Cheapest state car insurance is a common search for drivers, and for good reason. Car insurance costs can vary significantly based on factors like your driving history, the type of car you drive, your age, and where you live. Understanding these factors and how they influence premiums is crucial for finding the best deals.

This guide explores the key elements that determine car insurance costs, highlighting state-specific regulations and affordable insurance options. We’ll also provide practical tips for finding the cheapest car insurance, emphasizing the importance of comparing quotes and understanding your policy.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by a variety of factors that insurers consider to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions about your coverage and potentially lower your insurance costs.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. Insurers carefully review your driving record, looking for any incidents that might increase the likelihood of future accidents.

- Accidents: A history of accidents, particularly at-fault accidents, can significantly raise your premiums. The more accidents you have, the higher your risk is perceived to be.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations also contribute to higher premiums. These violations demonstrate a pattern of risky driving behavior.

- Driving Record Cleanliness: Maintaining a clean driving record with no accidents or violations is the best way to ensure lower premiums.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance costs.

- Make and Model: Certain car makes and models are statistically more prone to accidents or theft. Vehicles with a history of safety issues or high repair costs will generally have higher insurance premiums.

- Vehicle Value: More expensive vehicles typically have higher insurance premiums because they cost more to repair or replace in case of an accident.

- Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, often receive discounts on insurance premiums. These features reduce the likelihood and severity of accidents.

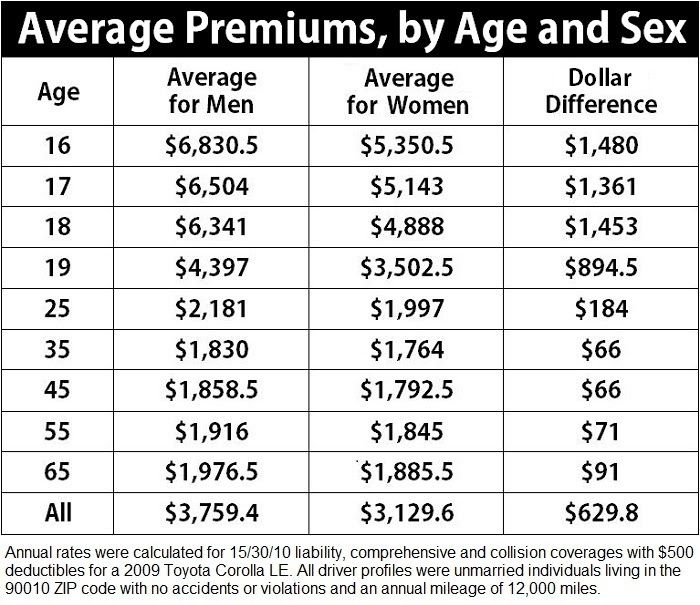

Age

Your age is a significant factor in determining your insurance premiums, reflecting the statistical trends in driving behavior and risk.

- Young Drivers: Younger drivers, particularly those under the age of 25, often have higher premiums due to their lack of experience and higher accident rates.

- Mature Drivers: Drivers over the age of 65 may also see higher premiums, although this can vary depending on the insurer. However, many insurers offer discounts for mature drivers who have a clean driving record.

- Age Range: Drivers in the middle age range (25-65) typically have lower premiums due to their experience and lower accident rates.

