Florida State Minimum Liability Insurance is a crucial aspect of driving in the Sunshine State. It acts as a safety net, protecting drivers and their assets in the unfortunate event of an accident. Understanding the minimum coverage requirements and the implications of driving without adequate insurance is essential for all motorists in Florida.

This article will delve into the intricacies of Florida’s minimum liability insurance requirements, covering topics such as the purpose of this coverage, the minimum amounts required, and the potential consequences of driving without it. We’ll also explore factors that affect insurance premiums, the importance of choosing the right coverage, and the process of navigating insurance claims.

Florida’s Minimum Liability Insurance Requirements

Driving in Florida requires you to have the proper insurance coverage. This ensures you can pay for damages if you cause an accident. The state’s minimum liability insurance requirements are in place to protect you and other drivers on the road.

Minimum Coverage Amounts

Florida’s minimum liability insurance requirements are designed to ensure that drivers have adequate financial protection in the event of an accident. These requirements include coverage for bodily injury liability, property damage liability, and personal injury protection (PIP).

Bodily Injury Liability

Bodily injury liability coverage pays for medical expenses, lost wages, and other damages to people injured in an accident caused by you. The minimum requirement in Florida is $10,000 per person and $20,000 per accident.

Property Damage Liability

Property damage liability coverage pays for damages to another person’s property, such as their vehicle, in an accident caused by you. The minimum requirement in Florida is $10,000 per accident.

Personal Injury Protection (PIP)

PIP coverage is mandatory in Florida and pays for your own medical expenses, lost wages, and other damages, regardless of who is at fault in an accident. The minimum requirement is $10,000 per person.

Consequences of Driving Without Minimum Liability Insurance

Driving without the minimum liability insurance in Florida can result in serious consequences. These consequences include:

- Suspension of your driver’s license: If you are caught driving without insurance, your driver’s license can be suspended.

- Fines and penalties: You can face significant fines and penalties for driving without insurance, which can be very expensive.

- Financial responsibility: If you cause an accident without insurance, you will be personally liable for all damages, which can be devastating.

- Imprisonment: In some cases, driving without insurance can even lead to imprisonment.

Understanding Liability Coverage

Liability insurance is an essential part of car insurance that protects drivers in case of an accident. This coverage helps pay for damages caused to other people and their property if you are at fault in an accident. It is crucial to understand how this coverage works to ensure you have adequate protection on the road.

Bodily Injury Liability and Property Damage Liability

Liability insurance in Florida is divided into two main categories: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by individuals injured in an accident that you caused. It is expressed as a limit per person and a limit per accident. For example, a 25/50/10 policy would cover up to $25,000 per person injured and up to $50,000 for all injuries in a single accident, with a maximum of $10,000 for property damage.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. It is expressed as a single limit, such as $10,000. This means you can only claim up to $10,000 for property damage in any single accident.

Examples of Liability Coverage Use

Liability insurance can be used to cover various damages in different scenarios. Here are some examples:

- Medical Expenses: If you cause an accident and injure another driver, your bodily injury liability coverage would pay for their medical bills, including hospital stays, surgeries, and rehabilitation.

- Lost Wages: If the injured driver is unable to work due to their injuries, your bodily injury liability coverage would pay for their lost wages for a certain period.

- Property Damage: If you cause an accident and damage another driver’s vehicle, your property damage liability coverage would pay for repairs or replacement costs.

- Pain and Suffering: In some cases, your liability insurance could also cover the injured party’s pain and suffering, depending on the severity of the accident and the extent of their injuries.

Factors Affecting Insurance Premiums

Understanding the factors that influence your minimum liability insurance premiums in Florida is crucial to making informed decisions about your coverage. Several factors play a role in determining the cost of your insurance, and understanding these factors can help you manage your expenses effectively.

Driving History

Your driving history is a major factor in determining your insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. However, having a history of accidents, traffic violations, or even a DUI can significantly increase your insurance costs. Insurance companies consider your driving history as a strong indicator of your risk as a driver. For example, if you have been involved in multiple accidents, the insurance company may perceive you as a higher risk driver and charge you higher premiums.

Age

Your age also plays a role in determining your insurance premiums. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. As a result, insurance companies typically charge higher premiums to younger drivers. As you age and gain more experience, your premiums tend to decrease. This is because insurance companies perceive older drivers as having a lower risk profile due to their experience and better driving habits.

Vehicle Type

The type of vehicle you drive is another significant factor influencing your insurance premiums. Some vehicles are considered higher risk due to their performance, value, or safety features. For instance, sports cars or luxury vehicles often have higher premiums due to their higher repair costs and greater potential for accidents. On the other hand, smaller, less expensive vehicles may have lower premiums.

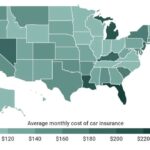

Location, Florida state minimum liability insurance

Your location in Florida can also impact your insurance premiums. Areas with higher traffic density, higher crime rates, or a greater number of accidents may have higher insurance premiums. Insurance companies consider these factors to assess the risk of accidents in different locations.

Credit Score

In Florida, insurance companies can use your credit score to determine your insurance premiums. A higher credit score is generally associated with a lower risk profile and can result in lower premiums. This is because a good credit score indicates financial responsibility, which is often correlated with responsible driving behavior. However, it’s important to note that credit score is just one factor among many considered by insurance companies, and its impact on your premiums may vary depending on the insurer.

Choosing the Right Coverage

While Florida’s minimum liability insurance requirements are the law, they may not be enough to protect you financially in the event of an accident. Choosing the right coverage involves understanding your individual needs and potential risks.

