Insurance quotes from State Farm can be a great way to find affordable coverage for your car, home, and more. State Farm is one of the largest and most trusted insurance companies in the United States, with a long history of providing excellent customer service and competitive rates. Whether you’re looking for auto insurance, home insurance, renters insurance, or life insurance, State Farm has a policy to fit your needs and budget.

Getting an insurance quote from State Farm is quick and easy. You can request a quote online, over the phone, or through a local agent. To get a quote, you’ll need to provide some basic information about yourself and your situation, such as your age, driving history, and the type of coverage you’re looking for. State Farm will then use this information to calculate your personalized quote.

State Farm Insurance Overview

State Farm is a leading provider of insurance and financial services in the United States, with a rich history spanning over a century. Founded in 1922 by George J. Mecherle, the company has grown from a small agency in Bloomington, Illinois, to a national powerhouse with a reputation for reliability and customer service.

State Farm’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams. The company’s core values are rooted in integrity, customer service, respect for the individual, and financial strength. These values guide State Farm’s approach to insurance, investment, and banking services, ensuring that customers receive fair and ethical treatment.

Market Share and Customer Base

State Farm’s commitment to customer satisfaction has translated into a loyal customer base and a significant market share. As of 2022, State Farm is the largest provider of auto insurance in the United States, holding a market share of over 18%. The company also ranks among the top providers of homeowners insurance, life insurance, and other financial products.

State Farm’s customer base is vast, with over 83 million policies in force across various lines of insurance. This strong customer base is a testament to the company’s ability to meet the diverse needs of individuals and families across the country.

Obtaining Insurance Quotes from State Farm

Getting an insurance quote from State Farm is a straightforward process that can be done through various channels. Whether you prefer the convenience of online tools or the personalized guidance of an agent, State Farm offers options to suit your needs.

Requesting a Quote

To obtain an insurance quote from State Farm, you can choose from several convenient methods:

- State Farm Website: The State Farm website provides a user-friendly online quoting tool. You can input your personal and vehicle information, select your desired coverage options, and receive an instant quote. This method allows you to compare different coverage options and explore various scenarios at your own pace.

- State Farm Mobile App: The State Farm mobile app offers a similar quoting experience to the website. You can conveniently access the app on your smartphone or tablet, providing a portable and accessible way to get a quote.

- Phone: You can call State Farm’s customer service line to speak with an agent and request a quote. This method allows you to discuss your specific needs and ask any questions you may have.

- Local Agent: Visiting a local State Farm agent is another option. You can schedule an appointment to discuss your insurance needs and receive a personalized quote tailored to your specific circumstances.

Information Required for a Quote

To provide you with an accurate insurance quote, State Farm will need certain information from you. This typically includes:

- Personal Details: Your name, address, date of birth, and contact information are essential for identifying you and understanding your risk profile.

- Driving History: Your driving record, including any accidents, violations, or suspensions, plays a significant role in determining your insurance premium.

- Vehicle Information: Details about your vehicle, such as the make, model, year, and value, are necessary to assess its risk and coverage needs.

- Coverage Preferences: You will need to specify the type of coverage you desire, such as liability, collision, comprehensive, and uninsured motorist coverage. The level of coverage you choose will directly impact your premium.

Factors Influencing Insurance Quote Pricing

State Farm considers several factors when calculating your insurance premium. These factors can influence the cost of your quote, and understanding them can help you make informed decisions about your coverage:

- Age: Younger drivers are statistically more likely to be involved in accidents, leading to higher premiums. As drivers age and gain experience, their premiums typically decrease.

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic offenses can lead to higher premiums.

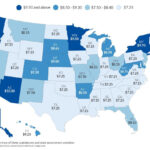

- Location: The location where you live can impact your insurance rates. Areas with higher crime rates or more frequent accidents may have higher premiums.

