto insurance or health insurance.

Differences in Insurance Regulations Across States

Insurance regulations can vary significantly across different states. This is because states have different priorities and needs, and they may have different views on how best to regulate the insurance industry. For instance, some states may have stricter regulations on rate increases than others, while some states may have more stringent licensing requirements for insurance agents and brokers.

Impact of State Laws on Insurance Availability and Cost

State insurance laws can have a significant impact on the availability and cost of insurance products. For example, if a state has strict regulations on rate increases, insurance companies may be less likely to offer coverage in that state, or they may charge higher premiums to compensate for the regulatory burden. Conversely, if a state has lax regulations, insurance companies may be more likely to offer coverage in that state, and they may be able to charge lower premiums.

State Insurance Departments

State insurance departments play a crucial role in regulating the insurance industry within their respective jurisdictions. They are responsible for ensuring the solvency and financial stability of insurance companies, protecting consumers from unfair or deceptive practices, and promoting a competitive and fair insurance market.

Functions and Responsibilities

State insurance departments perform a wide range of functions to fulfill their regulatory mandate. These include:

- Licensing and oversight of insurance companies, agents, and brokers

- Reviewing and approving insurance rates and policy forms

- Monitoring the financial health of insurance companies and taking corrective action when necessary

- Investigating consumer complaints and resolving disputes

- Educating consumers about insurance products and their rights

- Enforcing state insurance laws and regulations

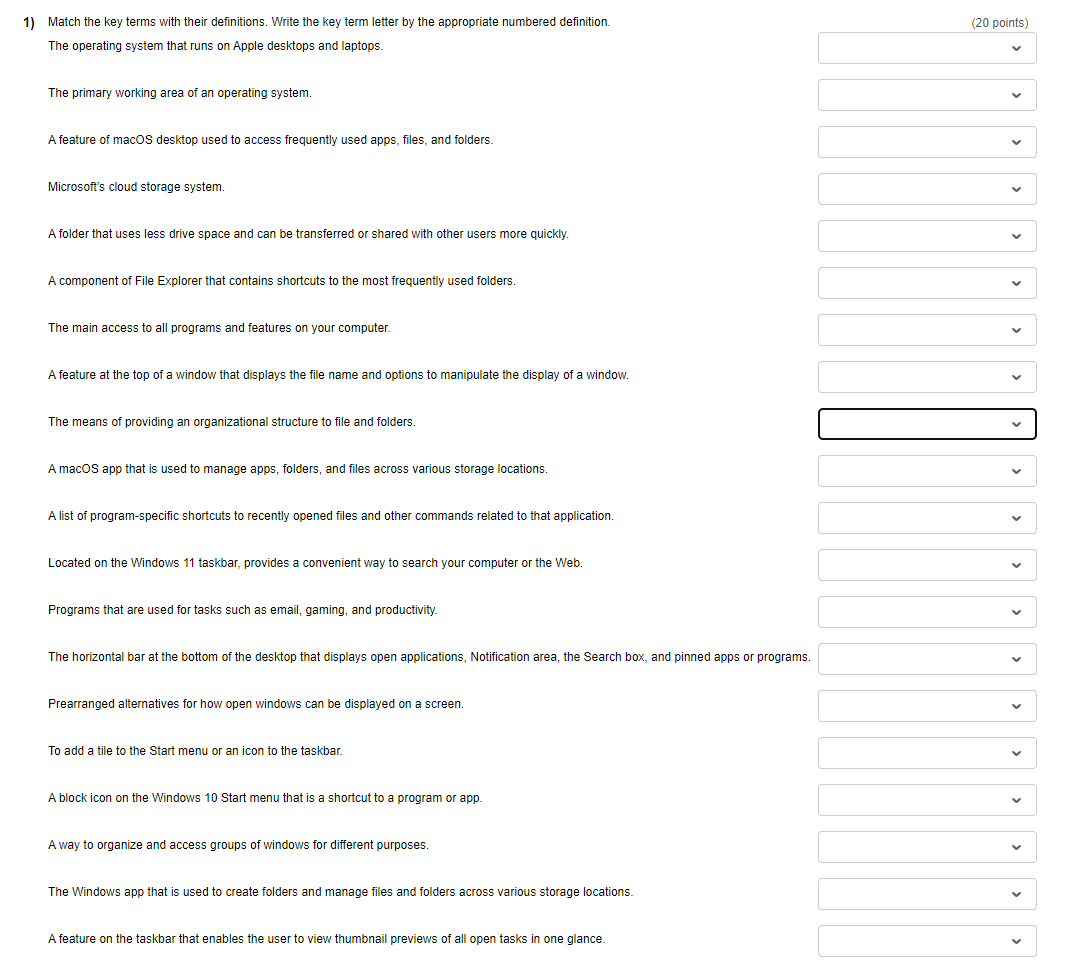

Obtaining an Insurance License, Insurance state

The process of obtaining an insurance license varies from state to state, but generally involves the following steps:

- Submitting an application to the state insurance department

- Passing a licensing exam

- Meeting the state’s continuing education requirements

- Paying the required fees

- Satisfying any other requirements specific to the state

Filing Insurance Claims and Resolving Disputes

When an insured individual files a claim with an insurance company, the company is obligated to investigate and process the claim in a timely and fair manner. If the insured and the insurer cannot reach an agreement on the claim, the insured may have the option to file a complaint with the state insurance department. The department will investigate the complaint and attempt to mediate a resolution between the parties. If mediation fails, the insured may have the right to pursue legal action.

Comparison of Key Functions

The following table compares the key functions of insurance departments in different states:

| State | Licensing | Rate Regulation | Consumer Protection | Dispute Resolution |

|---|---|---|---|---|

| California | Strict licensing requirements | Active rate regulation | Strong consumer protection laws | Robust dispute resolution process |

| New York | Comprehensive licensing program | Close oversight of rates | Consumer-friendly regulations | Efficient dispute resolution mechanisms |

| Texas | Competitive licensing environment | Limited rate regulation | Focus on market competition | Simplified dispute resolution process |

State Insurance Markets: Insurance State

The insurance market in each state is a complex ecosystem influenced by various factors, including demographics, economic conditions, and regulatory frameworks. Understanding the competitive landscape and the factors influencing pricing and availability of insurance in different regions within a state is crucial for both consumers and insurers.

Competitive Landscape of State Insurance Markets

The competitive landscape of state insurance markets varies significantly depending on the specific state and the insurance line. Some states have a highly concentrated market with a few dominant insurers, while others have a more fragmented market with numerous smaller players. Factors contributing to this variation include:

- State regulations: Different states have different regulations governing insurance companies, which can impact the competitive landscape. For example, some states may have stricter requirements for capital reserves or licensing, which can limit the number of insurers operating in the state.

- Market size and density: Larger states with a more dense population tend to attract more insurers, leading to increased competition. Smaller states with a less dense population may have fewer insurers, resulting in a less competitive market.

- Economic conditions: States with strong economies and high levels of income tend to attract more insurers, as they represent a larger potential customer base. States with weaker economies may have fewer insurers, as they may be less profitable.

Comparison of Insurance Products Offered by Different Companies in a Specific State

Insurers offer a wide range of insurance products, each with its own unique features and benefits. Comparing and contrasting these products is crucial for consumers to make informed decisions about their insurance needs. Factors to consider when comparing insurance products include:

- Coverage: The amount of coverage provided by each policy, including deductibles, limits, and exclusions.

- Premiums: The cost of the policy, which can vary significantly depending on the insurer, coverage, and the individual’s risk profile.

- Discounts: Any discounts available, such as for good driving records, bundling multiple policies, or being a member of certain organizations.

- Customer service: The quality of customer service provided by the insurer, including the ease of filing claims and the responsiveness of claims adjusters.

Factors Influencing Pricing and Availability of Insurance in Different Regions Within a State

The pricing and availability of insurance can vary significantly across different regions within a state. Factors influencing these variations include:

- Risk factors: Certain regions may have a higher risk of certain types of insurance claims, such as natural disasters or crime. These risks can influence the pricing and availability of insurance in those regions.

- Competition: The level of competition among insurers in a particular region can also impact pricing and availability. Regions with more insurers tend to have more competitive pricing and greater availability of insurance products.

- State regulations: Different regions within a state may have different regulations governing insurance, which can impact pricing and availability. For example, some regions may have stricter requirements for coverage or pricing, which can limit the number of insurers operating in those regions.