Benefits and Drawbacks of Minimum Liability Coverage

Minimum liability insurance offers basic protection, but it has limitations. Here’s a breakdown:

- Benefits: Minimum liability insurance meets the legal requirements in Florida and can help you avoid penalties. It provides some financial protection for injuries or property damage caused to others.

- Drawbacks: Minimum coverage may not be sufficient to cover the full cost of damages in a serious accident. If your liability exceeds your coverage limits, you’ll be personally responsible for the remaining costs, potentially leading to financial hardship.

The Importance of Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is crucial in Florida, where many drivers operate without adequate insurance. Here’s why:

- Protection Against Uninsured Drivers: This coverage protects you if you’re injured in an accident caused by a driver without insurance. UM/UIM coverage helps cover your medical expenses, lost wages, and other damages.

- Coverage for Underinsured Drivers: Even if the other driver has insurance, their coverage might not be enough to cover your losses. UIM coverage fills the gap, ensuring you receive adequate compensation.

Determining the Appropriate Level of Coverage

Determining the right coverage involves considering various factors:

- Your Assets: If you have substantial assets, such as a home or investments, you may need higher liability limits to protect them in case of a significant lawsuit.

- Driving Habits: Drivers who frequently commute long distances or drive in high-traffic areas may need more comprehensive coverage.

- Personal Risk Tolerance: Some individuals are comfortable with minimum coverage, while others prefer higher limits for greater peace of mind.

- Financial Situation: Your financial resources play a role in determining how much coverage you can afford.

Navigating Insurance Claims

In the event of an accident, understanding the process of filing a liability insurance claim is crucial. This section Artikels the steps involved, the role of the insurance company, and how to negotiate settlements effectively.

Filing a Claim

Following an accident, promptly notify your insurance company. This ensures they can begin investigating the claim and provide necessary support.

- Contact your insurance company within the stipulated timeframe, typically 24 to 72 hours after the accident.

- Provide accurate details about the accident, including the date, time, location, and the parties involved.

- Gather relevant information, such as police reports, witness statements, and photographs of the accident scene and vehicle damage.

Insurance Company’s Role

The insurance company will investigate the claim to determine liability and assess the extent of damages.

- The insurance company will review the accident report, witness statements, and other evidence to determine fault.

- They may contact the other parties involved in the accident to gather information and perspectives.

- The insurance company will evaluate the extent of damages to the vehicles and any injuries sustained, potentially requiring medical evaluations and assessments.

Negotiating Settlements

Once the investigation is complete, the insurance company will present a settlement offer.

- Review the settlement offer carefully, considering the extent of your damages and the potential for future medical expenses or lost wages.

- Negotiate with the insurance company if you believe the offer is insufficient. You can present supporting documentation, such as medical bills and repair estimates, to justify your request.

- Consider seeking legal counsel if you are unable to reach a satisfactory settlement agreement with the insurance company.

Resources and Information: Florida State Minimum Liability Insurance

Navigating the world of Florida’s minimum liability insurance can be overwhelming, but there are valuable resources available to help you make informed decisions. These resources can provide you with essential information, tools, and guidance to ensure you have the right coverage and understand your insurance obligations.

Government Websites and Insurance Organizations

Government websites and insurance organizations offer crucial information about Florida’s insurance laws, regulations, and consumer rights.

| Resource | Link | Description |

|---|---|---|

| Florida Department of Financial Services | https://www.fldfs.com/ | Provides information about insurance regulations, consumer rights, and resources for filing complaints. |

| Florida Office of Insurance Regulation | https://www.floir.com/ | Oversees the insurance industry in Florida, offering information on insurance rates, company financial stability, and consumer protection. |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | Provides information about insurance regulations and consumer protection nationwide. |

Insurance Comparison Websites and Tools

Insurance comparison websites and tools allow you to compare quotes from multiple insurers, helping you find the best rates and coverage options.

| Resource | Link | Description |

|---|---|---|

| Insurance.com | https://www.insurance.com/ | Offers a wide range of insurance comparison tools, including car insurance. |

| The Zebra | https://www.thezebra.com/ | Provides comprehensive insurance comparisons, including car, home, and renters insurance. |

| Policygenius | https://www.policygenius.com/ | Offers personalized insurance recommendations and comparisons, including car insurance. |

Recommended Resources for Learning More about Florida’s Insurance Laws

To gain a deeper understanding of Florida’s insurance laws and regulations, consider exploring these resources:

- Florida Statutes: The official collection of Florida laws, including those related to insurance.

- Florida Administrative Code: Contains rules and regulations adopted by state agencies, including the Florida Department of Financial Services, regarding insurance.

- Florida Bar: Provides information about legal resources and consumer rights related to insurance disputes.

Final Review

Driving in Florida requires a responsible approach to insurance, ensuring you have the necessary coverage to protect yourself and others on the road. By understanding the intricacies of Florida’s minimum liability insurance requirements, you can make informed decisions about your insurance coverage and navigate the claims process with confidence. Remember, choosing the right insurance policy is crucial for peace of mind and financial security while driving in Florida.

FAQ Guide

What happens if I get into an accident and don’t have the minimum liability insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you would be personally responsible for covering any damages or injuries you caused, which could lead to significant financial hardship.

Can I get a discount on my insurance premiums if I have a good driving record?

Yes, many insurance companies offer discounts for drivers with clean driving records. This can significantly reduce your insurance premiums.

How often should I review my insurance policy?

It’s a good idea to review your insurance policy at least once a year, or whenever you experience a significant life change, such as getting married, buying a new car, or having a child.