Car insurance in NY state is a necessity for all drivers, but navigating the complex world of coverage options and premiums can be daunting. Understanding your state’s requirements, the factors that influence your rates, and the available coverage choices is crucial for finding the best insurance for your needs. This comprehensive guide will provide insights into New York’s car insurance landscape, empowering you to make informed decisions.

From mandatory coverage requirements and premium influencing factors to available coverage options and finding the best insurance providers, this guide will cover all the essential aspects of car insurance in New York. We will also explore tips for safe driving practices, filing claims, and navigating the complexities of the insurance process.

Understanding New York Car Insurance Requirements

Driving a car in New York State requires you to have car insurance. This is a legal requirement to protect yourself and others from financial liability in case of an accident. Understanding the specific requirements for car insurance in New York is crucial to ensure you’re adequately covered and compliant with the law.

Minimum Liability Limits

New York State mandates that all drivers carry minimum liability insurance coverage. This coverage protects you financially if you cause an accident that results in injury or property damage to another person. The minimum liability limits are as follows:

* Bodily Injury Liability: $25,000 per person, $50,000 per accident

* Property Damage Liability: $10,000 per accident

These limits represent the maximum amount your insurance company will pay for damages related to an accident you cause. For example, if you cause an accident resulting in $30,000 in medical bills for the other driver, your insurance company will only cover up to $25,000. You would be personally responsible for the remaining $5,000.

Insurance Coverage for Specific Vehicle Types

New York State also has specific insurance requirements for different types of vehicles.

Commercial Vehicles

Commercial vehicles, such as trucks, vans, and buses used for business purposes, require additional insurance coverage beyond the minimum liability limits. This coverage includes:

- Commercial Auto Liability: Covers bodily injury and property damage caused by the commercial vehicle during business operations.

- Commercial Auto Physical Damage: Covers damage to the commercial vehicle itself, including collision and comprehensive coverage.

- Commercial Auto Medical Payments: Pays for medical expenses for the driver and passengers of the commercial vehicle in case of an accident, regardless of fault.

Motorcycles

Motorcycles, being more vulnerable in accidents, have specific insurance requirements in New York State. In addition to the minimum liability limits, motorcycle owners are required to have:

- Uninsured/Underinsured Motorist Coverage: Protects you in case you are hit by a driver without insurance or with insufficient insurance coverage.

- No-Fault Coverage: Covers your own medical expenses and lost wages in case of an accident, regardless of fault.

Factors Influencing Car Insurance Premiums in NY

Your car insurance premiums in New York are determined by a variety of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Driver Age

Younger drivers are statistically more likely to be involved in accidents. As a result, they typically pay higher premiums. However, premiums generally decrease as drivers gain experience and age. This is because insurance companies consider older drivers to be more experienced and less likely to take risks.

Driving History

Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or violations will result in lower premiums. Conversely, having a history of accidents, traffic violations, or DUI convictions will lead to higher premiums. Insurance companies use your driving history to assess your risk level and determine the cost of insuring you.

Credit Score

Surprisingly, your credit score can also affect your car insurance premiums in New York. Insurance companies use your credit score as a proxy for your financial responsibility. Individuals with good credit scores are often considered more reliable and less likely to file claims. As a result, they may qualify for lower premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for higher speeds. Conversely, smaller, less expensive vehicles typically have lower premiums.

Location

Where you live in New York can significantly impact your insurance premiums. Urban areas with higher traffic density and crime rates tend to have higher premiums than rural areas. This is because insurance companies consider these areas to be riskier.

Coverage Options

The type of coverage you choose will also affect your premiums. Comprehensive and collision coverage, which protect you from damage caused by non-accidental events and accidents, respectively, are more expensive than liability coverage, which only covers damage to other vehicles and property. You can reduce your premiums by choosing a higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

Available Car Insurance Coverage Options in NY

In New York State, car insurance is mandatory, and drivers must carry specific coverage to legally operate a vehicle. Understanding the various coverage options available can help you choose a policy that best suits your needs and financial situation.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. This coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by your negligence.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property damaged in an accident caused by your negligence.