Market Share of Major Insurance Providers in Different States

The following table illustrates the market share of major insurance providers in different states. It is important to note that this is a snapshot in time and market shares can change over time.

| State | Insurer | Market Share (%) |

|---|---|---|

| California | State Farm | 20 |

| California | Geico | 15 |

| California | Progressive | 10 |

| Texas | State Farm | 25 |

| Texas | USAA | 18 |

| Texas | Allstate | 12 |

| Florida | State Farm | 22 |

| Florida | Geico | 16 |

| Florida | Progressive | 11 |

Insurance Consumer Protection in States

State governments play a crucial role in safeguarding insurance consumers’ interests. They enact laws and regulations to ensure fair and transparent insurance practices, protect policyholders from unfair treatment, and promote a healthy insurance market.

State Consumer Protection Laws and Regulations

States have implemented a wide range of consumer protection measures to address various aspects of the insurance industry. These laws and regulations cover areas such as:

- Fair Insurance Practices: State laws prohibit unfair or deceptive insurance practices, including misrepresenting policy terms, refusing coverage without justification, and engaging in discriminatory pricing. These laws aim to ensure that insurance companies operate ethically and fairly.

- Consumer Disclosure Requirements: State regulations mandate that insurance companies provide consumers with clear and understandable information about their policies, including coverage details, exclusions, premiums, and renewal procedures. This ensures that consumers make informed decisions about their insurance needs.

- Policyholder Rights: States define specific rights for policyholders, such as the right to cancel a policy within a certain period, the right to receive timely claims payments, and the right to appeal adverse decisions. These rights empower consumers to navigate the insurance system effectively.

- Consumer Complaint Resolution: State insurance departments provide mechanisms for consumers to file complaints against insurance companies for unfair or illegal practices. These departments investigate complaints and take appropriate action to resolve issues and protect consumer rights.

Rights and Responsibilities of Insurance Policyholders

Understanding the rights and responsibilities associated with insurance policies is essential for consumers. State laws Artikel the following:

- Right to Access Information: Policyholders have the right to access clear and accurate information about their insurance policies, including coverage details, exclusions, premiums, and renewal procedures. This allows them to make informed decisions about their insurance needs.

- Right to Fair Claims Handling: Policyholders are entitled to fair and prompt handling of their claims. Insurance companies are required to investigate claims thoroughly and make reasonable payments within a specified timeframe.

- Right to Appeal Decisions: Policyholders have the right to appeal adverse decisions made by insurance companies. This includes decisions regarding coverage, claim payments, or policy cancellations.

- Responsibilities of Policyholders: Policyholders are responsible for providing accurate information to their insurance companies, adhering to the terms of their policies, and notifying their insurers of any changes that could affect coverage. They also have a responsibility to understand their policy terms and coverage limits.

State Initiatives to Prevent Insurance Fraud and Misconduct

States actively combat insurance fraud and misconduct through various initiatives, including:

- Fraud Investigation Units: State insurance departments have dedicated units to investigate insurance fraud. These units use advanced techniques to detect and prosecute fraudulent activities, protecting consumers from financial losses and ensuring the integrity of the insurance market.

- Consumer Education Programs: State insurance departments conduct consumer education programs to raise awareness about insurance fraud and empower consumers to identify and report suspicious activities. These programs equip consumers with the knowledge and tools to protect themselves from fraudulent schemes.

- Data Sharing and Collaboration: State insurance departments collaborate with other law enforcement agencies and industry stakeholders to share information and resources, enabling more effective detection and prosecution of insurance fraud. This collaborative approach helps to disrupt fraudulent networks and prevent future crimes.

Resources for Insurance Consumers

Consumers seeking information and assistance with insurance-related issues can access various resources provided by state governments and other organizations. These resources include:

- State Insurance Departments: Each state has an insurance department responsible for regulating the insurance industry and protecting consumers. These departments offer a range of services, including consumer education, complaint resolution, and fraud prevention.

- Consumer Protection Agencies: National consumer protection agencies, such as the National Association of Insurance Commissioners (NAIC), provide information and resources on insurance issues, including fraud prevention tips and consumer rights.

- Insurance Industry Associations: Insurance industry associations, such as the American Insurance Association (AIA) and the Insurance Information Institute (III), offer educational materials and resources for consumers, providing insights into insurance products and services.

State-Specific Insurance Programs

Many states have implemented their own insurance programs to address specific needs within their jurisdictions. These programs often target critical areas like health, workers’ compensation, and auto insurance, aiming to provide essential coverage to residents.