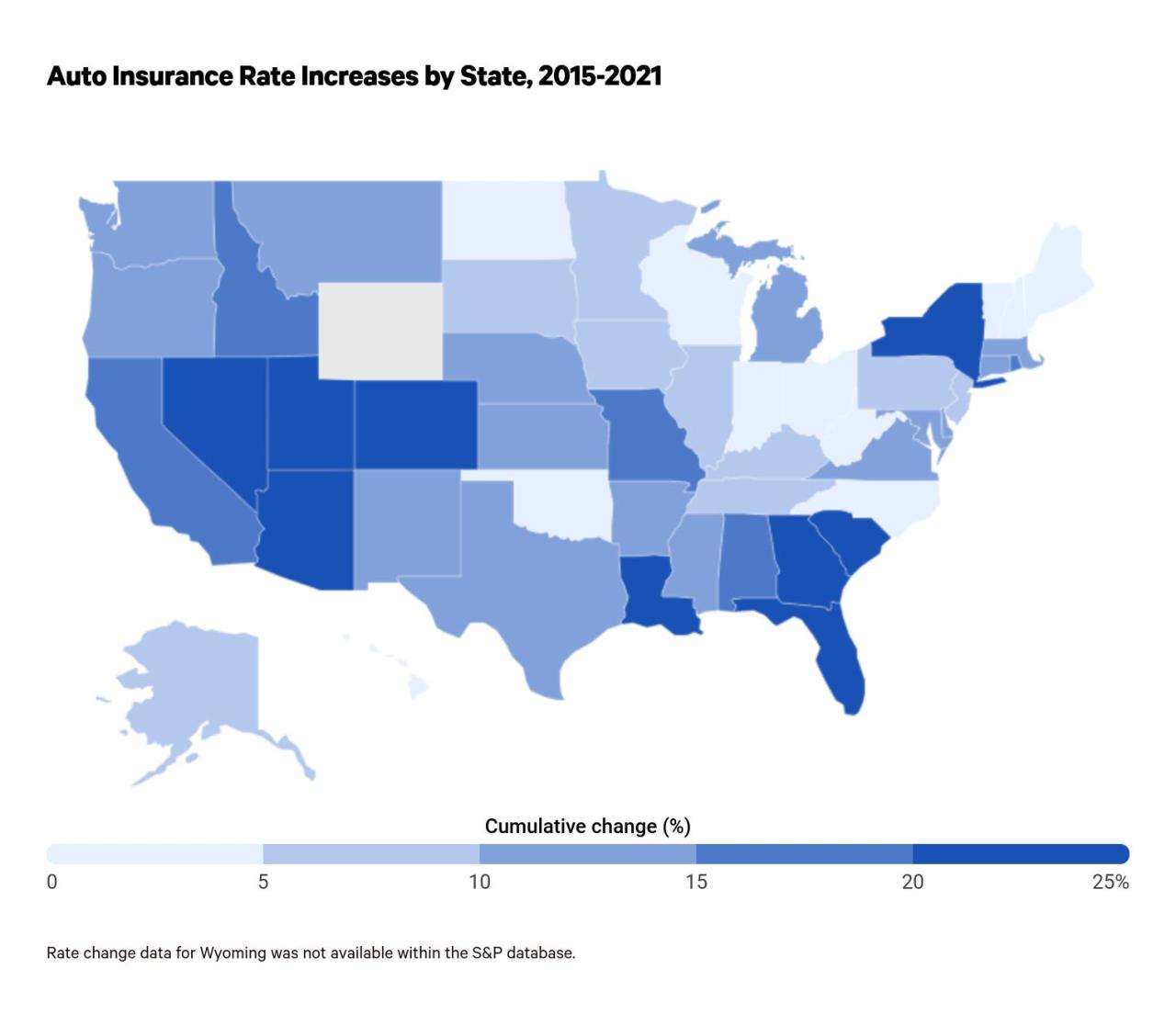

Location

The location where you live can significantly impact your car insurance premiums.

- Urban vs. Rural: Urban areas with high traffic density and higher crime rates tend to have higher insurance premiums. Rural areas with lower population density and less traffic may have lower premiums.

- Climate: Areas with extreme weather conditions, such as hurricanes, earthquakes, or severe winters, may have higher premiums due to the increased risk of damage to vehicles.

- Traffic Congestion: Areas with heavy traffic congestion can lead to a higher likelihood of accidents, resulting in higher insurance premiums.

Coverage Levels

The amount and type of coverage you choose directly affect your insurance premiums.

- Liability Coverage: Liability coverage pays for damages to other people’s property or injuries they sustain in an accident caused by you. Higher liability limits generally result in higher premiums.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is typically optional and can significantly impact your premiums.

- Comprehensive Coverage: Comprehensive coverage pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. This coverage is also typically optional and can influence your premiums.

Other Factors

- Credit Score: In some states, insurers may use your credit score as a factor in determining your insurance premiums. This practice is based on the assumption that individuals with good credit scores are more responsible and less likely to file claims.