In New York, the minimum required liability coverage limits are:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident

- Property Damage Liability: $10,000 per accident

It’s essential to understand that these minimum limits might not be enough to cover all damages in a serious accident. You might want to consider increasing your liability limits to protect yourself from potential financial hardship.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s highly recommended if you have a loan or lease on your vehicle.

Collision coverage will only pay for damages resulting from a collision with another vehicle or object, not from incidents like vandalism, theft, or natural disasters.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

Like collision coverage, comprehensive coverage is optional. However, it can be beneficial if you have a newer vehicle or one with a high value.

Uninsured/Underinsured Motorist Coverage, Car insurance in ny state

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage to cover your damages.

- Uninsured Motorist (UM) Coverage: This coverage pays for your injuries and damages if you’re hit by a driver without insurance.

- Underinsured Motorist (UIM) Coverage: This coverage covers the difference between the other driver’s liability coverage and your actual damages if you’re hit by a driver with insufficient insurance.

UM/UIM coverage is mandatory in New York, but you can choose to waive it. However, it’s strongly recommended to keep this coverage, as it provides crucial protection in case of an accident with an uninsured or underinsured driver.

Optional Coverage Options

In addition to the mandatory and commonly chosen coverage options, you can also consider adding optional coverage to your policy, such as:

- Rental Car Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, jump starts, and towing.

- Gap Insurance: This coverage pays the difference between your vehicle’s actual cash value and the outstanding loan balance if your vehicle is totaled.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault in an accident.

These optional coverage options can provide additional protection and peace of mind, but they also increase your insurance premium. It’s essential to carefully consider your needs and budget before adding any optional coverage.

Finding the Best Car Insurance in NY

Finding the best car insurance in New York can be a daunting task, but with the right approach, you can secure affordable coverage that meets your needs. This section provides a step-by-step guide to help you navigate the process effectively and find the most suitable car insurance policy for your situation.