State-Run Health Insurance Programs

State-run health insurance programs, often referred to as state-based marketplaces or exchanges, are designed to facilitate access to affordable health insurance for individuals and families. These programs operate under the Affordable Care Act (ACA) and offer a range of plans with varying coverage levels and premiums.

- Eligibility Criteria: Individuals and families typically qualify for these programs based on their income level and household size. Eligibility criteria vary by state, but generally follow the guidelines set by the ACA.

- Benefits Offered: State-run health insurance programs provide coverage for essential health benefits, including preventive care, hospitalization, prescription drugs, and mental health services. Specific benefits may vary depending on the chosen plan.

- Funding Mechanisms: State-run health insurance programs are funded through a combination of federal and state subsidies, as well as premiums paid by enrollees. The federal government provides financial assistance to states to support the operation of these programs.

- Administrative Structures: State-run health insurance programs are typically administered by state agencies or non-profit organizations contracted by the state. These entities handle enrollment, premium collection, and claims processing.

State Workers’ Compensation Programs

State workers’ compensation programs are mandatory insurance programs that provide benefits to employees injured or disabled while performing their jobs. These programs aim to ensure that workers receive medical treatment and financial support in the event of a work-related injury or illness.

- Eligibility Criteria: Employees are generally eligible for workers’ compensation benefits if they sustain an injury or illness directly related to their employment.

- Benefits Offered: Workers’ compensation programs provide a range of benefits, including medical expenses, lost wages, and disability payments.

- Funding Mechanisms: Workers’ compensation programs are typically funded through employer premiums, which are calculated based on the employer’s industry, size, and claims history.

- Administrative Structures: State workers’ compensation programs are administered by state agencies, which oversee claims processing, benefit payments, and dispute resolution.

State Auto Insurance Programs

State auto insurance programs can take various forms, including mandatory coverage requirements, state-run insurance funds, and programs designed to provide insurance to high-risk drivers. These programs aim to ensure that all drivers have adequate insurance coverage and to promote road safety.

- Eligibility Criteria: Eligibility for state auto insurance programs typically depends on factors such as residency, vehicle registration, and driving record.

- Benefits Offered: State auto insurance programs typically cover liability for bodily injury and property damage, as well as medical expenses for the insured and passengers.

- Funding Mechanisms: State auto insurance programs are funded through a combination of premiums, taxes, and fees.

- Administrative Structures: State auto insurance programs are administered by state agencies or private insurance companies contracted by the state.

The Impact of State Insurance Policies on the Economy

State insurance regulations play a crucial role in shaping the economic landscape of the United States. These regulations, while primarily focused on consumer protection and market stability, have significant implications for businesses and individuals, affecting the cost of living, business operations, and overall economic growth.

Impact on Businesses

State insurance regulations directly influence the cost of doing business in various ways. For example, regulations governing workers’ compensation insurance impact the cost of labor for employers, while regulations on liability insurance affect the cost of operating businesses in specific industries.

- Increased Costs: Stringent regulations, such as those requiring comprehensive coverage or high minimum liability limits, can lead to higher insurance premiums for businesses. This can impact profitability, particularly for small businesses with limited resources.

- Reduced Risk-Taking: Insurance regulations that limit the types of insurance products offered or impose strict underwriting requirements can discourage businesses from taking on new ventures or expanding into risky markets. This can stifle innovation and economic growth.

- Regulatory Compliance Costs: Businesses must comply with a complex web of state insurance regulations, which can involve significant administrative costs for paperwork, reporting, and training. These costs can be a burden, especially for small and medium-sized enterprises.

Impact on Individuals

State insurance regulations also impact the cost of living for individuals, influencing the cost of housing, healthcare, and other essential goods and services.

- Higher Insurance Premiums: Regulations that mandate specific coverage or limit competition can lead to higher insurance premiums for individuals, particularly for health insurance and auto insurance. This can strain household budgets and limit access to essential insurance products.

- Limited Choice: State regulations may restrict the types of insurance products available to consumers, limiting their ability to choose policies that best meet their individual needs and budgets. This can result in consumers being forced to purchase coverage that is not optimal for their circumstances.

- Access to Affordable Coverage: State regulations can impact the availability of affordable insurance products, particularly for low-income individuals and families. Regulations that focus on consumer protection may inadvertently make insurance less accessible to those who need it most.