- Driving Habits: Some insurers offer discounts for drivers who have good driving habits, such as maintaining a safe speed, avoiding distractions, and using their vehicles primarily for commuting.

- Deductibles: The deductible is the amount you agree to pay out of pocket in the event of a claim. Higher deductibles generally result in lower premiums.

State-Specific Car Insurance Regulations

Car insurance regulations vary significantly across states, influencing the types of coverage required, minimum liability limits, and ultimately, the cost of insurance. Understanding these differences can help you navigate the insurance market and find the most affordable options.

Mandatory Coverage Requirements

Each state mandates certain types of car insurance coverage, ensuring drivers have financial protection in case of accidents. These requirements vary significantly, influencing the overall cost of insurance.

- Liability Coverage: This is the most common type of mandatory coverage, protecting you financially if you cause an accident that injures someone or damages their property. Liability coverage typically includes two components:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident.

- Property Damage Liability: Covers damages to the other driver’s vehicle and any other property involved in the accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. This coverage is mandatory in some states but optional in others.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related expenses, regardless of who was at fault in an accident. It’s mandatory in some states, often called “no-fault” states, but optional in others.

Minimum Liability Limits

States set minimum liability limits, the lowest amount of coverage you’re required to carry. These limits can vary significantly, impacting the cost of insurance.

- States with higher minimum liability limits generally have higher insurance premiums, as they require more coverage.

- States with lower minimum liability limits may have lower insurance premiums, but you could face significant financial risks if you’re involved in an accident that exceeds your coverage limits.

Other Regulations

States also have other regulations that influence car insurance costs, including:

- Financial Responsibility Laws: These laws require drivers to prove they can pay for damages caused by an accident, often through insurance or a surety bond.

- No-Fault Laws: In no-fault states, drivers are typically required to file claims with their own insurance company, regardless of who was at fault. This can streamline the claims process but may lead to higher premiums.

- Usage-Based Insurance: Some states allow insurance companies to offer discounts based on driving habits tracked through telematics devices or smartphone apps.

States with Lower Car Insurance Premiums

States with lower car insurance premiums often have:

- Lower minimum liability limits.

- Less congested roads and fewer accidents.

- Stronger competition among insurance companies.

Examples of states known for relatively lower car insurance premiums include:

- Idaho

- Maine

- North Dakota

- Utah

- Wyoming

Affordable Car Insurance Options: Cheapest State Car Insurance

Finding the most affordable car insurance can be a challenging task, especially with the wide range of options and varying coverage levels available. However, understanding the different types of car insurance and their associated costs can help you make an informed decision that aligns with your budget and needs.

Types of Car Insurance Coverage

The type of car insurance you choose will significantly impact your premium. Here’s a breakdown of common car insurance options:

- Liability Coverage: This is the most basic type of car insurance and is usually required by law. It covers damages to other people’s property and injuries caused by an accident you are at fault for. Liability coverage is typically divided into two parts:

- Bodily Injury Liability: Covers medical expenses and other related costs for injuries sustained by others in an accident you cause.

- Property Damage Liability: Covers damages to other people’s vehicles or property caused by an accident you are at fault for.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This coverage is usually optional and is typically recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages from events other than accidents, such as theft, vandalism, natural disasters, and falling objects. It is typically optional and can be especially beneficial if your vehicle is newer or has a high value.

Optional Add-ons

In addition to basic coverage, several optional add-ons can enhance your car insurance policy, although they can also increase your premium. Some common add-ons include:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Rental Car Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged in an accident and is being repaired.

- Roadside Assistance: This coverage provides help with services such as towing, flat tire changes, and jump-starts.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of fault, if you are injured in an accident.

Choosing the Most Affordable Car Insurance Plan

Choosing the right car insurance plan can significantly impact your overall cost. Consider these tips:

- Compare Quotes: Obtain quotes from multiple insurance companies to compare prices and coverage options. Use online comparison tools or contact insurance companies directly.

- Consider Your Needs: Evaluate your driving history, the age and value of your vehicle, and your financial situation to determine the coverage levels you require.