- Vehicle Type: The make, model, year, and value of your vehicle play a role in determining your premium. Higher-value vehicles or those with a history of theft or accidents may have higher premiums.

- Credit Score: In some states, insurance companies use credit scores as a factor in determining premiums. A good credit score can indicate financial responsibility, potentially leading to lower premiums.

Types of Insurance Offered by State Farm

State Farm offers a comprehensive range of insurance products designed to protect individuals and families against various risks. From protecting your car and home to securing your financial future, State Farm provides a wide array of insurance options to meet your diverse needs.

Auto Insurance

Auto insurance is a crucial component of responsible vehicle ownership, providing financial protection in case of accidents, theft, or damage. State Farm offers a comprehensive suite of auto insurance coverage options tailored to individual requirements.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident, covering the other driver’s medical expenses, property damage, and legal fees. State Farm offers different liability limits, allowing you to choose the level of protection that aligns with your risk tolerance and financial situation.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s a valuable option for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-accident events, such as theft, vandalism, fire, or natural disasters. It’s an essential consideration if your vehicle is financed or has a high market value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It ensures you have financial protection for your medical expenses and property damage.

State Farm also offers various add-ons and optional coverage for auto insurance, including:

- Roadside Assistance: This coverage provides assistance in case of breakdowns, flat tires, or other roadside emergencies, offering peace of mind and convenience.

- Rental Car Coverage: This coverage provides temporary transportation if your vehicle is damaged or stolen, ensuring you can maintain your mobility while your vehicle is being repaired.

- Gap Coverage: This coverage helps bridge the gap between your vehicle’s actual cash value and the outstanding loan balance if your vehicle is totaled, protecting you from potential financial loss.

- Custom Equipment Coverage: This coverage provides additional protection for specialized equipment or modifications installed in your vehicle, such as custom wheels, audio systems, or performance upgrades.

Home Insurance

Home insurance is essential for safeguarding your home and belongings against various risks, providing financial protection in case of unexpected events. State Farm offers comprehensive home insurance coverage tailored to individual needs.

- Dwelling Coverage: This coverage protects your home’s structure against damage caused by fire, windstorms, hail, and other covered perils. It ensures you have financial resources to rebuild or repair your home in case of a covered event.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, clothing, and other personal items. It provides financial compensation for replacement or repair in case of damage or loss.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or you are found liable for property damage caused by you or a member of your household. It provides legal defense and financial compensation for covered claims.

- Additional Living Expenses Coverage: This coverage provides financial assistance to cover temporary living expenses if your home is uninhabitable due to a covered event. It helps ensure you have a place to stay and meet your basic needs while your home is being repaired or rebuilt.

State Farm offers a range of add-ons and optional coverage for home insurance, including:

- Personal Articles Coverage: This coverage provides additional protection for valuable items, such as jewelry, art, or antiques, ensuring they are adequately insured against loss or damage.

- Identity Theft Coverage: This coverage provides financial and legal assistance if you become a victim of identity theft, helping you mitigate the consequences and restore your financial security.

- Flood Insurance: This coverage provides protection against flood damage, which is typically not covered by standard home insurance policies. It’s essential for homes located in flood-prone areas.

- Earthquake Coverage: This coverage provides protection against earthquake damage, which is typically not covered by standard home insurance policies. It’s essential for homes located in earthquake-prone regions.

Life Insurance

Life insurance provides financial security for your loved ones in the event of your passing, ensuring their financial well-being and covering essential expenses. State Farm offers various life insurance options tailored to individual needs and circumstances.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers affordable premiums and provides a death benefit if you pass away during the policy term. Term life insurance is a cost-effective option for individuals with temporary coverage needs, such as young families with mortgage payments or outstanding debts.

- Permanent Life Insurance: This type of insurance provides lifelong coverage and includes a cash value component that accumulates over time. It offers a death benefit and allows you to build wealth through savings and investments. Permanent life insurance is a suitable option for individuals seeking long-term financial protection and wealth accumulation.