The Future of State Insurance Regulation

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, evolving consumer expectations, and the increasing frequency and severity of climate-related disasters. State insurance regulators are facing new challenges and opportunities as they strive to balance innovation, consumer protection, and economic stability.

Emerging Trends and Challenges in State Insurance Regulation

State insurance regulators are facing a complex landscape of emerging trends and challenges. The rapid adoption of technology, including artificial intelligence (AI), blockchain, and the Internet of Things (IoT), is transforming the insurance industry, creating new opportunities for innovation and efficiency but also raising concerns about data privacy, cybersecurity, and regulatory oversight.

- The rise of InsurTech companies, which are using technology to disrupt traditional insurance models, is creating new challenges for state regulators. These companies often operate across state lines, making it difficult for regulators to effectively oversee their activities.

- The increasing frequency and severity of climate-related disasters, such as hurricanes, wildfires, and floods, are putting significant pressure on the insurance industry and state insurance funds. Regulators are grappling with how to ensure the financial stability of insurers and the availability of affordable insurance coverage in areas prone to natural disasters.

- The growing demand for personalized insurance products and services, driven by consumer preferences and data analytics, is requiring state regulators to adapt their oversight frameworks to ensure fairness and transparency.

The Impact of Technological Advancements on the Insurance Industry

Technological advancements are transforming the insurance industry in numerous ways, creating both opportunities and challenges for state regulators.

- AI and machine learning are being used to automate tasks, improve risk assessment, and personalize insurance products. These technologies can help insurers to offer more tailored and affordable coverage, but they also raise concerns about bias, discrimination, and the need for transparency and accountability.

- Blockchain technology can enhance the efficiency and security of insurance transactions, reducing fraud and streamlining claims processing. However, the regulatory framework for blockchain applications in insurance is still evolving, and state regulators need to ensure that these technologies are implemented responsibly and do not compromise consumer protection.

- The Internet of Things (IoT) is enabling insurers to collect real-time data on insured assets, allowing them to better assess risk and offer dynamic pricing models. However, the use of IoT data raises privacy concerns and requires clear guidelines for data collection, storage, and use.

The Role of State Governments in Addressing Issues Related to Climate Change and Natural Disasters

State governments play a crucial role in addressing the challenges posed by climate change and natural disasters, including the need to ensure the availability of affordable insurance coverage and the resilience of communities.

- State insurance regulators can implement policies to encourage insurers to offer coverage for climate-related risks, such as flood insurance and wildfire protection.

- State governments can invest in infrastructure improvements and disaster preparedness programs to mitigate the impacts of natural disasters and reduce the demand for insurance coverage.

- States can work with the federal government to develop national strategies for addressing climate change and its impacts on the insurance industry.

A Framework for Future State Insurance Policies

State insurance policies should be designed to promote innovation, consumer protection, and economic stability in the insurance industry.

- State regulators should encourage the development and adoption of new technologies that enhance efficiency, improve risk assessment, and personalize insurance products. However, these technologies should be subject to appropriate regulatory oversight to ensure consumer protection and data privacy.

- State insurance policies should prioritize consumer protection by ensuring transparency, fairness, and access to affordable insurance coverage.

- State governments should invest in research and development to address the challenges posed by climate change and natural disasters, including the need to develop new insurance products and risk management strategies.

- State insurance regulators should work collaboratively with other stakeholders, including insurers, consumers, and the federal government, to develop effective and sustainable solutions for the challenges facing the insurance industry.

Final Review

Understanding the insurance state is essential for navigating the complex world of insurance. It empowers individuals and businesses to make informed decisions about their insurance needs, knowing they are protected by a robust regulatory framework. As the insurance landscape continues to evolve, the role of state governments will remain crucial in ensuring a fair and stable market for all.

Expert Answers

What are the main responsibilities of a state insurance department?

State insurance departments are responsible for licensing insurance companies, overseeing their financial stability, investigating complaints, and enforcing state insurance laws. They also educate consumers about their rights and responsibilities.

How can I find information about insurance regulations in my state?

You can usually find information about insurance regulations on the website of your state’s insurance department. You can also contact the department directly for assistance.

What are some examples of state-specific insurance programs?

Common state-specific insurance programs include health insurance programs, workers’ compensation programs, and auto insurance programs. Each state may have unique eligibility requirements and benefits for these programs.