Comparing Car Insurance Providers in NY

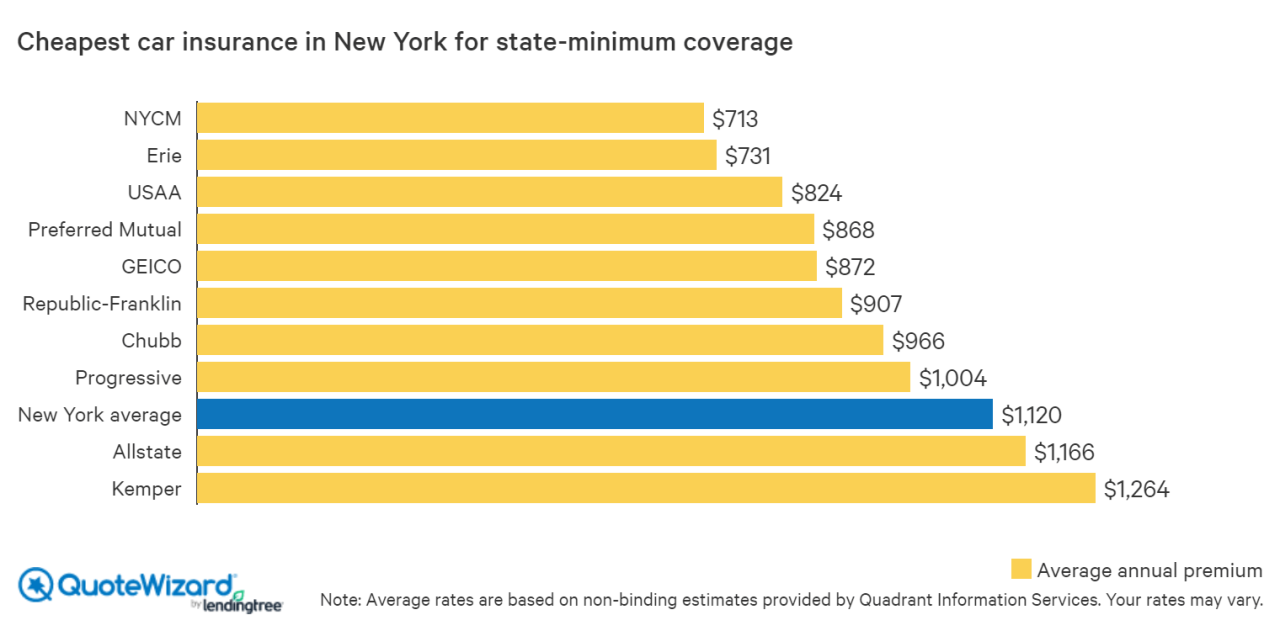

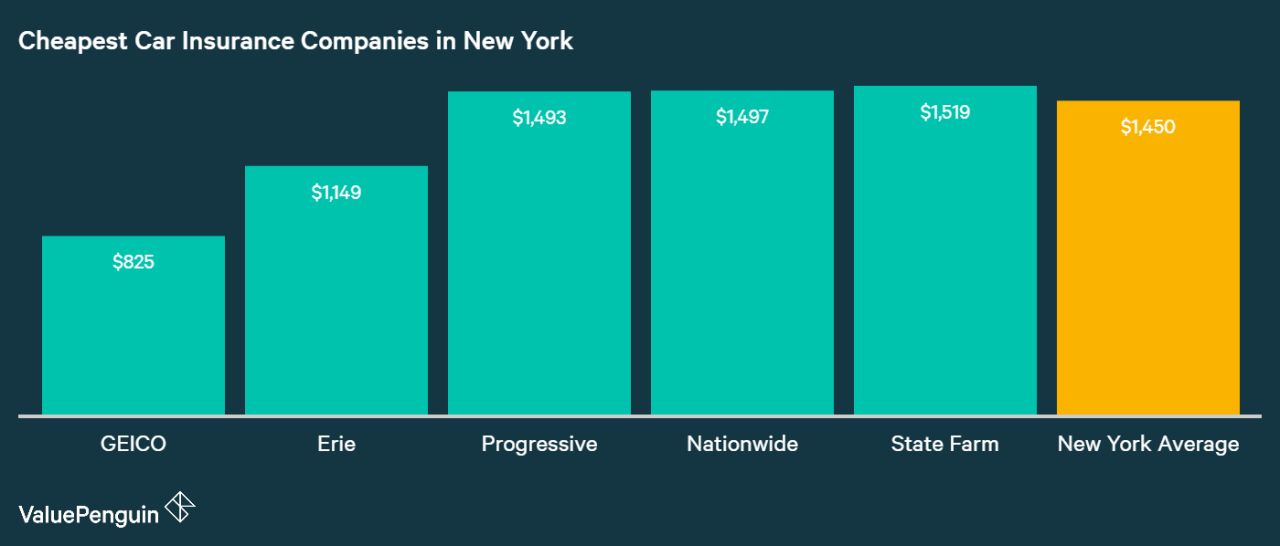

- Major Providers: New York has a diverse landscape of car insurance providers, with both national and regional companies vying for your business. Some of the most prominent names include Geico, State Farm, Allstate, Progressive, and Liberty Mutual. Each provider has its own unique strengths and weaknesses, so comparing their offerings is crucial.

- Factors to Consider: When comparing providers, consider factors such as coverage options, pricing, customer service, claims handling, and financial stability. Research each provider’s reputation and customer satisfaction ratings to get a holistic view of their performance.

- Online Comparison Tools: Several online comparison tools can streamline the process of comparing quotes from multiple providers. These tools typically require you to provide basic information about your vehicle, driving history, and coverage needs. They then present you with a side-by-side comparison of quotes, allowing you to identify the most competitive options.

Getting Accurate Car Insurance Quotes

- Be Honest and Thorough: When obtaining quotes, be honest about your driving history, including any accidents, violations, or other incidents that might affect your premium. Provide accurate details about your vehicle, including its make, model, year, and mileage.

- Shop Around: Don’t settle for the first quote you receive. Obtain quotes from multiple providers to ensure you’re getting the best possible rates. It’s generally advisable to get quotes from at least three to five providers.

- Consider Bundling: If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. Many providers offer discounts for bundling multiple policies, potentially leading to significant savings.

Negotiating the Best Car Insurance Rates

- Ask About Discounts: Many car insurance providers offer discounts for various factors, including safe driving records, good credit scores, and safety features in your vehicle. Be sure to ask about all available discounts and ensure you’re receiving them.