- Whole Life Insurance: This type of permanent life insurance provides a fixed premium and a guaranteed death benefit. It also offers a cash value component that grows at a fixed rate, providing a stable investment option. Whole life insurance is a suitable option for individuals seeking a predictable and reliable life insurance policy.

- Universal Life Insurance: This type of permanent life insurance offers flexible premiums and a death benefit that can be adjusted over time. It also allows you to customize your cash value accumulation strategy, providing greater control over your investment choices. Universal life insurance is a suitable option for individuals seeking a flexible and customizable life insurance policy.

State Farm offers various add-ons and optional coverage for life insurance, including:

- Accidental Death Benefit: This coverage provides an additional death benefit if the insured passes away due to an accident. It offers additional financial security for loved ones in the event of an unexpected accident.

- Waiver of Premium: This coverage waives your premium payments if you become disabled and unable to work. It ensures your life insurance policy remains in force, providing ongoing financial protection for your loved ones.

- Living Benefits: This coverage allows you to access a portion of your death benefit while you are still living if you are diagnosed with a terminal illness. It provides financial assistance for medical expenses and other needs during challenging times.

Renters Insurance

Renters insurance provides financial protection for your belongings and liability in case of damage or loss while renting. State Farm offers comprehensive renters insurance coverage tailored to individual needs.

- Personal Property Coverage: This coverage protects your belongings inside your rented apartment or house, such as furniture, electronics, clothing, and other personal items. It provides financial compensation for replacement or repair in case of damage or loss due to covered perils, such as fire, theft, or vandalism.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or you are found liable for property damage caused by you or a member of your household. It provides legal defense and financial compensation for covered claims.

- Additional Living Expenses Coverage: This coverage provides financial assistance to cover temporary living expenses if your rented apartment or house is uninhabitable due to a covered event. It helps ensure you have a place to stay and meet your basic needs while your home is being repaired or rebuilt.

State Farm offers various add-ons and optional coverage for renters insurance, including:

- Personal Articles Coverage: This coverage provides additional protection for valuable items, such as jewelry, art, or antiques, ensuring they are adequately insured against loss or damage.

- Identity Theft Coverage: This coverage provides financial and legal assistance if you become a victim of identity theft, helping you mitigate the consequences and restore your financial security.

- Flood Insurance: This coverage provides protection against flood damage, which is typically not covered by standard renters insurance policies. It’s essential for renters located in flood-prone areas.

- Earthquake Coverage: This coverage provides protection against earthquake damage, which is typically not covered by standard renters insurance policies. It’s essential for renters located in earthquake-prone regions.

Advantages and Disadvantages of State Farm Insurance

State Farm is one of the largest and most well-known insurance providers in the United States. The company offers a wide range of insurance products, including auto, home, life, and health insurance. When considering State Farm, it’s important to weigh its advantages and disadvantages to make an informed decision.

Advantages of State Farm Insurance

State Farm is known for its strong customer service, extensive network of agents, and competitive pricing. Here are some key advantages of choosing State Farm:

- Customer Service: State Farm consistently ranks high in customer satisfaction surveys. The company has a reputation for providing friendly and helpful customer service. State Farm offers a variety of ways to contact customer service, including phone, email, and online chat.

- Discounts: State Farm offers a wide range of discounts to its policyholders. These discounts can help lower your insurance premiums. Some common discounts include safe driving discounts, good student discounts, and multi-policy discounts.

- Financial Stability: State Farm is a financially strong company with a long history of stability. This means that the company is likely to be able to pay claims even in the event of a major disaster.

- Agent Network: State Farm has a large network of agents across the United States. This means that you can easily find an agent in your local area. Agents can provide personalized advice and help you find the right insurance coverage for your needs.

Disadvantages of State Farm Insurance

While State Farm offers many advantages, there are also some potential drawbacks to consider.