- Explore Discounts: Ask about available discounts, such as good driver discounts, safe driver discounts, multi-car discounts, and student discounts.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it can result in lower premiums. Consider increasing your deductible if you are comfortable with a higher out-of-pocket expense.

- Review Your Policy Regularly: Ensure your coverage levels are still adequate and that you are taking advantage of all available discounts. You may be able to lower your premiums by adjusting your policy based on your current needs.

Finding the Cheapest Car Insurance

Finding the cheapest car insurance involves a strategic approach, considering various factors and exploring available options. This process often requires comparing quotes from multiple insurers, utilizing online tools, and negotiating rates to secure the most affordable coverage.

Utilizing Online Comparison Tools, Cheapest state car insurance

Online comparison tools streamline the process of obtaining quotes from multiple insurers. These platforms aggregate quotes from various providers based on your specific criteria, allowing for side-by-side comparisons.

- These tools typically require basic information about your vehicle, driving history, and desired coverage.

- They can help you identify insurers offering competitive rates and coverage options.

- Examples of popular comparison websites include Policygenius, The Zebra, and Insurify.

Contacting Multiple Insurance Providers

While online comparison tools are convenient, contacting individual insurance providers directly can offer additional insights and personalized quotes.

- Reach out to several insurers, both national and regional, to get a diverse range of quotes.

- This allows you to discuss your specific needs and explore potential discounts.

- Direct contact can provide a more comprehensive understanding of their coverage options and pricing structure.

Negotiating Rates

Negotiating car insurance rates can help you secure a more favorable price.

- Be prepared to discuss your driving history, credit score, and any relevant factors that might impact your premium.

- Highlight any discounts you qualify for, such as safe driving records or bundling policies.

- Be polite but assertive in expressing your desire for a lower rate.

Obtaining Discounts

Insurance providers often offer discounts to policyholders who meet specific criteria.

- Safe driving records: Maintaining a clean driving history with no accidents or violations can significantly reduce your premium.

- Bundling policies: Combining multiple insurance policies, such as car insurance and homeowners insurance, with the same provider can lead to discounts.

- Paying premiums in full: Some insurers offer discounts for paying your annual premium upfront instead of monthly installments.

- Other potential discounts: These may include good student discounts, anti-theft device discounts, and loyalty discounts.

Avoiding Common Mistakes

Certain mistakes can lead to higher insurance costs.

- Waiting until the last minute to renew your policy: This can limit your options and potentially result in higher rates.

- Not shopping around for quotes: Failing to compare quotes from multiple insurers can lead to paying more than necessary.

- Choosing the cheapest option without considering coverage: Opting for the lowest premium without adequate coverage can leave you financially vulnerable in case of an accident.

Importance of Comparing Quotes

Finding the cheapest car insurance requires more than just searching for the lowest price on a single website. It’s crucial to compare quotes from multiple insurance providers to ensure you’re getting the most competitive rate. This proactive approach can help you avoid overpaying for your car insurance and potentially save hundreds or even thousands of dollars annually.

Benefits of Comparing Quotes

Comparing quotes from different insurance providers offers several advantages, empowering you to make an informed decision about your car insurance.

- Discovering Competitive Rates: By comparing quotes, you gain access to a broader range of insurance options and can identify the most competitive rates available in the market. This allows you to secure the best value for your coverage needs.

- Identifying Hidden Fees and Charges: Insurance companies may have hidden fees or charges that are not immediately apparent. Comparing quotes can help you uncover these hidden costs and ensure you’re getting a transparent and fair deal.

- Negotiating Better Rates: Armed with quotes from multiple providers, you can leverage this information to negotiate better rates with your current insurer. By demonstrating your willingness to switch, you may be able to secure a lower premium.

- Finding Additional Discounts: Each insurance provider offers a unique set of discounts and benefits. Comparing quotes allows you to discover additional discounts you may be eligible for, such as safe driver discounts, multi-car discounts, or good student discounts.

Impact of Driving Habits on Premiums

Your driving habits play a significant role in determining your car insurance premiums. Insurance companies assess your risk based on your driving history, mileage, and driving style.

Driving Record

Your driving record is a critical factor influencing your car insurance premiums. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your insurance costs.