- Increase Your Deductible: A higher deductible typically translates to lower premiums. Consider increasing your deductible if you’re comfortable with the financial risk of paying a higher amount out-of-pocket in case of an accident.

- Review Your Policy Regularly: Review your policy periodically to ensure it still meets your needs and that you’re not paying for unnecessary coverage. If your circumstances have changed, such as a change in your driving habits or vehicle ownership, consider adjusting your coverage accordingly.

Filing a Car Insurance Claim in NY

Filing a car insurance claim in New York can be a daunting process, but understanding the steps involved can make it smoother. This section will guide you through the process, from documenting the accident to handling the claim with your insurance company.

Documenting the Accident

It is crucial to gather all necessary information and documentation immediately after an accident. This will help you build a strong case for your claim.

- Exchange Information: Get the other driver’s name, address, phone number, insurance company, and policy number.

- Take Photos: Capture images of the damage to your vehicle, the other vehicle, and the accident scene, including any road signs or traffic signals.

- Get Witness Information: If there were any witnesses, get their names and contact information.

- File a Police Report: In New York, you are required to file a police report for accidents involving injuries, property damage exceeding $1,000, or hit-and-run incidents.

Contacting Your Insurance Company

Once you have gathered all necessary information, contact your insurance company as soon as possible.

- Report the Accident: Provide your insurance company with the details of the accident, including the date, time, location, and parties involved.

- Follow Instructions: Your insurance company will provide you with instructions on how to proceed with your claim.

- Submit Documentation: You will need to submit all relevant documentation, including the police report, photos, and witness statements, to your insurance company.

Handling the Claim Process

The claim process can vary depending on the circumstances of the accident and your insurance company. However, the general steps are as follows:

- Review the Claim: Your insurance company will review your claim and determine if it is covered under your policy.

- Negotiate a Settlement: If your claim is approved, you will need to negotiate a settlement with your insurance company. This may involve discussing the amount of compensation for your damages and injuries.

- Receive Payment: Once a settlement is reached, you will receive payment from your insurance company.

Additional Tips for Filing a Claim

- Be Honest: Provide accurate and complete information to your insurance company.

- Keep Records: Keep all documentation related to your claim, including receipts for repairs and medical bills.

- Be Patient: The claim process can take time, so be patient and cooperative with your insurance company.

Driving Safety and Car Insurance in NY

Safe driving practices are not just about avoiding accidents but also about keeping your car insurance premiums low. By being a responsible driver, you can significantly reduce your insurance costs.

In New York, your driving record is a key factor in determining your car insurance rates. The more accidents or traffic violations you have, the higher your premiums will be.

Impact of Traffic Violations and Accidents on Insurance Rates

Traffic violations and accidents have a significant impact on your car insurance rates. Even minor violations like speeding tickets can lead to an increase in your premiums. Here’s how:

- Accidents: Every accident, regardless of fault, will increase your insurance premiums. The severity of the accident and the number of accidents you have will influence the increase. For example, a fender bender might result in a smaller increase than a multi-car collision.

- Traffic Violations: Even a single traffic violation can lead to a significant increase in your insurance premiums. The severity of the violation will affect the increase. For example, a speeding ticket might result in a smaller increase than a DUI.

End of Discussion

By understanding the intricacies of car insurance in New York, you can make informed decisions about your coverage and secure the best possible rates. Remember, driving safely is not only essential for your own well-being but also plays a significant role in keeping your insurance premiums affordable. With the right knowledge and a proactive approach, you can navigate the world of car insurance in New York with confidence and peace of mind.

Helpful Answers: Car Insurance In Ny State

What are the minimum liability limits for car insurance in NY?

The minimum liability limits in New York are $25,000 per person/$50,000 per accident for bodily injury and $10,000 for property damage.

What is the difference between collision and comprehensive coverage?

Collision coverage protects your vehicle against damage caused by an accident, while comprehensive coverage covers damage from events like theft, vandalism, and natural disasters.

How can I get a discount on my car insurance?

There are various discounts available, including good driver discounts, safe driver courses, multi-car discounts, and bundling with other insurance policies.

What should I do if I’m involved in an accident?

Stay calm, exchange information with the other driver(s), call the police if necessary, and document the accident with photos and witness information.