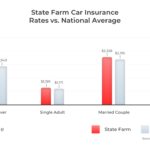

- Pricing: State Farm’s prices can vary depending on your location, driving record, and other factors. In some cases, you may be able to find lower rates from other insurance providers.

- Coverage Limitations: State Farm’s insurance policies may have certain limitations. It’s important to carefully review the policy documents to understand the coverage you’re getting.

- Claims Process: Some customers have reported challenges with the claims process at State Farm. It’s important to understand the company’s claims procedures and to be prepared to provide all necessary documentation.

Comparison to Other Insurance Providers

State Farm is a strong competitor in the insurance market, but it’s important to compare its offerings with those of other major providers. Other insurance companies, such as Geico, Progressive, and Allstate, may offer lower rates or more comprehensive coverage in certain areas.

Customer Experience with State Farm Quotes

Understanding the customer experience with State Farm quotes is crucial for the company to improve its services and maintain customer satisfaction. To gather insights into this experience, a survey can be designed to collect feedback from customers who have recently obtained insurance quotes from State Farm.

Survey Design for Customer Feedback

A comprehensive survey can be designed to collect valuable feedback from customers who have recently obtained insurance quotes from State Farm. The survey should be structured to gather information on various aspects of the quote process, including the ease of obtaining a quote, the clarity and accuracy of the information provided, and the overall satisfaction with the customer service received.

- Demographics: Gather basic information about the customer, such as age, gender, location, and occupation, to understand the demographics of the respondents.

- Quote Process: Ask questions about the ease of obtaining a quote, including the availability of online tools, the clarity of instructions, and the time it took to receive a quote. For example, “How easy was it to obtain a quote online?” or “How long did it take you to receive a quote?”

- Quote Clarity and Accuracy: Assess the clarity and accuracy of the information provided in the quote. Questions could include, “How clear was the information provided in the quote?” or “Did you find any inaccuracies in the quote?”

- Customer Service: Evaluate the customer service received during the quote process. Questions could include, “How helpful and responsive was the customer service representative?” or “Were you satisfied with the overall customer service experience?”

- Overall Satisfaction: Measure the overall satisfaction with the quote process. Questions could include, “How satisfied are you with the overall quote process?” or “Would you recommend State Farm to others?”

Analyzing Customer Feedback

Once the survey data is collected, it should be analyzed to identify common themes in customer satisfaction and dissatisfaction with the quote process. This analysis can be done using various statistical methods, such as frequency distributions, cross-tabulations, and correlation analysis.

- Identifying Common Themes: Analyze the survey responses to identify common themes in customer satisfaction and dissatisfaction. For example, a high percentage of customers may express satisfaction with the online quote process but dissatisfaction with the clarity of certain policy details.

- Customer Satisfaction Drivers: Identify the factors that contribute to customer satisfaction with the quote process. These factors could include the ease of obtaining a quote, the clarity and accuracy of the information provided, and the responsiveness of customer service representatives.

- Areas for Improvement: Identify areas where State Farm can improve the quote process to enhance customer satisfaction. This could involve simplifying the online quote process, providing clearer explanations of policy details, or improving the responsiveness of customer service representatives.

Insights from Customer Feedback

Customer feedback can provide valuable insights into the clarity, accuracy, and timeliness of State Farm insurance quotes. For example, customers may report that the quote process was easy to navigate, but the information provided in the quote was not clear enough. This feedback can help State Farm identify areas where they can improve the clarity and accuracy of their quotes.

- Clarity: Customers may report that the quote process was easy to navigate, but the information provided in the quote was not clear enough. This feedback can help State Farm identify areas where they can improve the clarity and accuracy of their quotes. For example, they can provide clearer explanations of policy details or use simpler language in their quotes.

- Accuracy: Customers may also report inaccuracies in the quotes they received. This could be due to errors in data entry or misinterpretations of customer information. State Farm can use this feedback to improve the accuracy of their quotes by implementing quality control measures and training their employees on data entry procedures.

