Cheap auto insurance ny state – Cheap auto insurance in NY state is a top priority for many drivers, especially considering the state’s mandatory coverage requirements and the potential for high premiums. Finding affordable coverage involves understanding the factors that influence your rates, comparing quotes from different providers, and exploring strategies to lower your costs. This guide will walk you through the process of securing cheap auto insurance in New York, providing insights and tips to help you navigate the complexities of the insurance market.

From understanding the different types of coverage available to exploring discounts and navigating common pitfalls, we’ll equip you with the knowledge you need to make informed decisions about your auto insurance. Whether you’re a new driver, a seasoned veteran, or simply looking for ways to save money, this comprehensive guide will serve as your roadmap to affordable auto insurance in New York.

Understanding New York Auto Insurance

Navigating the world of auto insurance in New York can be overwhelming, but understanding the basics is crucial for ensuring you have the right coverage and paying a fair price. This guide will help you understand the essential aspects of New York auto insurance.

Mandatory Coverage Requirements

New York State mandates specific auto insurance coverage for all drivers. These requirements are designed to protect you, other drivers, and pedestrians in case of an accident. Here are the mandatory coverages:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical bills, lost wages, and property damage. New York law requires a minimum liability coverage of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Personal Injury Protection (PIP): This coverage covers your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. It applies to you, your passengers, and even pedestrians injured in an accident caused by your vehicle. The minimum PIP coverage required in New York is $50,000 per person.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and other costs if the other driver’s insurance is insufficient to cover your losses. New York requires minimum coverage limits of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

Types of Auto Insurance

Beyond the mandatory coverage, there are several other types of auto insurance available in New York that can provide additional protection:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It’s essential if you want to protect yourself financially in case of an accident.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, or natural disasters. It can be particularly valuable if you live in an area prone to these types of incidents.

- Rental Reimbursement: This coverage helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies. It can be particularly helpful if you frequently travel long distances or drive in remote areas.

- Gap Insurance: This coverage protects you if your vehicle is totaled and your insurance payout is less than the amount you owe on your loan. It can help prevent you from being stuck with a debt even after your vehicle is gone.

Factors Influencing Auto Insurance Premiums

Your auto insurance premium in New York is determined by a variety of factors, including:

- Driving History: Your driving record is a major factor in determining your premium. Accidents, speeding tickets, and other violations can significantly increase your rates.

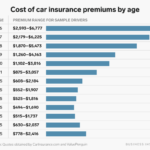

- Age and Gender: Younger drivers and males generally have higher premiums due to increased risk. However, it’s important to note that this is a general trend, and individual premiums may vary.

- Vehicle Type: The type of vehicle you drive can affect your premium. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and greater potential for accidents.

- Location: Your location can influence your premium, as areas with higher crime rates or traffic congestion may have higher rates.

- Credit Score: Your credit score can also be a factor in determining your premium. This is because a good credit score is often seen as an indicator of financial responsibility.

- Coverage Options: The amount and types of coverage you choose will affect your premium. Higher coverage limits generally result in higher premiums.

Finding Affordable Auto Insurance in New York: Cheap Auto Insurance Ny State

Navigating the world of auto insurance in New York can be a daunting task, especially when you’re trying to find the most affordable option. However, with a bit of research and strategic planning, you can significantly reduce your insurance premiums and find a policy that fits your budget. This section will provide you with valuable tips and resources to help you find cheap auto insurance in New York.

Comparing Auto Insurance Quotes

Comparing quotes from different insurance providers is essential for finding the best deal. This process helps you understand the market rates and identify policies that offer the best coverage for your needs.

- Use online comparison tools: Many websites allow you to enter your information once and receive quotes from multiple insurance companies. This saves you time and effort, making the comparison process more efficient. Some popular websites include Insurance.com, The Zebra, and Policygenius.

- Contact insurance companies directly: You can also contact insurance companies directly to request quotes. This allows you to ask specific questions and get personalized recommendations. Remember to gather all relevant information, such as your driving history, vehicle details, and coverage needs, before contacting each company.