- Accidents: Each accident, regardless of fault, will likely increase your premiums. The severity of the accident, such as damage to property or injuries, will also impact the premium increase.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can significantly raise your premiums. The number and severity of violations will influence the premium increase.

- DUI/DWI Convictions: Driving under the influence (DUI) or driving while intoxicated (DWI) convictions have the most significant impact on your premiums. Insurance companies view these offenses as high-risk behavior and will likely charge much higher premiums.

Mileage

The number of miles you drive annually impacts your car insurance premiums. The more you drive, the higher the likelihood of an accident. Insurance companies often offer discounts for low-mileage drivers, as they pose a lower risk.

- Commuting Distance: A long commute can significantly increase your mileage and, consequently, your premiums.

- Business Use: Using your car for business purposes often results in higher mileage and therefore higher premiums.

Driving Style

Your driving style, including factors like speeding, aggressive driving, and distracted driving, can influence your car insurance premiums. Insurance companies may consider your driving style, though it’s not always explicitly assessed.

- Speeding: Frequent speeding, even if you haven’t been ticketed, can indicate a higher risk of accidents and increase your premiums.

- Aggressive Driving: Tailgating, abrupt lane changes, and other aggressive driving behaviors can also increase your insurance costs.

- Distracted Driving: Using a cell phone, texting, or engaging in other distractions while driving can increase your risk of accidents and higher premiums.

Tips for Improving Driving Habits

Here are some tips for improving your driving habits to potentially reduce your car insurance premiums:

- Drive Safely: Adhere to speed limits, avoid distractions, and practice defensive driving techniques.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents.

- Reduce Mileage: Consider carpooling, public transportation, or working from home to minimize your mileage.

- Take Defensive Driving Courses: These courses can teach you safer driving habits and potentially earn you a discount on your insurance.

Understanding Car Insurance Policies

Car insurance policies are complex legal documents that Artikel the terms and conditions of your coverage. Understanding these terms is crucial to ensure you’re adequately protected in case of an accident or other covered event. This section delves into the key components of a car insurance policy, highlighting their significance and providing tips for selecting a policy that meets your specific needs.

Coverage Limits

Coverage limits define the maximum amount your insurer will pay for covered losses. They are usually expressed as dollar amounts per incident or per year. Different types of coverage have separate limits. For example, liability coverage limits the amount your insurer will pay for damages caused to others in an accident. Understanding these limits is essential to ensure you have sufficient protection in case of a significant accident.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. When choosing a deductible, consider your financial situation and risk tolerance. If you can afford to pay a higher deductible, you can save on premiums. However, if you are risk-averse or have limited financial resources, a lower deductible may be a better option.

Exclusions

Exclusions are specific situations or events that are not covered by your insurance policy. These can include, for example, damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. It’s important to carefully review the exclusions section of your policy to understand what is and isn’t covered. This will help you avoid unexpected costs and ensure you have adequate protection for your specific needs.

Reading and Understanding Policy Terms

Before signing up for a car insurance policy, it’s crucial to thoroughly read and understand all the terms and conditions. Don’t hesitate to ask your insurer for clarification on any confusing or unclear language. It’s better to be safe than sorry and have a clear understanding of your coverage before you need it.

Ensuring Adequate Coverage

To ensure your chosen policy meets your individual needs, consider the following tips:

- Evaluate your driving history and risk profile: Your driving history, including any accidents or violations, significantly impacts your insurance premiums. A clean driving record generally translates to lower premiums.

- Assess your vehicle’s value: Ensure your policy provides adequate coverage for the value of your vehicle. If your car is older or has depreciated significantly, you may consider reducing your coverage limits and opting for a higher deductible.

- Consider your individual circumstances: Your personal circumstances, such as your age, occupation, and driving habits, can influence your insurance needs. If you frequently drive long distances or live in a high-risk area, you may need higher coverage limits or additional coverage options.

- Compare quotes from multiple insurers: It’s always advisable to compare quotes from multiple insurers to find the best rates and coverage options. Online comparison tools can streamline this process.