- Timeliness: Customers may also express concerns about the time it takes to receive a quote. State Farm can use this feedback to improve the timeliness of their quotes by streamlining the quote process and ensuring that customer service representatives are available to answer questions promptly.

Tips for Getting the Best Insurance Quotes from State Farm

Getting the best insurance quotes from State Farm requires a strategic approach. By understanding the factors that influence your premiums and utilizing available resources, you can significantly improve your chances of securing competitive rates.

Understanding Factors Affecting Insurance Quotes

The cost of your insurance premiums is determined by several factors, including your driving history, age, location, vehicle type, and coverage options. By understanding these factors, you can take steps to improve your chances of getting a lower quote.

Strategies for Negotiating Insurance Premiums

Once you have received an initial quote from State Farm, there are several strategies you can use to negotiate a lower premium. These strategies include:

- Bundle Your Policies: Combining multiple insurance policies, such as auto and home insurance, can lead to significant discounts. State Farm offers bundle discounts for customers who insure multiple vehicles or properties with them.

- Improve Your Credit Score: In many states, insurance companies consider your credit score when determining your premiums. Improving your credit score can potentially lead to lower rates.

- Shop Around: Comparing quotes from multiple insurance providers is essential to ensure you’re getting the best deal. Don’t hesitate to negotiate with State Farm if you find a lower quote from another insurer.

- Ask About Discounts: State Farm offers various discounts for safe drivers, good students, and those who install safety features in their vehicles. Be sure to inquire about all available discounts to maximize your savings.

Leveraging Available Discounts, Insurance quotes from state farm

State Farm offers a wide range of discounts to help customers save on their insurance premiums. These discounts can be significant, so it’s important to be aware of them and take advantage of any that apply to you.

- Safe Driver Discount: This discount is available to drivers with a clean driving record, demonstrating their commitment to safe driving practices.

- Good Student Discount: Students who maintain good grades in school are eligible for this discount, reflecting their responsible behavior and commitment to education.

- Multi-Car Discount: If you insure multiple vehicles with State Farm, you can qualify for a discount on your premiums, rewarding you for consolidating your insurance needs.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle, such as alarm systems or GPS trackers, can help deter theft and qualify you for a discount.

Importance of Comparing Quotes from Multiple Providers

Before making a final decision on your insurance coverage, it’s crucial to compare quotes from multiple insurance providers. This allows you to assess different coverage options and premiums, ensuring you choose the best value for your needs.

- Get Quotes from Multiple Insurers: Contact several insurance companies, including State Farm, and request quotes for the same coverage options.

- Compare Coverage and Premiums: Carefully review the quotes you receive, paying attention to the coverage provided and the associated premiums.

- Consider Your Needs and Budget: Choose the insurance provider and coverage that best align with your specific needs and budget, ensuring adequate protection without overspending.

Wrap-Up

Getting an insurance quote from State Farm is a crucial step in securing the right coverage for your needs. By understanding the different types of insurance offered, the factors that influence pricing, and the advantages and disadvantages of State Farm, you can make an informed decision that meets your financial and protection goals. Remember to compare quotes from multiple providers and leverage available discounts to maximize your savings.

FAQ Summary: Insurance Quotes From State Farm

How can I get an insurance quote from State Farm?

You can get a quote online, over the phone, or through a local agent.

What factors affect my insurance quote?

Factors such as your age, driving history, location, vehicle type, and coverage preferences can influence your insurance quote.

What types of insurance does State Farm offer?

State Farm offers a wide range of insurance products, including auto, home, life, renters, and business insurance.

Does State Farm offer discounts?

Yes, State Farm offers various discounts, such as safe driving discounts, good student discounts, and multi-policy discounts.

How can I compare insurance quotes from different companies?

You can use online comparison websites or contact multiple insurance providers directly to compare quotes.