- Consider your coverage needs: When comparing quotes, make sure you’re comparing similar coverage levels. Don’t be swayed by a lower price if it comes with less coverage than you need. Carefully review the coverage options and choose a policy that provides adequate protection for you and your vehicle.

Lowering Your Auto Insurance Premiums

Once you’ve gathered quotes from different providers, you can explore strategies to lower your auto insurance premiums. These strategies can help you save money on your monthly payments.

- Improve your driving record: Maintaining a clean driving record is crucial for lowering your insurance premiums. Avoid traffic violations, such as speeding tickets or accidents, as these can significantly increase your rates. Defensive driving courses can also help you improve your driving skills and potentially earn a discount on your insurance.

- Increase your deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, but it also means you’ll have to pay more in the event of an accident. Consider your financial situation and risk tolerance when deciding on your deductible amount.

- Bundle your insurance policies: Many insurance companies offer discounts for bundling your auto insurance with other policies, such as homeowners or renters insurance. This can lead to significant savings on your premiums.

- Ask about discounts: Insurance companies often offer various discounts, such as good student discounts, safe driver discounts, or discounts for anti-theft devices. Be sure to ask your insurance provider about all available discounts and ensure you’re taking advantage of those that apply to you.

- Shop around regularly: Auto insurance rates can change over time, so it’s important to shop around regularly to ensure you’re getting the best deal. You can do this by comparing quotes from different insurance companies every year or two, or whenever your current policy is up for renewal.

Resources for Finding Cheap Auto Insurance

Several resources can help you find cheap auto insurance in New York. These resources can provide valuable information and tools to guide you through the process.

- New York State Department of Financial Services (DFS): The DFS regulates insurance companies in New York and provides consumer information about auto insurance. You can find resources on their website, including information about coverage requirements, consumer rights, and how to file complaints.

- Insurance comparison websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurance companies in one place. These websites can be a valuable tool for finding the best deals on auto insurance.

- Local insurance brokers: Local insurance brokers can provide personalized advice and help you find a policy that meets your specific needs. They can also help you navigate the complex world of auto insurance and ensure you’re getting the best possible deal.

Key Considerations for Cheap Auto Insurance

When shopping for auto insurance in New York, several factors influence the cost of your premiums. Understanding these factors can help you make informed decisions to secure affordable coverage.

Driving History and Credit Score, Cheap auto insurance ny state

Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or violations will generally result in lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

Insurance companies also consider your credit score as a measure of your financial responsibility. A good credit score can often lead to lower insurance rates, while a poor credit score may result in higher premiums.

Vehicle Type, Age, and Location

The type of vehicle you drive significantly affects your insurance costs. Sports cars, luxury vehicles, and high-performance models are generally more expensive to insure due to their higher repair costs and greater risk of theft. Older vehicles, on the other hand, may have lower insurance premiums because they are less expensive to replace.

The age of the driver is also a factor in determining insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As drivers age, their premiums typically decrease.

Your location can also impact your insurance rates. Urban areas with higher traffic density and crime rates generally have higher insurance premiums than rural areas.

Insurance Discounts

Several discounts are available to help lower your auto insurance premiums. These discounts can vary depending on the insurance company, so it’s important to compare quotes from multiple providers.

- Good Student Discount: This discount is available to students who maintain a good academic record.

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record and no accidents or violations.

- Multi-Car Discount: You may qualify for a discount if you insure multiple vehicles with the same company.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can help lower your premiums.

- Loyalty Discount: Some insurance companies offer discounts to customers who have been with them for a long time.

While discounts can help lower your premiums, it’s essential to weigh the benefits against the potential drawbacks. For example, a discount for a specific safety feature might require you to pay more for the feature itself.

Avoiding Common Pitfalls with Cheap Auto Insurance

While the allure of low premiums is tempting, navigating the world of cheap auto insurance requires careful consideration. It’s essential to understand the potential pitfalls associated with seeking the lowest possible price, as some compromises might leave you vulnerable in the event of an accident.