Impact of Vehicle Type on Insurance Costs

The type of vehicle you drive significantly influences your car insurance premiums. Insurance companies consider various factors related to a vehicle’s design, performance, and safety features when calculating your rates. These factors determine the likelihood of an accident, the severity of potential damage, and the associated repair costs.

Factors Influencing Insurance Premiums Based on Vehicle Type

The insurance premiums for different vehicle types vary due to several factors:

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and airbags, are generally considered safer and therefore attract lower insurance premiums. Cars with lower safety ratings tend to have higher premiums because they pose a greater risk of accidents and injuries.

- Repair Costs: Vehicles with complex designs or rare parts often have higher repair costs, which translates to higher insurance premiums. Luxury cars and sports cars, for instance, often require specialized parts and labor, leading to more expensive repairs.

- Theft Risk: Certain vehicle types, like luxury cars and sports cars, are more prone to theft. Insurance companies consider the theft risk when setting premiums, as they have to cover the cost of replacing stolen vehicles.

- Performance: High-performance vehicles, such as sports cars and muscle cars, often have powerful engines and are capable of higher speeds. These vehicles are associated with a higher risk of accidents and injuries, leading to higher insurance premiums.

Examples of Vehicle Types and Their Insurance Premiums

- Sedans: Sedans are generally considered to have lower insurance premiums compared to other vehicle types. They are typically designed for everyday commuting and have relatively lower repair costs.

- SUVs: SUVs have become increasingly popular in recent years, but they often have higher insurance premiums than sedans. Their larger size and higher ground clearance can make them more prone to accidents, and their repair costs can be significant.

- Trucks: Trucks, especially heavy-duty trucks, have the highest insurance premiums due to their size, weight, and potential for severe damage in accidents.

- Sports Cars: Sports cars have high insurance premiums due to their performance capabilities, higher repair costs, and increased risk of theft.

Safety Features and Insurance Discounts

Car insurance companies recognize that vehicles equipped with advanced safety features are less likely to be involved in accidents or experience significant damage. As a result, they often offer discounts to policyholders who drive cars with these safety features. This practice incentivizes drivers to choose vehicles with enhanced safety technology, ultimately leading to a safer driving environment for everyone.

Discounts for Safety Features

Insurance companies typically offer discounts for various safety features, which can vary depending on the insurer and the specific feature. Some common examples include:

- Anti-theft Systems: These systems, such as alarms, immobilizers, and tracking devices, deter theft and reduce the likelihood of insurance claims related to stolen vehicles. Insurance companies often provide discounts for vehicles equipped with these systems.

- Airbags: Airbags are designed to protect occupants in the event of a collision. Insurance companies generally offer discounts for vehicles with a comprehensive airbag system, including front, side, and curtain airbags.

- Anti-lock Brakes (ABS): ABS helps prevent wheel lockup during braking, enhancing vehicle control and reducing the risk of accidents. Insurance companies often offer discounts for vehicles equipped with ABS.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability during sudden maneuvers or slippery road conditions, reducing the risk of accidents. Insurance companies often offer discounts for vehicles with ESC.

- Daytime Running Lights (DRLs): DRLs improve vehicle visibility during the day, reducing the risk of accidents. Some insurance companies offer discounts for vehicles with DRLs.

- Backup Cameras: Backup cameras enhance rear visibility, reducing the risk of accidents when reversing. Some insurance companies offer discounts for vehicles equipped with backup cameras.

Outcome Summary

By carefully considering the factors that impact car insurance premiums, taking advantage of discounts, and comparing quotes from multiple providers, you can significantly reduce your insurance costs. Remember, knowledge is power, and understanding the intricacies of car insurance can save you money in the long run.

FAQ Insights

How can I get the cheapest car insurance?

To find the cheapest car insurance, compare quotes from multiple insurers, consider discounts, and choose a policy that meets your needs without unnecessary coverage.

What are the most common car insurance discounts?

Common discounts include safe driving records, good student discounts, multi-car discounts, and bundling insurance policies.

Is it better to pay car insurance monthly or annually?

Paying annually often results in a lower overall cost, but monthly payments might be more manageable for some budgets.

How often should I review my car insurance policy?

It’s a good practice to review your car insurance policy annually to ensure it still meets your needs and to explore any potential discounts or changes in rates.