Understanding Coverage Limits

Choosing a cheap auto insurance policy often involves making trade-offs, particularly regarding coverage limits. Coverage limits determine the maximum amount your insurance company will pay for specific types of claims. Here’s a comparison of different types of cheap auto insurance policies and their coverage limits:

| Policy Type | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| Minimum Coverage | $25,000 per person, $50,000 per accident, $10,000 for property damage | Not included | Not included |

| Basic Coverage | $50,000 per person, $100,000 per accident, $25,000 for property damage | Optional | Optional |

| Full Coverage | $100,000 per person, $300,000 per accident, $50,000 for property damage | Included | Included |

Risks of Minimum Coverage

Purchasing the minimum required coverage in New York State might seem appealing due to lower premiums, but it comes with significant risks. Here’s a breakdown of potential consequences:

- Financial Burden: In case of an accident where you’re at fault, minimum coverage might not be enough to cover the costs of damages to the other party’s vehicle or injuries sustained. You could face substantial out-of-pocket expenses, potentially leading to financial hardship.

- Legal Issues: Insufficient coverage can result in legal complications, including lawsuits from the injured party. This can lead to substantial legal fees and potential financial penalties.

- Driving Restrictions: Some insurers may impose restrictions on your driving privileges if you opt for minimum coverage. This could limit your ability to drive certain types of vehicles or in specific areas.

Importance of Understanding the Fine Print

Scrutinizing the fine print of your insurance policy is crucial to avoid unpleasant surprises. Here’s why:

- Exclusions and Limitations: Policies often contain exclusions and limitations that restrict coverage. For example, some policies might not cover certain types of accidents or damages. Understanding these limitations can prevent unexpected financial burdens.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, but they can also increase your financial risk in the event of an accident.

- Coverage Gaps: It’s essential to ensure your policy covers all your needs. For instance, if you frequently drive your car for work, you might need additional coverage for business use. Failing to address such gaps can leave you underinsured and financially vulnerable.

Tips for Staying Safe and Insured

Staying safe on the road and maintaining a clean driving record are crucial for keeping your auto insurance costs down. These proactive measures not only protect you and others but also contribute to lower premiums in the long run.

Maintaining a Clean Driving Record

A clean driving record is essential for obtaining affordable auto insurance in New York. Driving violations, accidents, and other incidents can significantly increase your insurance premiums. Here are some tips for maintaining a clean driving record:

- Obey all traffic laws and regulations.

- Avoid speeding and reckless driving.

- Be mindful of your surroundings and anticipate potential hazards.

- Avoid driving under the influence of alcohol or drugs.

- Maintain your vehicle regularly to prevent breakdowns and ensure it’s roadworthy.

Protecting Your Vehicle from Theft or Damage

Protecting your vehicle from theft or damage is another way to minimize insurance claims and keep your premiums low. Here are some recommendations:

- Park your vehicle in well-lit and secure areas.

- Install an alarm system and consider a GPS tracker.

- Never leave valuables in plain sight within your vehicle.

- Lock your doors and windows whenever you leave your vehicle, even for short periods.

- Consider investing in a car cover or garage to protect your vehicle from the elements.

Final Wrap-Up

Securing cheap auto insurance in New York requires a strategic approach. By understanding the factors that influence your premiums, comparing quotes, and taking advantage of available discounts, you can significantly reduce your insurance costs. Remember to carefully review policy details and ensure you have adequate coverage to protect yourself and your vehicle. With a little research and effort, you can find the best auto insurance policy to fit your budget and needs.

FAQ Compilation

What is the minimum auto insurance coverage required in New York?

New York State requires drivers to have a minimum of liability coverage, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a free auto insurance quote?

Most insurance companies offer free online quotes. You can also contact an insurance agent directly to obtain a quote.

What are some common discounts offered by auto insurance companies?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features in your vehicle.